The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Sunday, July 07, 2019

Charts of the Week: Negative Bond Yield Spreads as Global yields fall to record, China’s Shibor rates plunge to 2009 lows as Hong Kong’s HIBOR rates spike!

Thursday, April 30, 2015

Risk Off is Back? German Stocks Tumble Most Since 2008

German stocks slid 3% on Wednesday, knocked lower by a sharp rise in the euro against the dollar after weak U.S. growth data underscored anticipation the Federal Reserve will delay a hike in interest rates.Germany’s DAX 30 DAX, -3.21% which has been a beneficiary of euro weakness this year, saw the biggest point decline since October 2008, down 378.94 points, or 3.2%, to 11,432.72. The drop also marked the largest percentage decline since March 3, 2014, according to FactSet data.At the same time, the Stoxx Europe 600 SXXP, -2.21% fell 2.2% to 397.30, its lowest close since late March.

Investors gave the clearest sign yet they’re losing patience with the record-low yields on euro-area government bonds in a selloff that spared no market.Yields on Germany’s bunds surged the most in two years as traders shunned an auction of the nation’s debt. Bond titan Jeffrey Gundlach of DoubleLine Capital egged on the declines, saying he’s considering making an amplified bet against the securities. His comments echoed Janus Capital’s Bill Gross, who once managed the world’s largest bond fund. He said bunds were the “short of a lifetime.”The bond slump reflects growing angst among investors after the European Central Bank’s 1.1 trillion-euro ($1.2 trillion) quantitative-easing program sent yields to unprecedented lows from Germany to Spain. Emerging signs of inflation in the 19-nation economy are also hurting demand.

Tuesday, January 10, 2012

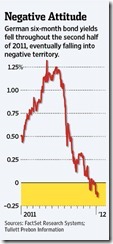

Germany’s Negative Yielding Debt

In Europe, desperate times calls for desperate measures. Now the public pays the government to hold their money.

From the Wall Street Journal, (bold emphasis mine)

Investors agreed to pay the German government for the privilege of lending it money.

In an auction Monday, Germany sold €3.9 billion ($4.96 billion) of six-month bills that had an average yield of negative 0.0122%, the first time on record that yields at a German debt auction moved into negative territory.

This means that unlike most other short-term sovereign debt, in which investors expect to be repaid more than they lend, investors agreed to be paid slightly less. And they are willing to do that because they are so worried about the potential for big losses elsewhere.

That is particularly the case in Europe, where sovereign-bond markets have been rocked by a years-long crisis. Switzerland and the Netherlands, also seen as relatively safe countries in which to invest, are among the few that have sold debt with negative yields in recent months.

In other words, German, Swiss and Dutch debt holders are losing money in exchange for safety.

Negative yields are symptomatic of an aura of uncertainty, the intensifying state of distress, the insufficiency of an alternative and the urgency to seek safehaven.

Interesting times indeed.