``This is what the phrase "lender of last resort" really means: the creation of fiat money by the central bank. It means breaking the normal rules of the fiat money game. It means bailouts.”- Gary North

A short note on Ireland financial crisis.

This from the Bloomberg[1],

European finance ministers are racing to conclude an international rescue package for Ireland before markets open to stop the country’s financial crisis from spreading to the rest of the euro region.

Prime Minister Brian Cowen’s government is finalizing a bailout agreement that may amount to 85 billion euros ($113 billion) after more than 50,000 people took to the streets of Dublin yesterday to protest budget cuts. As Ireland’s crisis spreads to Portugal and Spain, investors are looking for details on the interest rate Ireland will pay on its loans and the fate of senior bondholders in the country’s banks.

It is quite nonsensical to believe that the Euro will be sacrificed for the misguided notion that austerity will compel for its disintegration as previously argued[2]. As shown in the said article, Eurozone governments have been using market actions to justify interventionism via bailouts.

I am reminded of the institutional incentives borne out of government’s control of the monetary and banking system, as the great Professor Ludwig von Mises wrote[3], (bold emphasis mine)

But today credit expansion is an exclusive prerogative of government. As far as private banks and bankers are instrumental in issuing fiduciary media, their role is merely ancillary and concerns only technicalities. The governments alone direct the course of affairs. They have attained full supremacy in all matters concerning the size of circulation credit. While the size of the credit expansion that private banks and bankers are able to engineer on an unhampered market is strictly limited, the governments aim at the greatest possible amount of credit expansion. Credit expansion is the government's foremost tool in their struggle against the market economy. In their hands it is the magic wand designed to conjure away the scarcity of capital goods, to lower the rate of interest or to abolish it altogether, to finance lavish government spending, to expropriate the capitalists, to contrive everlasting booms, and to make-everybody prosperous.

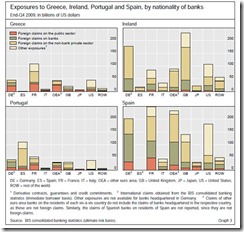

However this time we are dealing with the bailout on claims on sovereign assets, mostly for the benefit of the creditors or bondholders, which apparently are mostly held by the Euro banking system (see figure 3).

Figure 3 Bank of International Settlements: Exposures to PIIGS

According to the BIS[4], (bold highlights mine)

The integration of European bond markets after the advent of the euro has resulted in a much greater diversification of risk in the euro area. As of 31 December 2009, banks headquartered in the euro zone accounted for almost two thirds (62%) of all internationally active banks’ exposures to the residents of the euro area countries facing market pressures (Greece, Ireland, Portugal and Spain). Together, they had $727 billion of exposures to Spain, $402 billion to Ireland, $244 billion to Portugal and $206 billion to Greece.

French and German banks were particularly exposed to the residents of Greece, Ireland, Portugal, and Spain. At the end of the 2009, they had $958 billion of combined exposures ($493 billion and $465 billion, respectively) to the residents of these countries. This amounted to 61% of all reported euro area banks’ exposures to those economies.

As repeatedly argued here, redistributive policies have always been meant protect certain powerful interest groups. But they are camouflaged by the use of social welfare as cover and by the captured intelligentsia class in the provision of the technical rationalization.

Central banks, to quote Murray Rothbard[5], are ``governmentally created and sanctioned cartel device to enable the nation’s banks to inflate the money supply in a coordinated fashion, without suffering quick retribution from depositors or noteholders demanding cash. Recent researchers, however, have also highlighted the vital supporting role of the growing number of technocratic experts and academics, who were happy to lend the patina of their allegedly scientific expertise to the elite’s drive for a central bank. To achieve a regime of big government and government control, power elites cannot achieve their goal of privilege through statism without the vital legitimizing support of the supposedly disinterested experts and the professoriat. To achieve the Leviathan State, interests seeking special privilege, and intellectuals offering scholarship and ideology, must work hand in hand.”

The quote actually referred to the US Federal Reserve but can be applied universally.

Of course, the next question is how will these large scale sovereign bailouts be financed? The obvious answer by monetary inflation.

Again from Professor Rothbard[6], (bold highlights mine)

The Central Banks enjoy a monopoly on the printing of paper money, and through this money they control and encourage an inflationary fractional reserve banking system which pyramids deposits on top of a total of reserves determined by the Central Banks. Government fiat paper has replaced commodity money, and central banking has taken the place of free banking. Hence our chronic, permanent inflation problem, a problem which, if un checked, is bound to accelerate eventually into the fearful destruction of the currency known as runaway inflation.

So what we are basically seeing is a validation of the perspectives of these great Austrian economists which seem to be playing out or unfolding today in both the Euro and the US.

In short, what the mainstream mostly ignores is the political role played by the central banks on our global economy.

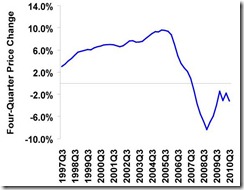

By the way, it would seem that I have been validated anew. I earlier said that the risks at the US housing markets could weigh on the balance sheets of the US banking system which has prompted the US Federal Reserve to pursue QE 2.0[7] despite tepid signs of economic recovery.

Figure 4: Federal Housing Finance Agency: Falling Home Prices

US home prices are reportedly falling anew[8].

Like in the US, inflating the monetary system have been designed to rescue the respective banking systems.

Austerity, hence, is a farce. US and European governments (and even Japan) will continue to inflate the system.

And like the US dollar, the Euro will be used as an instrument to achieve political goals but coursed through the central bank (ECB).

[1] Bloomberg, EU Ministers Meet to Find Agreement on Irish Bailout November 28, 2010

[2] See Ireland’s Woes Won’t Stop The Global Inflation Shindig, November 22, 2010

[3] Mises, Ludwig von Currency and Credit Manipulation, Chapter 31 Section 5 p.788

[4] Bank of International Settlements International banking and financial market developments BIS Quarterly Review June 2010

[5] Rothbard, Murray N The Origins of the Federal Reserve, Mises.org

[6] Rothbard, Murray N Central Banking: The Process of Bank Credit Expansion Chapter 11 Mystery of Banking p.176

[7] See The Possible Implications Of The Next Phase Of US Monetary Easing, October 17, 2010

[8] Bloomberg.com U.S. Home Prices Fell 3.2% in Third Quarter, FHFA Says, November 24, 2010