The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Sunday, August 12, 2018

Will Turkey’s Unfolding Currency Crisis Signify as the Periphery to the Core Transmission?

Monday, February 03, 2014

Emerging Market Turmoil: The Fallacy of Foreign Currency Reserves as Talisman

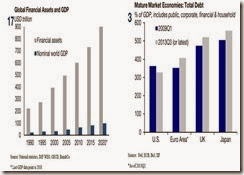

The expansion of debt by the issuer of the international reserve medium augments the stock of international reserves and the increase of the reserves works like a growth of the global money supply. Central bank balance sheets show that the circulating domestic money forms a debit item, while foreign reserves are part of the credit side. All other things being equal, an increase in foreign reserves implies money creation. This way, foreign debt accumulation by the issuer of a global reserve currency impacts monetary demand through two channels: in the debtor country by the domestic spending of foreign savings, and in the creditor country by the accumulation of foreign exchange reserves which augment the money supply

The country, which emits the international reserve currency, does not face a foreign exchange constraint; thus there will be no immediate limit for this process to go to its extremes. Additionally, an expansion of this kind must not be accompanied by price inflation right away. The prices for tradable goods may stay low for a considerable period of time and instead of a price inflation the bubble emerges in the asset markets. After all it is the transaction in the capital account of the balance of payments -- the buying and selling of debt instruments -- which lies at the heart of the process and it is here where the music plays in terms of the bubble. Bubbles, however, have the nasty habit of imploding because they are build on some unsustainable element. This factor within an international debt cycle concerns debt service payments, and this has consequences for international trade and economic growth

Wednesday, January 29, 2014

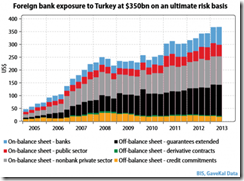

Turkey’s Central Banks Surprises With Huge Interest Rate Increases

Turkey’s central bank raised all its main interest rates at an emergency meeting, resisting political pressure and reversing years of policy, after the lira slid to a record low.The bank in Ankara raised the benchmark one-week repo rate to 10 percent from 4.5 percent, according to a statement posted on its website at midnight. It also raised the overnight lending rate to 12 percent from 7.75 percent, and the overnight borrowing rate to 8 percent from 3.5 percent. The lira extended gains after the announcement, adding 3 percent to 2.18 per dollar at 1 a.m. in Istanbul.

Wednesday, December 26, 2012

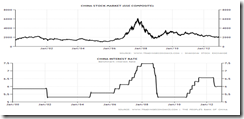

Charts: Stock Market Boom Bust Cycles and Interest Rates

[Note: I excluded Venezuela's case since her stock market's nearly 300% gains appear as part of the symptoms of a brewing hyperinflation]

But increases in the quantity of money and fiduciary media will not enrich the world or build up what destructionism has torn down. Expansion of credit does lead to a boom at first, it is true, but sooner or later this boom is bound to crash and bring about a new depression. Only apparent and temporary relief can be won by tricks of banking and currency. In the long run they must land the nation in profounder catastrophe. For the damage such methods inflict on national well-being is all the heavier, the longer people have managed to deceive themselves with the illusion of prosperity which the continuous creation of credit has conjured up

Friday, July 06, 2012

Turkish Banks offer Gold Deposit Accounts

Speaking of a reset in the global order monetary, one possible step towards the reintroduction of gold as money is for the banking system not only to accept gold as loan collateral but for people to be able to have gold deposit accounts which could pave way for payments and settlements services in gold.

Banks in Turkey seems to have lunged into this path.

From Mineweb.com

For centuries, Turks have flocked to the jewellery shops of Istanbul's labyrinthine Grand Bazaar to trade their gold - ornaments handed down through their families over generations, or bars stashed under mattresses as savings. But in recent months the shops have a new and unexpected competitor: banks.

The country's commercial banks are pouring their technical expertise and marketing resources into offering their customers gold deposit accounts. Customers hand their gold to a bank and can make withdrawals from their accounts in gold bars or the lira currency; the accounts offer interest rates that are substantially lower than those on normal time deposits.

Gold deposit accounts have been growing around the world, but Turkey's boom has made it a leader in the trend. This appears to have cut the amount of gold flowing to jewellers in the Grand Bazaar and elsewhere in the country, a trend which dismays the shop owners. In the long run, it could threaten their business model, which relies partly on turning scrap gold they buy into jewellery and selling it back to retail customers…

Gold is big business in Turkey, for cultural reasons and also because of the country's experience with bouts of high inflation over the past century. The metal is traditionally given as a gift at weddings and circumcision ceremonies, and demand for imports tends to surge during the summer months.

Turks are believed to have accumulated about 5,000 tonnes of gold in their homes, worth around $250 billion at current international prices, according to the World Gold Council, an industry lobby. It ranks Turkey's gold demand as fifth in the world for jewellery and eighth for retail investment, mostly behind countries with much bigger populations such as India, China and the United States.

I hope that Philippine banking system does the same.

Friday, March 23, 2012

Gold is Money: Turkey Edition

While Ben Bernanke and his ivory tower based cohorts do not treat gold as money, for the average Turks, gold is money.

From the Wall Street Journal,

The Turkish government, facing a bloated current-account deficit that threatens to derail the country's rapid expansion, is trying to persuade Turks to transfer their vast personal holdings of gold into the country's banking system.

The push to tap into the individual gold reserves—the traditional form of savings here—is part of Ankara's efforts to reduce a finance gap that is currently about 10% of gross domestic product.

Government officials say the banking regulator will soon publish a plan to boost incentives for consumers to park their household wealth inside the financial system. Banking executives said they are considering new interest-yielding gold-deposit accounts that would allow savers to withdraw gold bars from specially designed automated teller machines.

The moves come after the central bank in November announced that lenders could hold up to 10% of their local-currency reserves in gold, in part to tempt Turkey's gold hoarders to deposit their jewelry, coins or bullion at banks.

Economists say the policy shift is designed to change Turks' historic preference for storing a high percentage of personal wealth outside the banking system as a way to protect themselves against the economic volatility that has periodically hit Turkey in recent decades.

The effort is one front in a broader battle to encourage more savings while curbing the ballooning current-account deficit—a pressure point many investors fear could upend a fast-growing economy, estimated to have expanded more than 8% last year. Turkey's current-account gap has expanded faster than expected in recent weeks amid a surge in oil prices and data showing unexpectedly high consumer demand.

"Turkey has historically been hit by crises and inflation, so the tradition of holding gold outside the system could be hard to shift," said Murat Ucer, an economist at Global Source Partners, an Istanbul-based research consultancy.

The size of the gold haul stored outside Turkey's banking system is hard to quantify; no data reliably capture the scale of the informal economy. The Istanbul Gold Refinery estimates the figure at 5,000 metric tons, valued at $270 billion. Recent numbers show many consumers have boosted home-held deposits even as the country's tightly regulated banking system won plaudits for comfortably weathering the financial crisis.

Unlike India, whom recently announced plans to raise import duties on gold imports, Turkey’s government either has not yet reached a point of desperation to impose political controls over gold trades, or that they have come to realize of the futility of imposing antagonistic and oppressive policies. Instead, the Turkish government has, so far, resorted to wooing or appealing to the public to help the government.

However, I am inclined to the view that this as an initial or temporary step before any imposition of political controls. With institutional violence under their control (police or military power), the temptation to use force through tax or administrative policies will always be there.

It is also very important to note of how gold has served as insurance against political control via the banking system. It would appear that the average Turks, basically don’t trust the banking system, and thus keeps their savings in gold and stashed away from the prying eyes of political authorities. The average Turks, I presume, perhaps (culturally) understands that through the banking system, their savings or wealth could be faced with greater risks of confiscation through various political means as taxation.

Nevertheless this is a good remainder of the distinction between the world as seen by politicians and bureaucrats and of reality (which reflects on people’s sense of values.)

This quote, which I earlier blogged, attributed to Mr. Janos Feteke (who I think was the deputy governor of the National Bank of Hungary) seems very relevant

There are about three hundred economists in the world who are against gold, and they think that gold is a barbarous relic - and they might be right. Unfortunately, there are three billion inhabitants of the world who believe in gold

This is essentially why political actions that go against public’s desires eventually self-destructs.