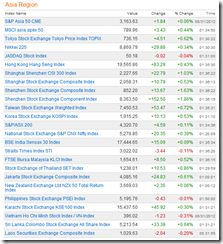

Here we are again, Asian stocks supposedly have risen due to bad news being interpreted as good news. (Below is a run down on Asian stocks as of this writing from Bloomberg)

First the bad news…

Fresh report says China’s manufacturing has contracted

This from Bloomberg,

In China, the Purchasing Managers Index fell to 49.2 in August from 50.1 in July, the National Bureau of Statistics and China Federation of Logistics and Purchasing said Sept. 1. It’s the first time in nine months that the measure has fallen below the 50 level that signals contraction.

A separate report released today by HSBC Holdings Plc and Markit Economics showed China’s manufacturing contracted last month at the fastest pace since March 2009.

China should “decisively” expand the strength of its policy fine-tuning based on economic developments and market changes, according to a front-page commentary published in China’s People’s Daily newspaper.

Next, more negative data from other Asian economies…

In Japan, a report showed companies’ capital spending gained less than expected. In South Korea, inflation slowed to the weakest pace in 12 years last month. Australia’s retail sales fell in July by the most in almost two years. In New Zealand, a gauge of the country’s terms of trade dropped for a fourth consecutive quarter.

Now the supposed good news… (bold added)

Asian stocks rose, reversing earlier losses, as economic reports from China, Japan, South Korea and New Zealand fueled speculation that central banks will boost stimulus measures…

The MSCI Asia Pacific Index added 0.5 percent to 118.32 as of 1:44 p.m. in Tokyo after earlier falling as much as 0.5 percent. U.S. Federal Reserve Chairman Ben S. Bernanke said on Aug. 31 that further monetary easing is an option.

Bernanke “is defending the case that quantitative easing and unconventional policy have been effective, and that could be a controversial statement,” said Tim Leung, a portfolio manager who helps manage about $1.5 billion at IG Investment Ltd. in Hong Kong, referring to the Fed’s large-scale asset purchases. “If in the future the economy is not performing as good as they expect, they still have room” for more stimulus.

I’d say that for China, the today’s reaction seems more of a dead cat’s bounce than from “bad news is good news” phenomenon

China’s Shanghai index has been under pressure for the past few weeks, so today’s bounce should come as a natural response. But this may have been misinterpreted by media

But I don’t think this applies with the rest.

What really has been happening is that the seduction of marketplace from promises of central bank steroids has been intensifying. As I noted last night,

Eventually stock markets will either reflect on economic reality or that central bankers will have to relent to the market’s expectations. Otherwise fat tail risks may also become a harsh reality.

Yes central banks will either have to deliver on their promises soon enough, or that financial markets will react violently if expectations have not been met or if economic data continues to exhibit pronounced deterioration.

A quote from the same Bloomberg articles gives a clue on the diminishing returns from central bank promises.

“It’s going to be difficult for the market to keep rallying on the promise of QE and other measures without some improvement in the data,” said Donald Williams, chief investment officer at Sydney-based Platypus Asset Management Ltd. that manages about $1 billion.

Inflationism distorts the pricing system which eventually spawns bubble cycles. The above accounts accounts for anecdotal evidences.

No comments:

Post a Comment