Volatility is king. Markets have been indifferent to claims that the latest broad sell-off of equities, lower quality corporate bonds, and certain emerging market currencies exaggerate any worsening of observable fundamentals. However, observable is the key adjective in the prior sentence. The two latest recessions were partly the consequence of markets not knowing the full extent of deteriorations in household and business credit quality. Not everything can be quantified, if only because some very critical things are hidden. Never underestimate the importance of thorough accounting. For now, it’s hard to imagine why the equity market will steady if the US high-yield bond spread remains wider than 800 bp. Taken together, the highest average EDF (expected default frequency) metric of US/Canadian non-investment-grade companies of the current recovery and its steepest three-month upturn since March 2009 favor an onerous high-yield bond spread of roughly 850 bp. Recently, the high-yield spread approximated 800 bp. (Figure 1.)A wider-than 800 bp high-yield spread reflects elevated risk aversion that will reduce capital formation and spending by non-investment-grade businesses. In addition, ultra-wide bond yield spreads favor a continuation of equity market volatility that should sap the confidence of businesses and consumers.M&A’s record pace may prompt more M&A-linked downgrades As derived from data supplied by Bloomberg, mergers and acquisitions (M&A) involving at least one US company soared higher by 19% annually to a new zenith of $3.336 trillion for yearlong 2015. A cresting by M&A may offer valuable insight regarding the state of the business cycle. The two previous yearlong peaks for US company M&A were set in Q3-2007 at $2.213 trillion and in Q1-2000 at $1.745 trillion. Recessions struck within one year of each of those peaks. Also, both previous peaks for M&A preceded a topping off of the quarter-long average for the market value of US common stock. (Figure 2.) For 2015, US-company M&A approximated 162.3% of pretax profits from current production and a record 18.6% of US GDP. The erstwhile record high ratio of M&A to GDP was the 17.8% of the year-ended Q1-2000. Year-end Q3-2000’s 215.1% still serves as the apex for the ratio of M&A to profits. During the early stages of an upturn by M&A, M&A-linked credit rating revisions show more upgrades than downgrades. For example, M&A-linked rating changes showed more upgrades than downgrades during 2010 through 2012, or after M&A activity had bottomed in 2009. However, M&A figured in more downgrades than upgrades once new record highs were set for M&A in 2000, 2007 and 2014. (Figure 3.)

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Wednesday, January 27, 2016

Moody's Warns on Rocketing US High Yield Spreads as Raising Risks of Recession

Friday, July 25, 2014

In Pictures: Global Financial Market Mania as Revealed by Record Credit, Volatility and Bank Asset Growth

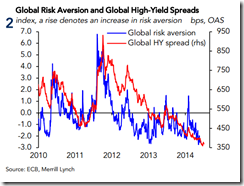

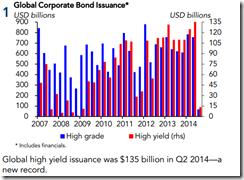

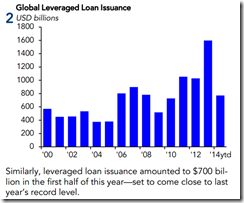

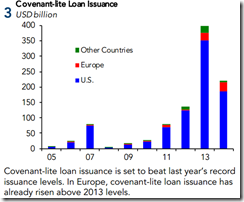

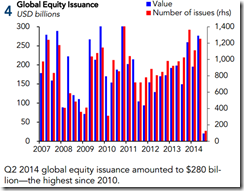

From all time high to record first half to unmatched highs…in almost all aspects of credit and credit related market activities as seen in global and US M&A, global corporate bonds, global junk bonds, US investment grade bonds, global and US IPOs and to corporate stock and equity linked securities… to record low volatility as measured by record low risk premium and volatility indices, haven’t these been signs of simmering instability waiting for the right opportunity to be ventilated???

Friday, November 21, 2008

The Curse of Deleveraging Haunts Warren Buffet’s Berkshire Hathaway

Warren Buffet’s flagship Berkshire Hathaway has been virtually whacked.

Hence some people have been asking, what’s wrong with Warren Buffett? Has the world’s best stock market investor lost his Midas touch?

Berkshire was down about 8% last night, and has been in a losing streak for 9 consecutive days. And is down by about 50% from the peak.

Courtesy of Bespoke Investments

Courtesy of Bespoke InvestmentsAccording to Bespoke Investments, ``While nine straight days of negative returns are not too rare for Berkshire (red dots in chart below), the magnitude of the drop is notable. Since November 7th, which was the last day Berkshire finished up on the day, the stock has declined by 29%. This is by far its largest percentage decline over a nine day period.”

So what’s been troubling Berkshire?

The most likely answer: the widening spreads of the company’s Credit Default Swaps.

According to Fool.com’s Alex Dumortier, ``The five-year credit-default-swap spread hit 440 basis points yesterday. That means the annual cost of insuring $10 million in Berkshire debt against default over five years is $440,000.”

In short, the cost of insuring Berkshire Hathaway’s debt has soared. The investing public has priced Berkshire’s credit risk as more than that of Republic of Columbia!

Why? According to many reports, the imputed reason for the surge in the spreads had been due to concerns about Berkshire’s exposure to derivatives. The credit swap market seems to imply that Berkshire is on the hook for some $37 billion, which could risk a credit rating downgrade from its “Triple A” status.

And such downgrade may translate to a call to raise collateral supply to counterparties and subsequently impose onerous demand to raise cash.

Nevertheless, Mr. Warren Buffett acknowledges this in his 2002 annual (emphasis mine),

``Another problem about derivatives is that they can exacerbate trouble that a corporation has run into for completely unrelated reasons. This pile-on effect occurs because many derivatives contracts require that a company suffering a credit downgrade immediately supply collateral to counterparties. Imagine, then, that a company is downgraded because of general adversity and that its derivatives instantly kick in with their requirement, imposing an unexpected and enormous demand for cash collateral on the company. The need to meet this demand can then throw the company into a liquidity crisis that may, in some cases, trigger still more downgrades. It all becomes a spiral that can lead to a corporate meltdown.”

He even discloses Berkshire’s derivatives risk in its 2007 annual report (emphasis mine),

``First, we have written 54 contracts that require us to make payments if certain bonds that are included in various high-yield indices default. These contracts expire at various times from 2009 to 2013. At yearend we had received $3.2 billion in premiums on these contracts; had paid $472 million in losses; and in the worst case (though it is extremely unlikely to occur) could be required to pay an additional $4.7 billion.

``The second category of contracts involves various put options we have sold on four stock indices (the S&P 500 plus three foreign indices). These puts had original terms of either 15 or 20 years and were struck at the market. We have received premiums of $4.5 billion, and we recorded a liability at yearend of $4.6 billion.

``The puts in these contracts are exercisable only at their expiration dates, which occur between 2019 and 2027, and Berkshire will then need to make a payment only if the index in question is quoted at a level below that existing on the day that the put was written.”

Following observations:

-Worst case scenario for the high yield index exposure will be a loss of $4.7 billion. Yet such losses if it were to materialize will arrive at different expiry dates somewhere between 2009 until 2013.

-Losses from put options sold on four stock indices can only be realized upon the expiration of contracts between 2019 and 2027.

To quote Stacy-Marie Ishmael in FT Alphaville, ``People are freaking out about BRK possibly having exposure of $37 billion, but this is the maximum payout if ALL FOUR major world indices were at ZERO 14-19 years from now!”

-Proceeds from sales of put options are at $4.5 billion. If Mr. Buffett manages to make 7% over the same period this would amount to $17.4 billion or nearly half of the assumed worst case scenario.

-Berkshire still has more than $33 billion in cash which if gradually invested in the present environment should, in the words of Dr. John Hussman, “be associated with extremely high subsequent returns.”

-In addition, when does having a substantial cash position become a liability under the present "debt deflation" environment?

-Of course, all these assume that we are looking at the same risk factors as those who are pricing in a credit downgrade.

Moreover, there is the danger of a self fulfilling prophecy which given the extent of the debt unwind, could lead to a reflexive self feeding action: market outcome influencing fundamentals.

All these add up to only one thing, extreme fear associated with the tidal wave of deleveraging.

As I wrote to a client, ``The seemingly insuperable force of deleveraging is simply looking for any standing issues to bring to its knees. And for securities included in markets that have been globally intertwined, there is no escaping its fury. Whether it is stocks, bonds, emerging markets, commodities, currencies, in the face of debt deflation [Harry] Markowitz's Nobel prize from his portfolio diversification or the Modern Portfolio theory seems non-existent, if not a flawed theory.”

So Mr. Buffett looks more likely a victim of contagion, than from a loss of his magical aura.