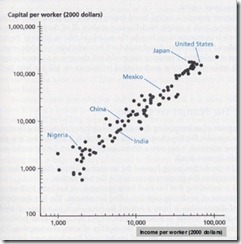

Professor Steve Landsburg posted on his blog a graph from a textbook of his colleague exhibiting the tight correlations between the increase in capital and economic prosperity.

Professor Landsburg writes,

But the overall picture is clear: More capital per worker means more output per worker, and more output per worker means more income per worker. This relationship — in fact, the nearly linear relationship that you see on the graph — is just what standard economic theory predicts. It’s nice to see that prediction so powerfully confirmed.

Capital here refers to physical capital — the machinery, factory space and office equipment that allows workers to be more productive. A garment worker with a sewing machine produces more blouses per hour than a garment worker with a needle and thread; therefore the garment worker with a sewing machine earns higher wages. (A good rule of thumb is that workers are paid about 2/3 the value of what they produce.) If you want rich garment workers, you need a lot of high-quality sewing machines. If you want rich farm workers, you need a lot of high-quality tractors…

As a caveat, it isn’t just the capital that is important, instead it is the political economic environment which allows the citizenry to accumulate capital that matters most.

Professor Landsburg explains further, (bold emphasis mine)

Do not, however, jump to the conclusion that if, say, Nigerians had access to Japanese levels of capital, then Nigerian wages would rise to Japanese levels. Part of the reason Nigerians have so little capital is that capital is used less efficiently in Nigeria, so people choose to accumulate less of it. To move up this ladder, you need to do more than just accumulate capital — you’ve got to be the sort of country where capital is worth accumulating. What that entails will be a topic for a future post.

As the great Ludwig von Mises wrote in 1955, (bold emphasis mine)

It is the insufficient supply of capital that prevents the rest of the world from adjusting its industries to the most efficient ways of production. Technological "know how" and the "passion for productivity" are useless if the capital required for the acquisition of new equipment and the inauguration of new methods is lacking.

What made modern capitalism possible and enabled the nations, first of Western Europe and later of central Europe and North America, to eclipse the rest of mankind in productivity was the fact that they created the political, legal, and institutional conditions that made capital accumulation safe. What prevents India, for example, from replacing its host of inefficient cobblers with shoe factories is only the lack of capital. As the Indian government virtually expropriates foreign capitalists and obstructs capital formation by natives, there is no way to remedy this situation. The result is that millions are barefoot in India while the average American buys several pairs of shoes every year.

America's present economic supremacy is due to the plentiful supply of capital. The allegedly "progressive" policies that slow down saving and capital accumulation, or even bring about dissaving and capital decumulation, came later to the United States than to most European countries. While Europe was being impoverished by excessive armaments, colonial adventures, anticapitalistic policies, and finally by wars and revolutions, the United States was committed to a free enterprise policy. At that time Europeans used to stigmatize American economic policies as socially backward. But it was precisely this alleged social backwardness that accounted for an amount of capital accumulation that surpassed by far the amount of capital available in other countries. When later the New Deal began to imitate the anticapitalistic policies of Europe, America had already acquired an advantage that it still retains today.

Wealth does not consist, as Marx said, in a collection of commodities, but in a collection of capital goods. Such a collection is the result of previous saving. The anti-saving doctrines of what is, paradoxically enough, called New Economics, first developed by Messrs. Foster and Catchings and then reshaped by Lord Keynes, are untenable.

If one wants to improve economic conditions, to raise the productivity of labor, wage rates and the peoples' standard of living, one must accumulate more capital goods in order to invest more and more. There is no other way to increase the amount of capital available than to expand saving by doing away with all ideological and institutional factors that hinder saving or even directly make for dissaving and capital decumulation. This is what the "underdeveloped nations" need to learn.

Bottom line, economic prosperity can only be attained through a market economy (economic freedom or laissez faire capitalism). Interventionism or politicization of the allocation of scarce resources can only result to the opposite—capital consumption.

No comments:

Post a Comment