Celebrity guru Nouriel Roubini writes about the Euro crisis and delivers his grand prescription,

So if you cannot devalue, or grow, or deflate to a real depreciation, the only option left will end up being to give up on the euro and to go back to the lira and other national currencies. Of course that will trigger a forced conversion of euro debts into new national currency debts.

Utter nonsense.

First of all, devaluation represents a default, not against the duplicity of the central bank-bankers-welfare state but against the average Greeks or the Italians. So politicians will be saving their skins at the expense of their respective citizenry.

Thus, the currency devaluation nostrum aims to preserve the welfare state which serves as the root of the Eurozone’s problem. This does nothing to solve the problem.

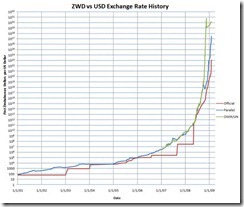

Second, if devaluation causes economic growth, then why has Zimbabwe’s massive devaluation (hyperinflation) not spurred her economy into the stratosphere?

Chart from Wikipedia.org

The answer; since inflationism forcibly redistributes resources from creditors to debtors, such policies impairs an economy’s division of labor via price signal distortions (aside from regulatory obstructions, particularly the twin of inflation: price controls) which restrains competitiveness and consequently poses a significant impediment to trading activities, capital accumulation, and most importantly, a substantial reduction in the purchasing power.

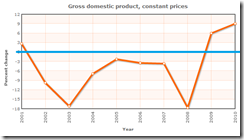

Chart from Indexmundi.com

Zimbabwe’s inflationism has led to 7 years of hyperinflationary depression (where economic recession has ranged from minus 3% to minus 18% in 2001-2008).

Zimbabwe’s economy has only begun to recover after the Mugabe government abdicated on such cataclysmic hyperinflationist policies which resulted to the demise of the Zimbabwe dollar and the adaption of the US dollar and South African Rand as mediums of exchanges.

This so applies with Brazil's experience too.

Three, devaluation will be a messy and chaotic process as pointed out by Professor Steve Hanke because this will translate to massive and widespread bankruptcies of the private sector (such as in Zimbabwe).

It is true that lowered standards of living from devaluation will force those affected to work more to cover for the loss of purchasing power, but this can hardly be construed as an improvement. Effects must not be read as a cause.

What is needed is to allow markets to clear by reducing the amount of government interferences, and importantly, by allowing malinvestments to be liquidated

As Professor Philipp Bagus writes,

First, relative prices must adjust. For instances, housing prices had to fall, which made other projects look relatively more profitable. If relative housing prices do not fall, ever more houses will be built, adding to existing distortions.

Second, savings must be available to finance investments in the hitherto neglected sectors, such as the commodity sector. Additional savings hasten the process as the new processes need savings.

Lastly, factor markets must be flexible to allow the factors of production to shift from the bubble sectors to the more urgently demanded projects. Workers must stop building additional houses and instead engage in more-urgent projects, such as the production of oil.

Fourth, currency devaluation nostrum signifies as an appeal to emotion rather than a logical construction of economic reality.

Such pretentious policy prescription has been predicated upon the oversimplistic assumptions of the world as operating in the prism of aggregates (where there is a single dynamic for wages, labor, product, price sensitivity and demand).

Again the Zimbabwe example shows how much quackery currency devaluation prescriptions are.

Fifth Mr. Roubini has an inferior batting average in terms of predicting markets (such as his debate with Jim Rogers on Gold), which implies that his analytical methodology must be severely flawed. And instead his views seem to be influenced by his political connections.

I am reminded of the great Ludwig von Mises who demolished the populist fallacies of inflationism…(bold emphasis mine)

The popularity of inflationism is in great part due to deep-rooted hatred of creditors. Inflation is considered just because it favors debtors at the expense of creditors. However, the inflationist view of history which we have to deal with in this section is only loosely related to this anticreditor argument. Its assertion that "expansionism" is the driving force of economic progress and that "restrictionism" is the worst of all evils is mainly based on other arguments…

…The question is whether the fall in purchasing power was or was not an indispensable factor in the evolution which led from the poverty of ages gone by to the more satisfactory conditions of modern Western capitalism. This question must be answered without reference to the historical experience, which can be and always is interpreted in different ways, and to which supporters and adversaries of every theory and of every explanation of history refer as a proof of their mutually contradictory and incompatible statements. What is needed is a clarification of the effects of changes in purchasing power on the division of labor, the accumulation of capital, and technological improvement…

In the conduct of business, reflections concerning the secular trend of prices do not bother any role whatever. Entrepreneurs and investors do not bother about secular trends. What guides their actions is their opinion about the movement of prices in the coming weeks, months. or at most years. They do not heed the general movement of all prices. What matters for them is the existence of discrepancies between the prices of the complementary factors of production and the anticipated prices of the products. No businessman embarks upon a definite production project because he believes that the prices, i.e., the prices of all goods and services, will rise. He engages himself if he believes that he can profit from a difference between the prices of goods of various orders. In a world with a secular tendency toward falling prices, such opportunities for earning profit will appear in the same way in which they appear in a world with a secular trend toward rising prices. The expectation of a general progressive upward movement of all prices does not bring about intensified production and improvement in well-being. It results in the "flight to real values," in the crack-up boom and the complete breakdown of the monetary system.

See the difference? The analytical backing of inflationism fundamentally relies on heuristics (mental shortcuts/cognitive biases) and or aggregates (math models) against the real world, whose risk-taking operations by capitalists and entrepreneurs are principally driven by the desire to earn profits.

No comments:

Post a Comment