The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Saturday, April 09, 2016

Friday, September 16, 2011

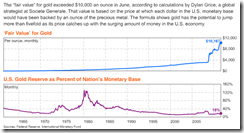

Bloomberg Chart: Gold Prices Headed for $10,000 an ounce?

The Bloomberg chart of the day features Societe Generale’s Dylan Grice assessment that Gold prices could reach $10k.

From Bloomberg, (hat tip Lew Rockwell blog)

Gold has the potential to jump more than fivefold as the precious metal’s price catches up with the surging amount of money in the U.S. economy, according to Dylan Grice, a global strategist at Societe Generale SA.

The CHART OF THE DAY shows the price at which each U.S. dollar in the monetary base, compiled by the Federal Reserve, would have been backed by an ounce of gold for the past half century. International Monetary Fund data on the country’s gold reserves were used in the calculation.

Grice, based in London, identified this price as the metal’s “fair value” yesterday in a report. Since June, it has exceeded $10,000 an ounce, as depicted in the chart’s top panel. Gold for immediate delivery closed at $1,819.63 an ounce on the spot market yesterday.

The bottom panel tracks the value of U.S. gold holdings, based on the spot price, as a percentage of the monetary base for the 50-year period. August’s proportion was 18 percent of the $2.66 trillion in the economy. The latter figure was more than triple the amount three years earlier, reflecting efforts by the Fed to spur economic growth.

I agree that $10k could indeed be a target or even possibly more. Austrian economist Bob Wenzel says $25k could be a possibility.

These, of course, will ultimately depend on the actions or reactions of global political authorities towards the imploding political institutions based on the troika of welfare-warfare state, central bank and the banking cartel system.

The $64 trillion question is “To what degree are they willing to debauch today’s paper money system?” The answer to this is likely the scale of where the level of gold prices will be + potential excesses from market irrationality (bandwagon effect).

For the meantime, low interest rates and modest inflation numbers (both markets which authorities have materially intervened) have been giving officials the leeway to pump up on inflationism.

So in my view, I’ll take it one step at a time, $2k first, then every additional $500 thereafter, where I would assess the reactions of the political leaders on the unfolding state of affairs.

Thursday, June 02, 2011

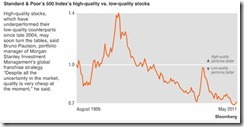

Chart of the Day: Earnings Don’t Drive Stock Prices

I’ve been arguing since that earnings have hardly been the principal drivers of stock prices.

Today’s Bloomberg’s chart of the day appears to bolster my case. And this time such dynamic applies to the S&P 500

Here’s a passage from the Bloomberg article,

Stocks with the most reliable earnings are underperforming those with the least predictable results by the most since at least 1997 and may soon start to outperform, Morgan Stanley Investment Management said.

The CHART OF THE DAY compares the performance of so-called high-quality companies on the Standard & Poor’s 500 Index with low-quality businesses. S&P awards all equities a quality rating based on the sustainability and robustness of both their earnings and their balance sheets.

“Despite all the uncertainty in the market, quality is very cheap at the moment,” said Bruno Paulson, the portfolio manager of MSIM’s global franchise strategy, which has $6.3 billion under management, in London. “It’s not unreasonable to expect some re-rating from here. I don’t know what will trigger it; it might be the end of liquidity.”

So the quoted expert partly attributes ‘liquidity’ to this phenomenon but sounds rather tentative. I would suggest that this represents the mainstream view (again I am applying representative bias here) where the mainstream don’t get it.

Inflationism has been the main culprit. Flooding the world with too much money leads to speculative excess. This amounts to the bidding up of prices of low quality stocks more than the high quality counterparts. When people chase prices, rumor based plays are rife and earnings become a side story.

I would like to reiterate Austrian economist Fritz Machlup’s dictum (bold highlights mine)

If it were not for the elasticity of bank credit, which has often been regarded as such a good thing, a boom in security values could not last for any length of time. In the absence of inflationary credit the funds available for lending to the public for security purchases would soon be exhausted, since even a large supply is ultimately limited. The supply of funds derived solely from current new savings and amortization current amortization allowances is fairly inelastic, and optimism about the development of security prices, inelastic would promptly lead to a "tightening" on the credit market, and the cessation of speculation "for the rise." There would thus be no chains of speculative transactions and the limited amount of credit available would pass into production without delay.

Each day that passes, evidences seem to emerge in favor our views.

Friday, July 16, 2010

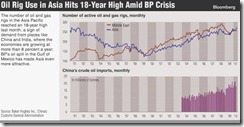

Oil Drilling Activities Shift To Asia

This should be an interesting development in the oil frontier.

The BP oil spill and the attendant political squabble over the drilling moratorium sanctioned by the Obama administration but contravened by the Federal Courts have prompted oil rigs and or drilling activities to shift to Asia.

According to Bloomberg’s chart of the day,

The CHART OF THE DAY shows monthly totals in the Middle East and Asia Pacific, with the 271 rigs deployed on and and sea in Asia, the most since December 1991, according to data compiled by Bloomberg from Baker Hughes Inc. The lower panel tracks China’s crude imports since December 2003.

“Asia is looking more and more attractive because of a rush for natural gas,” said Tony Regan, a consultant in Singapore with Tri-Zen International Ltd. “Oil companies are wary about the Gulf of Mexico after the drilling ban, and the Atlantic basin doesn’t look good because of lower gas prices.”

Explorers deployed 14 percent more rigs in Asia in June, compared with January last year as China, India, Australia and Indonesia opened up areas. China and India are seeking fuel for economies growing at more than 8 percent a year. The almost doubling of crude prices since January 2009 has also spurred the quest for oil and gas, said Regan, a former executive at Royal Dutch Shell Plc.

Reliance Industries Ltd. discovered India’s biggest gas field in 2002, and LNG projects in Australia valued at more than A$80 billion ($71 billion) are scheduled for final investment decisions in 2010, according to Goldman Sachs Group Inc. in February. The A$43 billion Gorgon LNG project was approved last year by partners Chevron Corp., Exxon Mobil Corp. and Shell.

Asia’s oil-demand growth has risen 27 percent since 1999, compared with a 2 percent decline for North America and Europe, according to data from BP. Oil-product demand in Asia’s emerging-market nations will rise by about 3.8 percent a year on average to 23 million barrels a day in 2015, the International Energy Agency said in a report. The number of rigs in the Gulf of Mexico plunged to the lowest level in 16 years last week, Baker Hughes, a Houston-based oilfield-services firm, said last month.

Some thoughts:

This is an example where the cost of interventionism means a redirection of the use of resources to where it is more “valued”.

Nevertheless what has been “lost” for the US should translate to “gains” for Asia.

From BBC

Although Asia isn’t much of a big player in terms of oil and conventional gas reserves, Asia is the largest in terms of unconventional gas as previously discussed.

The other implication is that more drilling activities should bring life to the stocks of Asian oil-gas exploration companies.

Thursday, June 10, 2010

Bloomberg Poll: BRIC Lose Out To US As Top Investment Choice

.bmp)

Thursday, November 26, 2009

Graphic: Booming Bond Market In Europe

From Bloomberg Chart of the Day,

``European companies are turning to credit markets after losses stemming from the financial crisis left banks reluctant to lend, cutting off corporations from their primary source of financing, according to UBS AG.

``The CHART OF THE DAY shows the level of corporate bonds in the credit market, in blue, has risen 12 percent over the past year, and bank loans, in yellow, have fallen to the lowest in 13 months. While the euro-region economy returned to growth in the third quarter, banks may remain reluctant to lend for some time, boosting bond issuance further, said Stephane Deo, UBS chief European economist in London.

“One of the key reasons why banks remain cautious about lending are future economic prospects,” Deo said. “New debt now comes disproportionately from markets. This is a very unusual pattern.”

``In the euro area, bank lending accounts for about 70 percent of corporate financing compared with 20 percent in the U.S., according to the European Central Bank. Banks started tightening credit standards in the third quarter of 2007 as a result of the financial crisis, according to ECB statistics.

“Companies that have access to the credit market are better off compared to those that have no access,” Deo said."

Let me add- perhaps the proceeds from global QE programs have been helping boost the liquidity in the system in support of these record bond issuance.

This also implies that a cut in QE would probably negatively impact on the bond markets unless lending from the banking system recovers.

Friday, October 09, 2009

Canada's Banks Outperform

This from Bloomberg, (bold highlights mine) ``The CHART OF THE DAY shows bank stocks in Canada’s Standard & Poor’s/TSX Composite Index have recouped almost all of their losses since Aug. 8, 2007, the day before credit markets began seizing up. The nine stocks in the bank index trade at 91 percent of their level on that day, rebounding from a six-year low on Feb. 23. That compares with 53 percent for the MSCI World Bank Index and 35 percent for the S&P 500 Banks Index.

``“It’s easier to be comfortable in the banking sector in Canada, because while they all have different strategies, they are all relatively conservative,” said Todd Johnson, who helps manage C$125 million ($115 million) at BCV Asset Management in Winnipeg.

``Canada has the soundest banking system of the 133 countries surveyed in the Global Competitiveness Report of the World Economic Forum, which runs the Davos meetings of world leaders. The U.S. ranks 108th. No Canadian bank has failed since the early 1990s, and none of Canada’s 21 domestic banks has asked for a government bailout.

``Royal Bank of Canada, the country’s largest lender, surpassed its August 2007 stock price on Aug. 27, and last week reached the highest price since July 2007. National Bank of Canada, the nation’s sixth-biggest bank, only needs to rise 1.3 percent to reach its Aug. 8, 2007, level. National Bank has surged 88 percent in 2009, the most among lenders in the S&P/TSX and S&P 500."

Aside from liquidity issues, sound banking have been rewarded by the market.

Wednesday, July 01, 2009

Global Financial Industry: More Upside Ahead?

We quote Mr. Wilson, (all bold emphasis mine)

``Financial stocks are poised to keep rising worldwide after posting this quarter’s best performance, according to Jeffrey Palma, a global strategist at UBS AG.

``The industry stands to benefit from “a much improved backdrop,” Palma wrote yesterday in a report. He recommended that investors increase their percentage of assets in financials to a “modest overweight” relative to benchmark indexes. They had been “neutral.”

``As the CHART OF THE DAY shows, financials are headed for the second quarter’s biggest gain among the 10 main industry groups in the MSCI World Index. They last set the pace in the second quarter of 2003, according to data compiled by Bloomberg. The chart has the MSCI World Financial Index's quarterly rankings and percentage moves during the past six years, including this quarter’s gain through yesterday.

``Relatively steep yield curves globally will help financial companies lift earnings, Palma wrote. The gap between yields on two-year and 10-year U.S. Treasury notes reached 2.76 percentage points, a record, on May 27. Falling loan-loss provisions and rising asset values, including share prices, may also lead to higher profits, the report said.

``There is still room for profitability to recover” even if the industry’s return on equity stays well below its 16 percent in 2007, Palma wrote. He favors banks in Australia, Canada and emerging markets.

``Financials amount to 20 percent of the MSCI World Index’s value, more than any other industry group, according to data compiled by Bloomberg."

My Comment:

All financials aren't cut from the same cloth. My impression is that the financials in the bubble bust afflicted economies (such as in the US or UK) may seem like landmines that could be triggered by a wrong move. Such risk remains until the issue of toxic assets in the industry's balance sheets are resolved.

Although I do share the enthusiasm for emerging markets and Asian financials, primarily on the steepening yield curve dynamics as previously discussed in Steepening Global Yield Curve Reflects Thriving Bubble Cycle, which should augment profitability, enhance lending and induce more risk taking.

However, cyclical weakness could be in the short term horizon given the bearish head and shoulders formation as seen below.

But for as long as the dynamics of liquidity and wide spreads across yield curve persists, we should use this dips as buying windows.

In essence it is all a matter of time horizon, possibly short term weakness with strenght going into the medium to the longer term.