Petro Subsidies Unnerves

``Men in general are quick to believe that which they wish to be true. “ -- Julius Caesar

Local mainstream analysts are wont to facilely attribute deflating asset prices on oil concerns. While I have mentioned in the past that Oil concerns may have SOME effects in today’s price levels, the activities in the domestic financial markets appear to support my assessment that oil concerns are subordinate to the present monetary tightening environment in the

Because your prudent investor analyst wants to show you the impact of an actual ‘oil induced shock’, let us turn to our neighbor,

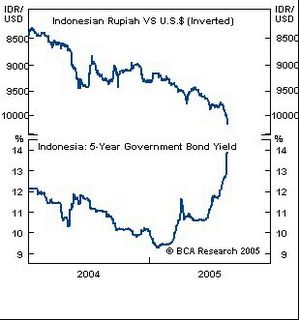

As you can see from the chart above courtesy of BCA Research, the Indonesian currency (upper window), the rupiah cratered by a startling 4.6% in a month, while its bond yields (lower window) soared making it the worst performing bond in the Asia Pacific sphere, according to Bloomberg’s Yumi Kuramitsu and Naila Firdausi, ``The iBoxx Indonesia index has fallen 5.5 percent in 2005 as of Aug. 23.”

In addition, the insurance premium on the possibility of a credit default via the credit default swap derivative surged. According to the same Bloomberg report, ``The annual cost of insuring $10 million of Indonesia's U.S. dollar-denominated government debt for five years using credit- default swaps rose to 325,000, from $300,000 yesterday, according to Deutsche Bank AG prices. A week ago, the cost was about $245,000. Indonesia's dollar-denominated international bonds have junk ratings of B+ from Standard & Poor's and one step lower at B2 from Moody's Investors Service.”

Naturally, because of the sharp selloff in Rupiah denominated assets, the equity benchmark represented by the Jakarta Stock Exchange (JKSE), as illustrated in the above chart courtesy of yahoo finance, likewise ‘fell off the cliff’ down 12% since August 11 or in about 2 weeks!

Because domestic demand for the fossil fuel exceeds that of the production (declining rate), the country has resorted to importing oil to meet demands. According to Bloomberg’s Christina Soon ``Indonesia's oil production fell 4.5 percent last year to 1.13 million barrels a day while oil consumption rose 1.4 percent to 1.15 million barrels a day, according to data from BP Plc, the world's second-largest publicly traded oil company...The country's fuel consumption may rise 7 percent in the second half from the first six months, Mohammad Harun, spokesman for the nation's biggest oil producer, PT Pertamina, said in an e- mailed statement on Aug. 12.”

``The country may import a net 61,000 barrels a day this year, compared with net exports of 27,000 barrels in 2004, based on figures in a document prepared for the Energy and Mineral Resources Ministry and obtained by Bloomberg News.” notes Bloomberg’s Yumi Kuramitsu and Naila Firdausi.

Since government restricts a `pass through’ of the price of fuel to its consumers and instead absorbs the price differential, this has accounted for a substantial chunk of strain in the country’s fiscal budget, ``President Susilo Bambang Yudhoyono on Aug. 16 forecast spending on fuel subsidies may reach 140 trillion rupiah ($13.4 billion) this year, threatening his plan to narrow the budget deficit and boost spending on health and education. Subsidies will widen the budget deficit to 1 percent of gross domestic product, the president said on Aug. 16, up from 0.8 percent.” reports Bloomberg’s Christina Soon.

Caught between the proverbial ``Devil and the deep blue sea” the government’s desire to balance its budget runs in conflict with the interests of the populace.

The heightened risk of political unrest and higher inflation landscape has caused the present ruckus in the country’s financial markets. According to widely followed BCA Research, ``Markets worry that the removal of subsidies will push inflation higher and increase political risks. In 2001, when the government last attempted to remove fuel subsidies this incited social unrest and led to the reinstatement of the subsidies. Market conditions are fluid and further weakness is likely. However, the inflationary shock from higher fuel prices will be transitory and long-term bonds yielding nearly 14% offer good value.” In short, BCA believes that the ‘transitory’ actions are simply knee-jerk reactions that presents for a buying opportunity.

Two important reflection points from the ‘Indonesian experience’. First, subsidies, for short term pacification of the general public, wreaks havoc on government finances which eventually percolates to the financial markets, as I have argued against the proponents of crowd appeasing nationalization or government subsidies in my May 2 to 6th edition `The Cure Is Worse Than The Disease’.

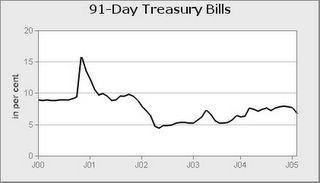

Second, because oil price shocks have ‘stagflationary’ effects on oil importing countries, which means it reduces the rate of growth, and leads to an increase in the general price level or potential inflation, higher interest rates or tightening money environment are its natural outgrowth, something that we have not yet seen in the local market, so far. As shown by the chart below from the National Statistical Coordination Board NSCB.

91-day Philippine Treasury Bills

So before you believe the mainstream analysts’ folderol that the current ennui in the domestic market is oil related, check out if the financial markets (across asset classes) are validating this view.

Finally, many economists correlate high oil prices to a consumption tax. Maybe it is, however, in my view they are even worse than taxes. Not only are they a drag to consumer spending, business hiring, capital expenditures, corporate profits and foreign currency reserves, the increased oil bills go overseas particularly to oil exporting countries. In short, it is a wealth transfer from oil consuming countries to oil producing countries. At least taxes get spent domestically whether one would argue that it be spent judiciously or otherwise.

No comments:

Post a Comment