I have to admit, the recent “euphoric” bouts of buying activities in the mining and oil sector has given me some apprehensions about a possible “top”. In fact, I’ve taken such opportunities to liquidate some of my trading positions. Yet it appears that the gravity defying momentum of oil and mining stocks appears to remain solid amidst an overbought backdrop.

Technicians or price action watchers known as Chartists have been blown off by the recent surge. Most of them have sold out or have been left behind, following the two week frenetic run, where the Mining and oil index have gained by almost 1,000 points or about 25% (and is up about 77% up from the first week of the year). Such is the flaw of trying to “time” the markets, because markets can remain irrational than one can remain solvent to paraphrase the preeminent economist John Maynard Keynes.

Nonetheless, in the past three trading sessions, from April 11-17, the Mining and Oil Index took the top spot in terms of Peso trading volume relative to the different sectors! Moreover, the mining and oil index appears to have generated its distinct sentiment relative to that of the Phisix. Put differently, the performance of the sector has been independent to that of the Phisix. Apparently, these are seminal manifestations or indications of the times to come.

At present, the Mining and oil index appears to be at still overbought levels, hence, a trading sell, in my view. However, despite the overbought conditions, one may be compelled to buy back ASAP due to Friday’s noteworthy surge to nominal RECORD highs by the world oil benchmarks, the West Texas Intermediate Crude (WTIC), as shown in Figure 1, and the Brent Crude, accompanied by a broadbased metal rebound. In New York, WTIC closed at $75.15 per barrel while Brent crude closed at $74.56 in

One has to keep in mind that rising commodity prices could be indicative of declining values of Paper based money or the present US dollar standard system. Even the proponents of deflation have now been raising concerns about the attendant emerging incidence of growing inflation.

You see by theory, paper based money and credit can be issued infinitely relative to the finite supplies of commodities, ergo, too much supplies means falling values of paper money or as manifested in the present case, the surge of commodity prices. For instance, while media has noted of rising Gold prices quoted in US dollars, what has not been said is that Gold has surged across the spectrum of major Fiat Currencies, as shown in Figure 2. Even against the top performing Canadian dollar, Gold still asserting domination.

Figure 2: Gold Surging against the Canadian "Loonie" Dollar and the Japanese Yen (courtesy of Fullermoney.com)

Now, since the locals have gradually imbued of these developments and learned how to price mining and oil stocks with that of its underlying products; with the present surge in commodity prices, you can expect another round of frenzied buying frenzy at the Philippine Stock Exchange next week.

Notwithstanding, the nominal record high set by Crude Oil prices, aside from the inflationary manifestations, are also about investment cycles and geopolitical considerations, something we discussed last May 2 to 6, 2005, The Cure Is Worse Than The Disease. One can expect that, with the present imbalances that have led to a tight margin exacerbated by present geopolitical conditions, these are recipes for new RECORD oil prices...Think $100 per barrel!

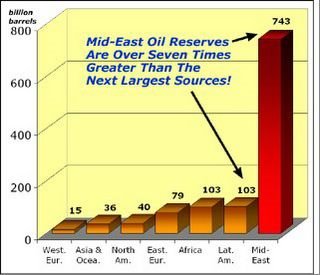

We must not forget that an estimated 743 billion barrels (see Figure 3) or over 66% of accrued world oil reserves are held by the Mid-East countries. Such that any military conflict or escalating unrests, e.g.

Figure 3 Distribution of World’s Reserves courtesy of Martin Weiss of Money and Markets

Furthermore, any events that may lead to the closure of Strait of Hormuz (see Figure 4) where 40% of the internationally traded oil’s passes through could cause an oil price spiral to over $100 per barrel!

To repeat the my above quote of Albert Einstein “We must learn to differentiate clearly the fundamentally important, that which is really basic, from that which is dispensable, and to turn aside from everything else, from the multitude of things which clutter up the mind and divert it from the essential.” What is essential to understand with the current developments is that the publicly listed oil companies act an insurance against any risk of an oil price shock which may worsen as geopolitical conditions have been threatening to escalate. Put bluntly, it pays to be invested in oil explo companies as an insurance against escalating oil prices.

Since oil exploration and production companies have existing reserves, even when most of them are not operational, rising prices of oil would translate to an increase of their asset values and should likewise be reflected in the share prices.

As discussed last year see August 1 to 5 edition, Hidden Wealth in Philippine Black Gold Stocks, oil stocks remained at the fringe for quite a time until its recent renaissance.

For the week, local investors bidded up domestic oil companies as Oriental Petroleum (+33%), Philippine Overseas (+29.03%) and PetroEnergy (+82%). With oil prices carving out new highs, one can expect these companies to shadow oil prices and similarly outperform together with the movements of their siblings, the mining stocks.

As for me, I would be compelled back into the market given the present circumstances regardless of what the technical indicators say. Besides since commodities are presently in a bull market, any mistakes should easily be covered, to quote the veteran Richard Russell, ``A bull market tends to bail you out of all your mistakes. Conversely, bear markets make you PAY for your mistakes.”

For one to achieve outsized returns, it takes to know WHEN to have the fortitude to take the necessary risks. And Time is NOW!

No comments:

Post a Comment