Current developments appear to have validated my projections. While I really don’t do short term predictions, I must admit to be lucky on this call.

I will be working from my outlook and recommendations of last week

Here is what I wrote[1],

And any further weakness in commodity prices will likely filter into the asset markets…

For the Phisix, the current resiliency by the heavy caps has been a noteworthy auspicious development. Yet we should not discount the likelihood of a contagion from any adverse exogenous events.

My inclination is that based on the above evidences and in the understanding that NO TREND GOES IN A STRAIGHT LINE, the Phisix will likely undergo a correction or profit taking phase.

This retrenchment, perhaps 5-10% from the peak or a low of 4,800, should be seen as healthy and normal. Should this be realized then the local benchmark will likely drift rangebound.

Of course external developments will play a big role in either confirming or falsifying this.

The retrenchment turned out exactly as described last week, albeit too fast and too soon.

The accelerating decline of the broad based commodity market, as measured by the CRB (behind), apparently dragged the Phisix substantially lower (candle).

The local benchmark slumped by a ghastly 5.4% in just one week! And the Phisix has lost about 8% from the peak and is just over 1.6% away from the 4,800 level. Year to date the Phisix is still up 11.61% as of Friday’s close.

It must be noted that the CRB has been on a downtrend since May of 2010. But following the temporary rebound which peaked this March, the rate of the recent decline has somewhat paralleled the intensity of the selloff in September-October 2011, in scale but not in timeframe.

The commodity rout then coincided with the short term massacre of global equities.

The seeming effect of today’s commodity slump appears to resonate with that of 2011, global stock markets have been clobbered.

It should be noted that factors driving the volatility of 2011 and today’s market stress has been different. And a further question is how long would this thrashing last?

In perspective, the decline of the Phisix signifies a worldwide dynamic that covers developed markets, the BRIC and the emerging markets.

Last week’s carnage has been no different with our ASEAN contemporaries.

Aside from the Phisix which posted the largest loss for the week, Indonesia’s JCI (green), Thailand’s SET (yellow) and Malaysia’s FBMKLSI (red) likewise hemorrhaged down by over 3% this week.

More from last week’s letter

Yet I am LESS inclined to believe that a new high for the Phisix will be reached soon. Such should be until major central bankers will have announced their renewed support for the markets or if there have been conspicuous signs that they have been operating behind the curtains…

So far, the fact is, that the damage seen in the market internals will have to be remedied first…

The good part is that the much of the selloff has been locally driven which unfortunately has affected many momentum participants. Yet foreign buying remains net positive in spite of the carnage and may have provided cushion to the heavyweights…

Finally in the expectation of the possibility of the non-participation of central banks until June or after, this means greater volatility ahead in both directions.

In fact, the damage to the general market seems to have intensified.

Previously, the concentration of the losses had mainly been in mid-tier and peripheral issues. Last week, seller’s wrath encompassed the Phisix major heavyweights.

Volatility has indeed been seen in both directions.

Except for Thursday bounce which reduced the overall impairment of this week’s market breadth as shown above, the broad corrosion of internal market activities over the past 2 weeks has practically chimed with the ferocity of losses endured by the major benchmark the Phisix.

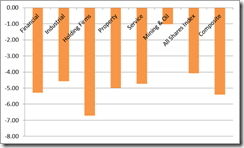

Despite the drubbing, sectoral rotation seems to have been evident last week as the distribution of losses rotated.

The major loser from last week’s funk, the Mining index was this week’s least injured.

On the other hand, last week’s second outperformer the Holding index, suffered most.

Foreign sentiment seemed to have also soured.

This week, foreign activities showed modest NET selling, which may have likewise been reflected on the local currency the peso, which lost 1.6% this week.

For almost every instance where the Phisix (red) encounters major downturn, the Peso fumbles along with it (green oval).

Yet this should not been as isolated to the local currency, but seen as a REGIONAL dynamic.

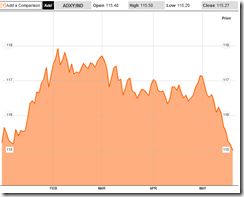

The year to date chart of the Bloomberg JP Morgan Asian dollar index[2] has exhibited the same degree of pressure as the peso

On the other hand, the US dollar has once again served as the lightning rod during market shocks.

My concluding statement of last week…

Investors may raise their cash balance during rallies and buy on every episodes of panic. And in the event that any one of the major central banks declares the next steroid (the size should matter), then our strategy shifts to buy high, sell higher.

All the evidences provided above suggest that for any material recovery to occur, market internals would have to settle or immensely improve from the current conditions.

Also while there will surely be intermittent rallies emanating from vastly oversold conditions, the path of least resistance for local equities, for the moment, seems tilted to the downside until proven otherwise. I am not sure if the 4,800 level will hold.

From this point of view, to improve on what I earlier wrote, while investors may raise cash balance during rallies, buying should be done lightly on select episodes of panic.

Again such position should be maintained until we see stability in the actions of the Phisix, which must be accompanied by an improvement of market internals.

Of course, since the Phisix has been externally influenced, any improvements must be compatible with developments abroad.

And since investments are about managing economic opportunities, then there would be time for profit, and there would also be time for wealth preservation.

Until we see marked progress in price trends, market internals and actions in overseas markets, for now, a bird at hand seems better than two in the bush.

Said differently, an overweight on cash position seems to be the most prudent option in negotiating with today’s tumultuous road.

[1] See Phisix: The Correction Phase Cometh, May 14, 2012

[2] Bloomberg.com Bloomberg JP Morgan Asia Dollar Index Chart

No comments:

Post a Comment