The Chinese government has a bias for international political contemporaries.

They prefer central banks and government controlled Sovereign Wealth Funds (SWFs) to have greater exposure in their stock markets in the assumption that these entities are “long term” investors than the private sector counterparts

From Bloomberg,

China scrapped a ceiling on investments by overseas sovereign wealth funds and central banks in its capital markets, part of government efforts to encourage long-term foreign ownership and shore up slumping equities.SWFs, central banks and monetary authorities can now exceed the $1 billion limit that still applies to other qualified foreign institutional investors, according to revised regulations posted yesterday on the State Administration of Foreign Exchange’s website.The Shanghai Composite Index (SHCOMP) jumped the most since October 2009 yesterday after the head of the Hong Kong Monetary Authority said Dec. 13 that China may relax or abolish a rule that requires Renminbi Qualified Foreign Institutional Investors to keep most of their funds in bonds. The China Securities Regulatory Commission has cut trading fees, pushed companies to increase dividends and allowed trust companies to buy equities since Guo Shuqing took over as chairman last year.Introducing more long-term funds from abroad will help improve market confidence, promote stable growth in capital markets and provide “robust” investment returns to domestic investors, the regulator said in May, a month after the government more than doubled the total quota for QFIIs to $80 billion from $30 billion….QFIIs can repatriate their principal and investment returns after a lock-up period ends, though the monthly net remittances cannot exceed 20 percent of their total onshore assets as of the previous year, according to yesterday’s rules. Open-ended China funds can remit funds on a weekly basis under the new regulation, compared with monthly in the previous version announced in 2009.The Hong Kong Monetary Authority, Norges Bank, Government of Singapore Investment Corp. and Temasek Holdings Pte.’s Fullerton Fund Management Co. have all reached the $1 billion limit as of Nov. 30, with QFIIs’ approved quotas totaling $36.04 billion, according to SAFE, the currency regulator. Foreign investors can only invest in capital markets through QFIIs.

The benefits from capital intermediation seems well understood by the Chinese government.

It is only in the prism where the incentives driving public sector ownership appears to have been mistakenly lumped as purely profit oriented enterprises similar to private corporations which gave SWFs the precedence.

In reality, the positioning of political or public financial institutions on international capital markets are different. They are based on (political) priorities and parameters diverse from their private sector peers (such technical operating differences may due politically determined guidelines).

This article gives us a clue, from ai-cio.com

SWFs, similar to other institutional investors, are less likely to invest in private equity versus public equity internationally, according to a newly published paper, written by Sofia Johan of York University, April Knill of Florida State University, and Nathan Mauck from the University of Missouri.However, the economic significance of this impact is surprisingly low, the paper asserted. "Unlike other institutional investors, SWFs are more likely to invest in private equity versus public equity in target nations where investor protection is low and where the bilateral political relations between the SWF and target nation are weak." The research demonstrates that contrary to non-governmental institutional investors, SWFs do not seek protection by investing in private equity in nations that provide strong investor protection.Surprisingly, cultural differences play a marginally positive role in the choice to invest in private equity outside of a SWF's own sovereign nation. "Comprehensively, we find that SWFs act distinctively from other traditional institutional investors when investing in private equity," the authors claimed.Furthermore, according to the paper, SWF investment in private equity may be primarily financially motivated as SWFs tend to underperform in the public markets.

As one can note the degree of bilateral relations differs and serves as example to a politically determined SWF fund management framework.

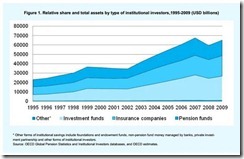

In 2009, pension funds, insurance companies and mutual funds dominated long term investing with over US$65 trillion in OECD economies. The share of SWF has also grown, given their hefty $4 trillion stockpile, but represents a fragment relative to the overall investible exposure by the private sector.

The above is a categorization of long term investors from the World Economic Forum shows that private sector remains the largest dynamic as long term investors

In addition, given the highly volatile politically charged environment, such priorities may change. Past performance may not serve as a useful guide for future actions. Long term may become short term and vice versa depending on how changes evolve.

Also, there is no technocratic magic on public investments. Bureaucrats don't outsmart the private sector.

Public funds like sovereign wealth funds are manned by people too. They are seduced to the herding effect as evidenced by their recent price chasing action of Emerging Market debt

This anecdotal evidence from Reuters.com

Sovereign wealth funds, along with other crossover investors, such as European pension funds, were in hot pursuit of EM credit in 2012, but US pension funds "missed the boat" after buying one too many underperforming EM equity trades, said Chang.

So SWFs can be short term as much as it can be long term

And to repeat the earlier point: The priorities of the public funds can be influenced by political circumstances whether domestic or international.

Take for instance, California Public Employees' Retirement System (CalPERS), the US largest public pension fund recently filed for bankruptcy in response to the bankruptcy proceedings made by two cities Stockton and San Bernandino.

Bankruptcy may turn long term investments into short term.

Bottom line: While the Chinese government’s thrust to liberalize her capital markets should be seen in a good light, which I believe encapsulates her path or grand design towards the yuan’s convertibility in order to challenge the US dollar hegemony as international currency reserve, her order of priorities in favor of SWFs seems unjustified.

Instead, China’s government should aggressively liberalize her capital markets. Capital flows are not the problem. Bubble policies are.

Finally, the above report has allegedly bolstered the Shanghai Index to break above the 50-day moving averages with Friday’s eye popping 4.32% gains

Such sharp recovery seems to indicate of a major inflection point for China's major benchmark. Part of which may be intended to paint a welcoming picture for the ushering in of the newly appointed leaders.

As I wrote last Sunday:

Given the recent record liquidity injections by the People’s Bank of China (PBoC) which coincided with the latest leadership changes, and improving signs of credit growth, perhaps from stealth stimulus coursed through State Owned Enterprises (SoE), accelerating signs of improvements on infrastructure investments, and with retail investors almost abandoning the stock market out of depression, China’s reflationary policies may yet spark new bubbles in both the stock market and the property sectors…Recovering prices of industrial metals also seem to underpin and or portend for China’s stock market recovery.A reflation of China’s asset bubbles will likely be supportive of the recent gains attained by ASEAN bourses.

Recent surge in industrial metals (GYX) have presaged this. And I believe that China’s market participants have been looking for an excuse to push up the stock market and found one in the liberalization report that favored SWFs.

No comments:

Post a Comment