I’ve been arguing since that earnings have hardly been the principal drivers of stock prices.

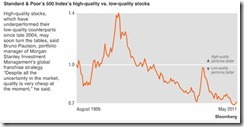

Today’s Bloomberg’s chart of the day appears to bolster my case. And this time such dynamic applies to the S&P 500

Here’s a passage from the Bloomberg article,

Stocks with the most reliable earnings are underperforming those with the least predictable results by the most since at least 1997 and may soon start to outperform, Morgan Stanley Investment Management said.

The CHART OF THE DAY compares the performance of so-called high-quality companies on the Standard & Poor’s 500 Index with low-quality businesses. S&P awards all equities a quality rating based on the sustainability and robustness of both their earnings and their balance sheets.

“Despite all the uncertainty in the market, quality is very cheap at the moment,” said Bruno Paulson, the portfolio manager of MSIM’s global franchise strategy, which has $6.3 billion under management, in London. “It’s not unreasonable to expect some re-rating from here. I don’t know what will trigger it; it might be the end of liquidity.”

So the quoted expert partly attributes ‘liquidity’ to this phenomenon but sounds rather tentative. I would suggest that this represents the mainstream view (again I am applying representative bias here) where the mainstream don’t get it.

Inflationism has been the main culprit. Flooding the world with too much money leads to speculative excess. This amounts to the bidding up of prices of low quality stocks more than the high quality counterparts. When people chase prices, rumor based plays are rife and earnings become a side story.

I would like to reiterate Austrian economist Fritz Machlup’s dictum (bold highlights mine)

If it were not for the elasticity of bank credit, which has often been regarded as such a good thing, a boom in security values could not last for any length of time. In the absence of inflationary credit the funds available for lending to the public for security purchases would soon be exhausted, since even a large supply is ultimately limited. The supply of funds derived solely from current new savings and amortization current amortization allowances is fairly inelastic, and optimism about the development of security prices, inelastic would promptly lead to a "tightening" on the credit market, and the cessation of speculation "for the rise." There would thus be no chains of speculative transactions and the limited amount of credit available would pass into production without delay.

Each day that passes, evidences seem to emerge in favor our views.

No comments:

Post a Comment