The federal budget is guaranteed to leave Canadians penniless — literally.Among the victims of cutbacks outlined by Finance Minister Jim Flaherty in the government's 2012 federal budget on Thursday is Canada's one-cent coin.Citing low purchasing power and rising production costs, the government has decided to phase the penny out of existence starting this fall, when the Royal Canadian Mint will stop distributing the one-cent coin to financial institutions.Over time, that will lead to the penny effectively becoming extinct, although the government noted on Thursday that one-cent coins will always be accepted in cash transactions for as long as people still hold on to them.The value of the penny has decreased to about 1/20th of its original purchasing power. Indeed, the lowly penny has fallen so far that Ottawa described it as a "burden to the economy" in a pamphlet explaining the change on Thursday.In part because of rising prices for the metals it's made of, it actually costs 1.6 cents to produce every penny. The government estimates it loses $11 million a year producing and distributing the penny, and that doesn't include the costs and frustrations for businesses and consumers that use them in transactions.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Friday, November 30, 2012

Inflation’s Toll: Canada Goes ‘Penniless’

Wednesday, November 28, 2012

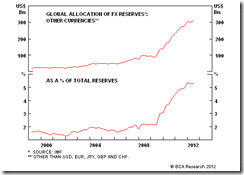

New Currency Reserves: Australian Dollar, Canadian Dollar and Gold

From about 2% of total reserves in 2009, the allocation to “other currencies” has risen to over 5%. The Canadian and Australian dollars probably account for the vast majority of this increase.To be sure, the IMF’s announcement is only a recognition of what central banks have been doing. It does not make the Canadian and Australian dollars any more attractive. Nevertheless, the shift into alternative currencies is a trend that is likely to persist. Global FX reserves total over $11 trillion, so a 1% change in currency allocation during the span of a year amounts to more than $100 billion.A large sum for relatively small economies like Canada and Australia to absorb.

Zero bound short term interest rates, ballooning central bank balance sheets, large fiscal deficits and worrisome government debt levels are forcing investors, in both the public and private sectors, to seek out relatively sound alternatives to the major currencies.

Friday, July 20, 2012

Canadians Have Overtaken Americans in Wealth

From the USNews.com

For the first time in recent history, the average Canadian is richer than the average American, according to a report cited in Toronto's Globe and Mail.

And not just by a little. Currently, the average Canadian household is more than $40,000 richer than the average American household. The net worth of the average Canadian household in 2011 was $363,202, compared to around $320,000 for Americans.

If you're thinking the Canadian advantage must be due to exchange rates, think again. The Canadian dollar has actually caught up to the U.S. dollar in recent years.

"These are not 60-cent dollars, but Canadian dollars more or less at par with the U.S. greenback," Globe and Mail's Michael Adams writes.

To add insult to injury, not only are Canadians comparatively better-off than Americans, they're also more likely to be employed. The unemployment rate is 7.2 percent—and dropping—in Canada, while the U.S. is stuck with a stubbornly high rate of 8.2 percent.

Besides a strengthening currency and a better labor market, experts credit the particularly savage fallout from the financial crisis on the U.S. economy and housing market, which torpedoed home values and gutted household wealth. According to the report, real estate held by Canadians is worth more than $140,000 more on average and they have almost four times as much equity in their real estate investments.

In contrast to most of mainstream reporting, Canada’s strong currency has been imputed as manifestation of a relatively “superior” performing economy than the US.

Of course commodity exports have been partly responsible for the this but has barely been an indication of the resource course: the Dutch Disease.

Canada’s strength, according to the report, has been founded on two aspects: one relatively “better” labor market, and two, America’s boom bust cycles which has “torpedoed home values and gutted household wealth”.

While there are many other factors to consider for comparison, I would focus on three;

One, Canadian banks has outperformed the US. Like in the great depression, the US financial crisis of 2008 barely dinted on Canada’s banking system.

Two, Canada tops the US in Economic Freedom…

Canada ranks 6th in the Heritage Foundation’s world’s country ranking of economic freedom index compared to the US…

The economic freedom in the US has been in a steady descent.

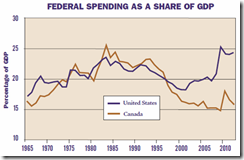

Finally, Canada’s government has been relatively fiscal prudent than her neighbor.

As Cato’s Chris Edwards writes

The spending reforms of the 1990s allowed the Canadian federal government to balance its budget every year between 1998 and 2008. The government's debt plunged from 68 percent of GDP in 1995 to just 34 percent today. In the United States federal debt held by the public fell during the 1990s, reaching a low of 33 percent of GDP in 2001, but debt has soared since then to reach more than 70 percent today.

Bottom line: Economic freedom and fiscal prudence are once again depicted as key to economic prosperity.

Saturday, March 03, 2012

For Iceland, Canadian Loonie is Better than the US Dollar

From Globe and Mail (hat tip Zero Hedge)

Iceland’s newfound love for the loonie is sparking a wave of controversy, from Reykjavik to Ottawa.

For 150 years, the rest of the world has shown scant interest in the Canadian dollar – the poor cousin to the coveted U.S. greenback.

But now tiny Iceland, still reeling from the aftershocks of the devastating collapse of its banks in 2008, is looking longingly to the loonie as the salvation from wild economic gyrations and suffocating capital controls.

Canadian ambassador to Iceland Alan Bones had planned to deliver remarks to a conference on the future of the Icelandic Krona, making it clear that if Iceland decided to adopt the Canadian dollar, with all its inherent risks, Canada was ready to talk.

The actual adaption to non-US Dollar reserves for the banking system represents as more evidence of the ongoing erosion of the foundations of the US dollar standard.

For now, intentions to shift signify as just that--proposals to act. Nevertheless, anxiety over the untenable state of the today's currency platform appear to be snowballing. Once a tipping point has been reached, then the decline will be pronounced.

Friday, June 12, 2009

Soaring Oil Prices Isn't Just Relative To The US Dollar, But On Most Currencies!

Having checked on the WTIC compared with different currencies we realized that this had only been partially accurate-oil has been surging across major currencies!