A friend recently called to say that there have been numerous accounts of “miniature bubbles” in the local markets. Others claim that these have been brought about by unscrupulous people engaged in “pump and dump”.

In reality as I have been pointing out, miniature bubbles are symptoms of the ultimate bubble blower—central bank policies. Central bank policies distort people’s incentives towards money. Savings, investment and consumption patterns will have all been skewered. Where negative real rates punish savers, naturally people whose savings are being diminished through the erosion of purchasing power will seek higher yield, and thus, redeploy their savings into other activities which may include more consumption activities, speculation or high risk investments and or take up more debt to fund these activities. Even private sector Ponzi schemes has been flourishing under today’s environment[1]

In essence policies that tamper with money motivates the public to value short term over the long term.

Thus heightened price volatilities which are deemed as “pump and dump” or as “miniature bubbles” represent as symptoms rather than the cause. People will look for excuses to push up prices or speculate for the simple reason that policies have egged them to do so.

The easy money climate lures the vulnerable public to go for momentum and chase prices using any available tools (charts, corporate fundamentals or even tips[2] and rumors) to do so. And this is why pump and dumps happen.

Large price swings make some people think that stock market operators are culpable for such swing. But this would be mistaking trees for the forests. Absent easy money policies, bubbles and pump and dumps hardly has been a feature. Had there been mini bubbles or pump and dumps during the bear market of 2007-2008? No, because inflated assets were all deflating in response or as contagion to the real estate-banking crisis abroad.

Broken Markets

And as earlier pointed out[3], the US today has not been different, junk bonds or high yielding debt has been booming.

Writes the Buttonwood (Philipp Coggan) of the Economist[4]

Of course, the broader point is that investors are being pushed into these high-yielding assets because of the policy of the Fed (and most developed world central banks) of keeping interest rates close to zero. Similar reasoning drove the enthusiasm for structured products that financed the subprime boom.

Zero bound rates have prompted for yield chasing actions, here or in the US.

The mainstream finally comes to admit what I have been saying all along—that markets have been vastly distorted where one cannot use “fundamentals” in the traditional and conventional sense to evaluate investments.

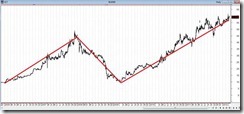

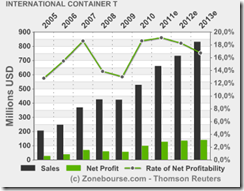

The excessive price volatility in today’s markets does not match with the fluctuations of conventional metrics of financial ratios. Today’s price volatility has been incongruent with trends of corporate fundamentals. And thus as I earlier pointed out[5], anyone who believed in “fundamentals” would have sold as early as March.

Considering the huge jump in prices from the start of the year, we should be around at near the peak of 2007. So anyone who believes in this stuff ought to be shorting or selling the market. I won’t.

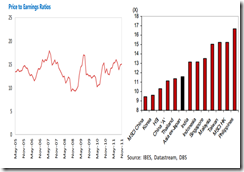

The left window from the chart above as I earlier posted last March has a time series that ended November of 2011. The right chart from DBS represents a more updated one albeit was updated until last March. Considering that the Phisix has now been drifting at over 5,150 which means valuations continues to climb higher away from these charts, the Phisix has become “priciest” stock market in Asia.

Yet leaning on earnings or conventional fundamental metrics, like the Heisenberg uncertainty principle, becomes a permanently moving target which is impossible to pin down, especially punctuated under today’s easy market climate.

Will I sell on the account of earnings/fundamentals? My answer is still no. Not until interest rates climb in response to consumer price inflation, or through heightened demand for credit, or questions over credit quality of government papers or the scarcity of capital becomes apparent[6]. Nominal interest rates are not a one-size-fits-all thing, and there are many measures (like real interest rates, CDS, yield curve et.al.) to gauge if the monetary environment has begun to tighten for one reason or another. This also should come in the condition that the hands of central bankers have also been shackled and would be unable to respond forcefully as they have been doing today.

For now central banks around will continue to find ways and means to push more easing measures in support of the asset markets which was highlighted by last week’s additional stimulus by the Bank of Japan (BoJ)[7]

The following excerpt from the mainstream loudly resonates on what I have been saying.

From the Financial Times[8],

Markets are broken. Accepted investment wisdom has been overturned and the basic tenets of value and diversification no longer work. The financial crisis put the market into a volatile “risk on, risk off” – or Roro – mode for which there is no cure.

For many investors, this has made stockpicking seemingly an impossible task. Markets once responded to their fundamentals. Now, disparate assets have a much greater tendency to move together, individual characteristics lost. Trusted strategies such as relative value and currency carry trades are nearly useless, overwhelmed by daily market-wide volatility.

“Assets now behave as either risky assets or safe havens, and their own fundamentals are secondary,” writes HSBC strategist Stacy Williams in a recent note. “In a world where most asset classes are synchronised, it becomes very difficult to achieve diversification. It also means that since most individual assets are dominated by a common price component, it becomes increasingly futile to invest in them based on their usual fundamentals.”

Though asset classes had been moving in closer correlation since the start of the financial crisis in 2007, the Roro trend became most apparent after the collapse of Lehman Brothers a year later. The uncertainty helped turn investing bimodal, where every price has been contaminated by systemic risk. Everything became a bet on whether we were closer to a global recovery or to deeper crisis.

So what recommendations do they offer for the public to deal with the state of “broken markets? They have three. One is to pick a position from the boom or the bust scenario, second is to chase momentum and third is to hedge positions through index futures.

I would like to emphasize on the second option, not because this is my preferred approach but because of its relevance to the conditions of the local markets, from the same article,

Another option is to seek out an investment strategy that still works. Momentum investing – in effect, buying the winners and selling the losers – is a method that HSBC analysts highlight as having been largely impervious to the risk trade. To chase a trend aims to harvest small but systematic mispricing of assets, and there is no reason to suppose these anomalies would disappear in bimodal markets, the broker argues. (In this context, the growth of high-frequency trading since the start of the crisis is unlikely to be coincidental.)

This simply means that the mainstream will largely be chasing momentum, by targeting frequency over magnitude through “harvest small but systematic mispricing of assets”. So in essence, high risk speculative activities or gambling (a.k.a “miniature bubbles” and “pump and dump”) has been recognized as the common or standardized feature of the current market place. So history will rhyme and a bust will be around the corner.

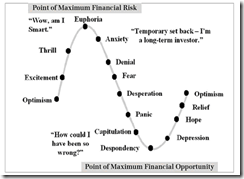

I would rather “time” the bubble cycle rather than go chasing prices. And this is why it is imperative for any serious investors to understand the bubble process or the boom bust cycle.

Stock Market is about Human Action

Finally financial markets signify a social phenomenon. There is a popular aphorism from former President John F. Kennedy, who said in the aftermath of the failed Bay of Pigs Invasion[9], which seems relevant to the financial markets,

Victory has a thousand fathers; defeat is an orphan.

Winning issues and or market tops tend to attract substantial participants as a function of easy money (get rich quick mentality), keeping up with the Joneses (bandwagon effect) or survivorship bias (focus on survivors or winners at the expense of the others) or social signaling (desire for greater social acceptance, elevated social status and or ego trips).

On the other hand market bottoms results to the opposite: depression, avoidance, isolation and animus behaviour for those caught by the crash.

Most people don’t realize that emotional intelligence or self discipline is key to surviving the market’s volatility, not math models or charts or any Holy Grail or Greek formulas. And this comes from the desire to attain self discipline than from advices of other people.

Yet self discipline is earned and acquired through knowledge and through the whetting of one’s skills based on these accrued knowledge. Alternatively, self discipline cannot be not given or inherited. And that’s why I vehemently opposed the suggestion by a popular religious personality, who had investments on a mutual fund, to get housemaids to invest in the stock market[10].

The incentive to acquire the desired knowledge and skills varies from individual to individual because they are largely driven by the degree of stakeholdings or the stakeholder’s dilemma or stakeholder’s problem[11].

Today’s information age has democratized access to information. What can be given are information relevant to attaining knowledge and skills. What can NOT be given is the knowledge that dovetails to one’s personality for the prudent management of one’s portfolio. Like entrepreneurship this involves a self-discovery process.

And most importantly, what can NOT be given are the attendant actions to fulfill the individual’s objectives.

Stock market investing is about people and their actions. That’s why this is a social phenomenon. No more, no less.

[1] See After 5,000: What’s Next for the Phisix?, March 5, 2012

[2] See New Record Highs for the Philippine Phisix; How to Deal with Tips February 20, 2012

[3] See Self-Discipline and Understanding Market Drivers as Key to Risk Management, April 12, 2012

[4] Buttonwood Hooked on junk, April 27, 2012, The Economist

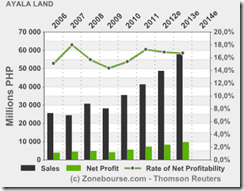

[5] See Earnings Drive Stock Prices? International Container Terminal and Ayala Land, March 6, 2012

[6] See Global Equity Market’s Inflationary Boom: Divergent Returns On Convergent Actions, February 13, 2002

[7] See Bank of Japan Adds More Stimulus, April 17, 2012

[8] Financial Times ‘Roro’ reduces trading to bets on black or red April 20, 2012

[9] Quotationspage.com Quotation Details John F. Kennedy, "A Thousand Days," by Arthur M. Schlesinger Jr [1965]., p289. Comment made by JFK in the aftermath of the failed Bay of Pigs invasion, 1961.

[10] See Should Your Housemaid Invest In The Stock Market? September 5, 2010

[11] See Knowledge Acquisition: The Importance of Information Sourcing and Quality, March 6, 2011