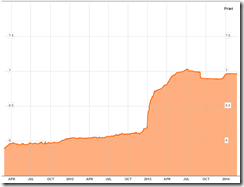

Egyptian stocks are showing all the signs that investors favor a return to a military-backed rule to end three years of political turmoil and revive an economy stuck in its worst slump in two decades.Share volume is up 159 percent this year over 2013’s daily average, according to data compiled by Bloomberg, coinciding with voters’ approval of a new constitution and the military’s endorsement of Defense Minister Abdel-Fattah al-Seesi’s possible presidential bid. The benchmark EGX 30 Index rose 18 percent in 2014 as of 10:39 a.m. in Cairo, the fifth-best performance of more than 90 gauges tracked by Bloomberg, with all but one of its members in a rising trend as of yesterday, the data show.Three years after protesters ended President Hosni Mubarak’s 29-year rule in a popular revolt that left hundreds dead and led to the slowest economic growth since 1992, local investors are piling back into Egyptian stocks amid speculation another military-backed ruler can restore order. The EGX 30 is trading near the highest since 2008, while volatility of the index fell last week to the lowest since before the start of the 2011 uprising.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Wednesday, February 26, 2014

Egypt’s Booming Stocks are Symptoms of Runaway Inflation

Saturday, July 06, 2013

Egypt’s People Power-Coup: Same Dog, Different Collars

Revolution. It’s a funny word when you think about it. In political terms, ‘revolution’ conjures images of heroes battling tyrants, of all-out forcible insurrection in the name of freedom and change.From a celestial perspective, however, ‘revolution’ denotes one complete orbit of a planetary body around its center, as in the earth’s revolution around the sun. In other words, after a revolution, you end up right back where you started.Same word, two completely different meanings– on one hand you have change, and on the other you have more of the same. This is exactly what has happened after Egypt’s revolution this year.Sure, Hosni Mubarak is now standing trial after 3-decades of looting and pillaging his country’s wealth. For most Egyptians, this is viewed as a major victory; there is a feeling of intense optimism here on the streets of Cairo, and even though nothing is fundamentally different, expectations are high.Mubarak was a symbol of tyranny, and a great deal of blood was shed to topple his regime. Unfortunately, Egyptians have essentially replaced one form of dictatorship with another.There is now one person in charge of Egypt– military Supreme Commander Mohamed Hussein Tantawi. Tantawi was Mubarak’s Minister of Defense, and as the man in charge of roughly one million soldiers, sailors, and airmen in a country with no political system, Tantawi has absolute authority.He’s not shy about using it either. Just ask any of the thousands of Egyptians who have been tried and sentenced by despotic military tribunals over the last several months.Many of these ‘criminals’ were bloggers like Maikel Nabil Sanad– found guilty of insulting the Egyptian military establishment. Sanad is currently serving a three-year sentence after a rubber-stamp tribunal convicted him five months ago. Several other bloggers and public figures have been jailed or detained as well.Despite all the song and dance about freedom in Egypt, their revolution has brought them right back to where they started– an autocratic dictatorship.When you think about it, this is how things usually work out in politics. How many people have campaigned on the ‘change’ platform, only to end up following the same path as the last guy? As the saying goes, ‘the more things change, the more they stay the same.’Egypt is due to hold parliamentary elections in a few months’ time. It’s questionable whether Tantawi will give up his supreme, unchecked power… but whatever happens, one thing is clear: a new power elite will emerge in Egypt that helps itself to wealth and privilege at the expense of everyone else.This is the great weakness in any political system: ‘government’ is based on the idea that some individual or organization is awarded power than no human being should possess– the power to kill, to declare war, to steal, to defraud, to counterfeit.All of these powers are considered immoral by man, but perfectly acceptable for government… and no matter how much they dress it up as being good for the people, any political system makes full use of its authority in order to maintain the status quo and keep the ruling elite in power.Egypt underscores an important lesson from history: with rare exception, even when you topple the ruling elite, someone else will simply step up to fill the void… just as the French traded Louis XVI for Maximilien Robespierre’s Reign of Terror in the 1790s.This is why advocating for political change, while virtuous and noble in deed, is ultimately a wasted effort. Power-hungry megalomaniacs and their sycophantic yes-men will always rise to the top, conning the masses along the way that ‘change is coming’. It’s all a big snow job.Bottom line- politicians are in it for their own benefit, not for yours. We only have a finite amount of resources available– time, money, and energy. It’s far better to allocate those resources to improving your own situation rather than some politician’s chances of reelection.

The irony of the Egyptian Arab Spring is that while it brought forth new players, it has not changed the regime or the fundamental architecture of Egyptian politics. The military remains the dominant force, and while it is prepared to shape Egypt cleverly, what matters is that it will continue to shape Egypt.Therefore, while it is legitimate to discuss a military coup, it is barely legitimate to do so. What is going on is that there is broad unhappiness in Egypt that is now free to announce its presence. This unhappiness takes many ideological paths, as well as many that have nothing to do with ideology. Standing on stage with the unhappiness is the military, manipulating, managing and containing it. Everyone else, all of the politicians, come and go, playing a short role and moving on -- the military and the crowd caught in a long, complex and barely comprehensible dance.

Tuesday, July 02, 2013

Egypt’s Arab Spring: From Tyranny to Tyranny

Egypt’s top generals on Monday gave President Mohamed Morsi 48 hours to respond to a wave of mass protests demanding his ouster, declaring that if he did not, then the military leaders themselves would impose their own “road map” to resolve the political crisis.Their statement, in the form of a communiqué read over state television, plunged the military back into the center of political life just 10 months after it handed full power to Mr. Morsi as Egypt’s first democratically elected leader.The communiqué was issued following an increasingly violent weekend of protests by millions of Egyptians angry with Mr. Morsi and his Muslim Brotherhood backers. It came hours after protesters destroyed the Brotherhood’s headquarters in Cairo.In tone and delivery, the communiqué echoed the announcement the Supreme Council of the Armed Forces issued 28 months ago to oust President Hosni Mubarak and seize full control of the state. But the scope and duration of the military’s latest threat of political intervention — and its consequences for Egypt’s halting transition to democracy — were not immediately clear, in part because the generals took pains to emphasize their reluctance to take over and the inclusion of civilians in any next steps.For Mr. Morsi and his Islamist allies in the Muslim Brotherhood, however, a military intervention would be an epic defeat. It would deny them the chance to govern Egypt that the Brotherhood had struggled 80 years to finally win, in democratic elections, only to see their prize snatched away after less than a year.“We understand it as a military coup,” one adviser to Mr. Morsi said, speaking on condition of anonymity to discuss confidential deliberations. “What form that will take remains to be seen.”The military’s ultimatum seemed to leave Mr. Morsi few choices: cut short his term as president with a resignation or early elections; share significant power with a political opponent in a role such as prime minister; or attempt to rally his Islamist supporters to fight back for power in the streets.

I cannot accept your canon that we are to judge Pope and King unlike other men, with a favourable presumption that they did no wrong. If there is any presumption it is the other way, against the holders of power, increasing as the power increases. Historic responsibility has to make up for the want of legal responsibility. Power tends to corrupt, and absolute power corrupts absolutely. Great men are almost always bad men, even when they exercise influence and not authority, still more when you superadd the tendency or the certainty of corruption by authority. There is no worse heresy than that the office sanctifies the holder of it.

Wednesday, February 09, 2011

When Public Education Backfires: Seeds To Egypt’s Revolt

Education equals prosperity is an immensely misguided concept.

It is a belief founded on an observation where prosperous societies are populated by educated people. The oversimplistic causation or applied syllogism which led to this conclusion says that education “caused” prosperity. Hence, many social policies adapted by nation states focus on getting people “educated”.

We have pointed out in this space that this isn’t (necessarily) true. Throngs of unemployed in many places as the Philippines have been “educated” people.

Here is an eye-opening insight from Troy Camplin who argues that Egypt’s free “public” education has backfired and has virtually sowed the seeds of the today’s upheaval.

We quote Mr. Camplin, (all bold highlights mine)

There are plenty of reasons to want to overthrow the sitting Egyptian government. But the irony is that the government’s largesse is part of the problem. The government provided free educations for its people, even though there was not a sufficiently complex economic system in place to create jobs for all of those people. In 2001, Alison Wolf argued in Does Education Matter? that “Egypt is a country whose government made a commitment to give (university) graduates first call on jobs in the public sector. It very quickly found itself with a vast and underemployed army of civil servants, and a huge queue of students aiming at comparable sinecures for themselves” (p.40).

There can only be so many government jobs. What happens when government can no longer absorb the excess college graduates? In the end, the Egyptian government created the current situation by creating a population too educated for its economic system.

Critics will immediately accuse me of arguing that we ought to keep the masses poor and uneducated, to ensure they don’t rise up. What I am in fact arguing is that we cannot create wealth by skipping steps, by leaping a country into a population whose education does not match its economic realities.

One of the side effects of an overly-educated population (overly-educated meaning there are more people with educations than jobs for them at that level of education) is that one has a population composed of people who are both dissatisfied with their lot in life and who know exactly what is causing their dissatisfaction. Their world is bigger, and the limits of their situation cannot contain them. It eventually spills into the streets.

Keeping people ignorant is one way to control people.

Also indoctrination in the form of public education is another form of control, as John Stuart Mill once wrote

A general State education is a mere contrivance for molding people to be exactly like one another; and as the mold in which it casts them is that which pleases the dominant power in the government, whether this be a monarch, an aristocracy, or a majority of the existing generation; in proportion as it is efficient and successful, it establishes a despotism over the mind, leading by a natural tendency to one over the body

Nevertheless, governments, as F. A. Hayek and Mises pointed out, can’t know everything and can’t calculate the nitty-gritty requirements of society. Thus, governments frequently institute policies that are noble sounding that comes with short term benefits, but has been laden self destructive traps, e.g. policies may eventually be used against themselves.

I am reminded of the nice apropos quote from A. Whitney Griswold (1909-1963: Essays on Education, 1954) who wrote,

"Certain things we cannot accomplish… by any process of government. We cannot legislate intelligence. We cannot legislate morality. No, and we cannot legislate loyalty, for loyalty is a kind of morality."

Education isn’t intelligence nor is it a source of political loyalty. The Egyptian Revolt seems to demonstrate this.

Tuesday, February 01, 2011

Egyptian Revolt: Web Censorship Fails

Learning from the Jasmine Revolution in Tunisia, the Egyptian government swiftly severed web connections.

But this hasn’t prevented Egyptian malcontents from going around recently imposed government controls.

From the computerworld.com, (bold highlights mine)

"When countries block, we evolve," an activist with the group We Rebuild wrote in a Twitter message Friday.

That's just what many Egyptians have been doing this week, as groups like We Rebuild scramble to keep the country connected to the outside world, turning to landline telephones, fax machines and even ham radio to keep information flowing in and out of the country.

Although one Internet service provider -- Noor Group -- remains in operation, Egypt's government abruptly ordered the rest of the country's ISPs to shut down their services just after midnight local time Thursday. Mobile networks have also been turned off in some areas. The blackout appears designed to disrupt organization of the country's growing protest movement, which is calling for the ouster of Egyptian President Hosni Mubarak.

"[B]asically, there are three ways of getting information out right now -- get access to the Noor ISP (which has about 8 percent of the market), use a land line to call someone, or use dial-up," Jillian York, a researcher with the Berkman Center for Internet & Society, said via e-mail.

Egyptians with dial-up modems get no Internet connection when they call into their local ISP, but calling an international number to reach a modem in another country gives them a connection to the outside world.

Centralization under fire.

The Economic Roots of Egypt’s Revolt

Zachary Karabell, at the Wall Street Journal, spells out the economic aspects of the ongoing revolt in Egypt.

He writes, (bold emphasis mine)

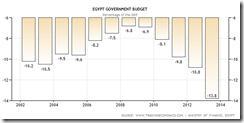

The country ranks 137 in the world in per-capita income (just behind Tonga and ahead of Kirbati), with a population in the top 20. And while GDP growth for the past few years has been respectable, averaging 4%-5% save for 2009 (when all countries suffered), even that is at best middle of the pack in a period where the more competitive dynamic nations have been surging ahead.

Egypt has long been famous for crony inefficiency. Yet Hosni Mubarak was graced with nearly $2 billion in annual U.S. aid, another $5 billion from dues from the Suez Canal, and $10 billion in tourism, so he could buy off a considerable portion of the 80 million Egyptians...

What allows China to thrive for now (and Brazil and India and Indonesia, among many others) is that its citizens believe they have some control over their material lives and a chance to turn their dreams and ambitions into reality. They have an outlet for their passions that is not determined for them, and an increasing degree of economic freedom.

The young in Egypt—two-thirds of the population is under the age of 30—believe that they have no future, and in many ways they are correct. Under Mr. Mubarak, their food and housing is subsidized and they are placed in jobs or left in unemployed limbo, not starving but without any hope of anything but years of numbing sameness.

These realities alone don't cause revolution. Many countries are poor and quiet. But Egypt has had all the marks of a tinderbox. The future could bring worse, with radical regimes or chaos. But for millions who have concluded that their dreams for a better life would expire unfulfilled, nothing could be worse than the present.

My comments:

1. The welfare state strips out the self-worthiness or self esteem of people, as the public’s sense of achievement from trade and production has been limited to a few. Web connectivity may have reinforced this perception and incited for this seemingly widespread clamor for political change.

2. Since economics drive politics, the imbalances from a closed system or state (crony) capitalism eventually gets vented on politics. What is unsustainable won’t last.

3. Political systems built around the industrial age (Second Wave) are feeling the strains of the transition towards the information age (Third Wave)

Today the elites can no longer predict the outcomes of their actions. The political systems through which they operate are so antiquated and creaky, so outraced by events that even when closely “controlled” by the elites for their own benefit, the results often backfire.

This does not mean, one hastens to add, that the power lost by the elites has accrued to the rest of society. Power is not transferred; it is increasingly randomized, so that no one knows from moment to moment who is responsible for what, who has real (as distinct from nominal) authority, or how long that authority will last. In this seething semi-anarchy, ordinary people grow bitterly cynical not merely about their own “representatives” but—more ominously—about the very possibility of being represented at all.

From the underrated but highly prescient author Alvin Toffler in his 1990 book The Third Wave.

Monday, January 31, 2011

Gold Fundamentals Remain Positive

``Gold, on the other hand, is a much-needed safeguard against the barbarism of monetary authorities. Historically, the international monetary system, imposed after World War II by the Bretton Woods agreements, gave the dollar a central role. It was considered "as good as gold" because it was the only currency that maintained a link with the yellow metal. Gold thus acted as economic actors' safety valve against American monetary authorities' abuse of inflationary expansion.” Valentin Petkantchin Gold and the Barbarians

I have always emphasized that gold has proven to be quite a reliable thermostat of the global equity markets[1].

Gold has not escaped the short deflationary episode in 2008 nor has it eluded the recession in the early 2008. Thus gold, as we have repeatedly argued here[2], isn’t likely to function as a deflation hedge for the simple reason that gold isn’t part of the incumbent monetary architecture unlike during the Great Depression days of the 1930s. In short comparing gold in the 30s and gold today would be like comparing apples to coconuts.

The implication of this is that a sustained fall in gold prices could suggest of contracting money supply or a resurfacing of recessionary (deflationary) forces. Thus, a sustained fall or a dramatic collapse of gold prices should be mean alarm bells for us.

As a side note, not all recessions have been deflationary as alleged by some, and this has been evident in the stagflation era of the 70s (see figure 4).

Figure 4: Economagic: Stagflation

In the 70s, even as the S&P 500 (green line) fell, the consumer price (blue line) index continued to surge. Meanwhile, precious metals (red line) peaked amidst the 1980 recession.

But of course, like money, gold is also subject to demand and supply balanced by prices. Thus given the 10 successive years of gains, gold is certainly not immune to plain vanilla profit taking.

The point is—we should ascertain if any fall in the price of gold constitutes structural or countercyclical forces at work.

Monetary Disorder Remains The Dominant Theme

When we learn that China intends to issue 1 trillion yuan ($151 billion) this year[3], the the Central Bank of Ireland is financing €51bn of an emergency loan programme by printing its own money[4] and that the US monetary aggregate M2 has been surging by biggest weekly amount since 2008[5], we don’t seem to see any substantial or structural changes that should impact the long term price trend of gold materially.

In short, global central banks continue to pump money like mad, and this should be bullish for gold.

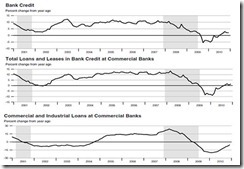

Figure 4: St. Louis Federal Reserve: Bank Credit

To add, as I have rightly been predicting[6]; the steep yield curve would influence the US credit markets positively, though at a time lag, as I previously wrote “the US yield curve cycle has a 2-3 year lag period from which we should expect it to generate “traction” by the last quarter of 2010.”[7]

And they seem to performing as expected (see figure 4), as the US credit market appear to show signs of improvements.

The risk here is that with record “excess” bank reserves or banks' base-money holdings minus required reserves that is either held in their vaults or on deposit with the Federal Reserve, given the fractional reserve system, these reserves can multiply credit and money supply that may amplify or accelerate the rate of inflation.

In other words, even what may be read as a positive ‘economic’ sign could represent a prospective hazard—an offshoot to the previous policies.

Thus, the recent volatility in gold prices for me would account for profit taking and certainly not a reason to see a reversal.

Yet part of the recent fall in gold prices has allegedly been traced to a speculator-trader, who massively levered up on huge (long- short) gold positions, which turned out to be unprofitable and had been forced to liquidate.

The ensuing liquidation resulted to what the Wall Street Journal reports as the biggest single reduction ever[8]in gold contracts.

So with the possibility that this event may have already passed and or could have been discounted, gold could regain its lustre over the coming sessions.

Gold And The Web Enabled Middle East Political Revolutions

Friday’s huge rally in gold, which media attributed to Egypt’s worsening political crisis and had likewise been adduced to the heightened risks of a regional political upheaval—where dictatorships and the entrenched aristocracy appear to be facing a comeuppance from the long disgruntled populace, a revolution apparently enabled by the web[9] and partly triggered by surging food prices—appear more like rationalization.

Figure 5: Bloomberg[10]: Political Tremors In The Middle East

Although, stock markets in the Middle East had indeed been rattled by such fears (see figure 5).

Perhaps the embattled aristocracy could be scrambling to safekeep their wealth overseas by buying gold for laundering purposes or for absconding it, similar to reports where the First Lady of the deposed President of Tunisia was alleged to have fled with 1.5 tonnes of gold (worth $55 million)[11].

The spike in oil prices should be more of a natural side effect over concerns of supply side disruptions once political standoffs become exceedingly violent. But given that the political turmoil account for as domestic issues, I am sceptical over the prospects of prolonged violent stalemate.

For me, these so-called uncertainties are icing in the cake for gold.

Yet in my view, we should see these ongoing revolts as positive.

People appear to be emboldened in asserting their sovereignty over an increasingly derelict political structure built upon vertical hierarchies predicated on central planning and or political-economic fascism.

In short, the web has functioned as a pivotal instrument in counterbalancing or levelling or reducing the concentration of political power to a few or to the once powerful elite. The likelihood is that the rule of autocrats will be diminished, unless governments would be successful in introducing and imposing controls and censorship on the cyberspace.

With over 2 billion people now wired or connected online or “With the world's population exceeding 6.8 billion, nearly one person in three surfs online”[12], add to that the 5 billion mobile phone subscriptions or about 73% of the global population, it’s no wonder how the political playing field is being reconfigured to adjust to these new realities.

Governments in the future are likely to be more attuned to the public and would likely shed a lot of bureaucratic fats.

And these ongoing revolutions represent the aforementioned structural adjustments in the political process. Hopefully, these people power revolts will be alot less bloody than their counterparts in the early to mid 20th century.

And if there should be any major force that could influence the current trend of gold it would likely be gold’s reversion to the new monetary framework which will likely be brought upon by people’s realization and intolerance of the abuses of central banking system.

So I unlike those who see a surge in the “event risks” from the current string of upheavals in the Middle East as a reason to sell, I see gold rebounding from these uncertainties, fed by the inflationism in central banks and eventually a rally in most of the global equity markets, including the Phisix.

[1] See Gold As Our Seasonal Barometer, February 23, 2009

[2] See Gold Unlikely A Deflation Hedge, June 28, 2010

[3] People’s Daily Online Central bank to print 1 trillion yuan in paper currency, January 20, 2011

[4] Independent.ie Central Bank steps up its cash support to Irish banks financed by institution printing own money January 15, 2011

[5] Durden, Tyler M2 Surges By Biggest Weekly Amount Since 2008 As It Hits Fresh All Time Record, Zero Hedge, January 27, 2011

[6] See Influences Of The Yield Curve On The Equity And Commodity Markets, March 22, 2010, See What’s The Yield Curve Saying About Asia And The Bubble Cycle?, January 17, 2010

[7] See Trigger To The Inflation Time Bomb, October 7, 2010

[8] Cui Carolyn and Zuckerman Gregory Small Gold Trader Makes Big Splash, Wall Street Journal, January 28, 2011

[9] See The Web Is Changing The Global Political Order, January 29, 2011

[10] Bloomberg.com Bloomberg GCC (Gulf Cooperation Council) 200; The Bloomberg GCC 200 Index is a capitalization weighted index of the top 200 equities in the GCC region based on market capitalization and liquidity. The index was developed with a base value of 100 and is rebalanced semi-annually in April and October.

[11] MoroccoBoard.com Tunisia: Ex First Lady Absconded With 1.5 T Of Gold Bullions, January 17, 2010

[12] Physorg.com Number of Internet users worldwide reaches two billion, January 26, 2011

Saturday, January 29, 2011

The Web Is Changing The Global Political Order

Here is futurist Alvin Toffler as interviewed by the Gartner fellows in 2006: (bold emphasis mine)

I also think there's going to be a great boom when we stop thinking about companies and start thinking about restructuring governments - and completely restructuring these gigantic pyramidal bureaucracies that we rely on and that no longer function. So I think that there's going to be a huge market for software in new kinds of organizations. Now, I'm not sure whether it'll still be called software or what, but as you no doubt read in the book, I expect to see one big institution after another collapse just like the Katrina experience with FEMA and the government and so on. That our corporate structures are designed for the industrial age - and that made sense then and Max Weber wrote about it in 1910 and so forth and so on - but they're clearly inappropriate to the systems that are now growing up, economic, social, cultural and all the rest.

The web became an instrumental tool in uprooting Tunisia’s dictatorship as shown here and here.

Sensing the same fate that might befall the 30 year authoritarian regime, Egypt’s President Hosni Mubarak swiftly orders communications cut as riots has escalated.

From Business Insider

From the New York Times

For the first time since the 1980s, Mr. Mubarak felt compelled to call the military into the streets of the major cities to restore order and enforce a national 6 p.m. curfew. He also ordered that Egypt be essentially severed from the global Internet and telecommunications systems. Even so, videos from Cairo and other major cities showed protesters openly defying the curfew and few efforts being made to enforce it. (emphasis mine)

Old political structures designed for the Industrial era appear to be crumbling exactly as Mr. Toffler predicted. This is only part of the ongoing adjustment towards the “knowledge economy”.

I’d like to add that the transition to the knowledge economy is being fed by the forces of decentralization brought about by connectivity and information dissemination. And this is what governments are afraid of.

As we have long been saying, these are two major forces in collision.