Given the relentless growth in credit exactly to the same sectors during the two months of April-May, statistical GDP growth will likely remain ‘solid’ and will likely fall in the expectations of the mainstream. The results are likely to be announced in August.

This was my prediction on the 2nd quarter Philippine economic statistical growth[1] that had been released last week. Such news was cheered upon and interpreted as signs of relief by a confirmation bias starved public from the ongoing market pressures

The Secret of ‘Resilient’ 2nd quarter Philippine Economic Growth

The Philippine government’s National Statistical Coordination Board (NSCB) hails the current growth streak[2] as the “second quarter growth is the fourth consecutive GDP growth of more than 7.0 percent under the Aquino Administration” implying for a politically induced growth nirvana.

But where did the growth come from?

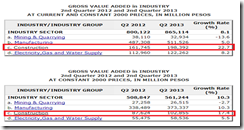

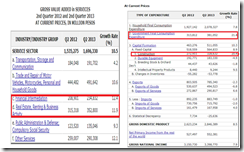

The services sector which grew by 7.4%, remained as the “main driver” of the Philippine economy and had been “supported by the 10.3 percent and 17.4 percent growth of manufacturing and construction, respectively boosting the Industry sector to grow by 10.3 percent” according to the NSCB.

From the industry side (left window), the so-called ‘resilient’ growth in the services sector comes from financial intermediation (stock and bond market speculation?) and real estate, renting and business activity (real estate speculation?).

From the expenditure side (right window), the source of “resiliency” growth is from construction (20.4%) and government spending (21.4%).

So we have bubbles and prospective higher taxes or inflation as models for a boom.

Yet here is the secret recipe or ingredient behind the fourth successive quarter of vigorous statistical growth…a surge in real estate related bank loans (year on year basis) as well as financial intermediation loans as per Bangko Sentral ng Pilipinas data[3].

Soaring banking loan growth has translated to a spending and supply side boom, which has been reflected on money supply growth and deposit growth in the banking system.

Notice, y-o-y construction loan growth has hovered in the 50% area for the past 6 months. Real estate loan growth has peaked in January and has been on a decline but remains above the 20% growth level.

Yet household final demand or household final consumption expenditure grew by only 7.8% during the 2nd quarter, whereas construction has grown by 20.4%, so who will buy those excess real estate units?

This only means that a reduction of the growth rate of banking loans on these ‘bubble’ sectors will effectively diminish the rate of statistical growth and expose on the system’s dependence to, and fragility from, a credit fuelled statistical growth.

The recent resilient economic picture has already shown some indications of incipient cracks.

Since the first bear market attack on the Philippine Stock Exchange (PSE) last June, growth in the financial intermediation sector shrivelled to only 1.45% which I pointed out earlier[4]. Fortunately enough, the banking loan growth conditions of April and May has been significant enough to neutralize the substantial rate of slowdown, thus 2nd quarter’s “resilient” growth.

But if June’s financial intermediation sector conditions will become a trend, and if June’s financial intermediation sector conditions will serve as precedent and diffuse into the overall banking loan growth conditions going forward, then this will signify as a foreboding sign for future statistical growth conditions.

Philippine asset markets have already been showing the way.

The illusions of frontloading of statistical economic growth via inflationary credit will be bared soon enough.

Unreliable Statistics and Regulatory Arbitrage

I have lumped or categorized wholesale and retail trade along with hotel and restaurant as these sectors are parcel or inclusive to the real estate bubble via the shopping mall[5] and casino[6] bubbles.

While the consensus worships Philippine statistical data as reliable indicators of economic performance, I don’t. For instance, I see banking caps on the real estate sector as being bypassed by market participants. Loans are likely to have been diverted to other industries but end up on inflating bubble sectors.

The lessons of the Bangladesh stock market crash in 2011 tells us of how numerous companies circumvented banking regulations by rechanneling industrial loans in the hunt for yields into the once booming stock market. But when the Bangladesh government tightened the monetary environment the ramification has been a nasty stock market crash which provoked riots[7].

The emergence of the shadow banking represents an offshoot to repressive regulatory environment. Shadow banking emerged mainly out of arbitrage activities based on loopholes from existing regulations or regulatory arbitrages.

The global shadow banking industry has been estimated at $67 trillion as of November 2012[8] and has been expanding swiftly.

The Philippines as I pointed out last May has its own shadow banking system which like Thailand accounts for more than one third of total financial assets according to the World Bank[9].

Local regulators like to project that they are in control of “excessive credit extension[10]” but current market actions seem to suggest otherwise.

Political direction and market forces have now been diverging

Despite Possible GSIS Interventions, the Bears Rule

The Phisix June bear market lows have been reinforced by the latest meltdown.

The bear market area has been encroached for the second time in less than three months. Such alarming deterioration in risk conditions has validated my repeated warnings where we should expect heightened volatility in both directions but with a downside bias.

As I previously wrote[11]; (bold original)

I believe that such dynamic, viz. sharp volatilities in both direction but with a downside bias, will remain as the dominant theme going forward, unless again, the turmoil in the global bond markets will subside and stabilize.

From the technical viewpoint, the recent short-term head and shoulder breakdown (not drawn in chart) has not only falsified the bullish reverse head and shoulder pattern established last June (not drawn too) which became a popular sight in social media, but has been strengthening the longer version of head and shoulder topping formation (curved green trend lines) as the recent string of harrowing declines have been approaching the huge neckline (downward sloping green line)

With the imminence of the “death cross” or the crossover of the 50 day moving averages (blue line) with 200 day moving averages (red line), the Phisix chart conditions looks awfully biased towards the bears.

The sizable rebound last Thursday (3.54%) and Friday (2.2%) from the new lows has been similarly uninspiring (right blue ellipse). The sum of the two day gains only equals the fierce 5.7% one day comeback by the bulls last June 26th. Yet then, the two day bullish rebellion last June totalled 9.31%. The four day rebound saw a 12.7% gain from the lows (left blue ellipse). The current pace of rally seems to be weakening.

Market internals have equally been unimpressive. The advance decline spread for last Thursday and Friday, 79 and 47 respectively has been quite distant from the spread of 112 and 102 of the huge two day rally for June 26th and 27th correspondingly.

The message is that despite the optimistic chatters in media, particularly by bureaucrats who have little skin in the game and their institutional defenders, the bulls evidently are having diminished convictions in pushing up the markets or that the bears have increasingly been gaining strength which essentially has been neutralizing the bulls.

Interestingly Friday’s material 2.2% gain came amidst a narrow but positive 47 advance decline spread. Since Friday posted a substantial net foreign selling, this means that there may have been orchestrated efforts from what seems as non-profit motivated locals in driving the Phisix higher by concentrating the buying activities to a few index heavyweight issues.

I would suspect that since the incumbent Government Service Insurance System (GSIS) president explicitly placed a floor on the Phisix by announcing last July an increase in the equity holdings of the government pension fund to 20% of total assets “ if the gauge falls below the 5,500 level”[12], then possibly a substance of the local buying during the last three days may have been from Philippine government intervention.

As of July, 16.5% of the Php 725 billion (US $16.2 billion @ USDPHP 44.5) investible assets of the GSIS have been allocated into equities[13]. An increase of 3.5% to 20% would parlay into a Php 25.375 billion (US $16.2 billion @ USDPHP 44.5) wager. While such amount looks big, in perspective this would amount to only 14.9% and 12.7% of the total trading volume in the PSE for the months of July and August respectively.

In short, the intended GSIS investments (euphemism for intervention) will hardly be sufficient enough to prop up the Phisix should foreigners remain on a selling spree.

Worst, this signifies as bad news to either pension fund beneficiaries (who may see their retirement savings dwindle from losses made from reckless punts aimed at promoting the administration’s public approval ratings) or to the taxpayers (who will likely shoulder these losses via bailout of the government pension fund). Milton Friedman was right, the easiest thing to do is to spend other’s people money.

But the Government’s pension fund’s equity market dilemma will overshadow its huge 46.5% exposure in the fixed income or bond markets.

Tightly Controlled Philippine Bond Markets

So far the stock market and peso rout has not transmuted into a domestic bond market selloff, since there has been little exposure by foreigners on local currency or peso based government bond market.

The investor profile of the domestic bond market reveals of a seeming proportional distribution of the outstanding bonds between the resident private sector institutions and various domestic government agencies[14]. In other words, the Philippine government and their private sector allies have been able to ‘manage’ bond markets.

No wonder the BSP can get away with declaring low price inflation figures (e.g. 2.5% July 2013), the entwined interests by the government and the banking sector enables them to manage the illiquid domestic government bond markets and thereby sustain a low interest rate regime to prop up an artificial credit financed asset based boom.

As further proof of how distorted the system is, ironically, the PCSO doubled lotto ticket prices last May[15] to Php 20 from Php 10 or an equivalent of 3.93% lotto ticket inflation rate (from its inception in 1995[16]) with promises of higher winning prices. You see the chasm? 3.93% PCSO inflation ticket rate versus 2.5% BSP inflation rate.

Nevertheless when the losses in the financial markets (peso and stocks) percolate into the real economy (real estate and related sectors), where private sector financial institutions will be forced to raise cash to meet demands of the real economy, doing so will mean selling these bonds. And this would extrapolate to rising yields.

The bond vigilantes will find many outlets to undermine artificially installed barriers.

Reality Check: Bear Markets Overwhelm ASEAN Bourses

I would like reiterate, contra popular wisdom, current developments has not just been an emerging market phenomena but has been spreading through the ASEAN-Asian region.

The bond vigilantes have already even begun to make their presence felt in the European crisis nations stricken PIGS as I have been anticipating[17].

Bear markets has become a regional or ASEAN concern.

THREE ASEAN majors have broken into bear markets, particularly, Indonesia (JCI), Thailand (SET) and the Philippines (PCOMP) as shown in the chart above[18].

And as discussed last week, surprisingly even foreign exchange reserve rich (US $290 billion) first world ASEAN economy Singapore has been caught in the line of fire.

The big rallies in the Phisix and JCI last Thursday and Friday, failed to inspire Thailand and Singapore (STI) to do the same. Friday, the SET closed marginally higher while the STI closed modestly lower.

Yet even if Singapore’s STI has yet to reach bear markets, chart indicators suggests of a bearish momentum due to the “death cross”.

I would like to point out that the ASEAN’s bear markets should not be overlooked or dismissed as some figurative nightmare or a bad dream that will be wished away or vanish when the sun shines or when one awakens.

Denials are really destructive to one’s portfolio.

The ASEAN bear markets have been portentous of a deeper economic malaise unseen or unrecognized yet by the public.

Seething pressures from a build-up of accrued imbalances (bubbles) may have just begun to surface and may have found its release valve in currencies and stocks, as well as partly bonds.

The mainstream misattributes the cause of today’s upheaval to capital outflows which are in reality symptoms.

Foreigners don’t just dump stocks mainly out of fear or out of mistaken group identities. Their actions reflect on a perceived negative impact from radical changes in the environment and from changes in arbitrage spreads[19].

Since 1996, each time the Indonesian currency, the rupiah (top), and the Thai currency, the baht (lower pane), declined considerably or crashed vis-à-vis the US dollar, they coincided with either a major world recession (dot.com bust), or a crisis (2007-8 US mortgage crisis and 1997 Asian crisis).

This implies that falling ASEAN currencies today are typically symptoms of an unfolding adverse economic and financial event, which in the current case has yet to be revealed.

This means that the risk conditions from the current environment may further deteriorate.

Déjà vu Asian Crisis?

This reminds me of the Asian 1997 crisis where the Phisix fell by a terrifying 68.6% in 19 months.

February 1997 marked the beginning of the free fall of the Phisix, where the local benchmark dived by 25% into the lows of May 1997. The Phisix rebounded to form a right shoulder, then commenced on the next descent where a head and shoulder pattern came into motion.

A head and shoulder top déjà vu today?

It was 5 months into the bear market when the Asian crisis became official in July of 1997. Says the timeline of the Asian crisis in May[20] (bold mine)

Early May (1997) - Japan hinted that it would raise interest rates to defend the yen. The threat was never carried out, but it did cause global investors to begin selling Asian currencies.

Just replace Japan with the US Federal Reserve. Sounds familiar?

A month after the crisis, the head and shoulder neckline was breached and this was followed by the next wave of the horrendous liquidation based tailspin.

Those two downward pointing red arrows following the market’s peak in February of 1997 exhibits the intense bear market ‘denial’ rallies.

Last week’s rally seem as unlikely a bottom or a reversal rally. They are instead signs of a possible bear market reprieve or a sucker’s rally that has been in reaction to short term government actions.

If there should be any lessons from 1997, then current market meltdown seem suggestive of major bad developments for ASEAN by the yearend.

ASEAN Contagion: The Singapore-Indonesian Link

After fighting market forces in futility by depleting forex reserves, Indonesia’s government succumbed to the tightening imposed by market forces by officially raising rates anew last week[21].

The Indonesian government has been very reluctant to raise interest rates because of the massive recent build-up of both public sector and private sector credit.

But Indonesian government seem to have been cornered.

By refusing to raise rates the domestic markets have wickedly sold off which effectively translates to a tightening.

Yet by accommodating pressures from the markets through policy interest rate increases, the selling pressure may temporarily have waned but the effect of tightening will likely cause a meaningful economic growth slowdown that would expose on the systemic (excess debt/gearing) fragilities, which is likely to spark the next wave of liquidations.

And if the barrage of liquidations will affect the core of the banking system, then Indonesia may have opened the nexus to next ASEAN banking or even an external debt crisis which may lead to a currency crisis.

The opposite may also hold true, if the rupiah continues to melt, this may trigger loan defaults on unhedged exposures that again may impact the core of the banking system.

Remember Indonesia had been a darling of emerging markets in 2011, whose supposed success story was extolled by credit rating upgrades.

Indonesia’s Thursday and Friday’s rebound has not been cheered by Singapore. Yet there are important links between Singapore and Indonesia.

Singapore has been the largest foreign investor in Indonesia with a cumulative investment of US $1.14 billion in 142 projects according to Indonesia’s Investment Coordinating Board. Trade between the two countries hit around $68 billion in 2010[22]. Moreover, Singapore has been the biggest market in the region for Indonesia’s non-oil and gas exports.

In addition, many regional investors have used Singapore as a regional hub in setting up holding companies to take advantage of double-taxation arrangements that Singapore has with other countries in the Association of Southeast Asian Nations (Asean)[23]. Singapore has also become an important source of finance for Indonesia.

This also that means Singapore is highly sensitive to the developments in ASEAN.

Yet with regards to stock market linkages in terms of returns, while a study shows that bilateral foreign investments does not appear to be a significant factor, stock market returns are mostly determined by cross-country and sectoral factors based on bilateral linkages through trade and finance (Forbes and Chinn 2004[24]).

If such theory holds true, then a faltering STI may be a reflection of an ongoing deterioration of the real economy through trade and finance between Singapore and Indonesia.

Such signs are hardly “bullish”.

The ASEAN contagion appears to have even affected Vietnam’s stock market which fell another 2.9% this week, a continuation of last week’s 4.13% slump.

A crisis may or may not occur but current environment is hardly an environment conducive for taking on risks.

Yet should ASEAN financial markets continue to fall, then we should expect the unexpected

ASEAN financial markets appear to be in a highly sensitive and critical point.

Better safe than sorry.

[1] See Phisix: The Myth of the Consumer ‘Dream’ Economy July 22, 2013

[2] National Statistical Coordination Board PHILIPPINE ECONOMY POSTS 7.5 PERCENT GDP GROWTH IN 2nd QUARTER; 7.6 PERCENT IN FIRST HALF OF 2013 August 29, 2013

[3] Bangko Sentral ng Pilipinas Bank Lending Sustains Growth in June July 31, 2013

[4] See Phisix: The Impact of Slowing Banking Loans August 5, 2012

[5] See Philippine Economy’s Achilles Heels: Shopping Mall Bubble (Redux) January 13, 2013

[6] See The Philippine Casino Bubble April 11, 2013

[7] See Bangladesh Stock Market Crash: Evidence of Inflation Driven Markets January 11, 2011

[8] Wikipedia.org Shadow banking system

[9] Shadow banking See The Flaws of BSP’s Real Estate Monitoring and Banking Stress Tests May 20, 2013

[10] Inquirer.net BSP monitoring ‘shadow’ banking in property sector May 27, 2013

[11] See Phisix: Don’t Ignore the Bear Market Warnings June 30, 2013

[12] Bloomberg.com Biggest Philippine Pension Fund Sees 9% Stocks Rally July 17, 2013

[13] Manila Standard Today GSIS’ net income dips 5.7% to P33b July 16, 2013

[14] Asian Development Bank Asia Bond Monitor March 2013

[15] Philstar.com Bigger prizes await online lottery winners May 7, 2013

[16] PCSO About the Philippine Charity Sweepstakes Office, PCSO.gov.ph

[17] See Are Europe’s PIGS the Next Target of the Bond Vigilantes? August 31, 2013

[18] Bloomberg.com Asia-Pacific Stock Indexes

[19] See More Troubling Signs in the Charts of ASEAN Stock Markets; The Peso Carry Trade? August 19, 2013

[20] Wikispaces.com Timeline The 1997 Asian Financial Crisis

[21] See Indonesian Government Succumbs to Market Forces, Raises Interest Rates August 30, 2013

[22] The Jakarta Globe, Yudhoyono Wants More Singapore Investors, July 22, 2011

[23] Financial Times Singapore bank expands Indonesian links to Jakarta August 21, 2013

[24] Kristin J. Forbes and Menzie D. Chinn A DECOMPOSITION OF GLOBAL LINKAGES IN FINANCIAL MARKETS OVER TIME*

2 comments:

Asian markets are indeed at a critical point.

Liberalism’s dollarization scheme of credit is failing; and with that national sovereignty and traditional political order is failing. Bloomberg reports Asian bonds tumble below par in capital flight .... http://tinyurl.com/ld94vwa .... Asia dollar-denominated bonds have dropped below par for the first time since 2011 as investors pull money out of the region amid concerns that growth is slowing and as currencies from the rupee to rupiah plunge. Average prices of company debentures in the region fell to 98.61 cents on the dollar on Aug. 22, the least since October 2011, Bank of America Merrill Lynch indexes show. Dollar bonds globally have held above 100 cents since September 2009. Both investment- and non-investment-grade debt in Asia were below par on Aug. 22. The last time that happened was in September 2008, when Lehman Brothers Holdings Inc. collapsed. Investor sentiment toward Asia is shifting as economic growth in China slows and currencies in India and Indonesia -- the two countries with the biggest external funding needs in the region -- plunge. About $44 billion has been pulled from emerging-market stock and bond funds globally since the end of May, data provider EPFR Global said on Aug. 23. “You risk being swept away by fund outflows even if you buy bonds from the best companies in Asia,” said Ben Bennett, a global credit strategist in London at Legal & General Investment Management, which manages $670 billion. “You’d need to be very brave to add credit risk before currencies show signs of stabilization.”

With the failure of not only credit, currencies and financial wealth, Jesus Christ, acting in dispensation, that is the oversight of all things economic and political, Ephesians 1:10, has completed the old things of liberalism and is bringing forth the new things of authoritarianism.

New dynamos are in operation. The dynamos of corporate profit and global growth were based upon investment opportunities in sovereign nation states, are powering down; now the dynamos of regional security, stability and sustainability, are powering up, reflecting responsibilities to regional authority.

A new seigniorage, that is a new moneyness, is developing. The seigniorage of investment choice, is waining; and the seigniorage of diktat is gaining strength.

A new trust is emerging. Gone is trust in bankers, carry trade investing and credit, in particular Treasury debt, to increasing trust in statist nannycrats, totalitarian collectivism, public private partnerships and debt servitude, growing to the point of diefication of regional governance, as is presented in Revaltion 13:3-4, where the people’s trust comes to consitute worship. There be no more citizens or patriots of countries, there be only residents of a regional state, that is one of ten regional zones.

A new religion will emerge. Liberalism featured religions and philosophies based upon the worship of one’s own will, eventually a mandatory one world religion consisting of emperor worship will emerge; yet for the elect, that is God’s chosen ones, a persecuted faith in Christ

@theyenguy thanks for the Asian bond article

Post a Comment