Woe to Japan's pensioners. Continuing stock market losses might just bleed Japan's Government Pension Investment Fund (GPIF) dry. The GPIF had been pressured by the Abe administration in 2014 to makeover its portfolio by increasing its exposure in the stock markets (domestic and global). Now stock market losses have been mounting.

It has been a brutal week for the Japanese stock market. Today, the Nikkei 225 suffered another 4.84% crash! Today's slump marks the third consecutive day of heavy losses for the key benchmark this week.

From Bloomberg:

Stocks plummeted in Tokyo, with the Topix index posting its biggest weekly loss since 2008, as global equities plunged into a bear market and the yen rose to its highest level in 15 months.The Topix sank 5.4 percent to 1,196.28 at the close in Tokyo as trading resumed after a holiday, capping a 13 percent weekly decline. The Nikkei 225 Stock Average fell 4.8 percent to 14,952.61. The yen traded at 112.45 per dollar after touching 110.99 on Thursday, the strongest level since Oct. 31, 2014, when the Bank of Japan eased policy.“We’ve entered a different phase in the market,” Juichi Wako, a senior strategist at Nomura Holdings Inc. in Tokyo, said by phone. “Dollar-yen movements are at the center as it is now the foreign-exchange market that is in the driver’s seat. We’re at the mercy of how currencies move.”The currency’s surge is intensifying speculation the BOJ may intervene to arrest gains that threaten to undermine almost three years of monetary stimulus. Finance Minister Taro Aso said Friday the government is watching market movements and will take any action necessary. Following a regular meeting with Prime Minister Shinzo Abe, BOJ Governor Haruhiko Kuroda said he also would watch market moves closely.

Part of the crash has been due to margin calls...

Investors said this week’s declines to below key levels have triggered margin calls among retail traders in Japan, who are being automatically forced to close souring bets. That’s adding to the selling pressure, according to Miki Securities Co.

The Nikkei 225 hemorrhaged a stunning 11.1% in a holiday abbreviated week.

Curiously, this week's string of losses has brought the Nikkei back lower than when the Abenomics 2.0 was launched in 4Q of 2014.

So the Abenomics stock market bubble has almost entirely been erased! This should be another wonderful example of the proportionality of bursting bubbles. Or as I previously noted, the bust will be roughly proportional to the imbalances acquired during the inflationary boom.

And if the GPIF pushed the stocks all the way to the recent top, then today's downside breach of the 15,000 level must translate to heavy losses for the fund.

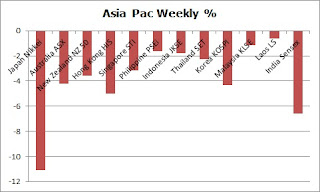

Well, most of Asian bourses have been under the spell of bears

Yesterday I noted that Hong Kong's Hang Seng index greeted the year of the Monkey (really year of the bears) with a selloff. A follow thru session was seen today.

From Bloomberg

The Hang Seng Index lost 1.2 percent to 18,319.58, its lowest close since June 2012. HSBC was the biggest drag, capping a 8.1 percent two-day drop, amid concern over the perceived creditworthiness of European banks. Tencent Holdings Ltd., which has the largest weighting on the index, sank 1.9 percent. Hong Kong stocks have lost almost $2 trillion in market value from an April peak, data compiled by Bloomberg show, while a measure of equities around the world fell into a bear market this week.“Global sentiment isn’t that great and with the world conditions worsening, the Hong Kong market will tag along with that downtrend," said Jackson Wong, associate director at Huarong International Securities Ltd. in Hong Kong. “We didn’t see any panic selling, but we don’t have any extremely positive catalyst to push up the stock market."Hong Kong stocks extended their worst start to a lunar new year since 1994 as a global equity slump compounded concern that capital outflows, a slumping property market and China’s economic slowdown will hurt earnings. The Hang Seng Index has tumbled 16 percent this year, while the Hang Seng China Enterprises Index is trading at its lowest level since March 2009. Mainland markets resume trading on Monday after a week-long break.

The Hang Seng index fell 5.02% in a holiday truncated trading week.

This week's selloff in Hong Kong's equities maybe a bad omen for the resumption of trading activities in mainland China next week. Will stocks of mainland China crash too? Or will the national team will be active next week to prevent this?

And another noteworthy event today has been the crash of Korea's small cap index the Kosdaq, which prompted for a trading halt.

From Bloomberg:

Trading in South Korea’s Kosdaq exchange for smaller stocks was temporarily halted after the benchmark gauge plunged more than 8 percent on concern valuations were excessive relative to earnings prospects.Trading was suspended for 20 minutes at 11:55 a.m. in Seoul after the measure dropped 8.2 percent. The index pared declines to 6.1 percent at the close. Celltrion Inc. was the biggest drag on the small-cap measure after the stock almost tripled in the past 12 months. The Kospi gauge of larger companies closed at its lowest level since August.The Kosdaq index of more than 1,100 companies jumped 26 percent to outperform the large-cap gauge last year as investors piled into biotech shares and other smaller companies in search of earnings growth as smokestack industries stagnated. Celltrion, which developed an arthritis medicine, trades at 42 times projected 12 month profits, four times the Kospi’s 10.5 times.Investors are selling small-cap stocks as they look for havens amid the global market turmoil, said Choi Kwang Kook, a senior fund manager at Assetplus Investment Management in Seoul.World equities entered a bear market on Thursday amid concern over the strength of the global economy, while the yen and gold rallied. Korean markets were closed for the first three days of this week for holidays. Today’s 8.2 percent intraday decline by the Kosdaq is the biggest since December 2011.

The Kosdaq closed down by still a huge 6.06% today!

Nonetheless, Korea's major benchmark the Kospi was spared of the carnage and was down by just 1.41% for the day and 4.3% for the week.

As noted in the report above, bears have now gained control of the world markets.

For this week, ASEAN majors were spared from the bloodletting suffered by other regional peers.

Will China's resumption of trading next week induce a uniformity of actions?

No comments:

Post a Comment