2014 has not been a good year for Macau’s casinos.

From Bloomberg:

Macau’s casinos recorded their worst year, ending a decade of expansion that turned the former Portuguese enclave into the world’s biggest gambling hub. More tough times are ahead.Casino revenue in the city fell 2.6 percent to 351.5 billion patacas ($44 billion) in 2014, after a record 30.4 percent monthly drop in December, according to figures from Macau’s Gaming Inspection and Coordination Bureau today.

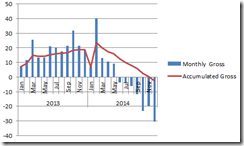

That sharp 40.3% February 2014 monthly gross revenue growth served as the peak, from which rapidly deteriorated through the year. Chart from Macau’s Gaming Inspection and Coordination Bureau

Media blames this on anti-corruption crackdown. Again from the same article.

Chinese President Xi Jinping’s bid to catch “tigers and flies” in an anti-corruption drive and weaker economic growth means Macau may face shrinking revenue until at least mid-2015, when new resorts open. The crackdown has deterred high rollers who account for two-thirds of Macau’s casino receipts, and wiped out about $73 billion in market value of companies including Wynn Macau Ltd. (1128) and SJM Holdings Ltd. last year…

Also on money flows to stealth money flows…

Macau’s government has been curbing money flows to the territory over concern that illegal funds are being taken out of the mainland. It is restricting the use of China UnionPay Co.’s debit cards and its hand-held card swipers at casinos. Further clampdowns are expected with the help of banks.

Let us put this in perspective. If indeed Macau’s casinos have only served as conduits for stealth transfers or 'capital flight' then only part of that money would have been funneled to the casinos, the rest would have moved elsewhere. This means Macau’s casinos should hardly have boomed.

But Macau’s previous boom most likely highlights easy money debt financed spending activities with capital flight as a subordinate cause.

Some have even suggested that such money flows has funded record high inflows to US real estate and perhaps rechanneled gambling activities to the US.

But actions of stocks of the US gaming industry suggests otherwise.

The 47 component Dow Jones Gambling index has swiftly capsized into a bear market since its peak in March. This would mark a real time example of how mania morphs into a collapse.

Since part of the US gambling index incorporates Macau exposure by US firms, then part of the decline may be attributed to Macau’s morose fate.

Apparently domestic (US) operations have failed to offset external conditions which explains the accentuated contagion effect.

But gambling industry woes hasn’t been just about Macau.

Singapore’s Genting’s G13.SI stocks has halved, since its October 2011 peak. This year’s decline has only punctuated the ongoing hemorrhage.

And when considering Genting’s competition, the Marina Bay Sands operated by Las Vegas Sands whose stocks has been shaved by a third, there seems hardly any difference.

So has the Chinese government’s crackdown on the political opposition bannered as ‘anti-corruption’ also spread to Singapore?

Interestingly, Macau’s casino operators seem to be focusing diverting expansion towards the leisure industry. Back to the Bloomberg report:

Casino companies including Sands China and Galaxy are shifting resources from high rollers to lure more vacationing Chinese and other mass-market gamblers by building malls, theaters, restaurants and hotels.New project openings starting in mid-2015 with Galaxy’s second-phase expansion of its resort on the Cotai Strip may help underscore a market revival, by targeting tourists who’re seeking a broader holiday experience in addition to gambling, according to CLSA’s Fischer.

In Asia, there seems to be an intensive race to build capacity to chase after the Chinese consumers/gamblers as seen by grand projects casino-leisure integrated resorts, not only in Macau but also in Vietnam, South Korea and the Philippines.

These operators hardly realize of the rapidly faltering conditions of the Chinese economy as shown by the 21 charts from zero hedge.

But the real reason for the casino industry’s weakness as I previously wrote:

The reality is that China’s sputtering economy has been reducing demand for the region's casinos. Political persecution of the opposition (via crackdown on graft) represents only the icing on the cake. Add to this the slowing regional economic growth which should exacerbate demand sluggishness.On the supply side, zero bound has led to casino operators to overestimate on demand, thus the region's overcapacity which has most likely having been funded by cheap debt.Now the chicken comes home to roost.

And as I also pointed out earlier, the Philippine counterparts has racked up a colossal Php 45-50 billion of debts to finance grand projects.

If those Chinese gamblers don’t come this year, if the domestic economy continues with its downshifting momentum and if political financial elites don’t patronize these entities enough to provide them financial viability, those humongous debts will come into the spotlight. This should make 2015 very interesting!

Anyway Macau’s stocks as the canary in the coal mine

MGM China Holdings (HK:2282)

Galaxy Entertainment Group (HK:27)

Melco Crown Entertainment (HK: 6883)

Sands China Ltd. (HK: 1928)

Wynn Macau Ltd. (HK: 1128)

SJM Holdings Ltd. (HK:880) owner of Grand Lisboa

The obverse side of every mania is a crash.

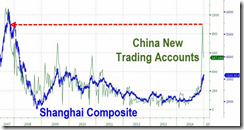

Or has it been that gambling has turned into household activity where Chinese punters bid up frenetically stocks prices!

The week prior to the 2014's end, the Zero Hedge reports (bold and italics original) “a stunning 900,000 new stock trading accounts opened - the most since October 2007 (right before the Shanghai Composite collapsed 70% in the following 9 months)

As revealed above, market crashes have become real time events.

Caveat emptor.

No comments:

Post a Comment