In the recent G-20 meeting, deposit confiscation (bailIns) had been included as part of the multipartite political agenda. Yet unknown to most, this serves as handwriting to the wall for the formal banking system.

In short, the formalization of the G20 accord on the downgrade of bank deposits implies, the greater risks of bank runs. Yet the institutionalization of bail INs will not likely to be limited to G20s but should spread even on Emerging-Frontier markets.

Governments around the world have been in a state of panic. They are desperately manipulating stock markets in the hope that these may produce “wealth effect”, a miracle intended to save their skin or the status quo (the welfare-warfare, banking system and central bank troika), as well as, camouflage current economic weakness and or kick the debt time bomb down the road.

Yet the same political institutions recognize that inflating stocks are unsustainable. So during this current low volatile tranquil phase, they have been implementing foundations for massive wealth confiscation.

What better way to confiscate than do it directly. Yet the more the confiscations, the greater risks of runs on banks and on money.

Several months ago, the government of Australia proposed to tax bank deposits up to $250,000 at a rate of 0.05% (5 basis points).

Their idea was for the money to be invested in a rainy day Financial Stabilization Fund to insure against in the unlikely event of a banking crisis… or all-out collapse.

And as of this morning, it looks like the levy might just pass and become law in Australia. All parties support the idea. Which means that Australia might just have a tax on bank deposits starting January 1, 2016.

To be clear, the proposal seems to plan on taxing the banks based on the amount of deposits they’re holding—but it’s pretty obvious this will be passed on to consumers in the form of lower interest rates.

Let’s look at what this means:

1. Taxes on bank deposits are generally the same as negative interest rates. Australia is a rare exception.

Interest rates on bank deposits in most developed nations are practically zero… if not already negative.

So charging a tax above and beyond this would clearly push rates (further) into negative territory.

I have, for example, a small bank account in the United States that pays me about .03% interest (three basis points). If the government imposes a tax of 5bp on interest of 3bp, I’m left with negative interest.

Australia (along with New Zealand) is a rare exception since interest rates are actually positive. You can get 2-3% on a savings account. So a 5bp tax still results in positive interest.

2. Taxes always start small… then increase over time.

Of course, the proposal on the table right now is a 5bp tax. There’s nothing that says this can’t increase to 50bp over time.

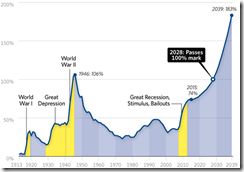

When the United States government first imposed the modern federal income tax a century ago, the top tax rate was just 7%. These days that would qualify the US as a tax haven.

Over time, tax rates rose to as high as 92%. Tax rates can (and do) rise. And once they’re passed, they’re almost never abolished.

3. Taxes are rarely used for their stated purpose

Politicians create and raise taxes all the time for special purposes. And again, over time, they are often diverted away from those purposes.

In 1936 after a devastating flood in Johnstown, Pennsylvania, the state government passed a ‘temporary’ 10% tax on all alcohol sold in the state in order to help pay for disaster relief.

Six years later the work was complete. But the tax is still on the books (now at 18%), with all the revenue going to whatever the state lawmakers want to blow it on.

FICA is another great example. Though payroll taxes in the US were initially established to fund Social Security and Medicare, the federal government steals this revenue every year to haplessly try and plug budget deficits.

So a tax to build a financial stabilization fund might sound comforting in theory… but will all the revenue actually be allocated for that purpose? Doubtful.

4. If this can happen in Australia, is anyone foolish enough to think it can’t happen in the US or Europe?

Australia has a sound and sturdy banking system.

Banks in Australia are actually, you know, solvent. Capital ratios and liquidity rates are solid. Australia’s is a well-capitalized banking system—far more than in the US and Europe.

The numbers tell a very clear story. Banking systems across Europe in particular have had to be routinely bailed out over the past few years—Slovenia, Spain, Greece, Cyprus, etc.

In the United States it is perhaps even more absurd. Based on their own numbers, US banks are highly illiquid, still gambling away customer funds in trendy investment fads that will likely suffer an epic meltdown.

Backing up this little scam is the FDIC, which itself is pitifully undercapitalized to support any significant problem in the banking system.

Backing up the FDIC is the US federal government, which is already drowning in more than $60 trillion in liabilities (based on the most recent GAO report).

And supplying crack to the crack head is the US Federal Reserve, America’s central bank.

With net capital just 1.26% of total assets, the Fed is so pitifully capitalized they make Lehman Brothers look like Berkshire Hathaway.

So if the government of Australia is concerned that their well-capitalized banking system needs a safety net and wants to tax deposits for such purpose, how in the world can we possibly expect the US and Europe, with all of their banking system risk, won’t do the same?

One thing leads to another.

When the next global crisis appears (very soon), domestic currency confiscation will likely spread to foreign currency deposits. The buck won’t stop here. As part of the manifold means to capture resources, capital controls will be imposed, trade controls, price and wage controls will most likely be also implemented.

Government’s use of monetary inflation or the inflation tax will intensify.

Proof? In Ireland, Irish politicians has proposed of the nationalization of money creation. They want to bar banks of this role and shift money creation to solely the domain of the central bank

Iceland's government is considering a revolutionary monetary proposal - removing the power of commercial banks to create money and handing it to the central bank.

The proposal, which would be a turnaround in the history of modern finance, was part of a report written by a lawmaker from the ruling centrist Progress Party, Frosti Sigurjonsson, entitled "A better monetary system for Iceland".

"The findings will be an important contribution to the upcoming discussion, here and elsewhere, on money creation and monetary policy," Prime Minister Sigmundur David Gunnlaugsson said.

The report, commissioned by the premier, is aimed at putting an end to a monetary system in place through a slew of financial crises, including the latest one in 2008.

According to a study by four central bankers, the country has had "over 20 instances of financial crises of different types" since 1875, with "six serious multiple financial crisis episodes occurring every 15 years on average".

Mr Sigurjonsson said the problem each time arose from ballooning credit during a strong economic cycle.

So instead of dealing with the incentives that whets on the appetite of the banking system to expand credit, politicians see knee jerk reactions as solutions.

Yet by monopolizing credit allocation, this will lead to even more politicization of distribution of credit. And because governments via central bank will pander to populist short term oriented political agenda, this heightens the risks of, or eventually paves way to, hyperinflation.

Going back to negative rates, yet the opportunity cost of negative rates will be the cost of storage of currency/banknotes. This means that if negative rates will go deeper, at a certain point, people will look at cash/banknotes (in safety boxes? or in pillow mattresses?) as a more feasible alternative to bank deposits.

So the likely unintended consequence will be intensified “debt deflation” as more people horde cash. And instead of global economies experiencing a renaissance, the opposite will occur, capital consumption will intensify, thus economies will falter if not collapse, thereby leading to massive debt defaults.

Stashing cash may increase security risks as robbery and theft. This will raise the cost of holding cash. So the public will be immersed in a conundrum: the devil or the deep blue sea; Submit to government confiscation or to heightened security risks of holding cash. This points at how inflationism destabilizes society

Although, some entrepreneurs may see this as commercial opportunities. They may offer large scale storage/safety box facilities with stringent security. I am hopeful that there will be private sector alternatives even if it means black market substitutes.

But governments will always attempt to employ a dragnet on the resources of her constituency by imposing controls. Example, the French government has been en route to outlaw or impose increase restrictions on cash holdings.

From Reuters: From September onwards, people who live in France will not be allowed to make payments of more than 1,000 euros ($1,060) in cash, down from 3,000 now. The cap for foreign visitors, left higher for reasons that include facilitating tourism, will be cut to 10,000 euros from 15,000.

So while stock markets have been running records, behind the scenes, perhaps in anticipation of violent adjustments from the current unsustainable arrangements, governments have been working 24/7 on the legal, political, technical platforms towards direct confiscation of people’s resources.