What happens when governments think that they can legislate away people’s preferred activities? Well, the obvious outcome has been to shift such activities underground. This applies to social activities like vices e.g. gambling, drugs, alcohol and etc..., security (e.g. guns) or even to money (via gold ownership).

In the case of the Indian government which has recently slapped higher import taxes on gold, the consequence has been that of the explosion of gold smuggling.

Cases of smuggled gold entering India are coming in thick and fast. Almost as fast as gold coins and jewellery pieces are flying off retail shelves…

Despite India's best efforts to curb illegal gold imports, which included a boost to the nation's customs in 2012, gold smuggling has been rather rampant.

According to the All India Gems and Jewellery Trade Federation, India imported 950 tonnes in 2012. Of this, 250 tonne has come into the country through the illegal channel.

``In 2011, India imported over 900 tonnes of gold and none of it came through smuggling. The hike in customs duty has not stopped the import of gold into the country. It has only changed the route as smugglers earn a profit of around $3,719 (Rs 200,000) on every kilogram of gold smuggled into the country,'' said Federation Chairman Bachhraj Bamalwa.

The duty rate hike has not dampened demand, it has just enhanced the profit margin of smugglers, he added.

Finance ministry data shows $175 million (Rs 9.4 billion) worth of gold was seized from more than 200 cases of smuggling during April to July 2012. This was a 272% rise from the level of the previous year. Moreover, between 2006-07 and 2010-11, gold seizure was almost nil, data from the directorate of revenue intelligence shows.

In the first 10 months of 2012-13, India's Directorate of Revenue Intelligence seized gold worth $11 million (Rs 601 million) which is some 200kgs at the current price, and cracked 36 cases of smuggling.

The Directorate of Revenue Intelligence is an agency that monitors economic offences. Officers said the incidence of gold smuggling in the current fiscal year has grown by more than eight times as compared to the corresponding period in the previous year.

They added that spot gold prices in India are 5.7% higher than in Dubai. Typically, gold is smuggled into India from neighbouring Dubai and Thailand.

So the implicit gold prohibition via taxation has only been rewarding the smugglers (who are most likely the politically connected), but failing in its goal to “dampen demand”. Talk about policy failure.

Besides even the relatively higher prices which the average Indians pay for has not curtailed demand.

The Indian government’s war on gold has been premised on all sorts of red herring. They blame gold for contributing to trade deficits, in as much as, supposed risks posed by gold to the banking system.

For instance for countries who carry cultural affinity for gold, the Business Insider notes that “where gold is a popular investment, those financial institutions which carry large gold deposits, lend cash against gold or offer interest-bearing gold deposit accounts, can pose a risk to the financial system if commodity prices suddenly shift.”

This simply hasn’t been true.

The reality is that the war on gold is about passing the blame on people for what truly has been about government profligacy and policy failure. This has been the case with India which I pointed out in the past.

Aside from cultural legacy, the average Indians value gold for as hedge against currency debasement, again from the Business Insider

Many Indians use gold to hedge investments against inflation. But a working group convened by India’s central bank recently advocated a range of alternative investment products which could be used by the public as an alternative to gold for inflation hedging. Gold-linked savings accounts, bonds and certificates that entitle a holder to physical gold could help reduce demand and quickly move more liquid assets into the country’s banking system, the group suggested.

Gold priced in rupee has skyrocketed by 115x from about 800 INR in 1973 to 93k INR in 2013. (chart from gold.org). The realization of such collapse in real currency value makes the average Indians want to own gold for savings.

However the Indian government essentially wants to arbitrarily transfer people’s savings to the government, channeled through inflation, from which the average Indians have balked at. And so the rampant smuggling.

The same dynamic applies to Vietnam

Vietnam’s government is trying to tackle a similar problem through aggressive intervention in the local gold market. More than 31 percent of Vietnamese households keep some of the shiny stuff on hand, according to a survey by a government finance committee cited in a recent Credit Suisse note. High inflation levels and a weakening Vietnamese currency have made Vietnamese investors even more eager to snap up gold.

The Vietnamese government has intervened to mitigate the resulting spread between local and international gold prices. After temporarily suspending interest-bearing gold deposit accounts and certificates in 2011, the government has told banks and credit facilities to phase out gold deposits and loans for good. The government has also taken over the country’s largest gold refinery, and the State Bank of Vietnam is rolling out a new set of licenses allowing traders to buy and sell gold bars only if they meet strict requirements.

As noted above, the Vietnam government’s attack on gold not only has forced the banking system to charge fees on gold deposits but importantly has used gold as an instrument for controlling banks.

As Kel Kelly at the Mises Canada notes, (chart above his, italics original)

Recently, however, the government-run Vietnamese central bank disallowed loans in gold. Now, it is preventing banks from paying interest to customers on their gold. Instead, it is forcing banks to charge customer to store their gold, and requiring banks to regularly report on their transactions with account holders.

What’s happening is that the government wants to prevent citizens from using alternatives to its own quickly devaluing currency. This, way, the government can continue to steal purchasing power from its citizens through inflation.

Taxing the citizenry for holding gold has been just one approach. The other more conciliatory approach has been to migrate the gold held by the households to the government controlled banking system for the banks to use them.

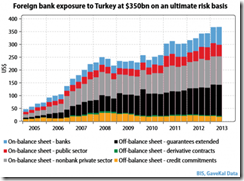

"Gold-based deposit accounts [in Turkey] surged 15% this year through the end of July," explained BusinessWeek back in October, "three times the increase in standard savings accounts."

"Although much criticised for its use of 'unconventional measures'," the Financial Times added in December, "few would argue that the decision last year by Turkey's central bank to allow the country’s banks to buy gold was anything less than a roaring success."

Buying gold isn't quite right. Starting in October 2011, the central bank began allowing commercial banks to hold a portion of their "required reserves" – needed to reassure depositors and other creditors they had plenty of money to hand – in physical gold bullion. Starting at 10%, that proportion was then raised to 30%.

Private citizens were similarly encouraged to hold their gold on deposit with their banks. That gold was thus transferred to the central bank's balance sheet. Et voila! Privately-owned gold now backed the nation's finances. A smart idea, which has coincided with Turkey's currency rising, interest rates falling, huge current-account shrinking, and government bonds regaining "investment grade" status.

Publicly targeting some of Turkey's estimated 2,200 tonnes of "under-the-pillow" gold, currently worth some $119 billion, the CBRT's governor Erdem Basci has meantime been awarded The Banker magazine's prestigious "Central Banker of the Year 2012" award.

Turkey’s government may be more successful in trying to take advantage of people preference for gold by synthesizing gold with banks through gold deposits, relative to the antagonistic approach by India and Vietnam.

Yet Turkey's accommodation may be linked to her gas-for-gold trade with Iran where the latter have been slapped by an economic embargo by the US along with her allies.

But Turkey’s gold integration with the banking system can be seen with suspicion. Banks who currently hold gold deposits may become agents of confiscation in the future when the government would have a change of heart.

The bottom line is that governments disdain competition particularly with money, such that they will resort to taxation or outright confiscation. But all these will not stop people from protecting their savings through hard currencies such as gold.