So the Chinese government’s attempts to stanch two bubbles from imploding has succeeded for now…

That’s by reviving one bubble (property) after another (stocks).

Bloomberg on today’s return to the bull market….(bold mine)

China’s stocks rose, with the benchmark index entering a bull market, after an unprecedented state rescue effort halted a $5 trillion crash and ordinary investors returned to the market.The Shanghai Composite Index climbed 1.8 percent to 3,522.82 at the close, taking its advance from its Aug. 26 low to more than 20 percent. Gains on Thursday were led by brokerages, while turnover was the highest since Aug. 18. The Hang Seng China Enterprises Index rose 0.7 percent in Hong Kong at 3:16 p.m., extending a 17 percent advance since this year’s Sept. 7 low.The government took extreme measures to shore up equities as a boom turned to bust in June, including banning major stockholders from selling shares, curbing short selling and directing state funds to purchase equities. While government-owned funds still influence the market, evidence of heavy intervention has dwindled as late-day rallies become less frequent. Margin debt is also rising, volumes have stabilized and companies favored by individual investors are leading the rebound…To keep growth on track, the People’s Bank of China has cut its benchmark interest rate six times in the past year, to a record low 4.35 percent. The world’s second-largest economy grew 7 percent in both of the first two quarters of this year, in line with the government’s goal for this year, before the expansion slowed to 6.9 percent in the third quarter…The Shanghai Composite entered a bear market on June 29, ending a 935-day long bull market -- the nation’s longest. The gauge is still down 32 percent from its June 12 high…“I suspect that the state or the state-backed funds are buying brokerage stocks and by doing that, they can quickly boost sentiment on the broader market,” said Wang Zheng, the Shanghai-based chief investment officer at Jingxi Investment Management Co.The Shanghai Composite jumped 4.3 percent on Wednesday after the central bank published five-month-old comments from governor Zhou Xiaochuan that said a link between exchanges in Shenzhen and Hong Kong would start in 2015. Traders also pegged the gains to optimism over China’s five-year plan to bolster the economy and use of the currency.

From another Bloomberg article

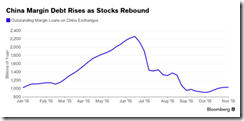

Investors are slowly rebuilding positions using borrowed money. Margin financing surged to more than 2.2 trillion yuan at the height of the stock boom, before falling by more than half in the bust. It’s now back above 1 trillion yuan, adding fuel to the rally but also raising the odds of bigger price swings.

Short sellers have largely been shut out of China’s market after curbs by both the government and brokers made it more difficult to bet on falling share prices. Authorities have also reined in China’s equity-index futures market, where traders used to be able to make large bearish wagers.

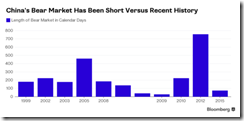

If the bull market is confirmed on Thursday, it would make the Chinese market’s slump from its June high one of the shortest in recent history. At 75 calendar days, it would compare with an average retreat of 226 days in bear markets since 1999.

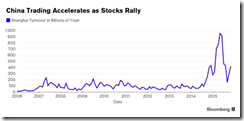

Trading has picked up in Shanghai as shares rallied, an indication that ordinary investors are starting to take over from the government-run funds that propped up prices during the depths of the rout

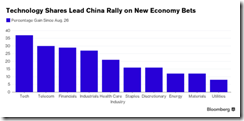

Rising confidence in China’s “new economy,” the catchphrase for policy makers’ goal of shifting growth toward technology, consumer and service industries, has propelled tech shares to the biggest gain since the market bottomed in August. Reducing the economy’s reliance on its old drivers of investment and low-tech manufacturing is a key part of China’s next five-year plan.

Just because Chinese shares are rallying, doesn’t mean they’re cheap. The median stock on mainland exchanges is valued at 63 times earnings, the highest level among the world’s 10 biggest markets. The Shanghai Composite Index, which has a heavy weighting in low-priced banks, has a ratio of 19. That compares with its five-year average of 13.

Here is a guess. When the government eases on “banning major stockholders from selling shares, curbing short selling and directing state funds to purchase equities”, the stock bubble deflation should return.

Besides, bubble deflation are manifestations of the natural market clearing process at work. What the government has done has been to postpone the day of reckoning. Importantly, the current massive government measures to forestall the market crash only COMPOUND on the very imbalances that has caused the bubble deflation: inflating bubbles.

Of course, strains from imbalances have not been limited to properties and stocks, other symptoms include rising incidences of defaults, the widening of spread between Offshore-Onshore yuan, accelerating capital outflows/capital flight and the ongoing downturn in the real economy.

In other words, through the Frankenstein dynamics, the Chinese government may have achieved a temporary Potemkin financial markets. But she would need more than that. She would need to contain the other fissures from where deflationary leaks have been seeping out.

No comments:

Post a Comment