New York Post columnist John Crudele argues that the US Federal Reserve should be audited “to see if its ruling body has broken the law by manipulating financial markets that are outside its jurisdiction. A thorough investigation of the Fed will show once and for all if its former chief Ben Bernanke and current Chairwoman Yellen should go to jail…”

Mr. Crudele propounds on how the audit should be made: “The Fed should be audited as a brokerage firm would be — its financial holdings, its transactions, market orders, emails and phone calls. Special attention should be given to what is called the “trade blotter” at the Federal Reserve Bank of New York, which handles all market transactions for the Fed.”

And the possible role played by Fed as part of the plunge protection team in the rescue of last week’s stock market turmoil: (bold mine)

Let’s look at what happened to the stock market last week, and it’ll explain what I think those who audit the Fed need to look for.As you probably remember, stocks were headed for oblivion on Monday, Aug. 24. The Dow Jones industrial average was down 1,089 points early in the day before the index rallied for a close that was “only” 588 points lower.China’s problems. Weak US economic growth. Greece. The possibility of an interest-rate hike. Those and other issues were the root causes of last Monday’s woe.But Wall Street’s real problem is that there is a bubble in stock prices created by years of risky monetary policy by the Fed. Quantitative easing, or QE — the experiment in money printing that has kept interest rates super-low — hasn’t helped the economy (and even the Federal Reserve Bank of St. Louis concluded that). But QE did force savers into the stock market whether they wanted to take the risk or not.None of that is illegal.But the Fed now finds itself in the awkward position of having to protect the stock market bubble it created. So Yellen and her board of governors must have been pretty nervous when the Dow and other market indexes fell by an unprecedented amount on Aug. 24.Then, overnight, there was massive buying of Standard & Poor’s 500 Index futures contracts. This was the remedy proposed by a guy named Robert Heller back in 1989 just after he left the Fed board. The Fed, Heller proposed, should rig the stock market in times of collapse.Were those contracts being bought overnight by some Wall Street cowboy for whom potential losses in the disastrous market were of no concern? Or was it the Fed propping up the market?Stock prices initially reacted well to the mysterious overnight buying on Tuesday, and the Dow was up 442 points — until it wasn’t anymore. The blue-chip index finished Tuesday, Aug. 25, with a loss of more than 200 points.Then the same magical buying of S&P futures contracts happened Tuesday night and early Wednesday morning. Stocks again went up at the opening on Wednesday, but this time the gain held.

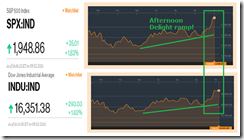

Well, has the same magical buying of S&P futures contracts been responsible for last night’s “afternoon delight” and the closing bell (quasi marking the close) ramp in US stock markets?

(charts from Bloomberg)

I guess the genius of Philippine stock market index manipulators have now been exported not only to China but to the US as well!

Well just a reminder, the transformation of the stock market as a political tool has an ideological underpinning. I called this the Bernanke doctrine. From the Ben Bernanke's Crash course for central bankers, Foreign Policy 2000:

There's no denying that a collapse in stock prices today would pose serious macroeconomic challenges for the United States. Consumer spending would slow, and the U.S. economy would become less of a magnet for foreign investors. Economic growth, which in any case has recently been at unsustainable levels, would decline somewhat. History proves, however, that a smart central bank can protect the economy and the financial sector from the nastier side effects of a stock market collapse.

Bubbles signify an invisible redistribution process in favor of politicians and cronies at the expense of everyone. So bubbles extrapolates to a lower living standard for society.

Don’t just stop at demanding for an audit on the Fed. End the Fed. Abolish the communist institution called central banking.

Don’t just stop at demanding for an audit on the Fed. End the Fed. Abolish the communist institution called central banking.

No comments:

Post a Comment