Ironically, despite all the previous stream of adulation on the supposed therapeutic wonders from QE, the ECB reportedly expanded this yesterday.

Mario Draghi unveiled a revamp of quantitative easing and signaled officials might expand stimulus if the rout in financial markets continues to weigh on growth and inflation.

The European Central Bank president said in Frankfurt on Thursday that the Governing Council raised the share of bonds the ECB can buy to 33 percent of each issue from 25 percent, and that policy makers are ready to make more adjustments to ensure the full implementation of the 1.1 trillion-euro ($1.2 trillion) program. A weaker global outlook prompted an across-the-board reduction of the institution’s growth and consumer-price forecasts through 2017. The euro slid to a two-week low.

The reset of the ECB’s stimulus program after a six-month review gives officials more flexibility as they prepare to continue bond purchases until at least September 2016. Weaker commodity prices, slowing trade and volatility in global equities have fueled speculation that more stimulus is on the way…

Stimulus will continue until the end of September 2016 “or beyond, if necessary,” Draghi told reporters, in a tweak to language that hints more strongly than before at a readiness to prolong purchases.

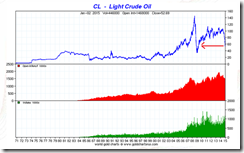

“The information available indicates a continued, though somewhat weaker, economic recovery and a slower increase in inflation rates compared with earlier expectations,” he said. “Taking into account the most recent developments in oil prices and recent exchange rates, there are downside risks” to the latest inflation forecasts.

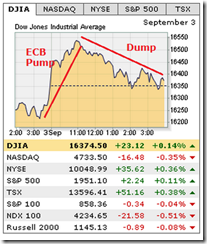

So in the face of wilting stocks, the ECB panicked again for them to prescribe to more monetary heroin!

Of course, Mr Draghi didn’t directly allude to stocks, rather, he ensconced this by indicating “downside risks” in “oil prices and recent exchange rates”

Yes it's another episode of "I recognize the problem of addiction but a withdrawal syndrome would even be more cataclysmic"! Or treat the problem of addiction by providing more of the same substance that caused the addiction!

So European stocks soared!

Unfortunately for the US, the ECB’s expanded QE only led to an initial pump, and then a closing dump!

Stunning response. Previously, central bank credit easing would have sent global stocks flying for weeks. And an adverse reaction would not have been the outcome. Yet like in China, stock markets appear to be pushing back on central bank policies.

There is no such thing as a free lunch. The anesthetic effects from central bank easing policies may have reached an inflection or breaking point. The writing is on the wall.

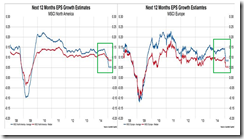

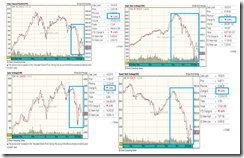

Even charts appear to be showing such strains

“Death crosses” have plagued not only US major equity indices such as the S&P 500, Dow Industrials and the Russell 2000, but has spread to Europe…

German Dax now engulfed by a death cross…

Europe’s stoxx 50 seem headed in the same direction!

Oh by the way, the IMF continues to raise alarm bells on the global economy…

China’s slowdown and a host of other downside risks threaten to push the global economy into much deeper trouble without concerted action by the world’s largest economies, the International Monetary Fund warned Wednesday.

“Risks are tilted to the downside, and a simultaneous realization of some of these risks would imply a much weaker outlook,” the IMF said in a report on the state of the global economy ahead of a meeting of top finance officials from the Group of 20 biggest economies…

But China isn’t the only concern. With growth slowing in many corners of the world and the U.S. economy strengthening, investors have plowed back into the U.S., pushing the value of the dollar up against most major currencies. That is a problem for many countries and corporations that have borrowed heavily in dollars but whose income is denominated in local currencies. And with the U.S. Federal Reserve preparing to raise interest rates, weak growth prospects and heavy debt loads are a toxic mix for many companies and economies, especially in industrializing nations.

“Near-term downside risks for emerging economies have increased,” the IMF warned.

The risks have been so so so so much obvious that even the erstwhile blind can see or sense them.

.bmp)