A few weeks back I wrote,

Interestingly, Hong Kong’s tourism seems as suffering from a facelift. Chinese tourists have become dominated by ‘Day Trippers’ which now accounts for a record 60%of Chinese tourists. According to a report from Bloomberg, Day-trippers spent an average of around HK$2,700 ($350) per capita in Hong Kong in 2013, compared with about HK$8,800 by overnight tourists, according to government data.Wow, that’s a 69% collapse in spending budget by tourists! And this has resulted to a slump in luxury brand sales but a surge in medicine and cosmetic sales! What the report suggests has been that China’s economic slowdown and the government’s anti-corruption drive (political persecution) have changed the character of Hong Kong based Chinese tourists.Well if the trend continues, then this will radically shake up the Hong Kong economy!

It appears that the tourism ‘facelift’ has resulted to the cratering of retail sales down by 14.6% in January on a year and year basis!

This is how mainstream media explains the slump, from the South China Morning Post:

A slump of 14.6 per cent in retail sales ahead of the Lunar New Year is the worst since a 2003 outbreak of severe acute respiratory syndrome, putting businesses and concern groups at loggerheads over whether to curb the inflow of mainland visitors.Sales in January fell to HK$46.6 billion from a year ago, the Census and Statistics Department said yesterday.It is the first decline in any January since 2007, when sales dipped 1.6 per cent.The Retail Management Association reacted strongly, saying the data reflected retail difficulties in the face of slowing growth in cross-border arrivals. The association would object to limiting visitor numbers, chairwoman Caroline Mak Sui-king said.That stance will put the industry in conflict with political parties and anti-mainland protesters that advocate caps on a multiple-entry visa scheme granting permanent Shenzhen residents unlimited trips to Hong Kong.

As one would note this has been blamed on mainland tourist flows.

Chart from Investing.com

I would like to point out that rate of growth of Hong Kong’s retail industry has been on a downtrend since its peak in the 1Q of 2013. It plunged to a negative in the 2Q 2014, bounced slightly during the 4Q and has retrenched again to its biggest loss since, as stated above, 2003.

What’s been interesting has been that changes in mainland visits to China has been volatile. As the chart above from Quartz pointed out, the Umbrella protests has even induced more arrivals from both mainland and ex-China tourists.

And if one looks at Hong Kong’s January 2015 tourist arrivals, it’s been growth from Asian visitors that has exhibited negative (-.4%). This has been led by Indonesia (-19%) Singapore (-5.3%) and Japan (-3.5%).

Mainland tourists have been up by only 3.3% which is at the lower level of the 2014 growth trend.

Thus what explains the slump in retail sales has been the change in the character of mainland tourists (or the Day Trippers with limited spending power) and partly, the slack of growth from Asian visitors.

As of 2013, based on Hong Kong Census and Statistic Department, wholesale and retail trade account for 5.3% of Hong Kong’s statistical GDP while accommodation and food services account for 3.6%.

So a slump in retail sales will have some effect on the economy.

And what’s even more interesting has been that slumping Hong Kong Retail sales seems to coincide with activities in Macau’s casinos.

Macau’s gambling revenues HALVED last February. Monthly gross revenues fell 48.6% while accumulated gross revenues collapsed by 35.1% according to Gaming Inspection and Coordination Bureau Macao SAR

Nikkei Asia on the culprit: Beijing's crackdown on corruption and a move toward a full smoking ban are just two sources of concern. Late last month, it was reported that the Macau government was weighing restrictions on the entry of mainland tourists.

Note that negative numbers of Macau's casinos appeared in the 3Q 2014, almost a quarter after Hong Kong’s retail sales turned negative.

Yet another article from Bloomberg reinforces the changing character of Chinese tourists affecting Macau’s tourism and casino business which seem to resonate with Hong Kong's dynamics (bold mine)

The recent wave of mainland Chinese visitors also spend less than before, a further blow to the fine-dining eateries, luxury retail malls, and high-end hotels that casinos have set up next to their gambling halls. Excluding gambling, per-capita shopping expenses by Chinese tourists dipped 32.8 percent to 1,079 patacas in the fourth quarter of 2014, according to data from the Macau government.Average occupancy at 3-star to 5-star hotels for the so-called Golden Week period of Chinese holiday, which ran from Feb. 18 to 24, fell 6.9 percentage points to 87.5 percent, while average room rates declined 15.4 percent, the Macau Government Tourist Office announced on Feb. 26.

While crackdown corruption may be a factor, this has been more of epiphenomenon (or secondary phenomenon) or a contributing force.

The changing character of Chinese spending in Hong Kong and Macau has been reflecting more about economic conditions of China.

And note the hit in Macau’s revenues have been affecting malls and hotels.

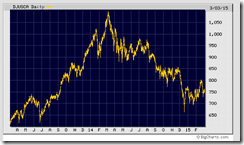

Just to show an update of the 3 year charts of Macau’s major casinos

MGM China Holdings (HK:2282)

Galaxy Entertainment Group (HK:27)

Melco Crown Entertainment (HK: 6883)

Sands China Ltd. (HK: 1928)

Wynn Macau Ltd. (HK: 1128)

SJM Holdings Ltd. (HK:880) owner of Grand Lisboa

What goes up MUST come down!

Again it’s not just Macau, Singapore’s casinos have likewise been taking a beating.

Singapore’s Genting (G13.SI) operator of Resorts World Sentosa reported a 30% crash in net profits in 4Q according to Reuters. So the grueling bear market in her stocks.

Meanwhile Marina Bay Sands operated by Las Vegas reportedly doubled profits in 4Q 2014 due to non recurring tax benefits and from a statistical sigma event from higher-than-usual win percentage at its tables according to Channel News Asia

That doubling of profits have left the markets unconvinced as shown in the charts of Las Vegas Sands from stockchart.com

The trend flows of LVS mirrors the activities of the US Dow Jones Gambling index.

Incidentally, a unit of US casino operator Caesar Entertainment filed for bankruptcy for Chapter 11 last January. Such are just signs that casino troubles have not been limited to Macau, Singapore but also the US.

Have the Chinese government been able to 'crackdown' on Chinese gamblers in the US?

So if Chinese tourist spending have been down, and if Chinese high rollers have been curtailed by their government's crackdown where will the casinos of the Philippines, Vietnam,South Korea and others get their clientele base, especially that they have been in a frantic race to build capacity?

Will the casino crash in Macau prompt for a shift by Chinese gamblers to Manila?

Yet if economic factors have been the main drivers of crashing casino stocks in Macau and Singapore and of Hong Kong retail activities, that declared shift looks like wishful thinking. And as noted above, there are other countries likewise competing for Chinese money.

So essentially a shrinking market in the face of a massive buildup in capacity.

Remember, for the local industry, there have been about Php 57.22 billion of debt backing this race with the region. And a failure of expectations will not just mean losses and surplus supply, but importantly credit problems.

Yet many media reports look like company press releases that have been anchored on hopium.

No comments:

Post a Comment