The Skyscraper Index introduced by Dresdner Kleinwort Wasserstein research director Andrew Lawrence has been a reliable but a not perfect leading indicator of business cycles.

Skyscraper booms tend to highlight the peak of a business cycle, as I discussed in 2009, or tends to rise on “the eve of economic downturns” according to Wikipedia.org.

The peak of the Skyscraper cycles has frequently signaled the advent of recessions, the Wikipedia.org elaborates, “where investment in skyscrapers peaks when cyclical growth is exhausted and the economy is ready for recession”

Has the Skyscraper curse become a reality in China?

The construction of the world’s tallest building in China has reportedly been suspended.

According the Dubai Chronicle: (bold mine)

In May, the Dubai Chronicle reported that China is planning to challenge Dubai’s Burj Khalifa’s status as world’s tallest building. The Asian country is preparing to build a skyscraper which is even taller than Burj Khalifa’s 2,716 feet. The building, called Sky City, was initially planned for completion by the end of the year. However, the date is now pushed forward, slowing down the mega project.Only a couple of months ago, China’s Sky City project was said to be ready by end of 2013. The developers behind the ambitious project were confident in their prognosis even though the construction works on the tower had not even begun. According to them, the 2,739-feet Sky City would take only half a year to complete due to its unique construction process.But despite the forecasts, Sky City’s completion is now delayed to April 2014. There is no specific information on why the project is taking so long, given that it is enjoying the great support of the Chinese government.In addition, this is not the first time in which Sky City’s opening is being delayed. Originally, the project was supposed to be ready at the beginning of 2013. However, the construction work started last week.The cost of the record-aiming building has also been changed. In May, Sky City was expected to consume only $625 million. Now, its construction is estimated at over $855 million.

Skyscraper manias have always been accompanied by overconfidence, similar to the stock market.

Next, the cost overrun has simply been a manifestation of the inadequate savings in sustaining of such grandiose project. As the great Austrian economist Ludwig von Mises explained:

The whole entrepreneurial class is, as it were, in the position of a master builder whose task it is to erect a building out of a limited supply of building materials. If this man overestimates the quantity of the available supply, he drafts a plan for the execution of which the means at his disposal are not sufficient. He oversizes the groundwork and the foundations and only discovers later in the progress of the construction that he lacks the material needed for the completion of the structure. It is obvious that our master builder's fault was not overinvestment, but an inappropriate employment of the means at his disposal.

The “lack of material needed” has been expressed by higher input prices as the construction-real industry earlier bid up on input prices, enabled and facilitated by cheap interest rates, thus resulting to the ballooning cost of the project.

The Zero Hedge has an illustration of the Sky City…

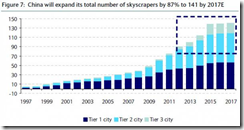

…and of China’s simmering skyscraper mania.

Unraveling of malinvestments are presently being manifested through cash squeezes which has been ventilated via higher interest rates.

Austrian economist Professor Mark Thornton, who expanded the study on the Skyscraper Index to cover the Austrian Business Cycle, notes that,

Higher interest rates discourage the building of taller buildings and of construction in general because capital is scarcer and land is less in demand and available at lower prices.

And the weakness in the Chinese economy seem to be intensifying. This would further expose on the massive misallocations of capital that would further translate to even higher interest rates or higher costs of capital.

A fresh Bloomberg article reports that China’s manufacturing index “weakened further in July, signaling the worst of the nation’s slowdown has yet to be reached, according to a preliminary survey of purchasing managers”

And its not just in the economy, current social policies may help prick the runaway property bubble.

In what seems as another attempt by the Chinese government to curtail such property bubbles, a 5 year ban has been imposed on construction of new government buildings.

From another fresh Bloomberg report:

China banned government and Communist Party agencies from constructing new buildings for five years and told them to suspend projects that have already won approval as the country seeks to cut wasteful spending.The ban includes construction for purposes of training, meetings and accommodation, the government said in a statement on its website yesterday, calling for resources to be spent instead on developing the economy and improving public welfare. All localities should report the implementation of the new rules by Sept. 30, according to the statement.

The suspension of the construction of the world’s tallest building, intermittent cash squeezes, the reappearance of the bond vigilantes, tanking stock markets, signs of intensifying weakness of the economy, declining yuan-US Dollar (see above) and the Chinese government’s policy path to break the runaway property bubble seem to reinforce the Skyscraper curse.

And a severe downturn may lead to a "period of instability" says a state researcher.

And a severe downturn may lead to a "period of instability" says a state researcher.

Oh, don't forget, ASEAN has her own Skyscraper mania.

Ignore these signs at your own peril.

No comments:

Post a Comment