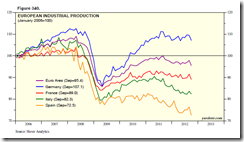

Political solutions in the Eurozone, meant to preserve the status quo for the political establishment, has been worsening economic conditions as industrial production has rolled over even in major nations as Germany and France.

Writes Dr. Ed Yardeni (chart also from Dr. Yardeni’s Blog)

The Euro Mess remains as messy as ever. However, investors have been less concerned about a financial meltdown in Europe ever since ECB President Mario Draghi volunteered at the end of July to do whatever it takes to avert a euro cliff. Furthermore, the Europeans continue to kick Greece down the road rather than force it out of the euro zone. Nevertheless, Europe is sinking deeper into a recession. That’s becoming a more significant concern to investors I’ve talked with recently, especially if the US economy falls off the fiscal cliff.Particularly unsettling yesterday were massive and widespread anti-austerity protests across Europe. The strikes and demonstrations, some involving hundreds of thousands of people, hit more than 20 countries in the EU, disrupting airports and ports, closing roads and public transportation, and shutting some essential services. The biggest protests were in Portugal, Spain, Greece, and Italy. The union-led protests--called "European Day of Action and Solidarity"--were mostly peaceful, but turned violent in Lisbon, Madrid, and Rome.

Yet political solutions (bank and sovereign bailouts, ECB’s interventions, surging regulations, higher taxes and etc…) will not only hamper economic recovery, they will lead to more social frictions which increases the risks of the EU’s disunion—as evidenced by the snowballing secession movements—and of the escalation of violence.