The whack a mole strategy being applied by officials of crisis stricken doesn’t seem to work.

Now the US officials are getting increasingly concerned over the escalating banking problems at the Eurozone.

Reports the Wall Street Journal (bold highlights mine)

Federal and state regulators, signaling their growing worry that Europe's debt crisis could spill into the U.S. banking system, are intensifying their scrutiny of the U.S. arms of Europe's biggest banks, according to people familiar with the matter.

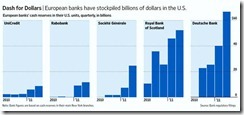

The Federal Reserve Bank of New York, which oversees the U.S. operations of many large European banks, recently has been holding extensive meetings with the lenders to gauge their vulnerability to escalating financial pressures. The Fed is demanding more information from the banks about whether they have reliable access to the funds needed to operate on a day-to-day basis in the U.S. and, in some cases, pushing the banks to overhaul their U.S. structures, the people familiar with the matter say.

Officials at the New York Fed "are very concerned" about European banks facing funding difficulties in the U.S., said a senior executive at a major European bank who has participated in the talks…

Regulators are trying to guard against the possibility European banks that encounter trouble could siphon funds out of their U.S. arms, these people said. Regulators recently have ramped up pressure on European banks to transform their U.S. businesses into self-financed organizations that are better insulated from problems with their parent companies, a senior bank executive said.

In one sign of how European banks may be having trouble getting dollar funding, an unidentified European bank on Wednesday borrowed $500 million in one-week debt from the European Central Bank, according to ECB data. The bank paid a higher cost than what other banks would pay to borrow dollars from fellow lenders. It was the first time for that type of borrowing since Feb 23.

Anxiety about European banks' U.S. funding comes amid broader concerns about whether Europe's struggling banks will be able to refinance maturing debt in coming years. Investors, wary of many European banks' holdings of debt issued by troubled euro-zone governments, are shunning large swaths of the sector. While top European banks already have satisfied about 90% of their funding needs for 2011, they still need to raise a total of roughly €80 billion ($115 billion) by the end of the year, according to Morgan Stanley.

Part of the $500 million loan was said to have been funded by the US Federal Reserve via $200 million currency swap lines to the Swiss National Bank (!), according to Zero Hedge. There goes another stealth QE.

This partly validates my earlier suspicion that SNB’s intervention in the currency markets has been mostly about providing liquidity to the distressed equity markets which has been symptomatic of the banking sector’s woes.

I would suspect that part of this intervention, aside from publicly wishing for a weaker franc, is to flood the system with money to mitigate the losses being endured by European equity markets.

Nonetheless the wild swings in global markets seem to suggest that the recent measures undertaken by the US Federal Reserve or the ECB have been deemed as ‘inadequate’.

Remember, since 2003, global financial markets have increasingly been dependent on central bank policies, where the 2008 crisis has made financial markets essentially stand on the crutches of the Fed’s money printing policies. In short, global equity markets have been mostly dependent on the combination of QEs and an extended low interest rate environment.

And as stated earlier, given Europe’s funding problems which may spillover to the US, it is very likely to expect that the US Federal Reserve will eventually conform to the desires of markets addicted to central bank steroids with aggressive dosages.

And this is being signaled by record gold prices.

No comments:

Post a Comment