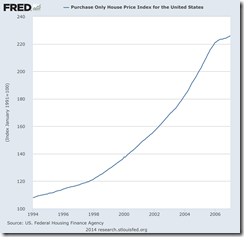

Data published on last week showed that house prices have now fallen for nine months in a row – the longest run on record, under this relatively new measure. Mudanjiang, one of the 67 Chinese cities that registered house prices falls over the past twelve months for second-hand residential buildings, experienced a 13.9% fall. The US entered recession around two years after house price inflation had peaked. After nine months of recession, Lehman Brothers collapsed. As our chart illustrates, house price inflation in China has slowed from its peak in January 2014 at least as rapidly as it did in the US.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Friday, February 27, 2015

Chart of the Day: China’s Housing Bubble Unraveling Faster than pre Lehman US Housing Episode

Wednesday, December 10, 2014

Causa Proxima: Will US Shale Oil Debt function as the Modern Day Equivalent of Housing Subprime Mortgages?

At bottom, the leading edge of the housing mania was the implicit price of land. That’s what always get bid up to irrational heights when the central bank fiddles with free market pricing of capital and debt.Even as land prices were being driven to irrational heights you didn’t need to spend night and day in arcane data dumps to document it. All you had to do was look at the stock price of the homebuilders.As I documented in The Great Deformation, the combined market cap of the big six national homebuilders including DH Horton, Lennar, Hovnanian, Pulte, Toll Brothers and KBH Homes soared from $6.5 billion in 2000 to $65 billion by the 2005-2006 peak. Yet you only needed peruse the financial statements and disclosures of any of these high-flyers and one thing was screamingly evident. They weren’t homebuilders at all; they were land banks that did not own a single hammer or saw or employ a single carpenter or electrician.Stated differently, the homebuilders’ soaring profits were nothing more than speculative gain on their land banks—gains driven by the cheap mortgage mania that had been unleashed by Greenspan when he slashed the so-called policy rate from 6% to 1% in hardly 30 months of foot-to-the-floor monetary acceleration between 2001 and 2004.Indeed, that cluelessness amounted to willful negligence. DH Horton was the monster of the homebuilder midway—–a giant bucket shop that never built a single home, but did accumulate land and sell finished turnkey units by the tens of thousands each period. Did it not therefore occur to the monetary politburo that DH Horton had possibly not really generated a 11X gain in sustainable economic profits in hardly 5 years?

So now we come to the current screaming evidence of bubble finance—–the fact that upwards of $500 billion of junk bonds ($200B) and leveraged loans ($300 B) have surged into the US energy sector over the past decades—–and much of it into the shale oil and gas patch.Folks, you don’t have to know whether the breakeven for wells drilled in the Eagleville Condy portion of the great Eagle Ford shale play is $80.28 per barrel, as one recent analysis documents, or $55 if you don’t count all the so-called “sunk costs” such as acreage leases and oilfield infrastructure. The point is, an honest free market would have never delivered up even $50 billion of leveraged capital—let alone $500 billion— at less than 400bps over risk-free treasuries to wildly speculative ventures like shale oil extraction.The fact is, few North American shale oil fields make money below $55/barrel WTI on a full cycle basis (lease cost, taxes, overhead, transport, lifting cost etc.). As shown below, that actually amounts to up to $10 less on a netback to the wellhead basis—–the calculation that drives return on drillings costs.In short, as the oil market price takes its next leg down into the $50s/bbl. bracket, much of the fracking patch will become a losing proposition. Moreover, given the faltering state of the global economy and the huge overhang of excess supply, it is likely that the current crude oil crash will be more like 1986, which was long-lasting, than 2008-09, which was artificially resuscitated by the raging money printers at the world’s central banks.So why is there a shale patch depression in store? Because there is literally a no more toxic combination than the high fixed costs of fracked oil wells, which produce 90% of their lifetime output in less than two years, and the massive range of short-run uncertainty that applies to the selling price of the world’s most important commodity.Surely, it doesn’t need restating, but here is the price path for crude oil over the past 100 months. That is to say, it went from $40 per barrel to $150, back to $40, up to $115 and now back to barely $60 in what is an exceedingly short time horizon.Obviously, what we have here is another massive deformation of capital markets and the related flow of economic activity. The so-called “shale miracle” was not made in Houston with some technology help from Silicon Valley. The technology of horizontal drilling and well fracking with chemicals has been around for decades. What changed were the economics, and those were made in the Eccles Building with some help from Wall Street.As to the latter, was it not made clear by Wall Street’s mortgage CDO meth labs last time that when the central bank engages in deep and sustained financial repression that it produces a stampede for “yield” which is not warranted by any sensible relationship between risk and return? It should not have been even possible to sell a shale junk bond or CLO that was based on assets with an effective two year life, a revenue stream subject to wild commodity price swings and one thing even more unaccountable. Namely, that the enterprise viability of virtually every shale junk issuer has always been dependent upon an endless rise in the junk bond issuance cycle.Stated differently, oil and gas shale E&P operators are drastic capital consumption machines. Due to the lightening fast decline rates of shale wells, firms must access more and more capital just to run in place. If they don’t flush money down the well bore, they die along with all the “sunk” capital that was previously put in place.In the case of shale oil, for example, it is estimated that were drilling to stop for just one month, production in the Eagle Ford, Bakken and one or two other major provinces would drop by 250,000 barrels per day. After four months, the drop would be 1 million bbl./day and after a one-year, nearly half the current four million barrels of shale oil production would disappear.That’s why all of a sudden there is so much strum and drang about “breakeven” pricing. Obviously, new drilling is not going to go to zero under any imaginable price scenario, but for all practical purposes the shale revolution could shut down just as fast as did the housing boom in 2006-2007. In effect, the shale financing boom presumed that both the junk bond cycle and the oil price cycle had been eliminated.Needless to say, they have not. So the impending “correction” may well be as swift and violent as was the housing bust.

Indeed, in the short-run the shale crash could be worse. The fantastic, debt-fueled drilling spree of the past 5-years is now sunk and will produce rising levels of production for a few quarters until rig activity is sharply curtailed and some of the better capitalized operators stop drilling in order to avoid lease expiration writeoffs.So as the WTI market price is driven toward $50/ barrel, recall that the netback to the producer is significantly less. In the case of the biggest shale oil province, the Bakken, the netback to the well-head is upwards of $11 below WTI. Accordingly, cash flow will plunge and that source of drilling funds will evaporate with it.But the big down-leg is coming in the junk market. This time around, Wall Street has been even more reckless in its underwriting than it was with toxic securitized mortgages. Barely six months ago it sold $900 million of junk bonds for CCC rated Rice Energy. The latter operates in the Marcellus gas shale trend but that makes the story even more preposterous.These bonds were sold at barely 400 bp over the 10-years treasury, and the issue was 4X oversubscribed. That is, there was upwards of $4 billion of demand for the bottom of the barrel securities of a shale speculator that had generated the following results during its 15 quarters as a public filer with the SEC. To wit, it had produced $100 million of cumulative operating cash flow versus $1.2 billion of CapEx. In short, if the junk bond market dies, Rice Energy is a goner soon thereafter.

As the global boom cools, oil demand withers, the junk market craters, and the shale patch tumbles into depression, someone might actually note the chart below.Its been another central bank parlor trick. The job count in the 45 non-shale states last Friday was 400,000 lower than it was at the end of 2007. That’s right, not one new job—even part-time or in the HES complex—- for the last seven years.All the new jobs have been in the 5 shale states. That is, they were manufactured by the Fed’s tidal wave of cheap capital and the central bank fueled global recovery which created the illusion that $100 oil was here to stay.But it isn’t and neither is the shale boom, the shale jobs or the shale investment spike, which counts for a good share of overall CapEx growth since the crisis.Yes, indeed. The monetary politburo did it again.

Thursday, July 24, 2014

US Government to Control Money Market Fund Redemptions

U.S. regulators approved rules intended to prevent a repeat of an investor exodus out of money-market mutual funds during the financial crisis, addressing one of the biggest unresolved issues from the 2008 meltdown.The asset-management industry, long wary of stricter rules, largely said it could live with the new regulations, which the Securities and Exchange Commission backed in a 3-2 vote.The rules would require prime money funds catering to large, institutional investors to abandon their fixed $1 share price and float in value like other mutual funds. Prime funds sold to individual investors can keep the $1 share price. The rules also allow all money funds to temporarily block investors from withdrawing cash in times of stress or allow the funds to impose fees for investors to redeem shares…

In the culmination of the 2008 US mortgage crisis, when Lehman Bros filed for bankruptcy, the US money market seized up when a wave of redemptions prompted for the failure of Reserve Primary fund to maintain her net asset value (NAV) at par or above the US $1 per share. This caused a liquidity crisis known as “breaking the buck” particularly for many non-US banks heavily reliant on US wholesale markets. Unlike typical retail depositor led bank runs, the 2008 “breaking the buck” was a bank run on the shadow banking industry or essentially on wholesale deposits by institutional investors in the face of deteriorating conditions in the market particularly deleveraging and or de-risking

The New York Federal Reserve Bank in April warned in a paper of the consequences of such a rule:[T]he possibility of suspending convertibility, including the imposition of gates or fees for redemptions, can create runs that would not otherwise occur... Rules that provide intermediaries, such as MMFs, the ability to restrict redemptions when liquidity falls short may threaten financial stability by setting up the possibility of preemptive runs...one notable concern, given the similarity of MMF portfolios, is that a preemptive run on one fund might cause investors in other funds to reassess whether risks in their funds...Got that? The Fed recognizes the possibility of preemptive runs that could spread throughout the money market sector because of these new rules.Bottom line: The risk of holding funds in a money market fund just increased exponentially. Your money will be much more liquid in an elitist, establishment bank account.Get your money out of money market funds now!

Friday, July 26, 2013

US Home Builders Slammed as 10 Year UST Yield Rise

The same story holds true with Pulte Homes (PHM).

Saturday, March 02, 2013

Knowledge Problem and the US Housing Bubble

If man is not to do more harm than good in his efforts to improve the social order, he will have to learn that in this, as in all other fields where essential complexity of an organized kind prevails, he cannot acquire the full knowledge which would make mastery of the events possible. He will therefore have to use what knowledge he can achieve, not to shape the results as the craftsman shapes his handiwork, but rather to cultivate a growth by providing the appropriate environment, in the manner in which the gardener does this for his plants. There is danger in the exuberant feeling of ever growing power which the advance of the physical sciences has engendered and which tempts man to try, "dizzy with success", to use a characteristic phrase of early communism, to subject not only our natural but also our human environment to the control of a human will. The recognition of the insuperable limits to his knowledge ought indeed to teach the student of society a lesson of humility which should guard him against becoming an accomplice in men's fatal striving to control society - a striving which makes him not only a tyrant over his fellows, but which may well make him the destroyer of a civilization which no brain has designed but which has grown from the free efforts of millions of individuals.

How much can you trust the word of government officials? How much about the financial future can central bankers or anybody know? Consider the lessons of the following 10 quotations:1. About whether Fannie and Freddie’s debt was backed by the government: “There is no guarantee. There’s no explicit guarantee. There’s no implicit guarantee. There’s no wink-and-nod guarantee. Invest and you’re on your own.” — Barney Frank, senior Democratic congressman, notable Fannie supporter, later chairman of the House Financial Services CommitteeIt would be difficult to imagine a statement more wrong.2. “We do not believe there is any government guarantee, and we go out of our way to say there is not a government guarantee.” — John Snow, Republican and secretary of the TreasurySaying it did not make it so, unfortunately.3. “The facts are that Fannie and Freddie are in sound situations.” — Christopher Dodd, senior Democratic senator, prominent Fannie supporter, chairman of the Senate Banking CommitteePronounced two months before Fannie and Freddie collapsed.4. “We have no plans to insert money into either of those two institutions [Fannie and Freddie].” — Henry Paulson, Republican and secretary of the TreasuryStated one month before the Treasury started inserting money into Fannie and Freddie.5. “Home prices could recede. A sharp decline, the consequences of a bursting bubble, however, seems most unlikely.” — Alan Greenspan, chairman of the Federal Reserve BoardThe common wisdom of the bubble years. At the time of this statement in 2003, the Fed was in the process of dramatically reducing short-term interest rates and stimulating house-price increases.6. “Global economic risks [have] declined.” — International Monetary FundObserved four months before the international financial panic started in August 2007.7. “More than 99 percent of all insured institutions met or exceeded the requirements of the highest regulatory capital standards.” — Federal Deposit Insurance CorporationThis statement was made in the second quarter of 2006, at the peak of the housing bubble. More than 400 such institutions later failed and others were bailed out in the ensuing bust. The FDIC failed its own required capital ratio, reporting negative net worth.8. “The risk to the government from a potential default on GSE [Fannie and Freddie] debt is effectively zero.” — Joseph Stiglitz, Nobel Prize–winning economist, Peter Orszag, a future White House budget director, and Jonathan OrszagConclusion after considering “millions of potential future scenarios” — but obviously not the scenario which then actually happened.9. "'Not only didn’t we see it coming,' but once the crisis started, central bankers 'had trouble' understanding what was happening." — Remarks by Donald Kohn, vice chairman of the Federal Reserve BoardA candid statement of the truth.10. Finally: “Libenter homines id quod volunt credunt.” That is: “People easily believe that which they want to believe.” — Julius CaesarNothing has changed in this respect since Caesar’s day, and his dictum applies to government officials, central bankers, economists, and experts — just as it does to you and me.

Wednesday, November 07, 2012

Why Short Selling has been at the Losing End

THE long-short ratio of global equities, a gauge of market sentiment, is at a five-year high. The ratio, which measures the value of stocks available for short-selling to what is actually on loan, shows longs outnumber shorts by a factor of more than 12, suggesting investors are increasingly bullish. Higher stockmarkets are driving the ratio upwards, as the amount on loan has not changed significantly in the last few years. The appetite for short-selling has been affected by uncertainty over regulation, and by a change of strategy from hedge funds (big short-sellers), which have been less leveraged since the financial crisis. But while the long-short ratio of American and European equities has increased, bears are far from extinct: between 7% and 8% of lendable value is still on loan to short-sellers.

Thursday, March 24, 2011

Falling US Home Sales Points To QE 3.0

The Reuters reports,

Sales of new U.S. homes sank to a record low in February and prices were the weakest since December 2003, showing the housing market slide was deepening.

The Commerce Department said on Wednesday sales of new single-family homes dropped 16.9 percent to a seasonally adjusted 250,000 unit annual rate, the lowest since records began in 1963, after a 301,000-unit pace in January.

The following charts from Northern Trust....

As I earlier wrote

Under enfeebled housing conditions, a failure to continue with the QE amplifies the risks of falling housing prices thereby jeopardizing the fragile state of the US banking system

Looks like Quantitative Easing (QE) 3.0 is underway

Sunday, March 20, 2011

The US Dollar’s Dependence On Quantitative Easing

Since every central bank of major economies has been inflating, it’s a question of which central bank has been inflating the most. The obvious answer is the US. The US has not only been inflating her economy, she has basically been inflating the rest of the world.

A US Dollar rally can occur and can be sustained once the US withholds inflationism. But $64 trillion question is: Can they afford the consequences?

Like in early 2010, experts and officials babbled about “exit strategies” as the US economy’s recovery advanced, something which we debunked as a Poker Bluff[1]. Yet 10 months later, the Fed re-engaged in Quantitative Easing 2[2] citing “low consumer spending” and “unemployment” as an excuse even as the US moved out of the recession in June of 2009th[3].

The mainstream doesn’t get it or has stubbornly been denying this.

Quantitative Easing or euphemistically called Credit Easing isn’t about the economy but about buttressing politically the US government and the banking system.

As Mises Institute Lew Rockwell writes[4],

Another truth is that the Fed doesn’t really care about inflation as much as it cares about the solvency of the banking and financial systems. Bernanke would drive us right into hyperinflation to save his industries. Savers living on pensions just don’t have the political clout to stop the money machine.

US housing has still been struggling. Since a substantial segment of the banking system’s balance sheets have been stuffed with US mortgages, then QE 1.0 and 2.0 has managed to keep these afloat but has, so far, failed to strongly revive the US housing market[5].

Under enfeebled housing conditions, a failure to continue with the QE amplifies the risks of falling housing prices thereby jeopardizing the fragile state of the US banking system.

Most importantly, the US Federal Reserve has been buying US Treasuries which means the US central bank has been funding the profligacy of US government.

Yet much of US treasury has also been substantially held by the foreign governments.

However, there are signs that the interest to hold US debt has been waning.

According to Economic Times India[6]

China, the biggest foreign holder of US debt has trimmed its portfolio to $1.15 trillion to diversify its foreign reserve portfolio to avoid risks.

China reduced its US Treasuries portfolio by $5.4 billion to $1.15 trillion in January, according to the data released by the US Treasury Department on Wednesday.

It is the third straight month of net selling after China's holdings of US debt reached a peak of nearly $1.18 trillion in October 2010.

If the Japan repatriation trade proves to be a real event risk, then this could even further dampen interest to support US debt.

With substantial foreign held US debt maturing over the next 36 months[7], if foreign governments withhold from buying, will the US accept higher interest rates?

Given the ideological background and the path dependency by the incumbent monetary authorities, the answer is a likely NO!

The US government can’t simply put her fragile banking system at risks, and thus, we can bet that QE 3, 4, 5 to the nth, will likely occur until the market recoils from these.

The above doesn’t even include the financial conditions of wobbly states and municipalities.

Financial conditions of US states have been plodding[8] while Municipal bonds, following a huge meltdown, has also been floundering. The rally in the Muni bonds have not erased the losses.

Controversial analyst Meredith Whitney, who recently presaged “50 to 100 sizable defaults to the tune of “hundreds of billions of dollars worth of defaults”[9], has been constantly under fire by the mainstream, for such prognosis. She has even been summoned by a US Congressional Panel. Anyone who goes against the government appears to be subject to censorship or political harassment.

The point is: given all these fragile conditions, will the Ben Bernanke led US Federal Reserve bear the onus of withdrawing, what has given Bernanke and the Fed an artificial aura of success?

[1] See Poker Bluff: The Exit Strategy Theme For 2010, January 11, 2011

[2] CNN Money.com QE2: Fed pulls the trigger, November 3, 2010

[3] Reuters.com Recession ended in June 2009: NBER, September 20, 2010

[4] Rockwell, Llewellyn H. Is QE3 Ahead?, Mises.org, March 18, 2011

[5] Northern Trust, Sales of Existing Homes Moved Up, But Median Price Establishes New Low, February 23, 2011 and

Food and Energy Prices Lift Wholesales Prices, But Pass through to Retail Prices is Key, March 16, 2011

[6] Economic Times India, China continues to trim its US debt to avoid risks, March 18, 2011

[7] Osborne, Kieran U.S. Government: Evermore Reliant on Foreign Investors Merk Investments, March 15, 2011

[8] Center on Budget Policies and Policy Priorities, States Continue to Feel Recession’s Impact, March 9, 2011

[9] New York Times, A Seer on Banks Raises a Furor on Bonds, February 7, 2011

Thursday, April 09, 2009

Negative Chain Effects from Regulatory Arbitrage: The AIG experience

In the Freakonomics blog, Daniel Hamermesh commented on a review of Kat Long’s The Forbidden Apple where he notes of how prohibitions have triggered unintended consequences.

Mr. Hamermesh wrote, ``The review describes a number of incidents where efforts to ban or restrict transactions in one market spilled over with negative consequences into a related market.

``To eliminate drinking on Sundays, New York City restricted it to hotels. In response, bars created makeshift hotel rooms, separated by dividers, which in turn created a burgeoning prostitution business. To avoid having men buy a drink in a bar in order to use the only publicly available restroom, the city opened public restrooms. But this created places where gay sex could proliferate.

``Both of these examples illustrate the law of unintended consequences: actions that restrict quantity or price in one market will affect them in related markets. Indeed, they may even create markets that nobody had heretofore imagined. No doubt there are many other, equally prurient examples.” (bold highlight mine)

Mr. Hamermesh’s remarks reminds us of how the “restrictions” based regulatory arbitrages in the financial sector spawned “related markets” in derivatives, the shadow banking system and other “structured finance” instruments.

As Paul Farrell wrote in the marketwatch.com in 2008, `` The fact is, derivatives have become the world's biggest "black market," exceeding the illicit traffic in stuff like arms, drugs, alcohol, gambling, cigarettes, stolen art and pirated movies. Why? Because like all black markets, derivatives are a perfect way of getting rich while avoiding taxes and government regulations. And in today's slowdown, plus a volatile global market, Wall Street knows derivatives remain a lucrative business.” (bold highlight mine)

These innovative vehicles ultimately served as the principal financing conduits or the “black markets” which fueled the colossal real estate bubble that subsequently shaped today’s crisis.

Essentially the banking system which sought for higher yields took advantage of legal loopholes to assume more risks by leveraging up. Hedge instruments became speculative and Ponzi financed.

Although the actions of the "bailout cultured" banking system had been partially typical of an arbitrageur, which as Michael Mauboussin of Legg Mason says is driven by “The idea is simple and intuitive: a smart subset of investors cruise markets seeking discrepancies between price and value and make small profits closing those aberrant gaps.”

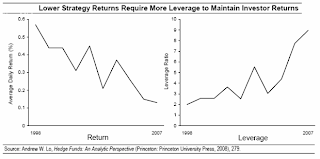

Chart from Michael Mauboussin of Legg Mason

Chart from Michael Mauboussin of Legg MasonNonetheless Chris Whalen of Institutional Risk Analytics gives an example of how AIG morphed from an insurance and reinsurance business model to a Ponzi by virtue of “regulatory arbitrage” or “may even create markets that nobody had heretofore imagined” (Daniel Hamermesh)…

``One of the first things we learned about the insurance world is that the concept of "shifting risk" for a variety of business and regulatory reasons has been ongoing in the insurance world for decades. Finite insurance and other scams have been at least visible to the investment community for years and have been documented in the media, but what is less understood is that firms like AIG took the risk shifting shell game to a whole new level long before the firm's entry into the CDS market….

``One of the most widespread means of risk shifting is reinsurance, the act of paying an insurer to offset the risk on the books of a second insurer. This may sound pretty routine and plain vanilla, but what most people don't know is that often times when insurers would write reinsurance contracts with one another, they would enter into "side letters" whereby the parties would agree that the reinsurance contract was essentially a canard, a form of window dressing to make a company, bank or another insurer look better on paper, but where the seller of protection had no intention of ever paying out on the contract…

``It is important to understand that a side letter is a secret agreement, a document that is often hidden from internal and external auditors, regulators and even senior management of insurers and reinsurers….

``It appears to us that, seeing the heightened attention from regulators and federal law enforcement agencies such as the FBI on side letters, AIG began to move its shell game to the CDS markets, where it could continue to falsify the balance sheets and income statements of non-insurers all over the world, including banks and other financial institutions.

Read the rest here

Monday, March 30, 2009

Expect A Different Inflationary Environment

``For inflation does not come without cause. It is the result of policy. It is the result of something that is always within the control of government—the supply of money and bank credit. An inflation is initiated or continued in the belief that it will benefit debtors at the expense of creditors, or exporters at the expense of importers, or workers at the expense of employers, or farmers at the expense of city dwellers, or the old at the expense of the young, or this generation at the expense of the next. But what is certain is that everybody cannot get rich at the expense of everybody else. There is no magic in paper money.” -Henry Hazlitt, What You Should Know About Inflation p.135

Ever since the US Federal Reserve announced that it would embark on buying $300 billion of long term US treasury bonds and ante up on its acquisitions of mortgage-based securities by $750 billion, this has generated an electrifying response in the global financial markets.

First, it hastened the decline in the US dollar index, see figure 1.

Next, it goosed up both the commodity markets (as represented by the CRB-Reuters benchmark lowest pane) and key global equity markets, as seen in the Dow Jones World index (topmost pane) and the Dow Jones Asia ex-Japan (pane below main window). The seemingly congruous movements seem to be in response to US dollar’s activities.

At the end of the week as the US dollar rallied vigorously, where the same assets reacted in the opposite direction. So it is our supposition that correlation here implies causation: a falling US dollar simply means more surplus dollars in the global financial system relative to its major trading partners.

In other words, since the efficiency of the global financial markets have greatly been impeded by collaborative intensive worldwide government interventions, the main vent of the officially instituted policy measures have been through the currency markets.

And since the US dollar is the world’s de facto currency reserve, the actions of the US dollar are thereby being transmitted into global financial assets. As former US Treasury secretary John B. Connolly memorably remarked in 1971, ``The US dollar is our currency, but your problem!”

Bernanke’s Inflation Guidebook

And as we have long predicted, the US Federal Reserve will be using up its policy arsenal tools to the hilt. And if there is anything likeable from Mr. Bernanke is that his prospective policy directives have been explicitly defined in his November 21 2002 speech Deflation: Making Sure It Doesn’t Happen Here which has served as a potent guidebook for any Central Bank watcher.

For instance, the latest move to prop up the long end of the Treasury market was revealed in 2001 where Bernanke noted that ``a sufficiently determined Fed can peg or cap Treasury bond prices and yields at other than the shortest maturities”, and the shoring up of the mortgage market as ``might next consider attempting to influence directly the yields on privately issued securities”.

Nevertheless even as Mr. Bernanke once said that ``I am today neither forecasting nor recommending any attempt by U.S. policymakers to target the international value of the dollar”, he believes in the ultimate antidote against the threat of deflation could be through the transmission effects of the US dollar’s devaluation, ``it's worth noting that there have been times when exchange rate policy has been an effective weapon against deflation” where he has showcased the great depression as an example; he said,`` If nothing else, the episode illustrates that monetary actions can have powerful effects on the economy, even when the nominal interest rate is at or near zero, as was the case at the time of Roosevelt's devaluation.”

Of course, this isn’t merely going to be a central bank operation but one combined with coordinated efforts with the executive department or through the US Treasury, again Mr. Bernanke, ``effectiveness of anti-deflation policy could be significantly enhanced by cooperation between the monetary and fiscal authorities”.

Although Mr. Bernanke’s main prescription has been a tax cut, he combines this with government spending via purchases of assets, he recommended `` the government could increase spending on current goods and services or even acquire existing real or financial assets. If the Treasury issued debt to purchase private assets and the Fed then purchased an equal amount of Treasury debt with newly created money, the whole operation would be the economic equivalent of direct open-market operations in private assets.”

And the recent fiscal stimulus, guarantees and other bailout programs which have amassed to some nearly $9.9 trillion [see $9.9 Trillion and Counting, Accelerating the Mises Moment] of US taxpayers exposure plus the recent $1 trillion Private Investment Program or PPIP have all accrued in accordance to Mr. Bernanke’s design.

In all, Mr. Bernanke hasn’t been doing differently from Zimbabwe’s Dr. Gideon Gono except that the US Federal Reserve can deliver the same results via different vehicles.

Inflation is what policymakers have been aspiring for and outsized inflation is what we’re gonna get.

Stages of Inflation

There are many skeptics that remain steadfast to the global deflationary outlook based on either the continued worsening outlook of debt deleveraging in the major financial institutions and or from the premise of excessive supplies or surplus capacities in the economic system.

We agree with the debt deflation premise (but not the global deflationary environment) and pointed to the dim prospects of Geither’s PPIP program [see Why Geither's Toxic Asset Program Won't Float] precisely from the angle of deleveraging and economic recessionary pressures. However, this is exactly why central bankers will continue to massively inflate-to reduce the real value of these outstanding obligations. And this episode has been a colossal tug-of-war between government generated inflation and market based deflation.

It is further a curiosity how the academe world or mainstream analysis has been obsessing over the premise of the normalization of “borrowing and lending” in order to spur inflation. It just depicts how detached “classroom” or “ivory tower” based thinking is relative to the “real” functioning world.

We don’t really need to restore the private sector driven credit process to achieve inflation. As manifested in the recent hyperinflation case of Zimbabwe; all that is needed is for a government to simply endlessly print money and to spend it.

The sheer magnitude of money printing combined with market distortive administrative policies sent Zimbabwe’s inflation figures skyrocketing to vertiginous heights (89.7 SEXTILLION percent or a number backed with 21 zeroes!!!) as massive dislocations and shortages in the economy emerged out of such policy failures.

By the way, as we correctly predicted in Dr. Gideon Gono Yields! Zimbabwe Dump Domestic Currency, since the “Dollarization” or “rand-ization or pula-ization” of Zimbabwe’s economy, prices have begun to deflate (down 3% last January and February)! The BBC reported ``The Zimbabwean dollar has disappeared from the streets since it was dumped as official currency.” The evisceration of the Zimbabwean Dollar translates to equally a declension of power by the Mugabe regime which has resorted to a face saving “unity” government between the opposition represented by current Prime Minister Morgan Tsvangirai of the MDC and President Mugabe's Zanu-PF.

And going back to inflation basics, we might add that a dysfunctional deflation plagued private banking system wouldn’t serve as an effective deterrent to government/s staunchly fixated with conflagrating the inflation flames.

For instance, in the bedrock of the ongoing unwinding debt deleveraging distressed environment, the UK has “surprisingly” reported a resurgence of inflation last February brought about by a “rise” in food prices due to the “decline” in UK’s currency the British pound-which has dropped by some 26% against the US dollar during the past year (Bloomberg). While many astonished analysts deem this to be a “hiccup”, we believe that there will be more dumbfounding of the consensus as inflation figures come by. And we see the same “startling” rise in inflation figures reported in Canada and in South Africa.

What we are going to see isn’t “stag-deflation” but at the onset STAGFLATION, an environment which dominated against the conventional expectations during the 70s.

Why? Because this isn’t simply about demand and supply of goods and services as peddled by the orthodoxy, but about the demand and supply of money relative to the demand and supply of goods and services. Better defined by Professor John Hussman, ``Inflation basically measures the percentage change in the ratio of two “marginal utilities”: the marginal utility of real goods and services divided by the marginal utility (mostly for portfolio and transactions purposes) of government liabilities.”

For instance mainstream analysts tell us that stock prices reflect on economic growth expectations and that during economic recessions, which normally impairs earnings growth, this automatically translates to falling stock prices.

We’ll argue that it depends--on the rate of inflation.

Figure 2: Nowandfutures.com: Weimar Germany: Surging Stock Prices on Massive Recession

This is basically the same argument we’ve made based on Zimbabwe’s experience, in the Weimar hyperinflation of 1921-1923, its massively devaluing currency, which accounted for as the currency’s loss of store of value sent people searching for an alternative safehaven regardless of the economic conditions.

People piled into stocks (right), whose index gained by 9,999,900%, even as unemployment rate soared to nearly 30%! It’s because the German government printed so much money that Germans lost fate in their currency “marks” and sought refuge in stocks. Although, stock market gains were mostly nominal and while the US dollar based was muted (green line).

In other words, money isn’t neutral or that the impact of monetary inflation ranges in many ways to a society, to quote Mr. Ludwig von Mises, ``there is no constant relation between changes in the quantity of money and in prices. Changes in the supply of money affect individual prices and wages in different ways.”

For example, it doesn’t mean just because gold prices hasn’t continually been going up that the inflationary process are being subverted by deflation.

As Henry Hazlitt poignantly lay out the divergent effects of inflation in What You Should Know About Inflation (bold highlight mine) ``Inflation never affects everybody simultaneously and equally. It begins at a specific point, with a specific group. When the government puts more money into circulation, it may do so by paying defense contractors, or by increasing subsidies to farmers or social security benefits to special groups. The incomes of those who receive this money go up first. Those who begin spending the money first buy at the old level of prices. But their additional buying begins to force up prices. Those whose money incomes have not been raised are forced to pay higher prices than before; the purchasing power of their incomes has been reduced. Eventually, through the play of economic forces, their own money-incomes may be increased. But if these incomes are increased either less or later than the average prices of what they buy, they will never fully make up the loss they suffered from the inflation.”

In short, inflation comes in stages.

Let us use the example from the recent boom-bust cycle…

When the US dot.com bust in 2000 prompted the US Federal Reserve to cut interest rates from 6% to 1%, the inflationary pressures had initially been soaked up by its household sector which amassed household debts filliped by a gigantic punt in real estate.

As the speculative momentum fueled by easy money policies accelerated, monetary inflation were ventilated through three ways:

1. An explosion of the moneyness of Wall Street’s credit instruments which directly financed the housing bubble.

Credit Bubble Bulletin’s Doug Noland has the specifics, ``As is so often the case, we can look directly to the Fed’s Z.1 “flow of funds” report for Credit Bubble clarification. Total (non-financial and financial) system Credit expanded $1.735 TN in 2000. As one would expect from aggressive monetary easing, total Credit growth accelerated to $2.016 TN in 2001, then to $2.385 TN in 2002, $2.786 TN in 2003, $3.126 TN in 2004, $3.553 TN in 2005, $4.025 TN in 2006 and finally to $4.395 TN during 2007. Recall that the Greenspan Fed had cut rates to an unprecedented 1.0% by mid-2003 (in the face of double-digit mortgage Credit growth and the rapid expansion of securitizations, hedge funds, and derivatives), where they remained until mid-2004. Fed funds didn’t rise above 2% until December of 2004. Mr. Greenspan refers to Fed “tightening” in 2004, but Credit and financial conditions remained incredibly loose until the 2007 eruption of the Credit crisis.” (bold highlight mine)

2. These deepened the current account deficits, which signified the US debt driven consumption boom.

Again the particulars from Mr. Noland, ``It is worth noting that our Current Account Deficit averaged about $120bn annually during the nineties. By 2003, it had surged more than four-fold to an unprecedented $523bn. Following the path of underlying Credit growth (and attendant home price inflation and consumption!), the Current Account Deficit inflated to $625bn in 2004, $729bn in 2005, $788bn in 2006, and $731bn in 2007.” (bold highlight mine)

3. The subsequent sharp fall in the US dollar reflected on both the transmission of the US inflationary process into the world and the globalization of the credit bubble.

Again Mr. Noland for the details, ``And examining the “Rest of World” (ROW) page from the Z.1 report, we see that ROW expanded U.S. financial asset holdings by $1.400 TN in 2004, $1.076 TN in 2005, $1.831 TN in 2006 and $1.686 TN in 2007. It is worth noting that ROW “net acquisition of financial assets” averaged $370bn during the nineties, or less than a quarter the level from the fateful years 2006 and 2007.”

In short, the inflationary process diffused over a specific order of sequence, namely, US real estate, US financial debt markets, US stock markets, global stock markets and real estate, commodities and lastly consumer prices.

Past Reflation Scenarios Won’t Be Revived, A Possible Rush To Commodities

Going into today’s crisis, we can’t expect an exact reprise of the most recent past as the US real estate and the US financial debt markets are likely to be still encumbered by the deleveraging process see figure 4.

Some of the financial instruments such as the Non-Agency Mortgage Backed Securities (left) and Asset Backed Securities (right), which buttressed the real estate bubble have materially shriveled and is unlikely to be resuscitated even by the transfer of liabilities to the government.

Besides, the general economic debt levels remain significantly high relative to the economy’s potential for a payback, especially under the weight of today’s recessionary environment.

Which is to say that today’s inflationary setting will probably evolve to a more short circuited fashion relative to the past.

This leads us to surmise that most of global stock markets (especially EM economies which we expect to rise faster in relative terms) could rise to absorb the collective inflationary actions led by the US Federal Reserve but on a much divergent scale. Currency destruction measures will also possibly support OECD prices but could underperform, as the onus from the tug-of-war will probably remain as a hefty drag in their financial markets.

And this also suggests that commodity prices will also likely rise faster (although not equally in relative terms) than the previous experience which would eventually filter into consumer prices.

In other words, the evolution of the opening up of about 3 billion people into the global markets, a more integrated global economy and the increased sophistication of the financial markets have successfully imbued the inflationary actions by central banks over the past few years. But this isn’t going to be the case this time around-unless economies which have low leverage level (mostly in the EM economies) will manage to sop up much of the slack.

Take for example China. China’s economy has generally a low of leverage which allows it the privilege of taking on more debts.

Figure 5: US Global Investors: China Loans and Fixed Asset Investment Surge

Figure 5: US Global Investors: China Loans and Fixed Asset Investment Surge

And that’s what it has been doing today in the face of this crisis-China’s national stimulus and monetary easing programs is expected to incur deficits of about 3-7% of its GDP coupled by the QE measures instituted by the US has impelled a recent surge in China’s domestic bank loans and real fixed investments.

Qing Wang of Morgan Stanley thinks that the US monetary policy measures has lowered “the opportunity cost of domestic fixed-asset investment”, which means increasing the attractiveness of Chinese assets.

According to Mr. Wang, ``In practice, lower yields on US government bonds means lower returns on the PBoC’s assets. This should enable the PBoC to lower the cost of its liabilities by: a) lowering the coupon interest rates it pays on the PBoC bills, which is a major liability item on its balance sheet; b) lowering the ratio of required reserves (RRR) on which the PBoC needs to pay interest; or c) lowering the interest rates that the PBoC needs to pay on the deposits of banks’ required reserves and excess reserves, currently at 1.62% and 0.72%, respectively. These potential changes should then lower the opportunity cost of bank lending from the perspective of individual banks.” (bold highlights mine)

In other words, low interest rates in the US can serve as fulcrum to propel a boom in China’s bank lending programs.

This brings us to the next perspective, which assets will likely benefit from such inflationary activities.

Henry Hazlitt gives us again a possible answer ``In answer to those who point out that inflation is primarily caused by an increase in money and credit, it is contended that the increase in commodity prices often occurs before the increase in the money supply. This is true. This is what happened immediately after the outbreak of war in Korea. Strategic raw materials began to go up in price on the fear that they were going to be scarce. Speculators and manufacturers began to buy them to hold for profit or protective inventories. But to do this they had to borrow more money from the banks. The rise in prices was accompanied by an equally marked rise in bank loans and deposits.” (bold highlight mine)

This suggests that expectations for more inflation are likely to trigger rising prices and growing shortages, which will likely be fed by more money printing, and eventually an increase in credit uptake in support these actions.

Some Proof?

China is on a bargain hunting binge for strategic resources, according to the Washington Post March 19th, ``Chinese companies have been on a shopping spree in the past month, snapping up tens of billions of dollars' worth of key assets in Iran, Brazil, Russia, Venezuela, Australia and France in a global fire sale set off by the financial crisis.

``The deals have allowed China to lock up supplies of oil, minerals, metals and other strategic natural resources it needs to continue to fuel its growth. The sheer scope of the agreements marks a shift in global finance, roiling energy markets and feeding worries about the future availability and prices of those commodities in other countries that compete for them, including the United States.”

China has also engaged in a record buying of copper, according to commodityonline.com March 14th, ``China has started to buy copper in a big way again. As part of the country’s strategy to make use of the recessionary trends in the global markets, China has hiked its copper buying during the past few months…

``According to recently released data, China’s copper import hit a record high of 329,300 tonnes in February, up 41.5 per cent from the 232,700 tonnes of January.”

Summary and Conclusion

Overall, these are some important points to ruminate on:

-It is clear that the thrust by the US government seems to be to reduce the real value of its outstanding liabilities by devaluing its currency. Since the US dollar is the world’s de facto currency reserve the path of the US government policy actions will be transmitted via its exchange rate value to the global financial markets and the world’s real economy. And this translates to greater volatility of the US dollar. Moreover, except for the ECB (yet), the QE efforts by most of the major central banks could translate to a race to the bottom in terms of devaluing paper money values.

-Collaborative global policy measures to inflate the world appear to be gaining traction in support of asset prices but at the expense of currency values.

-Global central bankers have been trying to revive inflationary expectations that are effectively “reflexive” in nature. By painting the perception of a ‘recovery’ through a rising tide of the asset markets, officials hope that this might induce a torrent of asset buying from a normalization of the credit process.

-The monumental efforts by global central banks to collectively turbocharge the global asset markets could eventually spillover to consumer prices and “surprise” mainstream analysts over their insistence to “tunnel” over the deflation angle. We expect higher consumer prices to come sooner than later especially if EM economies would be unable to fill the role of raising levels of systemic leveraging.

-Money isn’t neutral which means that the impact of inflation won’t be the same for financial assets and the real economy. Some assets or industries will benefit more than the others.

-We can’t expect the same “reflation” impact of the past episode to happen again as the ongoing tug-of-war between market-based debt deflation and government’s fixation to inflate the system has displaced the gains derived from the previous trends of globalization and the sophistication of financial markets. The US real estate markets will have surpluses to work off and the financial markets that financed the US real estate markets will remain broken for sometime and will take substantial number of years to recover.

-The impact of inflation will come in stages and perhaps accelerate in phases.

-The risk is that inflation could rear its ugly head in terms of greater than expected consumer prices earlier than what the consensus or policymakers expect. And if this is the case then it could pose as management dilemma for policymakers as the real economy remains weak and apparently fragile from the excessive dependence on the government and from the intense distortion brought about by government intervention in the marketplace. To quote Morgan Stanley’s Manoj Pradhan, ``Can QE be rolled back quickly? In theory, yes! Both passive and active QE could be reversed very quickly. The desire to hike rates above their currently low levels complicates matters slightly. Why? The effectiveness of passive QE depends on the willingness of banks to seek returns in the economy rather than simply parking excess reserves with the central bank. Hiking interest rates would reduce these incentives.”

Finally as we previously said it is increasingly becoming a cash unfriendly environment.