People like to assume that we are voting on issues. The media hector politicians to “stick to the issues.” We are supposed to do our civic duty and bone up on the “issues.” But when you get to the voting booth, there are no issues on the ballot on the federal level. There are only people’s names. That’s what we are voting for: person x or person y. All the rest is guesswork based on fleeting, gassy words in the air. All the talk about issues only distracts from this devastating reality that no one has a clue what this or that elected official is going to do in reality. Jeffrey A. Tucker

History has been etched on the stone. The US will endure four more years under Barack Obama.

So whether Obama or Romney, there will unlikely be any radical changes in the political structure to headoff the looming debt crisis.

This goes to show that elections have mainly been used to justify policies which benefit many entrenched power blocs operating behind the scenes.

Given the above conditions, the pricing dynamics of the markets will, thus, represent expectations from the feedback loop mechanism between policies and market responses to them.

President Obama’s Regime Uncertainty Factor

Optimism exuded by the mainstream media on the US electorate’s decision to award another term for President Obama does not seem to be shared by the US and global equity markets.

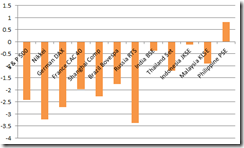

This week, developed market economies suffered heavy losses which rippled through the world. Except for the Philippines, ASEAN contemporaries had also been marginally affected by the selloff.

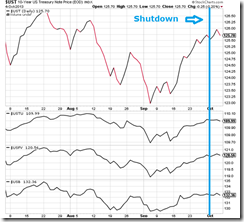

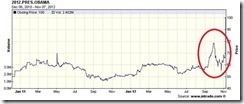

From the big picture, one can observe that this week’s hefty losses by the S&P 500 represents a two-month old downtrend (vertical blue trend line).

As of Friday’s close, the S&P 500 have fallen by 5.8% from its peak in September 14th, incidentally a day after US Federal Reserve chairman Ben Bernanke announced QE 3.0[2] or QE forever.

In total, nearly 42% of the overall decline—from September 14th until Friday—came from this week.

Some claim that Obama’s victory barely played a role in the current correction phase. For me, this seems foolhardy and politically bigoted. That’s because Obama’s lead in the prediction markets as shown by Intrade.com[3] culminated in mid-September (red ellipse). Again this coincides with the unlimited QE announcement from Ben Bernanke, giving more credence to my thesis that Mr. Bernanke’s policies had partly been designed to improve on or advance the chances of Mr. Obama’s electoral victory from which Bernanke’s career has been tied to[4].

Moreover as I recently pointed out a significant jump in terms of defense (13%) and all levels of government—federal, state and local—spending (3.7%) which accrued to an increase in the real federal spending (9.6%) over the past quarter[5] also bolstered US statistical economic growth which appears to have been part of the Obama’s electoral strategy.

As I also wrote last week

In a close battle, the incumbent have the edge. This is because they hold the political machinery which can be used to their advantage through whatever means

While I earlier stated that the current correction phase may have mostly been a “buy on rumor, sell on news dynamic”[6], there seems to be increasing evidences where political risks or regime uncertainty from Obama’s post re-election policies may have become a significant factor which has contributed to the current sluggishness in US equities.

I may further add that instead of a generalized Risk Off environment, or a broad selloff in risk assets, global financial markets have exhibited some signs of diversified actions but not meaningful enough to draw conspicuous divergences.

For instance, gold prices recently bounced off strongly on Obama’s re-election (see window below S&P 500). This implies of an extension of Bernanke’s credit easing policies. Although gold’s sharp rebound has hardly been reflected on the movements of the overall commodity markets (see CRB window).

The jury is out whether gold’s bounce will be sustained and which may spearhead and be accompanied by a general rally in prices of commodities, or if the financial market selloffs will broaden and accelerate to pose as hurdle or become a drag to gold’s recent rebound.

The important thing to point out is that the S&P 500, global equity markets (see MSWORLD on third window), gold and commodities prices have floated or sank based almost in tandem over the past year.

This exhibits high correlationship among risk assets. While the statistical correlations may vary among asset markets, tight correlations of trend undulations reveals of the risk ON (asset inflation) or risk OFF (asset deflation) nature of the current markets.

Besides, the S&P 500 moves almost uniformly along with gold relative to the volatility (fear) index seen in both new (VIX) and old (VXO) measurements over the past 3 years.

Rising gold over volatility conformed with higher S&P and vice versa.

Thus any deeply held idea that gold is about or represents as hedge against “fear” has largely been unfounded. Rather, gold has been a hedge against inflationism or currency debasement policies.

Greed and fear alone are symptoms and not sufficient forces enough to drive gold and stock market prices. Instead, emotional excesses account for as volatility from policy induced boom bust cycles

This means that an environment of rising prices gold and commodities amidst falling stock markets suggests of a transition towards stagflation.

Last week’s selloff has hardly shown any significant moves toward such direction, yet.

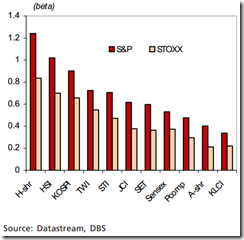

I would further input that it may be a mistake to interpret relative low statistical correlations by ASEAN markets[7] relative to developed economies as indicative of a “decoupling” landscape.

Statistical relationships can change overnight depending on how markets move. There is nothing constant except change in the marketplace.

This means that ASEAN outperformance may likely remain for as long as the US does not fall into a recession

But it would be a different story when a full blown US recession is in motion, and of course, the reactions of policymakers, particularly the central bankers, will matter under such setting.

Given the uncharted territory which current markets operate, assumptions based on past episodes could prove to be dicey.

The Fiscal Cliff’s Influence on the Recent US Equity Market Selloff

Going back to the global market’s selloff on anxiety over Obama’s policies.

Media has put a spotlight on newly re-elected President Obama to resolve the stalemate over the so-called fiscal cliff[8].

Markets supposedly disdain uncertainty. However the deepening and intensifying politicization of the financial markets imply of more uncertainties as people’s incentives have been skewered or redirected from consumer desires, which almost always goes in conflict with, the pronounced or latent objectives of political agents.

For instance, instead of locking money through interest rate dividends from savings account in the financial institutions, zero bound regime or negative real rates which are part of financial repression have been forcing people to chase on yields and gamble in order to generate returns. So the public have become more of a “risk taker” and take on “greedy” activities in response to such policies. Some would even fall or become victims to Ponzi schemes which I expect to mushroom.

Yet it is mostly the individual’s behavior rather than the cause—the policies that encourage such behavioral deviances—which mainstream media and politicians focuses on.

Recently many blamed the recent market carnage on political gridlock. Where political risks is concerned, I think that the prospects of more regulatory and policy obstacles or regime uncertainty, and perhaps an arbitrage on prospective policy transitions have been the culprit.

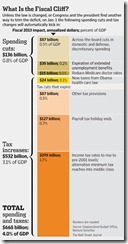

Unless there will be an agreement reached by the bi-partisan controlled legislative branches, the fiscal cliff[9] means the end of the Bush tax cuts, which translates to tax increases to the tune of $532 billion, as against automatic sequestration or spending cuts to the tune of $136 billion[10] under Budget Control Act of 2011.

Note that the balance of spending cuts (.8% of GDP) and tax increases (3.1% of GDP) has been tilted in favor of tax increases.

Nonetheless any deal reached by the two houses of Congress will likely be cosmetically in favor of increasing taxes, as against farcical spending cuts where the latter will likely be premised on growth rates rather than real cuts.

Also, spending cuts on defense will likely be subject to US foreign military engagements. A new war may disable such provisions.

According to New York University Economics Professor Mario Rizzo[11],

There will probably be defense cuts for now. But should the US encounter “unexpected” expenses, including any new war, they will be quickly eliminated. Unexpected events that increase the defense budget will definitely occur. The only thing that is uncertain is the precise events that will arise.

So spending cuts may not hold for long.

Importantly, while there is little to expect from legislation which may arise from the current politically deadlocked setting, most of the damage to US businesses will likely emanate from executive orders or regulations particularly centered on (as per University of Chicago Professor John H Cochrane[12]):

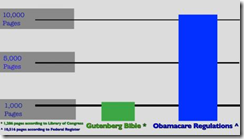

-Obamacare. Affordable Care Act regulations should include the expansion of Medicaid, health insurance “exchanges”, mandate to buy insurance, the ban on discriminatory charges on preexisting conditions and “accountable care organizations”.

-Dodd-Frank. Financial regulations will cover the expiration date for CEA exemption for swaps, broadened leverage and risk based capital requirements, FDIC Investment grade definition, Final rule OCC credit rating alternatives, Joint final rule Market risk capital, OCC lending limit rule compliance, Supervision of consumer debt collectors, Incorporating swaps, Clearing agency standards and more…

-US Environmental Protection Agency EPA regulations may cover tighter fracking regulations, much higher ozone standards, Cut sulfur in gas from 30 ppm to 10 ppm EPA: $90 billion a year, Temperature standards to protect fish in powerplant cooling ponds, tighter standards for farm dust, farms have to submit mediation plans, Water quality control for every body of water in the country, strict regulation of industrial boilers ($10-20 billion) formaldehyde emissions from plywood and more.

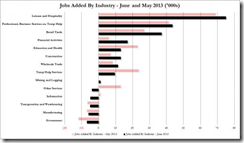

The recent bludgeoning of Utility stocks, which suffered most this week[13], can be traced to forthcoming environmental regulations from the Obama regime.

For instance tighter regulatory limits on mercury, sulphur dioxide and other pollutants may be used against the coal industry[14] as part of President Obama’s campaign to promote his beloved renewable energy sector which has been heavily subsidized by US taxpayers[15].

Tax increases on dividends could have also been a factor.

Writes Growth Stock Wire’s Small Stock Specialist editor Frank Curzio[16] (italics original)

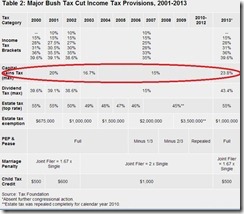

Today, the tax rate on dividend income is 15%. If this expires, the tax rate on dividends would jump to 39.6%. That would significantly reduce the rate of return on dividend-paying stocks like utilities….

…But we're talking about a potential 25% tax hike on dividends. We've never seen anything like this before.

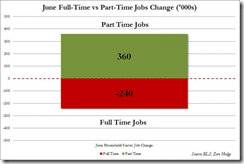

Current market pressures may have also been from policy arbitrage

Market participants expecting the fiscal cliff could be selling to take advantage of the transitions from the current to next year’s tax regime.

The end of the Bush tax cuts would mean a reversion of capital gains taxes to 20% from 15%. Adding the PPACA Obamacare provisions, capital gains will increase by 3.8% on high income individuals which should take effect in 2013, according to Tax Foundation.org[17]

As a tax analyst recently recommended[18]

If a taxpayer owns appreciated stock outright –– not through a tax-deferred retirement account –– that the individual has owned for more than a year and wants to lock in the 0 percent to 15 percent tax rate on the gain, but thinks the stock still has plenty of room to grow, he or she should consider selling the stock and then repurchasing it

So yes, material changes in the Obama’s largely anti-business regime have had material influences to the current pressures experienced by the US markets.

While the odds may seem small for a recession to occur, this cannot be discounted. The distortionary effects from the transition to a heavily regulated, compounded by higher tax environment, may become strong and self-fulling enough to heighten the risk premium and the hurdle rates to dissuade investment spending, as well as, to dampen the market’s favorite “animal spirits”.

Of course, given the increased political risks, President Obama seems to be relying more on the US Federal Reserve’s Ben Bernanke to do the economic weightlifting (well, in terms statistical figures).

There have been more chatters, possibly as part of policy signaling channel by the FED, of expanding unlimited QE 3.0 from $600 billion now to $ 1 trillion[19]. Federal Reserve Bank of St. Louis President James Bullard has even floated on the possibility of the replacement of Operation Twist with an expanded QE 3.0[20]. I have been saying that the FED-ECB program will reach $2 trillion or more.

So President Obama’s proposed solutions to the nation’s economic predicament will be to continue with trillion dollar annual deficits through more government spending (but perhaps at a slightly reduced growth rate), which will likely be financed by more debt and by the US Federal Reserve’s monetization of such debts.

At same time, President Obama plans to strangle businesses with supposedly ‘class warfare’ policies of higher taxes—which in reality will cover even taxpayers of the middle class—and promote cronyism with a maze of EO’s and regulations. So appeasing the political class to generate more hiring opportunities should mean hiring more lobbyists and lawyers.

President Obama surely knows how to kill the goose that lays the golden egg.

It’s only in politics where bad or mediocre performance gets rewarded. That’s relative to the perceived worst option: the political opposition.

Perhaps increased searches for a second passport[21] have not only been a US dynamic but also in the Eurozone where more people could be looking at the exit or migration option or Tiebout Model[22] given the growing etatism (socialism and interventionism) practised by these economies.

What the US Fiscal Cliff Means to the Phisix

What has all these to do with Philippine stocks?

One, the prices of my neighborhood sari sari retail store’s San Miguel Beer Pale Pilsen have increased from 21 pesos (USD 51 cents at 41) per bottle to 23 pesos (USD .56 cents) or a 9.5% beer price inflation. This has not merely been due to sin taxes but through negative real rates regime as food prices and gasul, in the sphere of my operations have sizably risen.

The idea that domestic price inflation has been contained through supposed “good governance” has been arrant political canard[23] and represents statistical manipulation which eventually will lead to Argentina like political protests[24] overtime.

Yet there will be more pressure from domestic stock market participants to chase prices out of the growing evidence of the inflation tax from the Bangko Sentral ng Pilipinas’ (BSP) negative real rates regime. This means we should expect more bubble movements of specific issues within the Philippine Stock Exchange, many of which will be blamed on “manipulation”.

Nonetheless price inflation pressures will become more evident in 2013 and all the blarney about the “Asian Tiger” will be exposed as nothing more than a credit driven bubble.

I am not suggesting of a bear market, although stocks will likely come under pressure from tightening conditions. I am saying that we should expect price inflation to transform into street rallies and a drop in approval ratings.

Two, for as long as the selloff in US stocks moderates and in the condition that US will not fall into a recession, the year-end rally for ASEAN and the Phisix markets should continue.

However if the selling pressure does not abate, and if the risk of a US recession gets amplified, then these will eventually be transmitted to the Phisix and to the ASEAN markets. And all the low correlations will likely be transformed into high correlations similar to 2008.

Three, watch the actions of FED which will increasingly become President Obama’s major instrument for obtaining statistical economic growth, as well as, the actions of the Fed’s major collaborator, the ECB. Both of whom will likely aggressively employ balance sheet expansions that may get reflected on gold and other commodity prices.

The Phisix has vastly outpaced gold in terms of returns over the past year (lower window PSEC/Gold where rising trend means PSE outperforming gold in nominal terms). Year-to-date, nominal returns exhibit that gold has been up by only 10.49% while the Phisix has been up by a robust 25.09%. Since the Peso have risen by 6% against the USD, the equivalent US dollar returns on the Phisix translates to over 31%

Nevertheless gold and Phisix have shown some important correlations. A fall in gold prices eventually meant a similar fall in the Phisix, although the timing has not been synchronous. Yet under consolidation or on a rally mode gold prices have shown the Phisix the path higher although at a faster pace.

This demonstrates of the RISK ON or OFF environment where both gold and the Phisix operates.

Should gold breach above the 50-day moving averages, and backed by a rebound in other commodity prices, the Phisix should follow suit.

As usual, heightened volatility remains the order of politicized markets. So do expect sharp swings on both directions with an upside bias strictly based on the abovementioned conditions.

[17] Tax Foundation.org The Fiscal Cliff: A Primer, November 8, 2012. The tax on long-term capital gains would rise from a maximum of 15 percent to a maximum of 20 percent. Additionally, a 3.8 percent capital gains tax on high-income individuals, enacted as part of PPACA (Obamacare), takes effect in 2013. The top capital gains tax rate would thus be 23.8 percent (20 percent plus 3.8 percent). President Obama’s budgets have recommended retaining the 15 percent preferential rate for taxpayers whose income is below $200,000 ($250,000 for couples).