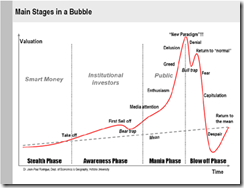

Bubble behavior can be seen as rational, even if market participants know they are seeing a bubble. After all, as long as one catches a bubble on the way up, buying low and selling high, one can make money. Furthermore, bubbles burst precisely because investors recognize that the asset prices at the top of the bubble are out of balance with market fundamentals; it is just that these things do not happen with the mathematical precision and smoothness of the mathematical models, so many academic economists simply turn away from looking at things as they really are. Professor William L. Anderson

The parameters for my repositioning or for undertaking additional risk exposure to markets has been specified last week[1]

To see signs of improvement, we need a significant expansion of Peso volume trades, a broad based bullish or optimistic market breadth which should be supported by an improvement in chart price actions.

But most importantly, outside the local context, we need to see strong evidences of recoveries from our neighbors’ bourses, and similarly from the commodity markets.

Such recovery should likely be accompanied by signs of consolidation or parallel enhancements of the price actions in developed economy contemporaries.

Only from the above developments can we say that we have successfully sailed through the Greek mythological treacherous waters of Scylla and Charybdis

The notable improvements in the commodity and developed nation’s equity markets seem to have satisfied two very significant conditions.

Regional Confirmation

Now we need to see how our neighbors have been responding to the recent “shock and awe” policy steroids

Like their developed economy contemporary, the ASEAN-4 bourses have all been manifesting material signs of recuperation even prior to the Euro Bazooka bailout deal.

The Philippine Phisix seems as having the best chart picture among the four. The PSEC is the only chart that has yet to transition to a bearish ‘death cross’ pattern. The current buoyant actions by the domestic bellwether will likely widen the spread of the 50-day (blue line) and 200 moving averages (red line) that should signal a clearance from the bear market hurdle or a pivotal move away from the recent critical test. Importantly, sustained upside momentum should highlight the resumption of the bull market.

Three of our neighbors have still been scourged by the bearish ‘death crosses’ patterns, where only Indonesia’s IDDOW have successfully breached both 50 and 200 day moving averages. The implication is that, like the PSEC, should the IDDOW persist to the upside, the ‘death cross’ pattern will transform into a whipsaw, which serves as another evidence of chart pattern failure.

And I believe that a buoyant PSEC and IDDOW will eventually translate to the same market actions for benchmarks of Malaysia (MYDOW) and Thailand’s (SETI)

Moreover, Asian currencies as reflected by the ADXY or Bloomberg-JP Morgan’s basket of Asian currencies have likewise made a dramatic turnabout.

Again the above only reinforces my repeated assertions that actions of global policymakers have been directing price movements of international markets.

The external environment as seen by the price actions of the commodity markets, developed equity markets and ASEAN-Asian markets have resonated conditions that seem to justify an environment increasingly ripe for renewed risk taking activities.

More Confirmations: Market Internals and the Philippine Peso

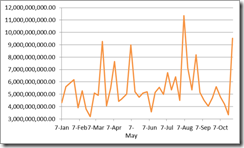

At the Philippine Stock Exchange, market internals appear to be on the mend too.

This week’s average volume has exploded to the upside. But this has mostly been due to the special block sales which accounted for 56% of the total.

The market breadth has also gradually been improving.

Sectoral performances have all strongly recovered from the recent lows. Services (bright green) lifted by PLDT appears to lead the way, with the other sectors Mining (teal) Property (brown), Holding (orange) and Banking (blue) also up but whose performances has relatively varied.

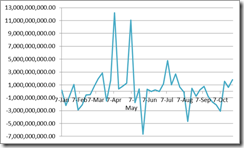

What seems as the most impressive has been the action of the Philippine Peso

The Euro Bazooka bailout deal may have prompted for a stunning breakaway gap for the Philippine Peso. The jump in the Peso essentially reflects on the Asian currencies.

Nevertheless the Peso has been firming up even prior to Friday’s breakaway run (in spite of BSP’s interventions). The gap, if sustained, could signal even more strength for the Peso and the Phisix ahead.

I would reckon that the Peso’s improvement has been immensely supported by expanding net foreign inflows to the PSE.

ALL of the parameters or conditionalities on my checklist appear to have been satisfied. This implies for a graduated re-entry for me.

Although I would still deem that China’s highly uncertain environment could pose as a black swan risk worthy of continuing vigil, inflationary developments globally may be providing a cushion from which may have alleviated the risk environment in China. Again this has to be proven or established.

Learning from this episode, what worries me is that many people seem to have acquired the mentality where all selloffs should be seen as buying opportunities, premised on what seems to be a deepening assumption that governments will always successfully moderate any prices decline.

We understand this outlook as representative of moral hazard, or even as the Bernanke Put[2]—the expectations that central banks will ‘fight market falls’.

This is also symptomatic of the market’s intensifying bubble psychology shaped by intensifying bubble-bailout policies[3].

In the fullness of time, again markets will be prove that interventions as unsound, tenuous and subject to bust dynamics similar to 2008.

It must be impressed upon everyone that inflation is a policy that cannot last.

[1] See The Philippine Phisix at Crossroads, October 23, 2011

[2] Bernanke Put Wikipedia.org, Greenspan Put

[3] See A Primer On Stock Markets-Why It Isn’t Generally A Gambling Casino, January 18, 2009

No comments:

Post a Comment