Central bankers around the world have been resorting to crisis resolution measures of aggressively slashing rates (and other easing measures)…

Last night Russia announced a 100 basis point cut

From Bloomberg: (bold mine)

Russia’s central bank lowered its main interest rate and signaled more policy easing ahead if inflation continues to ease as the economy buckles under low oil prices and sanctions over Ukraine.The one-week auction rate was cut by one percentage point to 14 percent, the central bank said in a statement on its website Friday. Seventeen of 32 economists in a Bloomberg survey predicted the move, with nine seeing no change and five forecasting a bigger reduction. Another analyst predicted a half-point cut.The Bank of Russia is pressing ahead with monetary easing after a surprise 2 percentage-point cut at its January meeting as weekly inflation decelerated. Even with price growth more than fourfold its mid-term target, the regulator is responding to calls from business to unwind December’s emergency increase to 17 percent to buoy an economy entering its first recession in six years.

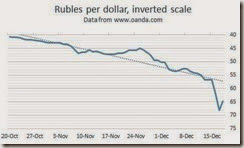

The first and second rate cut follows an earlier emergency rate hike last December intended to stanch capital flight out that has battered her currency the ruble. (chart from tradingeconomics.com)

The December sell-off or the ruble, see USD-RUB (from Google Finance) has apparently been in a hiatus.

As I explained here and here, despite relatively lower levels compared to developed economy contemporaries, Russia has her own debt problems. And thus the central bank’s response “to calls from business to unwind December’s emergency increase” via rate cuts.

The problem has been that those rate cuts (with more to come) are likely to rekindle a weaker ruble and place the Russian economy in a indeterminate juncture.

Now Serbia's version. From another Bloomberg report: (bold mine)

Serbia’s central bank cut its benchmark interest rate for the first time since November as it fights a recession and the threat of deflation amid the government’s effort to tame the budget deficit.The National Bank of Serbia lowered its one-week repurchase rate by half a point to 7.5 percent, it said in a statement on its website. Six of 23 economists surveyed by Bloomberg predicted a quarter-point reduction, eight forecast a half-point cut and nine expected no change.Policy makers reduced the cost of borrowing amid “increased global liquidity as a result of the ECB’s quantitative easing” program, the bank said in a statement on its website. They also took into consideration “fiscal consolidation measures and structural reforms, as well as the conclusion of the International Monetary Fund program.”With one of the highest benchmark rates in emerging Europe, Serbia’s central bank is caught between trying to help the economy emerge from its third recession since 2009 while also shoring up the dinar, which fell after the bank’s November move. Last week, non-executive central bank Chairman Nebojsa Savic said policy makers should hold rates at least until May, when the International Monetary Fund arrives to review Serbia’s compliance with conditions of a stand-by loan.

The following charts help explain the decision

Consumer credit has been exploding…

Meanwhile the spendthrift government has widened the fiscal deficit

And such reckless government spending financed by debt has helped increased the debt burden of the nation

Add to this the chronic deficit in her current account which means Serbia has been consuming more than producing

Unfortunately all those debt financed consumption spending has weighed on her annual gdp where Serbia’s economy has been mired in a twin recession of 2012 and 2014 (third or triple dip if to consider 2009)

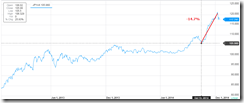

Serbia’s stock market appears to ignore the 2014 recession because they have been in an uptrend since 2012

Yet part of the debt financing of consumption has been through external channels which has spiked over the past few years…

The problem with toying with money and credit is that there will be an outlet where accrued imbalances will be vented. And thus far this has been through a crashing currency the Serbian dinar via Google Finance USD-RSD.

And while rate cuts may temporarily ease the burden of domestic debt, this will likely put pressure on the dinar which will amplify pressures on her external liabilities.

So when media reports that Serbia has been "caught between trying to help the economy emerge from its third recession since 2009 while also shoring up the dinar"...this really is a symptom of a debt trap.

Debt is no free lunch.

As for why I believe central banks will be cutting rates I previously explained here.

This marks the 24th rate cuts by global central banks according to CBRates.com. 11 last January, 7 in February and 6 for March with more to come. The tally reflects only on official rate cuts and not other easing measures applied.

Record stocks in the face of record imbalances at the precipice.

.bmp)