This article attempts to cheerlead on the supposed benefits of the weak Japanese currency the yen.

From Bloomberg:

The Thai baht’s biggest quarterly gain against the yen since 1998 was enough reason for Kornkarun Cheewatrakoolpong, a 32-year-old economics lecturer in Bangkok, to change her honeymoon destination to Japan from Italy.“It’s more affordable,” Kornkarun said in an interview from her home in the capital on April 17, after returning from a business trip to Japan. “I don’t feel it’s that expensive like in the past. I still expect that when I go for my honeymoon in November, the yen will remain weak.”Kornkarun followed 36,000 Thai tourists who headed to Japan in the first two months of the year, 31 percent more than the same period of 2012 and the largest increase among five major Southeast Asian countries, according to data from the Japan National Tourist Organization. The baht, Asia’s best-performing currency in 2013, strengthened 14 percent versus the yen in the three months through March before rising a further 7.1 percent in April, making costs for accommodation, shopping and food cheaper for visitors from Thailand.The rise in tourists caused a shortage of yen banknotes in Thailand, central bank Governor Prasarn Trairatvorakul told reporters in Bangkok on April 9, before the nation’s markets closed for the four-day New Year holiday, known as Songkran. The Bank of Japan’s monetary easing, coupled with increasing investment, helped drive the baht to its strongest against the yen in five years on April 22. Japan’s currency may weaken to 100 per dollar for the first time since 2009 by year-end, according to 54 analysts surveyed by Bloomberg.

For now the weak yen may boost tourism. This represents one of the short term effects of inflationist policies. Yet such a boom will be temporary. When the inflation genie pops out of the proverbial lamp, which has been the expressed goal of 'Abenomics', and runs berserk, the risks of a crisis and social unrest will be magnified.

Political and economic instability reduces the incentives of foreigners to travel. Thus, if price inflation turns for the worst or if a crisis emerges, tourism will take a hit.

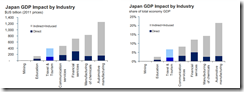

Japan’s tourism (direct and indirect) constitutes only 6.7% of the GDP, according to World Travel and Tourism Council.

This means that whatever benefits the tourism sector will reap are relatively puny, and will be more than offset or neutralized by economic losses in the broader economy due to the distortions of economic calculation, which reduces incentives for people to invest but nonetheless encourages speculation and capital flight. Also inflationism will constrict on the purchasing power of the consumers.

As the Austrian economist great Ludwig von Mises wrote,

The much-talked-about advantages which devaluation secures in foreign trade and tourism are entirely due to the fact that the adjustment of domestic prices and wage rates to the state of affairs created by devaluation requires some time. As long as this adjustment process is not yet completed, exporting is encouraged and importing is discouraged. However, this merely means that in this interval the citizens of the devaluating country are getting less for what they are selling abroad and paying more for what they are buying abroad; concomitantly they must restrict their consumption.

So enjoy the boom while it last.

As for the strong baht, that’s the result of Thailand’s credit bubble.

No comments:

Post a Comment