Explains Simon Black of the Sovereign Man (bold original)

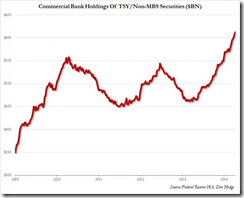

What banks are stockpiling these days are US government bonds, and they’re not doing this casually, they’re going nuts for them.In just the last month alone American banks increased their holdings of US treasuries by $54 billion, to a record $1.99 trillion.Citigroup, for example, held $103.8 billion worth of bonds at the end of June, up 19% from the end of last year.This is like preparing for an earthquake by running out and buying whole new sets of porcelain dishes and glass vases.All it’s going to do is make things more dangerous, and even if you somehow make it through the disaster, you have a million more shards to clean up.With government bonds you are guaranteed to lose both in the short-term and the long-term. Bonds keep you consistently behind inflation (even the deceptively named TIPS—Treasury Inflation Protected Securities), so the value of your savings is slowly being chipped away.But that’s nothing compared to the long-term threats of the US government not being able to repay the loans.Facing $127 trillion in unfunded liabilities – which is nearly double 2012’s total global output – and with no inclination to reduce those numbers at all, at this point disaster for the US is entirely unavoidable.Never before in history has a government stretched itself so thin and accumulated anywhere close to this amount of debt.So when the day comes, it won’t be a minor rumble. It will be completely off the Richter scale.These facts about the US government are in no way secret. Every bank out there knows it, yet they keep piling in.

Chart from Zero Hedge

No comments:

Post a Comment