China’s economic deterioration seems to be broadening and worsening and may be indicative of a hard landing…

From Bloomberg,

Chinese industrial companies’ profits fell for a fourth month in July, a government report showed today, adding to evidence the nation’s economic slowdown is deepening.

Income dropped 5.4 percent last month from a year earlier to 366.8 billion yuan ($57.7 billion), the National Bureau of Statistics said in a statement on its website today. That compares with a 1.7 percent decline in June and a 5.3 percent drop in May.

Today’s data add pressure on the government to step up policy easing to reverse a slowdown that may extend into a seventh quarter. On an inspection of Guangdong province from Aug. 24 to 25, Premier Wen Jiabao said difficulties in stabilizing the expansion are “still relatively large” and called for measures to promote export growth to help meet the country’s annual economic targets, the Xinhua News Agency reported.

Another Bloomberg article says bad news is good news, as Premier Wen’s call for more stimulus means the end to China’s economic woes.

Most Asian stocks rose, recovering from declines last week, on speculation policy makers in Asia and the U.S. will take more steps to support economic growth. Oil gained for the first time in three days as a storm shut output in the U.S. and soybeans reached a record..

China’s Premier Wen Jiabao urged extra measures to support exports as evidence mounts that the nation’s slowdown is deepening. U.S. Federal Reserve Chairman Ben S. Bernanke said policy makers can take additional steps to boost the economy before they meet on Aug. 30 in Jackson Hole,Wyoming. About 24 percent of U.S. oil production and 8.2 percent of natural gas output from the Gulf of Mexico has been shut because of Tropical Storm Isaac.

People are really being made to believe in the magic of political snake oil elixirs.

Unfortunately, investors in China’s stock market do not seem to buy such balderdash.

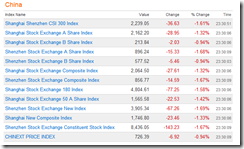

(Table from Bloomberg)

As of these writing China’s stock market has bleeding profusely.

No comments:

Post a Comment