One observation I recently received concerned about how US Federal Reserve policies allegedly produced an “immediate inflation” in the 1970s (via stagflation) while today’s massive over $4 trillion of balance sheet expansion as of December 2013 hasn’t produced the same effect.

Well inflation don’t just appear, like a genie, from nowhere. Inflation is a process.

This applies as well to during the 1960s to 1980s

In 1944, the Bretton Woods system fixed exchange rates based on the U.S. dollar, which was redeemable for gold by the U.S. government at the price of $35 per ounce. Thus, the United States was committed to backing every dollar overseas with gold. Other currencies were fixed to the dollar, and the dollar was pegged to gold.

For the first years after World War II, the Bretton Woods system worked well. With the Marshall Plan Japan and Europe were rebuilding from the war, and foreigners wanted dollars to spend on American goods – cars, steel, machinery, etc. Because the U.S. owned over half the world's official gold reserves – 574 million ounces at the end of World War II – the system appeared secure.

However, from 1950 to 1969, as Germany and Japan recovered, the US share of the world's economic output dropped significantly, from 35 percent to 27 percent. Furthermore, a negative balance of payments, growing public debt incurred by the Vietnam War and Great Society programs, and monetary inflation by the Federal Reserve caused the dollar to become increasingly overvalued in the 1960s. The drain on US gold reserves culminated with the London Gold Pool collapse in March 1968.

By 1971, America's gold stock had fallen to $10 billion, half its 1960 level. Foreign banks held many more dollars than the U.S. held gold, leaving the U.S. vulnerable to a run on its gold.

By 1971, the money supply had increased by 10%. In May 1971, West Germany was the first to leave the Bretton Woods system, unwilling to devalue the Deutsche Mark in order to prop up the dollar. In the following three months, this move strengthened its economy. Simultaneously, the dollar dropped 7.5% against the Deutsche Mark. Other nations began to demand redemption of their dollars for gold. Switzerland redeemed $50 million in July. France acquired $191 million in gold. On August 5, 1971, the United States Congress released a report recommending devaluation of the dollar, in an effort to protect the dollar against "foreign price-gougers". On August 9, 1971, as the dollar dropped in value against European currencies, Switzerland left the Bretton Woods system. The pressure began to intensify on the United States to leave Bretton Woods.

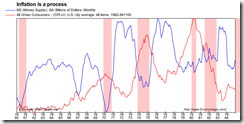

The above chart from economagic reveals that price inflation didn’t just “appear”.

The US government had already indulged in monetary inflation as far back in the advent of the 1960s (as seen via M2 blue line). Meanwhile price inflation (CPI red line) began its upward trek only 5 years after. (both are measured via % change from a year ago).

When the Bretton Woods era came to a close, US M2 soared in two occasions. This led to accompanying spikes in CPI which resulted to ‘stagflationary’ recessions.

The point is inflation is a process which undergoes different stages

The first stage of inflation is when housewives say: "Prices are going up. I think I had better put off buying whatever I can. I need a new vacuum cleaner, but with prices going up, I'll wait until they come down." During this stage, prices do not rise as fast as the quantity of money is being increased. This period in the great German inflation lasted nine years, from the outbreak of war in 1914 until the summer of 1923.

During the second period of inflation, housewives say: "I shall need a vacuum cleaner next year. Prices are going up. I had better get it now before prices go any higher." During this stage, prices rise at a faster rate than the quantity of money is being increased. In Germany this period lasted a couple of months.

If the inflation is not stopped, the third stage follows. In this third stage, housewives say: "I don't like flowers. They bother me. They are a nuisance. But I would rather have even this pot of flowers than hold on to this money a moment longer." People then exchange their money for anything they can get. This period may last from 24 hours to 48 hours.

From the US ‘stagflationary’ experience, market developments combined with policy actions prevented the third stage (crack-up) boom from transpiring. But the policy tradeoff had been to induce harrowing periods of recessions.

Some notes:

-The foundation of the stagflation era of 1970s went as far back to the inflationary policies by the Fed during the early 1960s. The sustained inflationist policies eventually led to consumer price inflation.

-US inflationist policies largely due to the Vietnam war and US welfare (New Society) programs put an end to the Bretton Woods Standards.

-Recessions are necessary to reverse previous monetary abuse. The Bust serve as necessary medicine and therapy for the inflationary boom ailment.

There are also other factors that influence price inflation. For one, productivity growth from globalization helped reduced the impact of US Federal Reserve policies in the post Volcker era. This has been wrongly construed as the Great Moderation.

The massive explosion in the growth of the asset markets supported by debt that have also been instrumental in shifting the nature of the impact of inflation since a lot of monetary inflation today have been absorbed by asset markets (trillion dollar derivatives, bond markets, currency markets, etc...).

Bottom line: Just because statistical consumer price inflation seem subdued today, doesn’t mean there won’t be price inflation tomorrow or sometime in the future.

And in my view, the highly volatile financial markets today are symptoms such transition, but in a different light: asset inflation boom morphing into asset bust.

The next question is how will central bankers and the government react? Will their response lead to a crack-up boom (ruination of a currency via hyperinflation) or deflationary depression? I call this the von Mises Moment