``Accuracy of observation is the equivalent of accuracy of thinking." Wallace Stevens, American Poet, (1879-1955)

Correlation doesn’t necessarily translate to causation, but I hope those who adamantly insist that the activities in the Phisix is borne out of “micro” factors can explain the tight association among these key benchmarks; namely the Phisix, the Dow Jones Industrial Averages and the Morgan Stanley Emerging Free Index, as shown in Figure 1.

Figure 1: Stockcharts.com: Phisix’s Tight Correlations with DJIA and MSEMFThe chart over a timeframe spread of one year and 6 months shows of an almost lockstep movement by the PHISIX, the DJIA (behind) and the MSEMF (lower pane). The MSEMF is an index of emerging markets bourses.

The arrows above points of major inflection points, which has strangely occurred in simultaneous fashion. Observe too that even during periods of consolidation, the contours in general have been tightly similar.

Mainstream analysts with their elaborate presentations continually assert that the present progress in the Philippine financial markets have been due to domestic economic and political factors. While I do not deny that such variables could have abetted the current conditions, does this sufficiently explain such closely knit relations? Apparently not.

One may even recall that political tumults as the July 2003 Oakwood incident, the 2004 Presidential elections and the GARCI scandals have all failed to deter the rise of the Phisix. Oddly enough, it even found such events as springboard to its present state, a case of Wall Street’s favorite tenet “climbing a wall of worry” perhaps?

Well again all these do not explain such correlations. And when we are far from the true drivers of the market, our tendency is to misinterpret, which could lead us to fatal investing decisions.

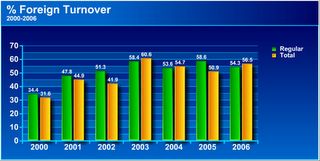

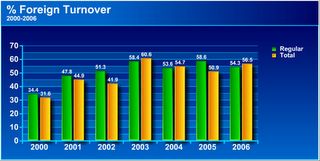

For starters, we have to consider the framework of the Philippine Stock Market where the fluxes of foreign capital have had a significant contribution. In fact, they represent a majority, relative to total Peso volume turnover, as shown in Figure 2.

Figure 2: PSE: Foreign Capital Makes Up the Bulk of TurnoverThe above chart, with special thanks to JM Ian Salas of the PSE for the data and Wilson Chong for the Chart, shows of the foreign money share representation to the total turnover, which had been over 50% since 2002 on a regular board exchange basis and since 2003 on a total basis or inclusive of special block sales.

Figure 3: PSE: Net Foreign Inflows Has Driven the Phisix since 2003Figure 3 is a representation of the net foreign transaction or the inflow or outflow of foreign funds. Please take note that foreign inflows have been in a growing trend since 2003 on a regular or board exchange basis. While on a total basis or inclusive of special block sales, the uptrend has been from 2004.

And if you think that this has been limited to the domestic arena, let me show you of Thailand’s SET framework, the more liberal among our neighboring bourses in terms of internal data disclosure.

In Thailand, LOCAL RETAIL investors have been the dominant force. However, foreign capital flows have likewise been significant but to a lesser degree. Let me elaborate.

Figure 4: SET: Transactions by Investor TypeFigure 4 shows of Thailand’s share distribution by investor type over a period of 10 years. I’d like you to note of the trend of foreign investor take-up has been growing (light blue bar) since 2003 at the expense of local retailers (dark blue bar).

Figure 5: SET: Average Daily TurnoverIn Figure 5, one can take note of the growing intensity of foreign money into Thailand’s bourse as measured in volume. This means that the increase in daily turnover has been mostly due to a more substantial rate of change growth from foreign money flows into the SET.

Here are some important facts of note:

1. Thailand’s market cap is USD 127 billion at the end of 2005 compared to the Phisix’s at over USD 43 billion today.

2. Thailand’s population is about 65 million compared to around 85 million for the Philippines.

3. The Average daily turnover of is a whopping USD 409 million in 2005 against a measly the Philippines USD 30-60 million today!

4. Local RETAIL Investors constitute the majority of investors; although on a declining trend relative to market share, but has likewise increased in terms of nominal volume since 2003.

5. On the other hand, Foreign Money constitutes a significant growing minority!

6. According to IMF data, Thailand’s Stock market cap to GDP ratio is about 68% as compared 34% of the Philippines.

When economic analysis centering on comparisons about certain countries omit the financial market aspects, then it is not representative of a meaningful picture or analysis.

Why? Today’s global economy is much more dictated by the financial world than the actual exchange of widgets and services. Global Market Cap for the collective stock market is said to be at over USD 43 Trillion which is almost the same scale as today’s Global GDP.

Combined, the world capital markets broken down into sovereign bonds, corporate bonds, bank deposits and mortgage securities are at over an estimated 1.7 times the world economy!

Now relative to Thailand, the breadth, depth and sophistication of its financial markets signifies that their domestic capitalists had been successfully able to channel savings into the required investments to achieve their present state.

Figure 6: Bloomberg: Thailand’s SET (blue) and Phisix (green)In other words, the Thai stockmarket has meaningfully contributed in bolstering its economy and elevated the financial and economic state of its citizenry to achieve its present prosperity. Such that, despite the recent political turmoil, the sizeable participation of local investors makes it less prone to the sways or volatilities in the global market as shown in Figure 6.

Moreover, Thailand’s conduciveness to the business environment or a market-based economy can be seen with its 18th ranking in World Bank’s Doing Business, compared to the Philippines which ranked at 126th and in Heritage.org’s index of economic freedom where Thailand ranks 71st “mostly free” relative to the Philippine’s 98th place “mostly unfree”.

The lesson here is that the financial markets contribute substantially to state of economic progress, especially in the present evolutionary structure of a global finance-based economy. This should effectively translate to having more of our citizenry participate in the development of our capital markets in order to achieve our desired prosperity. Markets and not politics make prosperity.

Going back to our initial topic of tight correlation, this [Thai-Phil example] likewise reveals that when a country’s bourse is mainly reliant on the activities of foreign capital rather than of domestic investors, its direction is subjected to the sentiment, volatilities and dynamics of global fund flows.

Investors who continue to immerse themselves into the illusion that the local factors have been the key determinants of the domestic market will be left holding the proverbial “empty bag” or would be caught “swimming naked” when, to paraphrase Mr. Buffett, “the tide goes out”.

Figure 7: Economagic: US FED Fund Rate and the S & P 500 No markets are essentially single-variable/dimension determined over the long term, although in one instance or another, a variable may outweigh all others given their influence to the collective investors.

One of the most crucial factors that I’ve been repeatedly arguing for as major drivers to our financial markets or of the worlds’ is of global liquidity.

When the US Federal Reserve fretted upon the shadows of a Japan-like Deflation bugaboo, following the technology bust in 2000, they undertook an aggressive massive campaign to flood the world’s monetary system with surplus money and credit. The Fed took down its interest rates to its lowest levels in about half a century, as shown in Figure 7. This essentially prompted investors to take upon massive leverage worldwide in different trading forms, such as the widely known CARRY Trade.

Notice that all the indices mentioned above found their bullish stimulus almost synchronically in 2003. It likewise appears that almost all variants of asset classes [bonds, collectibles, stocks, commodities and real estate] around the world have responded to the US Fed’s easing.

Yes, the FED did take steps to increase its interbank lending rates 18 times to 5.25%, from its trough in June 2003, but essentially in nominal figures it remains lower compared to the past.

One should not forget that the present monetary system is based on the US dollar standard and that policies encompassing the US dollar have greatly weighed on the performances of various asset classes, if not among economies.

Yet, another supportive role of today’s fiat money based asset economies has been the increasing importance of new financial instruments, such as structured finance and the various strains of derivatives, aside from the technological innovations in the areas of information and communications which have transformed and enabled real-time money flow platforms that has essentially facilitated global money flows using the click of a mouse.

Denying these seismic changes in today’s world is a recipe to obsolescence and subsequent loss of capital.

3 comments:

You hit it on the dot.

Unfortunately, a lot of self-anointed experts are not really experts and have kept on propagating the lie that it was domestic factors that pushed the market.

mr benson, your thai analysis is very timely given the huge drop this morning.

Its comforting to realize that SET is largely on local thai investors.. suggesting (hopefully) that the panic will be contained within Bangkok shores. ..and where will the foreign funds re-allocate? Well, phisix sana..

is there a way to contact you ? I have been following your blog and have picked up quite a lot of learnings along the way

Thanks for your comments.

One of the fundamental risks in today’s world is the rising tide of protectionism. As in the case of Thailand which prospered under more liberal settings in the past, the recent imposition of capital controls to limit foreign money movements and rein the Baht’s appreciation, I think is grounded on a faulty premise. Where money is not treated well, the natural reaction would be an exodus.

Mainstream economists whose analysis influence policymakers are wont to believe that rising currencies curb exports. While such is a textbook dogma, the reality is different. Rising currencies of many Asian countries for several years hasn’t curtailed exports, so as with many Latin American and European countries. What you have is a global phenomenon of rising currencies and rising volume of exports, the probable reasons of which I may write about soon. In short, policymakers have been barking at the wrong tree. Exchange rates are usually made by policymakers as scapegoats for their inefficiencies. This is the same premise adopted by US politicians in pressuring China to appreciate its yuan to appease some sectors of its society. As always, political grandstanding equals the law of unintended consequences.

It was an ASEAN contagion as a general response to Thailand’s fiat as of yesterday. The premise is that what occurred in Thailand could be a model for other Asian emerging markets. However, I think such worries are overrated. Maybe the markets, having climbed to a vast degree, are seeking for reasons to correct, which could be a sign of exhaustion.

You may reach me at my email address benson.te@gmail.com or through landline 534-1114.

Post a Comment