Dear valued email subscribers

Since I have exceeded the maximum, the post below will not be included in your mailbox, so you may click the on the article to read it

Back to regular programming

This Bloomberg article entitled “Philippine Bonds Advance This Week on Central Bank Rate Signal” (dated November 14, 2014) portrays that Philippine bonds have rallied this week, and that the rally has been due to expectations on central bank actions. (italics mine)

Philippine three-year bonds posted the biggest five-day gain in three weeks after a central bank board member signaled interest rates will stay on hold at least for the rest of the year.Felipe Medalla said in an interview this week that inflation has eased, giving policy makers scope to maintain borrowing costs. “Barring any surprises, I don’t see a rate hike or a cut at least up to the first quarter,” Medalla said.The yield on the 4.125 percent government notes due November 2017 fell nine basis points this week and today to 3.11 percent, according to noon fixing prices from Philippine Dealing & Exchange Corp.

The article refers to 3 year Philippine bonds as shown above, which it extrapolates as representative of the Philippine sovereign bond spectrum.

From this basis, an interpretation has been deduced which supposedly has been reinforced by a quote from an expert conducted during an interview unrelated to the bond actions.

Let me say that the actions in 3 year bonds hardly represents of the activities in the overall domestic bond markets this week. The article doesn’t even give an explanation why the 3 year bond should carry the proverbial flag for the entire domestic bond market except that it assumes such a role.

This implies that to read the activities in 3 year bonds as the Philippine bond market has been based on the fallacy of composition

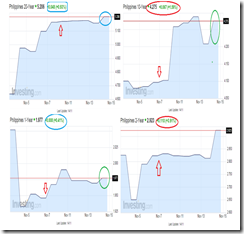

Next, contrary to the article’s assertion, the big moves had been on the opposite direction of the other bond maturities. This can be seen in 20, 10, 1 and 2 year bonds (left to right, arrows last Friday’s close). Meanwhile other bonds, 4 and 25 years rallied (yields declined) mildly while 5 and 7 years had been little change.

In other words, the most visible and dominant actions in Philippine bonds markets for the week had mostly been a SELL OFF rather than an "advance".

Also, it is unclear if the expert quoted in the article will make the same extrapolation based on the above outcome.

I didn't write this post to make any interpretations but to reveal of the flagrant inaccuracies of the mainstream article.

As to whether this is about "advertising" or about hastily beating deadlines or something else, the above strengthens what British essayist, critic, poet, and novelist Gilbert Keith Chesterton warned about mainstream media

Journalism is popular, but it is popular mainly as fiction. Life is one world, and life seen in the newspapers is another.

No comments:

Post a Comment