China’s richest man has a strong statement for those looking to invest: “The capital markets suck in China.”Zong Qinghou climbed his way to the top of the list of China’s wealthiest by amassing a fortune of $12.6 billion through his privately listed beverage empire Hangzhou Wahaha Group Co. On Tuesday, he made clear he didn’t gain his wealth through the country’s stock market.“When the ordinary people invest in it, the market should reward them with some benefits. But it does not,” Mr. Zong said on the sidelines of China’s annual parliamentary session, taking aim at speculators he says ruin the stock market for others. “The speculation has totally cheated ordinary investors of any benefits.”The sentiment of the billionaire, who is also an NPC representative, speaks volumes about the state of the country’s capital markets, highlighting the monumental obstacles investors face in China as they look for places to park their money in hopes of a return.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Wednesday, March 06, 2013

China’s Richest Man: Capital Markets suck in China

Thursday, January 17, 2013

Quote of the Day: The Virtues of Stock Market Speculation

But the speculator’s actions have conferred definite services to the community. He has smoothed out the jumps in Acme’s share price. By buying the undervalued stock, he has put upward pressure on the price. (Likewise, if he short sells an overvalued stock, he puts downward pressure on the price.) Rather than Acme’s stock jumping from $10 to $20 when war breaks out, it jumps only from $13 to $20, because (in our example) the speculator’s heavy buying had already closed 30% of the gap.By reducing stock price volatility, speculators take some of the risk out of holding stocks. For example, it’s not necessarily true that the person who sold early to the speculator at $11 “lost” $9 to the wily profiteer. It’s entirely possible that the person needed to sell his holdings of Acme because he had lost his job or because his kid’s tuition went up again. Thus, the speculator has actually made this person — who had planned to sell even if Acme remained at $10 — richer.More generally, by anticipating future changes in the “fundamentals” and translating them into current stock prices, speculators reward even long-term investors, the kind whom most people praise (as opposed to the short-term, quick-buck speculators). For example, if an institutional investor thinks she has found a solid company that will pay high dividends and will be around for at least 20 years, it is speculators who will help keep the day-to-day stock price from straying too far out of line with these long-term facts. If a financial panic sets in and shareholders are dumping stocks across the board, it is speculators who will staunch the bleeding and swoop in to pick up “deals” at fire-sale prices.This shows that speculators provide liquidity to the stock market and make it more lucrative for other, long-term investors to do their homework and put some of their savings into corporations they believe have a solid future. A major risk of such an investment is illiquidity — that the investor may have to sell under duress and accept a much lower price than she could get if she only had more time — but speculators mitigate this risk. If the price gets well below “what the stock is really worth,” then that’s exactly when a speculator has an incentive to swoop in and buy.

Tuesday, October 30, 2012

Quote of the Day: The Ethics of Speculation and Natural Calamities

Many of the same people who today publicly encourage us to speculate (“Make sure your family has ample supplies of batteries!”) are among the loudest critics of speculation at other times and in other markets.But in fact the oil speculator who, say, buys oil today in anticipation of oil becoming more scarce tomorrow does just what a consumer does today in a supermarket in anticipation of a disruptive storm: both persons usefully transfer resources across time. They both stock up on resources that are today relatively abundant in order to preserve these resources for consumption at a time when they are relatively more scarce (and, hence, more precious). Both persons transfer resources from today – when the consumption of any one bottle of water or gallon of gasoline provides relatively less benefit – to tomorrow when the consumption of that same bottle of water or gallon of gasoline will provide relatively more benefit.Anticipating the future and taking actions to allocate goods and services from times of relative abundance to times of relatively greater scarcity is an immensely useful activity. And we all perform such speculation whether or not we are popularly identified as “speculators.”

Monday, October 22, 2012

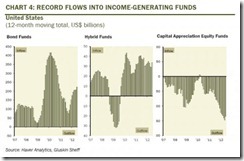

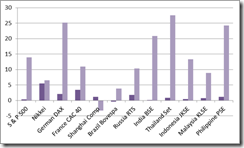

Will Frothy Bond Markets Drive the Phisix Higher?

One must be reminded that bubbles come in stages. So far the Philippines seem to be at a benign phase of the bubble cycle.Again bubbles will principally be manifested on capital intensive sectors (like real estate, mining, manufacturing) and possibly, but not necessarily, through the stock markets.This means that for as long as the US does not fall into a recession or a crisis, ASEAN outperformance, fueled by a banking credit boom and foreign fund flows operating on a carry trade dynamic or interest rate and currency arbitrages (capital flight I might add), should be expected to continue.And again I will maintain that ASEAN’s record breaking streak may be sustained at least until the end of the year 2012.

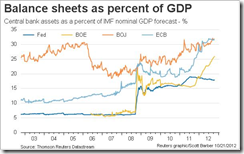

Much of the blame for this tends to be attributed to the fact that markets now move to a drumbeat of statements from politicians and central bankers, such as the head of the US Federal Reserve. “All 500 S&P companies have the same chairman and his name is Ben Bernanke,” says Jurrien Timmer of the Fidelity Global Strategies Fund.It is also true that securities within markets, as well as far-flung debt and equity markets have been trading more “in sync” with each other: the willingness of investors to take on risk being a common factor behind price moves.

Essentially, the Fed is inserting a sizeable policy wedge between market values and underlying fundamentals. And investors in virtually every market segment – including bonds, commodities, equities, foreign exchange and volatility – have benefited handsomely. In the process, many asset prices have been taken close to what would normally be regarded as bubble territory, with some already there.Central bank action, both real and perceived, rules the investment day, and will continue to do so for now. This is also the case in Europe.

Perhaps the most horrifying thing about the current combination of sales deceleration, margin contraction and high valuations is that it might not even be a sell signal. The central banks of the US and Europe may well keep investors trapped in risky assets indefinitely. Those who look at the fundamentals and flee to cash had better be patient.

Inflation, to sum up, is the increase in the volume of money and bank credit in relation to the volume of goods. It is harmful because it depreciates the value of the monetary unit, raises everybody's cost of living, imposes what is in effect a tax on the poorest (without exemptions) at as high a rate as the tax on the richest, wipes out the value of past savings, discourages future savings, redistributes wealth and income wantonly, encourages and rewards speculation and gambling at the expense of thrift and work, undermines confidence in the justice of a free enterprise system, and corrupts public and private morals.

Choose your battles wisely. After all, life isn't measured by how many times you stood up to fight. It's not winning battles that makes you happy, but it's how many times you turned away and chose to look into a better direction. Life is too short to spend it on warring. Fight only the most, most, most important ones, let the rest go.

[3] iShares.com MSCI Emerging Markets Index Fund us.iShares.com

[4] ADB, Asia Bond Monitor, Asianbondsonline.org September 2012

[5] Zero Hedge R(osenberg) & B(ernstein): Two Ex-Merrill Colleagues, Two Opposing Outlooks, One Permabull Rebuttal, October 19, 2012

[6] See How Capital Regulations Contributed to the Current Crisis December 5, 2011

[7] Wall Street Journal Japanese Banks Face Huge Rate Rise Risk, Warns BOJ, October 19, 2012

[8] Pedro Da Costa Central bank balance sheets: Battle of the bulge Reuters Blog April 12, 2012

[9] Asahi Shimbun BOJ mulls further monetary easing, October 18, 2012

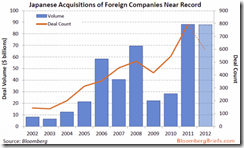

[10] Zero Hedge Forget China; Japan Is 'Taking Over' The World Again October 15, 2012

[11] Bloomberg.com Softbank’s Son Seeks to Skirt Cross-Border Failure History, October 17, 2012

[12] See Will Japan’s Investments Drive the Phisix to the 10,000 levels? March 19, 2012

[13] Dan McCrum End to ‘alpha’ spells trouble for fund managers Financial Times September 10, 2012

[14] Mohamed El Erian Beware the ‘central bank put’ bubble Financial Times, October 10, 2012

[15] Dave Glen Markets Remain Bid Despite Weakish Fundamentals September 18, 2012

[16] See US Federal Reserve Policies Re-Inflate US Property Bubble October 20, 2012

[17] Henry Hazlitt What You Should Know About Inflation p.18 Mises.org

[18] Alcorn Petroleum Re: Comment on Inquirer.net News Article PSE.com.ph October 16, 2012

[19] Business Inquirer.net Drillers settle dispute on farm-in deal August 10, 2012

[20]Business Inquirer.net Century Properties sets backdoor listing on Philippine Stock Exchange, August 18, 2012

[21] Newsflash.org BOI OKAYS REGISTRATION OF PHILWEB AS NEW I.T. FIRM January 29, 2001

[22] See FED-ECB’s Nuclear Policies: Risk ON is Back! September 17, 2012

[24] See Applying Emotional Intelligence to the Boom Bust Cycle August 21, 2011

Sunday, October 14, 2012

The Philippine SEC’s Phantasm of “Trading Gangs”

The Securities and Exchange Commission (SEC) is studying new surveillance initiatives that may see the establishment of a special division to monitor online chatter targeting so-called trading gangs, SEC Commissioner Juanita Cueto said on Thursday.Trading gangs, according to Cueto are loosely defined as short-term trader syndicates who have both the resources and numbers to drive market prices and volumes.She added that the trading rings that “play” the market are nothing new in the country or even abroad, but she noted that their influence had been growing in recent years, aided by the anonymity offered by the Internet and the influx of new and relatively inexperienced investors who may fall prey to these groups.“They have pseudo names on the Internet. The scary part is they buy and sell in unison. Some of their analyses are inaccurate and can hurt issuers,” Cueto told the BusinessMirror. “It is a concern of legitimate brokers and issuers.”She said the surveillance measures could involve closer scrutiny of Internet-based stock-market forums.

It is ultimately always the subjective value judgments of individuals that determine the formation of prices. Catallactics in conceiving the pricing process necessarily reverts to the fundamental category of action, the preference given to a over b. In view of popular errors it is expedient to emphasize that catallactics deals with the real prices as they are paid in definite transactions and not with imaginary prices. The concept of final prices is merely a mental tool for the grasp of a particular problem, the emergence of entrepreneurial profit and loss.

In the market society there are money prices. Economic calculation is calculation in terms of money prices. The various quantities of goods and services enter into this calculation with the amount of money for which they are bought and sold on the market or for which they could prospectively be bought and sold. It is a fictitious assumption that an isolated self-sufficient individual or the general manager of a socialist system, i.e., a system in which there is no market for means of production, could calculate. There is no way which could lead one from the money computation of a market economy to any kind of computation in a nonmarket system.

The concept of a "just" or "fair" price is devoid of any scientific meaning; it is a disguise for wishes, a striving for a state of affairs different from reality. Market prices are entirely determined by the value judgments of men as they really act.

This comment by a market practitioner from the same article “It could be really hard to prove wrongdoing this way,” is half correct, but has been obscured by the misleading reference of “noting how identities can be masked online”.

But whoever is ready to grant to the government this power would be inconsistent if he objected to the demand to submit the statements of churches and sects to the same examination. Freedom is indivisible. As soon as one starts to restrict it, one enters upon a decline on which it is difficult to stop. If one assigns to the government the task of making truth prevail in the advertising of perfumes and toothpaste, one cannot contest it the right to look after truth in the more important matters of religion, philosophy, and social ideology.

When government becomes involved in the enterprise of law, both the rules of conduct and the institutions for enforcement are likely to change. The primary functions of governments are to act as a mechanism to take wealth from some and transfer it to others, and to discriminate among groups on the basis of their relative power in order to determine who gains and who loses.

Inflation, to sum up, is the increase in the volume of money and bank credit in relation to the volume of goods. It is harmful because it depreciates the value of the monetary unit, raises everybody's cost of living, imposes what is in effect a tax on the poorest (without exemptions) at as high a rate as the tax on the richest, wipes out the value of past savings, discourages future savings, redistributes wealth and income wantonly, encourages and rewards speculation and gambling at the expense of thrift and work, undermines confidence in the justice of a free enterprise system, and corrupts public and private morals.

Commercial and financial crisis are intimately bound up with transactions that overstep the confines of law and morality shadowy though these confines be. The propensities to swindle and be swindled run parallel to the propensity to speculate during a boom. Crash and panic, with their motto of sauve qui peut induce still more to cheat in order to save themselves. And the signal for panic is often the revelation of some swindle, theft embezzlement or fraud

Money is the barometer of a society's virtue. When you see that trading is done, not by consent, but by compulsion--when you see that in order to produce, you need to obtain permission from men who produce nothing--when you see that money is flowing to those who deal, not in goods, but in favors--when you see that men get richer by graft and by pull than by work, and your laws don't protect you against them, but protect them against you--when you see corruption being rewarded and honesty becoming a self-sacrifice--you may know that your society is doomed. Money is so noble a medium that is does not compete with guns and it does not make terms with brutality. It will not permit a country to survive as half-property, half-loot.

Friday, May 11, 2012

David Stockman: The US Federal Reserve is Destroying the Capital Markets

David Stockman, former Republican U.S. Congressman and director of the Office of Management and Budget, founding partner of Heartland Industrial Partners and the author of The Triumph of Politics: Why Reagan's Revolution Failed and the soon-to-be released The Great Deformation: How Crony Capitalism Corrupts Free Markets and Democracy in an interview at the Gold Report has this biting message. [bold emphasis mine]

The Fed is destroying the capital market by pegging and manipulating the price of money and debt capital. Interest rates signal nothing anymore because they are zero. The yield curve signals nothing anymore because it is totally manipulated by the Fed. The very idea of "Operation Twist" is an abomination.

Capital markets are at the heart of capitalism and they are not working. Savers are being crushed when we desperately need savings. The federal government is borrowing when it is broke. Wall Street is arbitraging the Fed's monetary policy by borrowing overnight money at 10 basis points and investing it in 10-year treasuries at a yield of 200 basis points, capturing the profit and laughing all the way to the bank. The Fed has become a captive of the traders and robots on Wall Street…

I think the likely catalyst is a breakdown of the U.S. government bond market. It is the heart of the fixed income market and, therefore, the world's financial market.

Because of Fed management and interest-rate pegging, the market is artificially medicated. All of the rates and spreads are unreal. The yield curve is not market driven. Supply and demand for savings and investment, future inflation risk discounts by investors – none of these free market forces matter. The price of money is dictated by the Fed, and Wall Street merely attempts to front-run its next move.

As long as the hedge fund traders and fast-money boys believe the Fed can keep everything pegged, we may limp along. The minute they lose confidence, they will unwind their trades.

On the margin, nobody owns the Treasury bond; you rent it. Trillions of treasury paper is funded on repo: You buy $100 million (M) in Treasuries and immediately put them up as collateral for overnight borrowings of $98M. Traders can capture the spread as long as the price of the bond is stable or rising, as it has been for the last year or two. If the bond drops 2%, the spread has been wiped out.

If that happens, the massive repo structures – that is, debt owned by still more debt – will start to unwind and create a panic in the Treasury market. People will realize the emperor is naked.

Read the rest here.

Many people believe that the numerous incidences of irregularities seen in financial markets emanate from unscrupulous behavior by some market agents, little has been understood that central bank policies, together policies that cater to crony capitalism, have been incentivizing or fostering such behavioral anomalies.

And importantly, the nature of capital markets have been intensely distorted to the point where conventional wisdom of its mechanics has nearly been rendered obsolete.

Either we face up to such evolving realities or suffer from our recalcitrance to adjust when the day of reckoning arrives.

Tuesday, May 08, 2012

How US Federal Reserve Policies Stimulates the Public’s Speculative Behavior

In a book review, Douglas French, president of the Mises Institute, explains the physiological and psychological dimensions of how US Federal Reserve policies whets people’s appetite for speculation and gambling.

For the average Joe, the mere idea of making money fires the dopamine neurons in his brain, and because (crazy) people tend to herd, this leads investors to pile into the same investments at the same time, which happen to be investments that have done well in the past. Or in other words, investors gravitate en masse to investments that are overpriced. Merely watching the green arrows on CNBC stimulates dopamine.

So when the Fed hit the monetary gas in 2001, interest rates plunged and the lumpen investoriate collectively plunged into housing only to be massacred by the end of the decade. Before that, Greenspan's Fed lubricated the financial system thinking all kinds of things would go wrong at Y2K. The money sloshed into Internet stocks and investors piled in just in time to lose their shirts.

Dopamine neurons are stimulated only if the rewards exceed the expectation. If investments work as planned, even if the result is good, there will be no rush at reward. And when results are less than expected, dopamine neurons are depressed — creating immense regret.

As a real-estate developer told me in the early 2000s, "interest rates are so low, I have to do something." His brain was already feeling the dopamine tingle of anticipated profits by hearing of the lower rates. As Pavlov's dogs salivate at a bell that reliably signals food, low interest rates transformed investors into Greenspan's and now Bernanke's dogs.

Bernanke's zero-interest-rate policy has investors lunging for yield, buying junk bonds and junk houses. "The rally in junk bonds extends an advance that began in early 2009 and can be traced largely to the Federal Reserve's policy of keeping benchmark interest rates near zero," writes the Wall Street Journal's Matt Wirz. "A pretty robust cottage industry has developed and is absorbing [single family homes] at an incredibly fast pace," Richard Smith, chief executive of Realogy Corp., tells the WSJ.

To add insult to injury, Burnham points out that people are "systematically overconfident. We are bad at doing the calculations required to analyze investments, and simultaneously we are unaware of our shortcomings." And if this isn't bad enough, Burnham points out that numerous studies show that people "reveal themselves to be proud. They are willing to lose money to retain their self-esteem."

Of course this all flies in the face of the efficient-market hypothesis, which claims all market participants are rational, and therefore all news is priced into particular investments at any one time, and there is no such thing as a speculative bubble.

As he wound up his Atlanta speech, Burnham had some sobering thoughts. "Financial markets are the watering hole of society," he quipped. Like thirsty animals on the African Savannah, humans are attracted to the speculative gains that financial markets promise. But, stopping for a drink is likely hazardous to our financial health.

Incentives drives people’s actions. Yet policies plays a substantial role in influencing people’s incentives. What some see as inappropriate behavior (such as “speculation”) driven by individual character flaws, is in reality, mostly a reflection of people’s responses to such policies.

This simply shows that inflationism is immoral.

Friday, May 04, 2012

In Defense of Speculation

Riding to the defense of speculators, Terry Duffy, the executive chairman of exchange operator CME Group Inc. recently said, (hat tip Professor Mark Perry)

When the Dow goes above 13000, Google goes above $600 per share and everybody celebrates, who do you think did that? The U.S. equity market is 100% speculators

Rightly so.

Speculation happens not only when prices go up, but speculation also occurs when prices go down or stay stagnant.

As I previously wrote, Because we are uncertain of the future, all of us speculate.

Let me further quote the great Ludwig von Mises, (The Ultimate Foundation of Economic Science, p.50-51) [bold emphasis mine]

The term "speculate" was originally employed to signify any kind of meditation and forming of an opinion. Today it is employed with an opprobrious connotation to disparage those men who, in the capitalistic market economy, excel in better anticipating the future reactions of their fellow men than the average man does. The rationale of this semantic usage is to be seen in the inability of shortsighted people to notice the uncertainty of the future. These people fail to realize that all production activities aim at satisfying the most urgent future wants and that today no certainty about future conditions is available. They are not aware of the fact that there is a qualitative problem in providing for the future. In all the writings of the socialist authors there is not the slightest allusion to be found to the fact that one of the main problems of the conduct of production activities is to anticipate the future demands of the consumers.

Every action is a speculation, i.e., guided by a definite opinion concerning the uncertain conditions of the future. Even in short run activities this uncertainty prevails. Nobody can know whether some unexpected fact will not render vain all that he has provided for the next day or the next hour.

Politically controlling markets doesn’t solve the knowledge problem based on the issue of scarcity and human action or the “anticipation of the demands of the consumers”. Instead, interventions worsen them.

Proof?

Venezuela should be a vivid example the abject failure of price controls

From the New York Times

Venezuela is one of the world’s top oil producers at a time of soaring energy prices, yet shortages of staples like milk, meat and toilet paper are a chronic part of life here, often turning grocery shopping into a hit or miss proposition.

Some residents arrange their calendars around the once-a-week deliveries made to government-subsidized stores like this one, lining up before dawn to buy a single frozen chicken before the stock runs out. Or a couple of bags of flour. Or a bottle of cooking oil.

The shortages affect both the poor and the well-off, in surprising ways. A supermarket in the upscale La Castellana neighborhood recently had plenty of chicken and cheese — even quail eggs — but not a single roll of toilet paper. Only a few bags of coffee remained on a bottom shelf.

Asked where a shopper could get milk on a day when that, too, was out of stock, a manager said with sarcasm, “At Chávez’s house.”

At the heart of the debate is President Hugo Chávez’s socialist-inspired government, which imposes strict price controls that are intended to make a range of foods and other goods more affordable for the poor. They are often the very products that are the hardest to find.

“Venezuela is too rich a country to have this,” Nery Reyes, 55, a restaurant worker, said outside a government-subsidized store in the working-class Santa Rosalía neighborhood. “I’m wasting my day here standing in line to buy one chicken and some rice.”

Venezuela was long one of the most prosperous countries in the region, with sophisticated manufacturing, vibrant agriculture and strong businesses, making it hard for many residents to accept such widespread scarcities. But amid the prosperity, the gap between rich and poor was extreme, a problem that Mr. Chávez and his ministers say they are trying to eliminate.

They blame unfettered capitalism for the country’s economic ills and argue that controls are needed to keep prices in check in a country where inflation rose to 27.6 percent last year, one of the highest rates in the world. They say companies cause shortages on purpose, holding products off the market to push up prices. This month, the government required price cuts on fruit juice, toothpaste, disposable diapers and more than a dozen other products.

“We are not asking them to lose money, just that they make money in a rational way, that they don’t rob the people,” Mr. Chávez said recently.

But many economists call it a classic case of a government causing a problem rather than solving it. Prices are set so low, they say, that companies and producers cannot make a profit. So farmers grow less food, manufacturers cut back production and retailers stock less inventory. Moreover, some of the shortages are in industries, like dairy and coffee, where the government has seized private companies and is now running them, saying it is in the national interest.

Again, the knowledge problem or the failure to anticipate consumer demands in the absence of market based prices, due to suppression of capitalist speculations through political edicts, has led to shortages, black markets and worsened standard of living.

This is another classic example of how noble intentions (or feel good political biases) clashes with economic realities.

Or as an old saw goes, the path to hell is paved with good intentions.

![clip_image001[4] clip_image001[4]](http://lh5.ggpht.com/-URMowWYTGvc/UIQianY-oYI/AAAAAAAAOkw/OsAoLgyhtKU/clip_image001%25255B4%25255D_thumb.png?imgmax=800)

![clip_image002[4] clip_image002[4]](http://lh6.ggpht.com/-uwQ0U_YkIuI/UIQieI7Z3EI/AAAAAAAAOk8/3XlHgvhZxzM/clip_image002%25255B4%25255D_thumb.png?imgmax=800)

![clip_image004[4] clip_image004[4]](http://lh3.ggpht.com/-b6Uy3jMV-lY/UIQigmwosmI/AAAAAAAAOlQ/yEsy9aQWMms/clip_image004%25255B4%25255D_thumb.jpg?imgmax=800)

![clip_image005[4] clip_image005[4]](http://lh4.ggpht.com/-t6ofUXj-BEQ/UIQijCOjD7I/AAAAAAAAOlg/-yhwblFr-ZI/clip_image005%25255B4%25255D_thumb.png?imgmax=800)

![clip_image007[4] clip_image007[4]](http://lh6.ggpht.com/-V8j1YwTcv2o/UIQil2l-nVI/AAAAAAAAOls/hFJh1o4cGEk/clip_image007%25255B4%25255D_thumb.png?imgmax=800)