In his televised statement, Mr. Passos Coelho said the government would try to revise its budget plan through new spending cuts rather than new tax increases. A person close to the government said it had mulled the idea of paying public employees and pensioners one month of their income in Treasury bills, forcing them, in effect, to lend the Treasury the money the court said it couldn't cut from their paychecks. A government spokeswoman denied that the idea was being considered.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Monday, April 08, 2013

Portugal Considers Using T-Bills to Pay Public Workers and Pensioners

Thursday, February 21, 2013

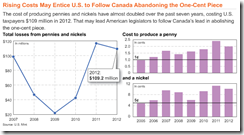

The War on Coins

Pennies and nickels have cost more than their face value to mint since 2006, resulting in a loss of at least $436 million to U.S. taxpayers.The CHART OF THE DAY shows that in 2012, the penny cost almost 2 cents to make and the nickel more than 10 cents, according to the U.S. Mint’s annual report released in January. Those prices have almost doubled over the past seven years.“If you look around in the budget, there aren’t a lot of places you can find savings where you don’t cut a program and you don’t raise anybody’s taxes and you can impact the deficit,” said Jim Kolbe, a former Arizona congressman who sponsored legislation to abolish the penny and dollar bill. “This is one where you can do that.”Neither of Kolbe’s bills, introduced in 2001 and 2006, made it to a full congressional vote.

Mintage has long been a prerogative of the rulers of the country. However, this government activity had originally no objective other than the stamping and certifying of weights and measures. The authority's stamp placed upon a piece of metal was supposed to certify its weight and fineness. When later princes resorted to substituting baser and cheaper metals for a part of the precious metals while retaining the customary face and name of the coins, they did it furtively and in full awareness of the fact that they were engaged in a fraudulent attempt to cheat the public. As soon as people found out these artifices, the debased coins were dealt with at a discount as against the old better ones. The governments reacted by resorting to compulsion and coercion. They made it illegal to discriminate in trade and in the settlement of deferred payments between "good" money and "bad" money and decreed maximum prices in terms of "bad" money. However, the result obtained was not that which the governments aimed at. Their decrees failed to stop the process which adjusted commodity prices (in terms of the debased currency) to the actual state of the money relation. Moreover, the effects appeared which Gresham's law describes.

Wednesday, May 16, 2012

Philippines Moves to Ban Coin Collection

The Philippine government has expanded her version of financial repression

Using flimsy scapegoats, a bill has been filed to criminalize coin hoarding.

From Yahoo.com

Coin collectors beware.

Senator Manuel Lapid has filed a bill to penalize the hoarding of coins to avoid coin shortage.

Citing figures from the Bangko Sentral ng Pilipinas (BSP), Lapid said there should be around 17.34 billion coins--worth around P18.94 billion--in circulation. He said that would mean around 184 coins per Filipino.

"To enterprising crooks, this volume of coins in circulation is a goldmine. Recent valuation of the worth of the country's coinage suggests four of the coins are worth more than their face value if melted," he said in his explanatory note.

Lapid warned that melting down coins "along with the common practice of keeping coins in piggy banks, commercial undertakings such as the Automatic Tubig Machines which use coins for operation, video games machines and illegal numbers games, may threaten the sound circulation of coins in the country."

His bill defines coin hoarding as possessing coins of legal tender "beyond the requirements of his regular business as may be determined by the BSP."…

More from the same article,

Although coin collecting is allowed, the BSP can demand that people turn in all their coins within a month of declaring a coin shortage. Under the Lapid bill, "failure to make the surrender within the required period shall constitute coin hoarding."

The bill proposes a penalty of one year in prison and a fine of P100,000 "for every one thousand pieces of coins hoarded or a fraction thereof."

If passed into law, the bill allows the government to confiscate the coins for its own use.

Finally the admission…

The bill also proposes to allow BSP, in case of a coin shortage, to require all business transactions to be done in coins. "Any transaction to the contrary shall be considered coin hoarding," his bill reads.

"Though the day may be far when we may legally accept being given candies for change instead of coins, such a problem may not be remote as indicated by reports in other jurisdictions. It is thus imperative that preventive measures be put in place," Lapid said.

BSP has had a coin recirculation program since 2005 to address perceived coin shortages in some areas in the Philippines and to save money because the “intrinsic value of the coin is greater than its nominal value especially for the lower-denominated coins.”

First, government issues you the money to use, and then wants to dictate to you how much, and what medium, you should keep and use. If this isn’t an example of despotism, then I don’t know what else is.

Next, the Philippine government finally admits that “intrinsic value of the coin is greater than its nominal value especially for the lower-denominated coins” which means the government has been inflating the purchasing power of the local currency, the paper Peso, away.

Yet instead of maintaining monetary discipline, they chose to pin the blame, threaten to criminalize and perhaps actualize confiscation of the savings owned by the innocent citizenry. This should be a noteworthy example of arbitrary immoral laws.

Also, as predicted, inflationism’s alter ego has always been price control. The proposed banning of the hoarding of coins extrapolates to forcing people to keep coins in circulation, for imagined hobgoblins.

This also means forcing people to accept the coins at face value, which ironically they admit, has been worth more. So in essence, the Philippine government wants you and me to forget about prices and values or economics.

[Updated to add: I forgot to mention that what the government fears is that when the value of coins immensely widens from its face value, out of the effects of inflation, the tendency is for the public to hoard them. This is Gresham's Law at work which I mentioned earlier when Ron Paul talked about modern day coin debasement]

Yet setting up a strawman to justify the attack on the citizenry, through price controls, has long been a pattern of desperate politicians, as the great Ludwig von Mises explained,

in futile and hopeless attempts to fight the inevitable consequences of inflation — the rise in prices — are masquerading their endeavors as a fight against inflation. While fighting the symptoms, they pretend to fight the root causes of the evil. And because they do not comprehend the causal relation between the increase in money in circulation and credit expansion on the one hand and the rise in prices on the other, they practically make things worse.

Moreover, this represents an assault to the informal economy which operates mostly on cash (paper money and coins). This means that such law will become an instrument of subjugation and repression of mostly the poor (who don’t have bank accounts and who are most likely the major users of coins), the middle class, and importantly the political opposition.

Lastly, I am inclined to think that some vested interest groups have been pushing to keep these coins for themselves, of course, by forcing the public cough up on these coins through legislation.

The great Frédéric Bastiat in “The Law” warned

It is impossible to introduce into society a greater change and a greater evil than this: the conversion of the law into an instrument of plunder.

Confiscation of coins will not remove the effects of monetary inflation.

Yet by disallowing people to save through their preferred means and by confiscation of their savings means that such policy have the latent intent to destroy people's wealth.

Wednesday, April 18, 2012

Ron Paul’s Message: Hoard Coins

In a statement to the subcommittee on Domestic Monetary Policy Hearing on "The Future of Money: Coin Production," April 17, 2012, Congressman Ron Paul writes, (lewrockwell.com) [bold highlights mine]

There is an old German saying that goes, "whoever does not respect the penny is not worthy of the dollar." It expresses the sense that those who neglect or ignore the small things cannot be trusted with larger things, and fittingly describes the problems facing both the dollar and our nation today. For nearly a century monetary policy has been delegated to the Federal Reserve System. Congress has ignored the importance of monetary policy and relegated monetary oversight to the sidelines, considering it less important than such matters as welfare spending, warfare spending, and who to tax and how much they should be taxed. While Congress has dithered, the Federal Reserve has destroyed the value of the dollar, so much so that the metal value of our already much-debased token coinage now exceeds its face value

The cost to mint pennies and nickels is alleged to be more than double their face value, so that the Mint loses tens of millions of dollars every year by placing them into circulation. Inflation continues to erode the purchasing power of the penny and nickel, so that many consumers find it aggravating and time-consuming to fish around for small change. But changing the composition of the penny and nickel to steel fails to address the root cause behind currency debasement. It also fails to provide a viable solution both for the devalued dollar and for our circulating coinage.

If Congress were truly interested in the cost of coinage, it would begin by reining in and eventually abolishing the Federal Reserve System. The Fed alone is responsible for the devaluation of the dollar. The problem with the penny and nickel is not that the price of copper and nickel are rising, but that the purchasing power of the dollar is declining due to the Fed's currency debasement. The same pattern has been seen throughout history, as debased currency results in the value of the metal content of coins outstripping their face value. Coins disappear from circulation and only paper money circulates. Finally, the currency collapses. Coins will begin to reappear once the monetary unit is restabilized, usually with the introduction of an entirely new currency and after much economic hardship for the people.

Read the rest here.

The bottom line is that governments around the world will continue with rampant policies of inflationism through their respective central banks. And given the metallic content of coins in circulation, coins will serve as insurance against devalued money and will be hoarded by the public as the symptoms of inflationism deepens.

I have noted of this Gresham’s Law on my earlier post.

Nevertheless here is the breakdown of the metallic content of Philippine coins in circulation.

From Wikipedia.org

Perhaps we should start to hoard coins too. Thanks for the reminder, Congressman Paul.

Thursday, March 29, 2012

US Treasury to Debase Coins

So policies of inflationism will not be restricted to the US Federal Reserve. The US Treasury as producer and minter of coins, proposes to join the FED by resorting to an age old trick of clipping or shaving the contents of the coin—or debasement—in the pretext of budgetary savings.

Here is the Wall Street Journal Blog (bold emphasis mine)

Geithner, in written testimony prepared for the House Committee on Appropriations, said a good portion of next year’s savings at Treasury will come from changing the composition of U.S. coins to more cost-effective materials.

“Currently, the costs of making the penny and the nickel are more than twice the face value of each of those coins,” Geithner said in his remarks.

The cost of making pennies and nickels are about twice the face value of the coins–2.4 cents for a penny and 11.2 cents for a nickel, the Treasury Department said earlier this month. Rising commodity prices have driven higher production costs. The Mint said it used 16,365 tons of copper, 2,311 tons of nickel and 11,844 tons of zinc to produce all coins in fiscal year 2011.

Changing the makeup of coins and improving the efficiency of currency production will save more than $75 million in the next fiscal year. In addition, the suspension of presidential dollar coin production, announced in December, will save another $50 million.

In reality, debasement is currency devaluation or inflationism, albeit in an archaic sense.

The great Professor Ludwig von Mises wrote (highlights mine)

Mintage has long been a prerogative of the rulers of the country. However, this government activity had originally no objective other than the stamping and certifying of weights and measures. The authority's stamp placed upon a piece of metal was supposed to certify its weight and fineness. When later princes resorted to substituting baser and cheaper metals for a part of the precious metals while retaining the customary face and name of the coins, they did it furtively and in full awareness of the fact that they were engaged in a fraudulent attempt to cheat the public. As soon as people found out these artifices, the debased coins were dealt with at a discount as against the old better ones. The governments reacted by resorting to compulsion and coercion. They made it illegal to discriminate in trade and in the settlement of deferred payments between "good" money and "bad" money and decreed maximum prices in terms of "bad" money. However, the result obtained was not that which the governments aimed at. Their decrees failed to stop the process which adjusted commodity prices (in terms of the debased currency) to the actual state of the money relation. Moreover, the effects appeared which Gresham's law describes.

Here is a visual of coins and currency in circulation in the US…

you can see the original graphics here, although the chart has been based on 2009 data.

My further comments:

Compared to the past where debasement of coins had been conducted surreptitiously by kings, the US Treasury like the Federal Reserve, has been, and will be doing this unreservedly.

As one would observe, whether the US Federal Reserve or the US Treasury, inflationism has been inherent to the actions of political agents

The public will hoard current coins which will spontaneously vanish from circulation as new debased coins will circulate. This is the Gresham’s Law at work.

As testament, hedge fund manager Kyle Bass has reportedly accumulated $1 million dollars worth of 20 million (5 cent coins) nickels.

More people will be looking for old coins as alternative path to preserve wealth. This comes amidst political actions to redistribute wealth for the benefit of politicians and at the expense of the public via rampant inflationism.

Saturday, September 24, 2011

War on Precious Metals: Has the Eurozone been Gradually Restricting Individual Gold Purchases?

Yes says Marc Slavo of SHTF Plan

A couple of weeks ago our report that some Austrian banks had begun restricting the sale of gold and silver to 15,000 Euro (~$20,000 USD) reportedly because of money laundering issues was met with disbelief by many readers of financial news and information web sites. As we mentioned in that commentary, it is our view that governments, namely in Western nations, are making it more difficult for individuals to make gold purchases, as well as to do so anonymously.

It looks like this trend of restricting the peoples’ ability to acquire assets of real monetary value is expanding. If a recent report from France is accurate, and based on the French governments official web site it looks like it is, then as of September 1, 2011, anyone attempting to sell or purchase ferrous or non-ferrous metals, which includes gold and silver, will be required to pay for their purchase via a credit card or bank wire transfer if it exceeds 450€ (~ $600 USD):

“Here is the applicable French law via www.legifrance.gouv.fr and translated into English by Google Translate:

“Article L112-6

Amended by Law n ° 2011-900 of July 29, 2011 – art. 51 (V)“I. Can be made in cash payment of a debt greater than an amount fixed by decree, taking into account the place of tax residence of the debtor and the professional purpose of the operation or not.

“In addition a monthly fixed by decree, the payment of salaries and wages is subject to the prohibition contained in the preceding paragraph and shall be made by check or by transfer to a bank or postal account or account held by a payment institution.

“Any transaction on the retail purchase of ferrous and non ferrous is made by crossed check, bank or postal transfer or by credit card, not the total amount of the transaction may not exceed a ceiling set by decree. Failure to comply with this requirement is punishable by a ticket for the fifth class.

“II.-I Notwithstanding, the costs of the department conceded that exceed the sum of 450 euros must be paid by bank transfer. (bold highlights original-Prudent Investor)

“III.-The preceding provisions shall not apply:

“a) For payments made by persons who are incapable of binding themselves by a check or other payment, as well as those who have no deposit account;

“b) For payments made between individuals not acting for business purposes;

“c) paying the expenses of the state and other public figures.

According to independent reports the law was passed to curb the illegal sale of stolen metals like copper, steel, etc. Given the rampant rise in thefts of these metals from telephone poles, construction sites and businesses here in the United States, we can certainly see this as a reasonable assessment for why the French passed this law.

When governments see their political privileges being eroded as a result of their own policies, the next set of actions would be to destroy any competitive threats on their monopoly franchise of money by restricting the ownership of metals.

I am reminded by the wisdom of the great F. A. Hayek who once wrote in Choice in Currency, (bold emphasis mine)

There could be no more effective check against the abuse of money by the government than if people were free to refuse any money they distrusted and to prefer money in which they had confidence. Nor could there be a stronger inducement to governments to ensure the stability of their money than the knowledge that, so long as they kept the supply below the demand for it, that demand would tend to grow. Therefore, let us deprive governments (or their monetary authorities) of all power to protect their money against competition: if they can no longer conceal that their money is becoming bad, they will have to restrict the issue…

…This was observed many times during the great inflations when even the most severe penalties threatened by governments could not prevent people from using other kinds of money; even commodities like cigarettes and bottles of brandy rather than the government money—which clearly meant that the good money was driving out the bad…

…But the malpractices of government would show themselves much more rapidly if prices rose only in terms of the money issued by it, and people would soon learn to hold the government responsible for the value of the money in which they were paid. Electronic calculators, which in seconds would give the equivalent of any price in any currency at the current rate, would soon be used everywhere. But, unless the national government all too badly mismanaged the currency it issued, it would probably be continued to be used in everyday retail transactions. What would be affected mostly would be not so much the use of money in daily payments as the willingness to hold different kinds of money. It would mainly be the tendency of all business and capital transactions rapidly to switch to a more reliable standard (and to base calculations and accounting on it) which would keep national monetary policy on the right path.

Legislative restrictions will not prevent people from switching to good money.

Monday, March 07, 2011

Will The US Bring Back The $1 Coin?

The US Congressional watchdog, the Government Accountability Office (GAO) says bringing back the $1 coin in replacement of the $1 note seems viable.

The GAO writes, (HT Mark Perry) [bold emphasis mine]

According to GAO’s analysis, replacing the $1 note with a $1 coin could save the government approximately $5.5 billion over 30 years. This would amount to an average yearly discounted net benefit—that is, the present value of future net benefits—of about $184 million. However, GAO’s analysis, which assumes a 4-year transition period beginning in 2011, indicates that the benefit would vary over the 30 years. As shown in the figure below, the government would incur a net loss in the first 4 years and then realize a net benefit in the remaining years. The early net loss is due in part to the up-front costs to the U.S. Mint of increasing its coin production during the transition. GAO’s current estimate is lower than its 2000 estimate, which indicated an annual net benefit to the government of $522 million. This is because some information has changed over time and GAO incorporated some different assumptions in its economic model. For example, the lifespan of the note has increased over the past decade, and GAO assumed a lower ratio of coins to notes needed for replacement. GAO has noted in past reports that efforts to increase the circulation and public acceptance of the $1 coin have not succeeded, in part, because the $1 note has remained in circulation. Other countries that have replaced a low-denomination note with a coin, such as Canada and the United Kingdom, stopped producing the note. Officials from both countries told GAO that this step was essential to the success of their transition and that, with no alternative to the note, public resistance dissipated within a few years.

My added comments:

-The previous unsuccessful efforts to replace notes because of simultaneous circulation of both notes and coins is a vivid example of Gresham’s Law at work.

Gresham's law, according to wikipedia.org, is an economic principle "which states that when government compulsorily overvalues one money and undervalues another, the undervalued money will leave the country or disappear into hoards, while the overvalued money will flood into circulation." It is commonly stated as: "Bad money drives out good", but is more accurately stated: "Bad money drives out good if their exchange rate is set by law."

In short, undervalued coins are hoarded and overvalued notes remain in circulation.

-We seem to be seeing more signs from the political authority to float trial balloons or ‘conditioning’ of the public of the possible return of the precious metals as part of the monetary system.

Add to the above a milestone, Utah recently passed in the House a bill recognizing gold and silver as a legal tender. (hat tip Mises Blog)