I have been saying that in the face of rising interest rates, the risks of a debt crisis can emerge out of multiple potential flashpoints.

Portugal could just be one candidate as seen by the unfolding developments in the political spectrum

From Bloomberg;

Portuguese borrowing costs topped 8 percent for the first time this year after two ministers quit, signaling the government will struggle to implement further budget cuts as its bailout program enters its final 12 months.Secretary of State for Treasury Maria Luis Albuquerque replaced Vitor Gaspar at the Ministry of Finance. That prompted Paulo Portas, who leads the smaller CDS party in the coalition government, to quit, saying the new minister would offer “mere continuity” of the country’s deficit-cutting plans…Portugal’s 10-year (GSPT10YR) bond yield jumped to 8 percent earlier today, the highest level since Nov. 27, and was hovering at 7.65 percent as of 11:10 a.m. London time. The nation pays an average 3.2 percent for loans it received as part of the aid package.Prime Minister Pedro Passos Coelho is battling rising unemployment and a deepening recession as he cuts spending and increases taxes to meet terms of a 78 billion-euro ($101 billion) rescue plan monitored by the European Union, the International Monetary Fund and the European Central Bank, known as the Troika. Coelho announced measures on May 3 intended to generate savings of about 4.8 billion euros through 2015 that include reducing the number of state workers…The difference in yield that investors demand to hold 10-year Portuguese bonds instead of German bunds is about 600 basis points, exceeding this year’s average of 461. The gap is down from a euro-era record of 16 percentage points in January 2012.

The political turmoil in Portugal, which seems representative for most of the crisis stricken Eurozone, has been about the resistance to reform and the struggle to preserve the unsustainable privileges of the political class via the welfare-bureaucratic state.

The failure of the economy to recover has been falsely blamed on “austerity”.

The reality is that there hardly has been “austerity”

The % change of government expenditures in Portugal as well as most of the European countries (with the exception Ireland and Hungary) has been mostly positive from 2007-2012.

What has been happening is a decline in the rate of increases rather than a net decline of expenditures.

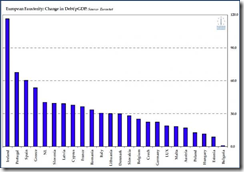

The same can be seen in % change in debt/gdp.

Yet the preferred path of more regulations and higher taxes (amidst cosmetic reduction of government spending) punishes rather than provides the incentives for the real economy to grow. Thus the austerity strawman.

Such resistance to reform will amplify the risk of a credit event which has presently been reflected on the bond markets. Charts from Zero Hedge.

While the political class thinks that there is an inexhaustible Santa Claus fund, the markets are saying otherwise.

As of this writing European stocks are trading significantly lower (Bloomberg)

US S&P futures are moderately down. (investing.com)

It remains to be seen if the current deterioration in Europe’s political landscape will worsen market conditions elsewhere

In the meantime, 10 year JGB yields has been trading on the upper bound (.88-.90%) of the current range. A spike beyond the 90s would likely put even pressure on global markets.

1 comment:

Another element of the austerity strawman is the high unit labor costs in the EU countries outside of Germany.

Post a Comment