Part 2 comingThe Great Depression was the most severe economic depression ever experienced by the Western world.It was during this troubled time that the world’s most famous case of deflation also happened. The resulting aftermath was so bad that economic policy since has been chiefly designed to prevent deflation at all costs.Setting the StageThe transition from wartime to peacetime created a bumpy economic road after World War I.Growth has hard to come by in the first years after the war, and by 1920-21 the economy fell into a brief deflationary depression. Prices dropped -18%, and unemployment jumped up to 11.7% in 1921.However, the troubles wouldn’t last. During the “Roaring Twenties”, economic growth picked up as the new technologies like the automobile, household appliances, and other mass-produced products led to a vibrant consumer culture and growth in the economy.More than half of the automobiles in the nation were sold on credit by the end of the 1920s. Consumer debt more than doubled during the decade.While GDP growth during this period was extremely strong, the Roaring Twenties also had a dark side. Income inequality during this era was the highest in American history. By 1929, the income of the top 1% had increased by 75%. Income for the rest of people (99%) increased by only 9%.The Roaring Twenties ended with a bang. On Black Thursday (Oct 24, 1929), the Dow Jones Industrial Average plunged 11% at the open in very heavy volume, precipitating the Wall Street crash of 1929 and the subsequent Great Depression of the 1930s.The Cause of the Great DepressionEconomists continue to debate to this day on the cause of the Great Depression. Here’s perspectives from three different economic schools:Keynesian:John Maynard Keynes saw the causes of the Great Depression hinge upon a lack of aggregate demand. This later became the subject of his most influential work, The General Theory of Employment, Interest, and Money, which was published in 1936.Keynes argued that the solution was to stimulate the economy through some combination of two approaches:1. A reduction in interest rates (monetary policy), and2. Government investment in infrastructure (fiscal policy).“The difficulty lies not so much in developing new ideas as in escaping from old ones.” – John Maynard KeynesMonetarist:Monetarists such as Milton Friedman viewed the cause of the Great Depression as a fall in the money supply.Friedman and Schwartz argue that people wanted to hold more money than the Federal Reserve was supplying. As a result, people hoarded money by consuming less. This caused a contraction in employment and production since prices were not flexible enough to immediately fall.“The Great Depression, like most other periods of severe unemployment, was produced by government mismanagement rather than by any inherent instability of the private economy.” ― Milton FriedmanAustrian:Austrian economists argue that the Great Depression was the inevitable outcome of the monetary policies of the Federal Reserve during the 1920s.

In their opinion, the central bank’s policy was an “easy credit policy” which led to an unsustainable credit-driven boom.“Any increase in the relative size of government in the economy, therefore, shifts the societal consumption-investment ratio in favor of consumption, and prolongs the depression.” – Murray RothbardThe Great Depression and DeflationBetween 1929 and 1932, worldwide GDP fell by an estimated 15%.Deflation hit.Personal income, tax revenue, profits and prices plunged. International trade fell by more than 50%. Unemployment in the U.S. rose to 25% and in some countries rose as high as 33%.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Friday, February 05, 2016

Infographics: The World's Most Famous Case of Deflation: The Great Depression Part 1

Sunday, June 03, 2012

Political Paralysis Paves Way to Bubble Bust Conditions

If politics continue to shackle central bankers, then the risks of a slowdown transitioning to a recession will get magnified.

The lucid example of political deadlock hounding the markets from the EU seems best captured by this Telegraph report[1]

The head of the European Central Bank hit out at the political paralysis gripping the region as he warned the eurozone's set-up was "unsustainable"

Mario Draghi said the central bank could not "fill the vacuum" left by member states' lack of action as it was claimed the zone is on the point of "disintegration".

Amid escalating talk of a potential bail-out for Spain, the president of the ECB said the central bank was powerless to stop the debt tornado. "It's not our duty, it's not in our mandate" to "fill the vacuum left by the lack of action by national governments on the fiscal front," he said.

Over at the worsening economic conditions in China, political debates over policy have once again been best illustrated by this comment from a former central banker turned representative for a think tank[2]

Americans and Europeans like it. Investors like it because they want to speculate on stocks. The whole world is hoping China will relax policy," Xia told Reuters.

"We will fall into a trap if we do. We will not be that stupid," Xia said, adding that the government should only stimulate economic growth in a "balanced and modest" way, while forging ahead with structural reforms to sustain growth over the longer term. China stimulus unnecessary, risks long-term damage

As a reminder, the current issue here has NOT been about a supposed “squeeze” on government spending and the supposed effects of low levels of capital from it.

The bank runs in the PIGS dismisses this false and self-contradictory logic, Spain experienced 100 billion capital flight during the first 3 months[3], as bank runs have been symptomatic of the fear of devaluations on the heightened prospects of a severance of EU ties.

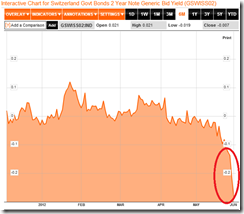

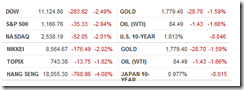

The monumental capital flight has produced negative interest rates on the treasury yields of Switzerland[4] (see above) and also in Denmark.

Instead, the issue here has been the unwinding of MASSIVE malinvestments from EXCESSIVE government spending (welfare, bureaucracy, bailouts, and etc…) that has not only produced unsustainable loads of debt, but also resulted to the CROWDING out of the private sector investments. When government confiscates scarce private sector resources through taxation and spends it, the private sector losses ‘capital’ and opportunity from which to undertake productive activities. This is known as OPPORTUNITY costs; something which becomes a monumental blackhole to mainstream logic, whose ideas are premised on the laws of abundance.

Of course, add to this the misdirected resources from private the sector, particularly the real estate industry, whom had been induced by bubble ‘convergent interest rate’ policies.

The capital flight from crisis affected Euro nations has also been affecting the US where volatile money flows could exacerbate the current boom-bust dynamics. Add to this policy actions to address on such flows[5].

Yet the predicament of crisis afflicted EU nations has essentially been about vastly diminished competitiveness from asphyxiating bureaucracy and choking regulations, particularly in the labor markets[6].

Accounts of massive tax avoidance from current tax increases only debunk the supposed solution of increased government spending. Greeks have shown that they have not been amenable to paying NEWLY IMPOSED taxes[7].

If people truly believed that government spending is the solution then they would have volunteered payment for taxes. In reality, both the intensifying tax avoidance and capital flight defeats the silly statist illusory elixirs.

Even China today has been revealing signs of emergent bank runs[8] and such bank run seems to coincide with the recent depreciation of the yuan relative to the US dollar. This increases signs of uncertainty over China’s bubble economy.

Yet in general, current uncertainty has been aggravated by the political paralysis which has led central bankers to dither from pursuing further inflationist policies.

This Reuters article entitled “Central Banks to hold fire... for now[9]” nails it.

The intensifying euro zone crisis and uncertain global growth outlook have raised hopes for a policy response from major central banks but, while it could be a close call, they are likely to resist pressure to act in the coming week.

When central banks and the banking system stops or withholds from further inflating, the ensuing market reaction from a PREVIOUS inflationary Boom would be a Bubble Bust.

As the great dean of Austrian school of economics explained[10]

For the banks, after all, are obligated to redeem their liabilities in cash, and their cash is flowing out rapidly as their liabilities pile up. Hence, the banks will eventually lose their nerve, stop their credit expansion, and in order to save themselves, contract their bank loans outstanding. Often, this retreat is precipitated by bankrupting runs on the banks touched off by the public, who had also been getting increasingly nervous about the ever more shaky condition of the nation's banks.

The bank contraction reverses the economic picture; contraction and bust follow boom. The banks pull in their horns, and businesses suffer as the pressure mounts for debt repayment and contraction…

This, then, is the meaning of the depression phase of the business cycle. Note that it is a phase that comes out of, and inevitably comes out of, the preceding expansionary boom. It is the preceding inflation that makes the depression phase necessary.

Pieces of the jigsaw puzzles have been falling right in place into the boom bust picture.

And another thing, if there should be a global recession it is not certain that this will be deflationary, as this will depend on how central bankers react. The term deflation has been adulterated by deliberate semantical misrepresentations.

Not all recessions imply a monetary deflationary environment as alleged by a popular analyst. The US S&P 500 fell into TWO bear markets 1968-70 and 1974-1975 even as consumer price inflation soared (blue trend line).

If in case the same phenomenon should occur where stagflation becomes the dominant economic landscape, then a bear market in stocks will likely coincide with a bull market in commodities.

Yet for now everything remains highly fluid with everything dependent on the prospective actions by policymakers

As of this writing, reports say that the EU has been preparing for the $620 ESM Rescue fund for July[11]. If this is true then perhaps, this means the ECB will begin her next phase of massive monetization of debt.

Let me reiterate my opening statement of last week[12]

Like it or not, UNLESS there will be monumental moves from central bankers of major economies in the coming days, the global financial markets including the local Phisix will LIKELY endure more period of intense volatility on both directions but with a downside bias.

I am NOT saying that we are on an inflection phase in transit towards a bear market. Evidences have yet to establish such conditions, although I am NOT DISCOUNTING such eventuality given the current flow of developments.

What I am simply saying is that for as long as UNCERTAINTIES OVER MONETARY POLICIES AND POLITICAL ENVIRONMENTS PREVAIL, global equity markets will be sensitive to dramatic volatilities from an increasingly short term “RISK ON-RISK OFF” environment.

And where the RISK ON environment has been structurally reliant on central banking STEROIDS, ambiguities in political and monetary policy directions tilts the balance towards a RISK OFF environment.

[1] Armistead Louise Eurozone is 'unsustainable' warns Mario Draghi, Telegraph.co.uk, May 31, 2012

[2] See HOT: China’s Manufacturing Activity Falls Sharply in May June 1, 2012

[3] CNBC.com Spain Reveals 100 Billion Euro Capital Flight, June 1, 2012

[4] Bloomberg.com Switzerland Govt Bonds 2 Year Note Generic Bid Yield

[5] See The Coming Colossal Bernanke Bubble Bust May 30, 2012

[6] See Germany’s Competitive Advantage over Spain: Freer Labor Markets, May 25, 2012

[7] See Is Greece Falling into a Failed State? May 28, 2012

[8] See Is China Suffering from Bank Runs too? June 2, 2012

[9] Reuters.com Central Banks to hold fire... for now, June 2, 2012

[10] Rothbard Murray N. Economic Depressions: Their Cause and Cure, Mises.org

[11] See HOT: EU Readies $620 ESM Rescue Fund for July, June 3, 2012

[12] See The RISK OFF Environment Has NOT Abated, May 27, 2012

Saturday, September 24, 2011

War on Precious Metals: Amidst Market Slump, Credit Margins Raised Anew!

From Barrons,

The CME Group (CME) on Friday raised margin requirements for some gold, silver and copper futures contracts. The hikes will be effective after the close of business on Monday, according to the exchange operator.

Initial requirements to trade and hold gold’s benchmark contract rose 21% to $11,475 per contract. Meanwhile, maintenance margins climbed to $8,500 from $7,000 per contract.

At the same time, initial requirements for silver rose 16% to $24,975 a contract and maintenance margins increased to $18,500 from $16,000 a contract.

Initial requirements for copper jumped 18% to $6,750 per contract, from $5,738. Also, maintenance margins were increased to $5,000 from $4,250 per contract.

Margin hikes have been blamed by traders for curtailing rallies earlier in the year. This time around, however, CME’s attempt to again dampen speculation comes at a time when market forces are already seemingly at work doing much the same.

Here is how the gold and the precious metal markets responded.

From Barrons,

Silver futures kept heading down on Friday, finishing with an 18% fall marking the metal’s biggest drop in decades. Meanwhile, the most active gold contract in New York sank 5.9% to register its largest percentage loss since June 2006.

More from Bloomberg,

Commodities fell to a nine-month low, led by routs in metals, on deepening concern that governments are running out of tools to avert a global recession, eroding prospects for raw-material demand.

European officials may accelerate the setup of a permanent rescue fund as the sovereign-debt crisis mounts. On Sept. 21, the Federal Reserve said the U.S. economy faces “significant downside risks.” In the next two days, gold plunged the most since 1983, and copper had the biggest slide in almost three years. Today, silver posted the largest drop in 32 years…

“We are seeing commodity prices correcting, so they are more compatible with the global economy,” said Christin Tuxen, a senior analyst at Danske Bank A/S in Copenhagen. “When we have fears over the economic cycle as we have now and a higher probability of contraction, it hits industrial metals and commodities.”

“We are not predicting a recession in the Western world, but low growth for the long term,” Tuxen said. “We are looking for a rebound in China and Asia in the fourth quarter and in 2012, which will help copper and aluminum.”

Some things to note here

The current financial market carnage has been indicating of an ongoing liquidity contraction, given that Mr. Bernanke’s has thwarted expectations of further aggressive rescue policies. Yes, Bernanke’s non inflation stance is something to cheer at, but this has not been about political-economic apostasy but rather about political obstacles.

Second, the timing of CME’s intervention appears suspicious. Such needless interventions have been weighing on an already bleak sentiment.

Yet the public is being impressed upon by media and experts that this has been about economic performance. If current environment is “not predicting a recession” then the dramatic selloff in commodities would seem unwarranted, except for liquidity and or manipulation issues.

I deem this continuing series of credit margin hikes as part of the signaling channel tool employed by team Bernanke to project on the intensifying risk environment of a deflationary bust, which will be used to rationalize QEs and to quell QE policy dissenters. As stated above, I am don’t think that Mr. Bernanke has backtracked from his activist central banking dogma.

And as pointed out earlier, Mr. Bernanke appears to be implicitly challenging his political detractors by laying the recent market carnage on their doors.

My guess is that eventually the divided FOMC will accede to Bernanke’s policy preferences, but that would entail more market pressures. In other words, the global financial markets would remain hostage to, or will be used as negotiation leverage by the political class in furtherance of their interests.

But until there will be clarity in the directions of policy actions, it would be best to stay clear from the current environment whom signifies as victims of the imbroglio or the bickering of political stewards.

Nonetheless, despite the slump in precious metals, these are likely to be temporary events.

Thursday, September 22, 2011

Bernanke Jilts Markets on Steroids, Suffers Violent Withdrawal Symptoms

Despite my current circumstances, I felt the compulsion to offer a reaction on today’s market meltdown.

Here is what I recently wrote,

I would certainly watch the US Federal Reserve’s announcement and the ensuing market response.

If team Bernake will commence on a third series of QE (dependent on the size) or a cut in the interest rate on excess reserves (IOER), I would be aggressively bullish with the equity markets, not because of conventional fundamentals, but because massive doses of money injections will have to flow somewhere. Equity markets—particulary in Asia and the commodity markets will likely be major beneficiaries.

As a caveat, with markets being sustained by policy steroids, expect sharp volatilities in both directions.

Obviously the market’s response on team Bernanke’s failure to deliver on what had been expected has apparently been violent.

The Philippine Phisix (chart from technistock.net), as well as ASEAN equity markets, has basically suffered the same degree of bloodbath relative to her developed economy equity market peers

This reaction from a market participant captures the underlying sentiment. From a Bloomberg article

“This is not likely to provide any significant stimulus,” said Jason Schenker, president of Prestige Economics LLC in Austin, Texas. “The market really needed a boost of confidence. There is no confidence from this.”

So what did the Mr. Bernanke deliver?

Again from the same article at Bloomberg

The Federal Reserve will replace $400 billion of short-term debt in its portfolio with longer- term Treasuries in an effort to reduce borrowing costs further and counter rising risks of a recession.

The central bank will buy securities with maturities of six to 30 years through June while selling an equal amount of debt maturing in three years or less, the Federal Open Market Committee said today in Washington after a two-day meeting. The action “should put downward pressure on longer-term interest rates and help make broader financial conditions more accommodative,” the FOMC said.

Chairman Ben S. Bernanke expanded use of unconventional monetary tools for a second straight meeting after job gains stalled and the government lowered its estimate of second- quarter growth. Yields on 30-year Treasuries fell below 3 percent for the first time since 2009 and U.S. stocks had their biggest drop in a month on the Fed’s plan, dubbed “Operation Twist” after a similar Fed action in 1961.

The twist, as earlier stated, has been telegraphed. What was not expected has been the non-appearance of Bernanke’s QE which resulted to today’s convulsions.

The ‘twist’ which essentially attempts to flatten the yield curve basically reduces the banking system’s profitability from the borrow short and lend long (maturity transformation) platform that has partly catalyzed these selloffs.

From the Wall Street Journal

But for bankers, who are already struggling with low interest rates on loans and tepid loan demand, the twist option could further dent already-weakened profits. That is because lower long-term interest rates would result in contracting net interest margins for banks—essentially, the profit margin in the lending business—at a time when their revenue is growing slowly, if at all. Banks would earn less on loans and investments, and might end up making fewer loans as well.

"Ouch" is how one executive at a big retail bank described the prospect of Operation Twist. (Bankers typically don't publicly comment on Fed policy given the central bank's role as a bank regulator.)

Austrian Economist Bob Wenzel says that Operation Twist represents a failed experiment…

So how did the original Operation Twist turn out? Three Federal Reserve economists in 2004 completed a study which, in part, examined the 1960's Operation Twist. Their conclusion (My bold):

“A second well-known historical episode involving the attempted manipulation of the term structure was so-called Operation Twist. Launched in early 1961 by the incoming Kennedy Administration, Operation Twist was intended to raise short-term rates (thereby promoting capital inflows and supporting the dollar) while lowering, or at least not raising, long-term rates. (Modigliani and Sutch 1966).... The two main actions of Operation Twist were the use of Federal Reserve open market operations and Treasury debt management operations.. Operation Twist is widely viewed today as having been a failure, largely due to classic work by Modigliani and Sutch.”

The economists go on to state that the size of Operation Twist was relatively small, possibly too small to determine if such an operation could be successful if carried out at on a larger scale. That experiment is now being conducted on the economy of the United States with the $400 billion Operation Twist announced today. How big was the original Operation Twist? $8.8 billion.

The three Fed economists, who seem to concur that the first Operation Twist was a failure, are sure going to get an experiment on the United States economy on a much grander scale to see if this time it will work different than it did the first time. So who are these three lucky Fed economists who are now going to be able to witness Operation Twist on a grander scale? Vincent R. Reinhart, Brian P. Sack and BEN S. BERNANKE.

So part of the market’s virulent reaction signifies a revolt on Bernanke’s experimental policy. This is an example of how interventionist measures prompts for heightened uncertainties.

The Fed also promised to support mortgage markets by keeping the interest low. Again from the same Bloomberg article,

The central bank said today it will also reinvest maturing housing debt into mortgage-backed securities instead of Treasuries “to help support conditions in mortgage markets.”

Yields on Fannie Mae and Freddie Mac mortgage securities that guide U.S. home-loan rates tumbled the most in more than two years relative to Treasuries. The average rate on a typical 30-year fixed loan fell to a record low 4.09 percent last week.

So why has Bernanke failed to live up with the expectations for more QE?

Like in the Eurozone, there has been mounting opposition to Bernanke’s inflationist bailout policies as seen by a divided FOMC… (same Bloomberg article)

The FOMC vote was 7-3. Dallas Fed President Richard Fisher, Minneapolis Fed President Narayana Kocherlakota and Charles Plosser of the Philadelphia Fed voted against the FOMC decision for a second consecutive meeting. They “did not support additional policy accommodation at this time,” the Fed statement said today.

…and from some Republicans who mostly recently who made public representations against further QEs.

Republican lawmakers including Boehner and Senate Minority Leader Mitch McConnell urged Bernanke in a letter this week to refrain from additional monetary easing to avoid “further harm” to the economy.

This is aside from political pressures applied by his predecessor, Paul Volker

In my view, Chairman Ben Bernanke could be:

-trying to lay the blame of policy restraints at the foot of his opponents in the recognition that markets would behave viciously from a stimulus dependent ‘withdrawal syndrome’, or

-that his penchant for grand experiments made him deliberately withhold QE to see how the markets would respond to his innovative ‘delusion of grandeur’ measures.

By withdrawal, I don’t mean a reduction of the Fed’s balance sheet, which the Fed aims to maintain (which probably would incrementally expand on a less evident scale) but from further specifically targeted asset purchases. The ‘twist’ essentially sterilizes the operation which means no money supply growth.

Today’s brutal reaction in global financial markets essentially validates my view that the contemporaneous market has been built on boom bust policies such that NOT even gold prices has been spared.

The tight correlations in the collapsing prices of equities and commodities as well as the rising dollar (falling global currencies) are manifestations of a bust process at work.

The primary issue here is that in absence of government’s backing via assorted stimulus, mostly via monetary injections, artificially established price structures from government stimulus or from credit expansion unravels.

Only when the tide goes out, to paraphrase Warren Buffett, do we know who has been swimming naked.

Or as Austrian economist George Reisman writes,

A fundamental fact is that our present monetary system is characterized both by irredeemable paper money, i.e., fiat money, and by credit expansion. There is no limit to the quantity of fiat money that can be created. This is the foundation for potentially limitless inflation and the ultimate destruction of the paper money, when the point is reached that it loses value so fast that no one will accept it any longer. The fact that our monetary system is also characterized by credit expansion is what creates the potential for massive deflation — for deflation to the point of wiping out the far greater part of the money supply, which in the conditions of the last centuries has been brought into existence through the mechanism of credit expansion

Monday, March 01, 2010

Where Is Deflation?

When deflation advocates point to charts of bank loan activities, the money multiplier or Treasury Inflated Protected Securities (TIPS) and proclaim “where is inflation?” - they seem to be asking the wrong question.

Figure 1 St. Louis Fed/Northern Trust: M1 Money Multiplier and Consumer US CPI

Figure 1 St. Louis Fed/Northern Trust: M1 Money Multiplier and Consumer US CPI

For instance, while it is true that the US M1 money multiplier[1] is down, (as shown in the left window in figure 1 and recently used by a popular analyst as example), there seems hardly a grain of truth that the falling money multiplier equates to sustained deflation in US consumer prices (right window).

In other words, if they are correct then obviously CPI should be adrift in the negative territory- to reflect on deflationary pressures until the present. Yet the CPI, both in the ALL items and ALL items LESS Food and Energy remains in the positive zone, in spite of, or even in the face of these ‘deflation pressure’ statistics; falling money aggregates, subdued TIPS and or lackluster bank activities.

And CPI turned negative only at the height of the crisis, which makes it more of an aberration than the norm. Of course, this counterpoint extends to the validity of the accuracy of the US government’s measure of inflation, which I am a skeptic of.

However, here are more of our counterarguments to the sarcastic question of “where is inflation?”:

1. Reading current performance into the future.

Deflation exponents insist that “deflationary pressures” ought to collapse the markets as they did in 2008. They’ve been doing so for the entire 2009. But this hasn’t been happening. That’s because the reality is, we haven’t been operating under the same ‘Lehman’ conditions of 2008!

The US government’s actions to effect a cumulative network of local and international market patches, as seen in the various ‘alphabet soup’ of emergency programs plus a raft of guarantees to the tune of over $10 trillion, swaps and direct expenditures (quantitative easing), seems to ensure of such non-repetition, as we have repeatedly discussed.

So more banks could indeed fail, the FDIC upgraded its watchlist from 552 to 702 banks in danger, but the liquidity gridlock of 2008 isn’t likely to happen. That’s because the Fed has a morbid fear of ‘deflation’ than warranted, and is likely to engage in a “whack a mole”; pouring liquidity on every account of the emergence of deflation.

Let me clarify that the US banking system is a solvency issue, but this is not the case for Asia or for major emerging markets. Ergo, the contagion from the Lehman collapse of October 2008 emanated from a liquidity shortfall as US banks seized up. Since today’s scenario is different, then predicting the same contagion seems unlikely, so any arguments calling for a 2008 scenario is like calling a banana an apple.

Besides, the Fed’s manipulation or “nationalization” of key markets such as the US mortgage markets seems to have been designed to stave off the odds of having a domino effect collapse in their banking industry. This, by keeping the banking system’s balance sheets afloat, through “elevated” or inflated prices. In spite of babbles for so-called exit strategies, this isn’t likely to change.

On the contrary, a broader view of markets appears to be suggesting that inflation looks likely a future or prospective phenomenon.

To consider, if any of these “deflationary” stats begin to recover then they are likely add to ‘inflation expectations’ and thus eventually reverse the current state of “deflation subdued” CPI .

2. Misleading Interpretation of Hyperinflations.

Hyperinflations have never been caused by excessive consumer borrowings, never in history. To paint of such an impression is to egregiously mislead.

Hyperinflations have basically been caused by insatiable government spending, whose exponential growth had been financed by the printing press. On the other hand, a credit boom from consumer borrowing is most likely to result in bubble (boom-bust) cycles and not hyperinflation.

The fundamental difference is that of the political goal; in boom bust cycles, government’s role to inflate the system is largely indirect-with mostly the goal to perpetuate ‘quasi’ economic boom conditions by inflating money supply and by skewing the public’s incentives through regulation or taxation to favoured political sectors, as in the case of the recent real estate-mortgage bubble.

Whereas, in hyperinflations, the government’s role is more direct, usually deliberate or represents an act of desperation to meet a political goal for the incumbent leadership, such as perpetuation of power (e.g. Zimbabwe), or the addiction to inflationism compounded by policy errors based on theoretical misunderstandings[2], as Germany’s Weimar hyperinflation experience, and not from war reparations as others have suggested[3].

Of course one may argue that there is always a possibility of first time. Perhaps.

3. Selective Perception And Misguided Expectations

Many deflation proponents tend to argue from the perspective of the private sector’s performance in the economy. Their propensity to “tunnel” or fixate into the private sector leads them to erroneously omit the impact of the rapidly bulging share of the US government’s contribution to the economy, which presently accounts for nearly a third.[4]

Ignoring government’s contribution and policy impacts to the economy renders a handicapped analysis.

Nevertheless, looking at the global scale, we seem to be seeing more incidences of a ‘quickening’ of consumer price inflation, as in Malaysia and in Brazil, aside from previous accounts in China, India, Vietnam, and even to the real estate bubble-banking crisis afflicted UK which saw consumer price inflation rise to its highest level since November 2008 (see figure 2)-where debt deflation has been the generally expected outcome by the mainstream.

Figure 2: Finfacts.ie/stockcharts.com: Surging UK Inflation, Devaluing UK Pound

Figure 2: Finfacts.ie/stockcharts.com: Surging UK Inflation, Devaluing UK Pound

Reporting on the surprising resilience on UK’s inflation (left window), according to Finfacts.ie. ``The ONS said the CPI fell by 0.2% between December and January. Although negative, this is the strongest ever CPI growth between these two months (prices typically fall at a faster rate between December and January). This record monthly movement is mainly due to the increase in January 2010 in the standard rate of Value Added Tax (VAT) to 17.5% from 15% and, to a lesser extent, the continued increase in the price of crude oil. In the year to January, the all items retail prices index (RPI) rose by 3.7% up from 2.4% in December. Over the same period, the all items RPI excluding mortgage interest payments index (RPIX) rose by 4.6%, up from 3.8% in December.” (bold highlights mine)

Why should oil prices rise if demand has been declining as the Fisherian and Keynesian deflationists experts allege? From a “money is neutral” perspective, wouldn’t that be a paradox?

Also, why should higher taxes become inflationary, when all it does is to distort the economic structure by shifting investments from private to the public, as well as, to decrease the incentives for the private sector to participate?

Murray Rothbard provides the answer[5], ``If inflation has been under way, this “excess purchasing power” is precisely the result of previous governmental inflation. In short, the government is supposed to burden the public twice: once in appropriating the resources of society by inflating the money supply, and again, by taxing back the new money from the public. Rather than “checking inflationary pressure,” then, a tax surplus in a boom will simply place an additional burden upon the public. If the taxes are used for further government spending, or for repaying debts to the public, then there is not even a deflationary effect. If the taxes are used to redeem government debt held by the banks, the deflationary effect will not be a credit contraction and therefore will not correct maladjustments brought about by the previous inflation. It will, indeed, create further dislocations and distortions of its own.” (bold highlights mine)

In short, what could easily be seen is that the inflationary effects of bailouts, subsidies and its domestic version of quantitative easing programs have gradually been manifesting on her devaluing currency first (right window), and next, to consumer prices. And the newly increased VAT in the UK only adds to the existing distortions already in place.

Of course this account of emerging inflation seems to have befuddled the mainstream anew.

Yet, this dynamic is likely to emerge in the US too...perhaps soon.

For us, another reason why inflation is still quiescent in the US; aside from the slack in the banking system out of the reluctance to lend due to balance sheet concerns, is because of the natural belated response to the record steepness in the yield curve.

The uncertainty arising from the abrupt market cleansing adjustments and the rediscovery phase of where resources are needed, implications of new regulatory regime, prospects of higher taxes to pay for the slew of stimulus programs, risks of more government interventions, impaired and unsettled balance sheets of banks and financial institutions mired in the bubbles have all conspired to inhibit investors from taking advantage of the steepness in the yield curve.

Yet the past has shown that eventually zero interest rates and a steep yield curves will likely artificially impact the credit process to jumpstart a new boom-bust cycle. Although we aren’t likely to believe that a boom phase of a bubble cycle could happen in sectors recently affected by a bust, any seminal bubbles will most likely diffuse into other sectors untainted by the recent bubble (technology or materials and energy?) or percolate outside of the US.

This implies that the ramifications from policies are likely to gain traction with a time lag, as had been in the past.[6]

Hence, expectations for the immediacy of the markets’ response from policies have not been only myopic but also constitutes as wishful thinking-anchoring on a belief that people don’t respond to incentives.

4. The Folly Of Excluding The Role of the US dollar And Other External Forces

In addition to the lagged response, it is likely that the US dollar, as the world’s de facto seignorage provider, has the privilege to extend its inflationism outside her shores hence, inflation becomes a precursory tailwind (see figure 3)

Recessionary forces around the world, as exhibited in gray shaded areas in both the 2000 and the present crisis, required diminished US dollar financing for global trade. This led to an improvement of the US trade balance (red line), which none the less, dampened US CPI inflation (blue line).

As the world recovered from the recession or the crisis, trade deficits surged anew to reflect on the revitalization of global trade. And the US CPI eventually followed suit. One could observe that the CPI trailed trade deficits by a short interval in both accounts.

And also given that today’s situation is vastly different from the 2000-2007, where the slack in private expenditures have been replaced by monstrous government spending, the impact from the surging “twin” deficits will likely have a more meaningful impact. First, this will be reflected externally, as in the account of emerging inflation ex-US, and possibly channelled via the US dollar relative to other currencies or if not through commodities. Next, this gets manifested on the US domestic consumer price indices.

Therefore the interstice, where CPI inflation seems subdued, should be known as inflation’s “sweet spot”, perhaps where we are today.

Hence the idea that slow inflation today equals slow inflation tomorrow predicated on the money multiplier and an impaired credit process, seems to grossly underestimate on the repercussions of inflationary policies because, aside from the lagged impact from yield curve and the blatant disregard of the expanding share of the US government in the economy, such analysis discounts on the effects of exogenous forces, particularly the US dollar’s role as chief financier of global trade, and the underlying transmission mechanism from external ‘inflation’, such as competitive devaluations, impact on nations with pegged currencies-a core to periphery phenomenon. This is, aside from, misconstruing money’s role as having neutral effect on the economy.

In other words, markets and economic trends will depend on the directions of ensuing policy actions, by major economies most especially the US, to ‘reflate’ the system.

And given that Fed Chairman Ben Bernanke was again shown as seemingly in a cautious stance about the “halting” pace of economic recovery for the US from which he reassured Congress of an extended regime of low interest rates and where in addition to the apparent mounting clamour of adopting a philosopher’s stone as mainstream policy, as discussed last week[7], more professional entities seem to be joining the chorus for extended inflationism, such as the latest joint project by Goldman Sachs [Economists Jan Hatzius] Deutsche Bank [Peter Hooper], Columbia University [Frederic Mishkin], New York University [Kermit Schoenholtz] and Princeton University [Mark Watson] who arrived at the conclusion that current conditions remain tight despite the Fed’s efforts.

We don’t need to actually wish for it, but evidently, the pronounced lobbying to justify more inflationism is likely to be music in the ears for the current crops of political and technocratic overseers.

So the question of “where is inflation?”, should be substituted with the opposite, given the limited and sporadic accounts of ‘deflation statistics’, the question should be “Where is Deflation?”

As markets haven’t been collapsing and as the world have elicited signs of rising incidences of inflation, the onus of proof, is on them.

[1] coins, currency, checkable deposits demand deposits and travellers checks from wikipedia.org

[2] “The government and the Reichsbank both believe that monetary troubles arise from an unfavorable balance of payments, from speculation and from unpatriotic behavior of the capitalist class. They therefore attempt to fight the menace of depreciation of the Reichsmark by controlling dealings in foreign currency and by confiscating German holdings of foreign assets. They do not understand that the only safeguard against the fall of a currency's value is a policy of rigid restriction. But though the government and the professors have learned nothing, the people have. When the war inflation came nobody in Germany understood what a change in the value of the money unit meant. The business-man and the worker both believed that a rising income in Marks was a real rise of income. They continued to reckon in Marks without any regard to its falling value. The rise of commodity prices they attributed to the scarcity of goods due to the blockade. When the government issued additional notes it could buy with these notes commodities and pay salaries because there was a time lag between this issue and the corresponding rise of prices. The public was ready to accept notes and to keep them because they had not yet realized that they were constantly losing purchasing power.” Ludwig von Mises, The Great German Inflation, Money, Method, and the Market Process ch 7

Money, Method, and the Market Process

[3] See Wikipedia.org, Inflation in the Weimar Republic

[4] See previous post, It’s Not Deleveraging But Inflationism, Stupid!

[5] Murray N. Rothbard, Chapter 12—The Economics of Violent Intervention in the Market, Man Economy and the State

[6] See our previous discussion, What Has Pavlov’s Dogs And Posttraumatic Stress Got To Do With The Current Market Weakness?

[7] See Why The Hike In The Fed’s Discount Rate Is Another Policy Bluff