``Efforts and courage are not enough without purpose and direction." - John F. Kennedy

After a long and tedious wait, finally that much awaited breakout!

Figure 1 Phisix Breakouts out of One Year Consolidation

Surging 2.7% for the week, the Philippine benchmark index posted cumulative gains of a noteworthy 5% over two consecutive weeks, to scale a 6 year high as of Friday’s close. The advances over the previous ten sessions represent the bulk of the 5.34% year-to-date advance for the Phisix.

Well, this isn’t exactly a surprising development since we have repeatedly delved on the possibility of this outcome over the past weeks, if not since late last year (see November 7 to 11 Market Timing: Preparing For the Christmas Rally). We have even taken as cue the movements of

Even amidst the most recent battering of the Phisix coincidental to the declines among contemporary emerging market indices, my forecasts for the Phisix remained steadfastly for the breakout, confidently banking on market cycles as basis for such gritty projections. As to whether the present breakout could simply be a headfake or the next leg up remains to be seen, however, signs are predominantly indicative for the latter to occur.

In contrast to the previous breakouts, which had been primarily driven by foreign money, today’s watermark activities could be characterized as being driven by a combination of more aggressive local investors and an equally optimistic foreign money. In fact, market internals reveal that the scope of foreign buying activities over the broadmarket has reached a March 2005 high! As an aside, net foreign buying constituted about 20% of accrued turnover at Php 1.273 billion.

It is safe to infer that the money flows from overseas investors into the domestic market could be consistent with the activities in the emerging market class. For the week that ended on March 22nd, according to Amgdata.com, ``Excluding ETF activity, International Equity funds report net inflows ($854 Mil) to all Emerging and Developed regions.” Moreover, most Asian bourses registered advances for the week except for

During the previous outlooks, I mentioned that the formative upside trends or the “successful breakouts” (see February 27 to March 3 edition, Bullish Signals from the Recent Rally) over the broadmarket indicated a psychological reversal by the locals whom have been sparingly bullish over the present advance cycle which incepted in the second quarter of 2003. The burst of activities from local investors have been conspicuously observed during the peak cycle of last year’s run, i.e. February to March.

Even prior to the present breakout, evidences abound that local investors’ activities have actually ramped up!

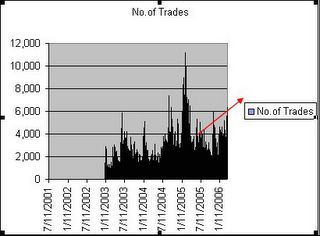

Figure 2: Ascending Number of Trades

As shown in Figure 2, the number of trades or the transactions consummated daily have been building up since the last quarter of 2005 until the present. The overall trend has likewise been on an upside since 2003. Please note that the spike or the record high number of transactions was recorded during the zenith of last year’s run from February to March. Present momentum tells us that we are about halfway from the previous peak. This suggests that as the market scales higher, activities are likely to reach or even surpass previous highs.

Figure 3: Issues Traded on an Uptrend

Now against the claptrap spouted by most conventional mainstream analysts/experts of improving micro aspects (there is no dispute that the micro environs has emitted signs of improvement but has not served as the driver!), your prudent investor analyst has pointed to the higher peso as the pivotal impetus for the psychological shift of the local investors as to being “positive” on the domestic market.

Again, using Bastiat’s law of the Unseen or in the words of the illustrious scientist Albert Einstein ``Not everything that counts can be counted and not everything that can be counted, counts”.

Figure 4: Peso’s Appreciation In September Coincides with Acceleration of Local activities

Now what appears to really count among the sundry of countable factors is that as the Philippine currency, the Peso begun its appreciation in September, activities in the market by the local investors, as demonstrated by the confluence of the rising number of traded issues and the daily transactions, have distinctively been on an uptick over the same period! In other words, the rising Peso has coincided with the growing activities of local investors over at the PSE.

The distinguished Austrian Economist Ludwig Von Mises argued that ``Human action is purposeful behavior” which means that people are generally moved by the judgments of value aiming at a definite end or that people act to attain their “perceived” interests. The Philippine Stock Exchange or the local equities market has evidently become an alternative avenue for local investors whom have found investing in the dollar denominated assets as a less appealing proposition. In short, local investors have been simply chasing for yields. Elementary my dear Watson!

One must remember that throughout the past decade, as the Peso depreciated amidst financial and economic turmoil, local investors have fundamentally fled from investing in local (peso) assets or (business) ventures and took the US dollar route as a haven for their savings. This essentially is known as “Capital Flight”.

In the past I mentioned that the domestic banking sector’s Foreign Currency Deposit Unit (FCDU) has been reportedly loaded with some $10.4 billion worth of dollar denominated investments lodged overseas by local resident investors, according to the Bangko Sentral ng Pilipinas as reported by the Philippine Daily Inquirer.

As the prospects of a firming peso/falling dollar and higher yielding rates for the domestic money market or fixed income units relative to US dollar based units gets to be entrenched upon the Filipino investor’s psyche, the odds are for a trend reversal of the past “Capital Flight”. You can expect a gradual repatriation of that $10.4 billion worth of locally owned dollar assets back to Philippine shores. Investments are likely to grow manifold in the form of expanded volume for the PSE (direction too!) as well as domestic fixed income securities, real estate and/or myriad business ventures or direct investments. This, notwithstanding, does not incorporate the unreported monies stashed overseas!

The logic is quite simple: Would you remain holding on to the US dollar or US dollar denominated assets when returns are falling? Would you not invest on a higher yielding currency?

So what your mainstream analysts deduces as micro improvements acting as drivers of the markets are essentially the consequences of ‘causality’. To reword the famous quote of author Harold Coffin, ``It’s the Peso, stupid.”

Because our goal is to always be ahead of the curve, understanding the drivers of the market is our main concern and acting on investments that are expected to respond or react to such trends and NOT training our eyes on relative effects. As the prominent economist John Maynard Keynes once said, ``Successful investing is anticipating the anticipations of others." We act on the anticipation of an emerging trend or surf on an existing wave/trend.

Again let me remind you that this is seen in the prism or through the looking glass of the local investors.

No comments:

Post a Comment