The parallel universe between stock markets and the real economy have been deepening.

In the US industrial production reportedly miss consensus estimates.

From Nasdaq/RTT News

With a drop in utilities output partly offsetting a rebound in manufacturing, the Federal Reserve released a report on Monday showing that U.S. industrial production rose by slightly less than expected in the month of August.The Fed said industrial production increased by 0.4 percent in August after coming in unchanged in July. Economists had expected production to rise by about 0.5 percent.

The reason for the above quote is to show mainstream headlines.

More details from the Zero Hedge (bold original)

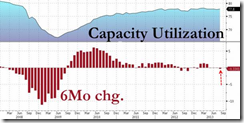

While headlines, we are sure, will crow of industrial production's best gain in six months, the sad fact is that the market was expecting more. At +0.4% - against an expectation of +0.5% - this is the 5th month in a row of missed expectations for this significant indicator of economic health. Capacity utilization rose but also missed expectations printing at the worst 6-month rate of change in 10 months. It seems manufacturing and mining got a modest boost (the former bounced more than expected but only thanks to a notable prior revision downward) and Utilities dragged the headline index down - so we await the "it's the weather's fault" remarks.5th miss in a row for IP...as the 6-month rate of change dropped to its lowest in 10 months...

This tepid industrial production data reinforces my position that the US economic growth will hardly give a lift to the real economy of emerging markets and Asia even if we have seen a reversion to financial market risk ON frenzied yield chasing dynamic.

Nonetheless data like this, for the steroid dependent markets, means uneventful news is good news. It means more policy accommodation from the US Federal Reserve in the name of (quack) economic recovery, it also means more money printing and unseen transfers and subsides provided by main street in favor of Wall Street.

Curiously even superficial events like the withdrawal of Larry Summers as a contender for the FED chairmanship has been powerful enough to electrify markets US-European markets to milestone highs, as well send shockwaves to Asia and emerging markets stock markets, creating the impression that risks have all vanished.

Ironically there hardly has been any nuance between the key contenders of the FED. As economist Gary North points out

So, if we are to believe this, Yellen is a “dove.” Summers is a “hawk.” But there is no evidence that Summers is now, or ever has been, a hawk. He is a standard Keynesian. They both want more fiat money.

The return to the risk ON environment seem increasingly like signs of desperation by the global yield chasers given the narrowing breadth of assets producing positive returns (bond markets and commodities have down year to date).

10 year US notes has only been partly affected by yesterday’s so-called Summer led monster equity market rallies as shown by the yield (TNX candle) and the inverse, the price (UST line chart).

The impact looked more like a technical correction or an oversold bounce for USTs or overbought retracement for the TNX yields, than a convincing return to zero bound environment.

Central banks will continue to inflate bubbles as the real economy flails along due to the former's transfer of resources to asset market holders.

Markets are likely to remain buoyant in anticipation of the FOMC meeting today and tomorrow.

Remember in the current casino like environment volatility excesses can go in both ways. Trades today have become 'short term', hoping that lady luck will be on your side.

Caveat emptor

No comments:

Post a Comment