And people today think that doing the same stuff like the Romans did would have a different repercussion.The Money Project is an ongoing collaboration between Visual Capitalist and Texas Precious Metals that seeks to use intuitive visualizations to explore the origins, nature, and use of money.At its peak, the Roman Empire held up to 130 million people over a span of 1.5 million square miles.Rome had conquered much of the known world. The Empire built 50,000 miles of roads, as well as many aqueducts, amphitheatres, and other works that are still in use today.Our alphabet, calendar, languages, literature, and architecture borrow much from the Romans. Even concepts of Roman justice still stand tall, such as being “innocent until proven guilty”.How could such a powerful empire collapse?The Roman EconomyTrade was vital to Rome. It was trade that allowed a wide variety of goods to be imported into its borders: beef, grains, glassware, iron, lead, leather, marble, olive oil, perfumes, purple dye, silk, silver, spices, timber, tin and wine.Trade generated vast wealth for the citizens of Rome. However, the city of Rome itself had only 1 million people, and costs kept rising as the empire became larger.Administrative, logistical, and military costs kept adding up, and the Empire found creative new ways to pay for things.Along with other factors, this led to hyperinflation, a fractured economy, localization of trade, heavy taxes, and a financial crisis that crippled Rome.Roman DebasementThe major silver coin used during the first 220 years of the empire was the denarius.This coin, between the size of a modern nickel and dime, was worth approximately a day’s wages for a skilled laborer or craftsman. During the first days of the Empire, these coins were of high purity, holding about 4.5 grams of pure silver.However, with a finite supply of silver and gold entering the empire, Roman spending was limited by the amount of denarii that could be minted.This made financing the pet-projects of emperors challenging. How was the newest war, thermae, palace, or circus to be paid for?Roman officials found a way to work around this. By decreasing the purity of their coinage, they were able to make more “silver” coins with the same face value. With more coins in circulation, the government could spend more. And so, the content of silver dropped over the years.By the time of Marcus Aurelius, the denarius was only about 75% silver. Caracalla tried a different method of debasement. He introduced the “double denarius”, which was worth 2x the denarius in face value. However, it had only the weight of 1.5 denarii. By the time of Gallienus, the coins had barely 5% silver. Each coin was a bronze core with a thin coating of silver. The shine quickly wore off to reveal the poor quality underneath.The ConsequencesThe real effects of debasement took time to materialize.Adding more coins of poorer quality into circulation did not help increase prosperity – it just transferred wealth away from the people, and it meant that more coins were needed to pay for goods and services.At times, there was runaway inflation in the empire. For example, soldiers demanded far higher wages as the quality of coins diminished.“Nobody should have any money but I, so that I may bestow it upon the soldiers.” – Caracalla, who raised soldiers pay by 50% near 210 AD.By 265 AD, when there was only 0.5% silver left in a denarius, prices skyrocketed 1,000% across the Roman Empire. Only barbarian mercenaries were to be paid in gold.The EffectsWith soaring logistical and admin costs and no precious metals left to plunder from enemies, the Romans levied more and more taxes against the people to sustain the Empire.Hyperinflation, soaring taxes, and worthless money created a trifecta that dissolved much of Rome’s trade. The economy was paralyzed.By the end of the 3rd century, any trade that was left was mostly local, using inefficient barter methods instead of any meaningful medium of exchange.The CollapseDuring the crisis of the 3rd century (235-284 A.D), there may have been more than 50 emperors. Most of these were murdered, assassinated, or killed in battle.The empire was in a free-for-all, and it split into three separate states.Constant civil wars meant the Empire’s borders were vulnerable. Trade networks were disintegrated and such activities became too dangerous.Barbarian invasions came in from every direction. Plague was rampant.And so the Western Roman Empire would cease to exist by 476 A.D.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Friday, February 19, 2016

Infographics: How Inflationism Led to the Collapse of the Roman Empire

Thursday, February 21, 2013

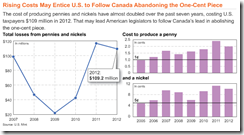

The War on Coins

Pennies and nickels have cost more than their face value to mint since 2006, resulting in a loss of at least $436 million to U.S. taxpayers.The CHART OF THE DAY shows that in 2012, the penny cost almost 2 cents to make and the nickel more than 10 cents, according to the U.S. Mint’s annual report released in January. Those prices have almost doubled over the past seven years.“If you look around in the budget, there aren’t a lot of places you can find savings where you don’t cut a program and you don’t raise anybody’s taxes and you can impact the deficit,” said Jim Kolbe, a former Arizona congressman who sponsored legislation to abolish the penny and dollar bill. “This is one where you can do that.”Neither of Kolbe’s bills, introduced in 2001 and 2006, made it to a full congressional vote.

Mintage has long been a prerogative of the rulers of the country. However, this government activity had originally no objective other than the stamping and certifying of weights and measures. The authority's stamp placed upon a piece of metal was supposed to certify its weight and fineness. When later princes resorted to substituting baser and cheaper metals for a part of the precious metals while retaining the customary face and name of the coins, they did it furtively and in full awareness of the fact that they were engaged in a fraudulent attempt to cheat the public. As soon as people found out these artifices, the debased coins were dealt with at a discount as against the old better ones. The governments reacted by resorting to compulsion and coercion. They made it illegal to discriminate in trade and in the settlement of deferred payments between "good" money and "bad" money and decreed maximum prices in terms of "bad" money. However, the result obtained was not that which the governments aimed at. Their decrees failed to stop the process which adjusted commodity prices (in terms of the debased currency) to the actual state of the money relation. Moreover, the effects appeared which Gresham's law describes.

Friday, November 30, 2012

Inflation’s Toll: Canada Goes ‘Penniless’

The federal budget is guaranteed to leave Canadians penniless — literally.Among the victims of cutbacks outlined by Finance Minister Jim Flaherty in the government's 2012 federal budget on Thursday is Canada's one-cent coin.Citing low purchasing power and rising production costs, the government has decided to phase the penny out of existence starting this fall, when the Royal Canadian Mint will stop distributing the one-cent coin to financial institutions.Over time, that will lead to the penny effectively becoming extinct, although the government noted on Thursday that one-cent coins will always be accepted in cash transactions for as long as people still hold on to them.The value of the penny has decreased to about 1/20th of its original purchasing power. Indeed, the lowly penny has fallen so far that Ottawa described it as a "burden to the economy" in a pamphlet explaining the change on Thursday.In part because of rising prices for the metals it's made of, it actually costs 1.6 cents to produce every penny. The government estimates it loses $11 million a year producing and distributing the penny, and that doesn't include the costs and frustrations for businesses and consumers that use them in transactions.

Monday, October 08, 2012

In 1792, Coin Debasement was Punishable by Death

And be it further enacted, That if any of the gold or silver coins which shall be struck or coined at the said mint shall be debased or made worse as to the proportion of the fine gold or fine silver therein contained, or shall be of less weight or value than the same out to be pursuant to the directions of this act, through the default or with the connivance of any of the officers or persons who shall be employed at the said mint, for the purpose of profit or gain, or otherwise with a fraudulent intent, and if any of the said officers or persons shall embezzle any of the metals which shall at any time be committed to their charge for the purpose of being coined, or any of the coins which shall be struck or coined at the said mint, every such officer or person who shall commit any or either of the said offenses, shall be deemed guilty of felony, and shall suffer death

Thursday, August 09, 2012

In Zimbabwe, Coin Shortages can mean Life or Death

The scars from the ravages of Zimbabwe’s recent episode of hyperinflation has been evident through the effects of coin shortages.

From the AFP

Shouting matches and even physical fights break out each time a mini-bus pulls up in downtown Harare as passengers battle to ensure they are not short-changed in coin-starved Zimbabwe.

Hyperinflation forced Zimbabwe to trash its worthless local currency three years ago in a move that brought much needed relief to the crippled economy but created a surprising new headache: a lack of coins.

"Change is a big problem, and at the same time passengers are impatient with us. I have been slapped a few times for not having change for them," said a bus conductor Walter Chakawata.

The US dollar and the rand from neighbouring South Africa are Zimbabwe's main adopted currencies. The dollar, however, is preferred and all prices are pegged to it.

But there is not enough US small change in circulation. The result is that prices are either rounded off -- making goods and services more expensive -- or customers brace themselves for a fight to get their change.

The average city commute costs 50 cents. But the dearth of coins means passengers -- handing over bills -- are always owed change. Some bus drivers pair the passengers, handing them a dollar bill in change and leaving the two riders to sort the rest out themselves.

Often their only alternative is to buy an item worth a dollar that they can then share -- a packet of cookies, a pie or anything they agree to.

But that has not gone down well with many, who feel obliged to make an unnecessary purchase. Others complain it forces them to spend time with a total stranger. Or what if one is in a hurry? And in a country where many live on less than $2 a day, 50 cents still remains a decent sum, not to be wasted.

The fights have at times turned deadly. Last year, independent papers reported that a state security agent pulled out a pistol and shot dead a bus conductor after he failed to give him change.

Markets don’t operate on a vacuum however. From the same article…

Not all merchants buy coins, however. Ice-cream and yoghurt vendor Locadia Chimimba conceded that "the situation is better these days because you can buy change if you want" but she herself does not and still asks customers to buy more to make up the difference.

In supermarkets, when the grocery bill does not add up neatly to a round figure shoppers are offered sweets, match boxes, chewing gum and even condoms to compensate.

So markets grope to find a substitute on such coin shortages. This should mark a transition phase.

But why the coin shortages?

Authorities considered importing US coins but the idea was dropped when shipping costs proved too expensive -- costing two dollars for a batch of coins worth one dollar, experts said.

Bottom line:

People’s psychology and behavior are materially influenced by changes in monetary conditions.

Monetary disorders spawns disruptions in the division of labor which incites violence.

Coins function as insurance against the corruption of money. This is why some of the political authorities have considered a ban on coin collection.

Sunday, July 29, 2012

Even Olympic Medals have been “Debased”

While I am a fan of sports, I am not a fan of the Olympics.

Olympics, for me, represents the politicization of sports premised on feel good nationalism, which are largely financed by massive expenditures of taxpayer money.

The economics of Olympics suggests that the popular games, except for some instances (e.g. LA Olympics), have incurred losses for the hosts. At worst, financial losses extrapolated to higher taxes.

Professor David Henderson notes of the Canadian experience,

That view is understandable because losing money has been the norm. When the Olympics were held in Montreal in 1976, for example, the loss amounted to $2 billion, which was $700 per Montreal resident. And remember that that was in 1976 dollars. That loss resulted in a special tax on tobacco because, you know, smokers are such fans of the Olympics.

And proof of the politicization of sports via the Olympics can be further seen through the medallions for the winners—where the content of the London 2012 medals has been materially debased or devalued.

Image from BBC.

The Zero Hedge points out (bold original)

As every Olympic athlete knows, size matters. The London 2012 medals are the largest ever in terms of both weight and diameter - almost double the medals from Beijing. However, just as equally well-known is that quality beats quantity and that is where the current global austerity, coin-clipping, devaluation-fest begins. The 2012 gold is 92.5 percent silver, 6.16 copper and... 1.34 percent gold, with IOC rules specifying that it must contain 550 grams of high-quality silver and a whopping 6 grams of gold. The resulting medallion is worth about $500. For the silver medal, the gold is replaced with more copper, for a $260 bill of materials. The bronze medal is 97 percent copper, 2.5 percent zinc and 0.5 percent tin. Valued at about $3, you might be able to trade one for a bag of chips in Olympic park if you skip the fish.

The devaluation of the Olympic medals just exhibits the natural or deep-seated impulse of governments to inflate, as well as, to break their own established rules or standards—sports or no sports.

Wednesday, April 18, 2012

Ron Paul’s Message: Hoard Coins

In a statement to the subcommittee on Domestic Monetary Policy Hearing on "The Future of Money: Coin Production," April 17, 2012, Congressman Ron Paul writes, (lewrockwell.com) [bold highlights mine]

There is an old German saying that goes, "whoever does not respect the penny is not worthy of the dollar." It expresses the sense that those who neglect or ignore the small things cannot be trusted with larger things, and fittingly describes the problems facing both the dollar and our nation today. For nearly a century monetary policy has been delegated to the Federal Reserve System. Congress has ignored the importance of monetary policy and relegated monetary oversight to the sidelines, considering it less important than such matters as welfare spending, warfare spending, and who to tax and how much they should be taxed. While Congress has dithered, the Federal Reserve has destroyed the value of the dollar, so much so that the metal value of our already much-debased token coinage now exceeds its face value

The cost to mint pennies and nickels is alleged to be more than double their face value, so that the Mint loses tens of millions of dollars every year by placing them into circulation. Inflation continues to erode the purchasing power of the penny and nickel, so that many consumers find it aggravating and time-consuming to fish around for small change. But changing the composition of the penny and nickel to steel fails to address the root cause behind currency debasement. It also fails to provide a viable solution both for the devalued dollar and for our circulating coinage.

If Congress were truly interested in the cost of coinage, it would begin by reining in and eventually abolishing the Federal Reserve System. The Fed alone is responsible for the devaluation of the dollar. The problem with the penny and nickel is not that the price of copper and nickel are rising, but that the purchasing power of the dollar is declining due to the Fed's currency debasement. The same pattern has been seen throughout history, as debased currency results in the value of the metal content of coins outstripping their face value. Coins disappear from circulation and only paper money circulates. Finally, the currency collapses. Coins will begin to reappear once the monetary unit is restabilized, usually with the introduction of an entirely new currency and after much economic hardship for the people.

Read the rest here.

The bottom line is that governments around the world will continue with rampant policies of inflationism through their respective central banks. And given the metallic content of coins in circulation, coins will serve as insurance against devalued money and will be hoarded by the public as the symptoms of inflationism deepens.

I have noted of this Gresham’s Law on my earlier post.

Nevertheless here is the breakdown of the metallic content of Philippine coins in circulation.

From Wikipedia.org

Perhaps we should start to hoard coins too. Thanks for the reminder, Congressman Paul.

Tuesday, April 17, 2012

Lessons from the Roman Era Devaluations

Writes Simon Black at the Sovereign Man

In his 1958 work State and Currency in the Roman Empire to 300 A.D., Sture Bolin outlines the systematic (and almost constant) debasement of the silver denarius coin of ancient Rome, which I have reproduced below:

Subsequent emperors became even more clever at debasing the currency; Caracalla (reign 211-217 AD) created a new coin, the Antoninianus, which had a face value far greater than its weight and metal content.

Under Gallienus (reign 260-268 AD), the Antoninianus was composed of less than 5% silver. By the time of Aurelian in 270 AD, further debasement was essentially impossible… though they kept trying.

Such debasement led to rampant inflation in the empire. A slave under the reign of Commodus that cost 500 denarii was five times as expensive under Septimius Severus. A second century modius of wheat (about 1/4 bushel) sold for 1/2 denarius. By the time of Diocletian’s price fixing in 301 AD, the nominal price was 200 times more expensive.

In Roman Egypt, where the best documentation on pricing has survived, a measure of wheat which sold for 200 drachmae in 276 AD increased to more than 2,000,000 drachmae in 334 AD, roughly 1,000,000% inflation in a span of 58-years.

In his 1960 work Roman Coins, historian Harold Mattingly remarked about Roman inflation that “[t]he Empire had, in all but words, declared itself bankrupt and thrown the burden of its insolvency on the citizens.”

Other historical examples abound, but Mattingly’s assessment sums it up the best.

Any government that resorts to debasing the currency is making a conscious decision to stick the people with the consequences of its insolvency.

The short of this is one of the history or the cycles of inflationism and financial repression, where political authorities repeatedly transferred the burden of their policy mistakes to their subjects. Put bluntly, politicians plundered the resources of their constituents through inflationism and financial repression to pay for their profligate ways. All of them, ex-post eventually, failed.

Today’s “unprecedented” pace of inflationism via the massive expansion of the balance sheets by global central bankers has been no different than the eon of the doomed Roman empire. The principle has been the same, but the application has been different.

In Roman times, inflationism had been about coin debasements, today’s inflationism has been coursed through central banking mostly based on digital computer keyboard inputs.

Remember, world governments today have fervently been attempting to put a rein on cash transactions from which they intend to gain wider control and greater access to the resources of the private sector—for the same intent as their Roman era peers.

History does not repeat itself, said Mark Twain, but it does rhyme. Alternatively, those who cannot remember the past, warned George Santayana, are condemned to repeat it.

The rhyme of condemnations beckons.

Thursday, March 29, 2012

US Treasury to Debase Coins

So policies of inflationism will not be restricted to the US Federal Reserve. The US Treasury as producer and minter of coins, proposes to join the FED by resorting to an age old trick of clipping or shaving the contents of the coin—or debasement—in the pretext of budgetary savings.

Here is the Wall Street Journal Blog (bold emphasis mine)

Geithner, in written testimony prepared for the House Committee on Appropriations, said a good portion of next year’s savings at Treasury will come from changing the composition of U.S. coins to more cost-effective materials.

“Currently, the costs of making the penny and the nickel are more than twice the face value of each of those coins,” Geithner said in his remarks.

The cost of making pennies and nickels are about twice the face value of the coins–2.4 cents for a penny and 11.2 cents for a nickel, the Treasury Department said earlier this month. Rising commodity prices have driven higher production costs. The Mint said it used 16,365 tons of copper, 2,311 tons of nickel and 11,844 tons of zinc to produce all coins in fiscal year 2011.

Changing the makeup of coins and improving the efficiency of currency production will save more than $75 million in the next fiscal year. In addition, the suspension of presidential dollar coin production, announced in December, will save another $50 million.

In reality, debasement is currency devaluation or inflationism, albeit in an archaic sense.

The great Professor Ludwig von Mises wrote (highlights mine)

Mintage has long been a prerogative of the rulers of the country. However, this government activity had originally no objective other than the stamping and certifying of weights and measures. The authority's stamp placed upon a piece of metal was supposed to certify its weight and fineness. When later princes resorted to substituting baser and cheaper metals for a part of the precious metals while retaining the customary face and name of the coins, they did it furtively and in full awareness of the fact that they were engaged in a fraudulent attempt to cheat the public. As soon as people found out these artifices, the debased coins were dealt with at a discount as against the old better ones. The governments reacted by resorting to compulsion and coercion. They made it illegal to discriminate in trade and in the settlement of deferred payments between "good" money and "bad" money and decreed maximum prices in terms of "bad" money. However, the result obtained was not that which the governments aimed at. Their decrees failed to stop the process which adjusted commodity prices (in terms of the debased currency) to the actual state of the money relation. Moreover, the effects appeared which Gresham's law describes.

Here is a visual of coins and currency in circulation in the US…

you can see the original graphics here, although the chart has been based on 2009 data.

My further comments:

Compared to the past where debasement of coins had been conducted surreptitiously by kings, the US Treasury like the Federal Reserve, has been, and will be doing this unreservedly.

As one would observe, whether the US Federal Reserve or the US Treasury, inflationism has been inherent to the actions of political agents

The public will hoard current coins which will spontaneously vanish from circulation as new debased coins will circulate. This is the Gresham’s Law at work.

As testament, hedge fund manager Kyle Bass has reportedly accumulated $1 million dollars worth of 20 million (5 cent coins) nickels.

More people will be looking for old coins as alternative path to preserve wealth. This comes amidst political actions to redistribute wealth for the benefit of politicians and at the expense of the public via rampant inflationism.