I used to own tourist companies in India at a time. India should have had the greatest tourist companies in the world. If you can only visit one country in your life, my goodness, it should be India—it is an astonishingly spectacular place to visit. There is no place that has the depth of culture that India has. Yes, I have new reasons to short India—just read its newspapers everyday and you will see why.The government goes from one mistake to another—no matter what the controls are, no matter how much the debt keeps rising, Indian politicians are only looking for scapegoats. Look at the latest thing with gold—Indian politicians want to blame the problems of their economy on someone else, and now it is gold. Gold is not causing India problems, but it is quite the contrary. Exchange controls in India are absurd, the regulations that India puts in place result in foreigners going through 70 loops before they can invest in India. Foreigners cannot invest in commodities in India.India should have been among the world’s greatest agriculture nations—you have the soil, the people, the weather, but it is astonishing that you have not become one—it is because Indian politicians, in their wisdom, have made it illegal for farmers to own more than five hectares of land. What the hell—can a farmer with just five hectares compete with someone in Australia or Canada? Even if you put together the land in all your family, it is still not possible to compete. Much as I love India, I am not a fan of its government. Every one year, they (Indian government) come up with more reasons for me to be less optimistic about that country.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Wednesday, August 14, 2013

Why Jim Rogers is Shorting India

Saturday, October 06, 2012

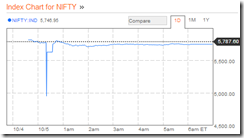

Electronic Errors Caused a Flash Crash In India’s Stock Markets

The plunge and rebound in Indian stocks that pushed the S&P CNX Nifty (NIFTY) Index down 16 percent over eight seconds underscored concern about financial markets.Trading in the Nifty and some companies stopped yesterday in Mumbai for 15 minutes after the 50-stock gauge tumbled as much as 16 percent. A brokerage that mishandled trades for an institutional client was to blame, according to the National Stock Exchange of India.Regulators around the world are probing market structure and electronic trading after a series of malfunctions. In May 2010, high-frequency orders worsened the so-called flash crash, which briefly wiped $862 billion from U.S. stocks. The Nasdaq Stock Market in May this year was overwhelmed by order cancellations and trade confirmations were delayed in the public debut of Facebook Inc. (FB), 2012’s largest initial public offering.“Everyone is very sensitive to these electronic errors,” Adam Mattessich, head of international trading at Cantor Fitzgerald LP, said by phone in New York. “It’s the kind of thing that could be nothing or it could become a financial calamity.”Orders entered by Emkay Global Financial Services Ltd. (EMKAY) that led to trades valued at 6.5 billion rupees ($126 million) caused the drop, NSE spokeswoman Divya Malik Lahiri said from New Delhi.Circuit breaker limits enforced by the NSE get activated “after existing orders are executed,” Ravi Varanasi, head of business development at the exchange in Mumbai, said by phone. “We are investigating the reason behind the wrong orders and how checks and balances at the member’s end failed.”

Thursday, June 11, 2009

India's Surging Markets Lures Companies From The Government and The Private Sector To Raise Financing

From the trough, India's BSE 30 is up about 84% and is 26% shy from its 2008 peak.

From the trough, India's BSE 30 is up about 84% and is 26% shy from its 2008 peak. The Indian rupee has also rallied furiously since the simultaneous trough in the stock and currency markets.

The Indian rupee has also rallied furiously since the simultaneous trough in the stock and currency markets.According to the Wall Street Journal, ``So far this year, issues of new shares have been scarce. But with the Bombay Stock Exchange's benchmark index at a 10-month high, many companies have plans to raise capital to bolster balance sheets and fund growth, bankers say.

``The new government's budget, scheduled for release in early July, also could usher in new sales of stakes in public companies. The frenzy may be welcome news to investors looking to ride a rapid rise in India's stock market over the past few months...

``Data provider Thomson Reuters expects $50 billion of new shares to be issued in India this year. So far, there has been just $1 billion.

Again from the same article, ``On the IPO front, state-owned hydro-power outfit NHPC Ltd. and oil-exploration company Oil India Ltd. are expected to issue shares. On Monday, Rahul Khullar, the outgoing top bureaucrat in the department in charge of state company disinvestment, said the government is likely to sell stakes in NHPC and Oil India by September, followed by six to seven other companies before March 31, 2010.

``The government's budget could offer further divestment plans amid the need to stimulate the economy without severely worsening the fiscal deficit.

``Air India, India's national airline, and state-run telecommunications company Bharat Sanchar Nigam Ltd., or BSNL, are likely to sell some shares, market watchers say."

The phenomenal activities in India are likely to be replicated in major Emerging Markets and in Asia.

Friday, February 06, 2009

Snap Shot of Asian Bourses

For the major ASEAN markets (Malaysia's KLSE-blue, Philippine Phisix-green, Thailand's Seti-yellow, Indonesia's JKSE- orange), we notice some consolidation or possible indications of a "bottom" formation.

For the major ASEAN markets (Malaysia's KLSE-blue, Philippine Phisix-green, Thailand's Seti-yellow, Indonesia's JKSE- orange), we notice some consolidation or possible indications of a "bottom" formation.

The industrialized export driven economies of Asia seem mostly coasting along the lows (Singapore's STI-blue, Taiwan's Taiex-green and Nikkei-yellow). Only crisis stricken Korea (orange) seems to have improved substantially.

The industrialized export driven economies of Asia seem mostly coasting along the lows (Singapore's STI-blue, Taiwan's Taiex-green and Nikkei-yellow). Only crisis stricken Korea (orange) seems to have improved substantially. Finally we see contrasting performances in Australia's S&P ASX 200 (green) also wafting near the lows while New Zealand's NZ 50 seems to be testing its resistance level.

Finally we see contrasting performances in Australia's S&P ASX 200 (green) also wafting near the lows while New Zealand's NZ 50 seems to be testing its resistance level.Overall, performances have been mixed albeit those with less exposure to global ex-intraregion trade appear to be performing better.