Last night I questioned the premises of a sustained divergence or potential decoupling by the Philippine Phisix, as propounded by some stock market Pollyannas.

I guess the proverbial ink has barely dried but the answer had already been provided.

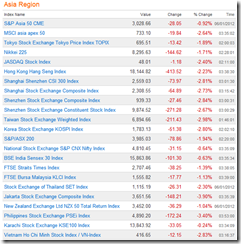

As of this writing the bloodbath has practically engulfed the region as ALL benchmarks have been in the red. Table above from Bloomberg.

I would especially note of the clobbering of China’s stock markets which represents a very negative sign.

Chart from technistock.com

And in sharp contrast to last Thursday, the Philippine Phisix closed at the weakest point of the trading session down by a horrific 3.4%

I was expecting the systematic aggressive buyers of Thursday, whom I suspect as non-market participants, to bid up the market anew. But it appears that either they were absent or that the selloff was simply too strong to contain. The Philippine equity market just kept collapsing from the opening bell until the end of the session.

And if these price insensitive buyers had been absent, it must be that they have exhausted their resources or that they have come to realize of the futility of trying to prop up markets, perhaps for political goals.

Nevertheless, the today’s market actions suggests of marked losses suffered by those parties attempting to embellish the Phisix.

Today’s action was lopsidedly in favor of the bears as market breadth and sectoral performances hemorrhaged profusely.

I don’t have access yet to the quotation page so my comments will limited to this.

Nevertheless, I previously warned.

Today’s big surge could be tomorrow’s slump. There has been NO clarity yet on geopolitics (China, EU or the US) and of policy directions mostly by central bankers. This is a period characterized by high uncertainty.

Be very careful out there.

For the Phisix, the gains of the last TWO weeks had shockingly been wiped out in a SINGLE day! Today had been a wretched sight not only for the Phisix but for the rest of Asia.

There will likely be more bad days ahead where we should expect, as I have been saying, “more period of intense volatility on both directions but with a downside bias”

Again, be very careful out there.