From Bloomberg

India’s economy expanded at the weakest pace in at least eight years last quarter, hurt by a slowdown in investment that has undermined the rupee and set back Prime Minister Manmohan Singh’s development agenda.

Gross domestic product rose 5.3 percent in the three months ended March from a year earlier, compared with 6.1 percent in the previous quarter, the Central Statistical Office said in a statement in New Delhi today. The median of 31 estimates in a Bloomberg News survey was for a 6.1 percent gain. GDP climbed 6.5 percent in the year to March, the office said.

Singh faces a struggle to bolster expansion as Europe’s debt crisis dims the global outlook and elevated inflation and a record trade deficit limit room for more interest-rate cuts to boost spending at home. Discord within the ruling coalition and claims of graft have impeded his push to open up the economy, deterring investment and sending the rupee to its lowest level.

Well, India’s economic deceleration poses as another factor that contributes to the current environment marked by accentuated uncertainty.

The chart above from tradingeconomics.com does not include the today’s data.

Left of center analyst Satyajit Das at the Minyanville.com has a pretty good account of India’s lingering economic woes, and a list of obstacles towards attaining a developed economy status. (bold emphasis mine)

In recent years, India has consistently run a public sector deficit of 9-10% of GDP (if state debt and off-balance-sheet items are included). The problem of large budget deficits is compounded by poorly targeted subsidies for fertilizer, food, and petroleum, which amount to as much as 9% of GDP. Currently the official deficit is just over 3% of GDP, but trending higher and the highest in the G-20.

In March 2012, India brought out a budget forecasting an official fiscal deficit of 5.9%, well above its previous fiscal deficit target of 4.6%. India’s strong rate of recent growth (an average rate of 14% between 2004-2005 and 2009-2010) made large deficits, in the order of 10% of GDP, relatively sustainable. Slowing growth will increasingly constrain India’s ability to manage large deficits.

As its debt is denominated in rupees and sold domestically, India faces no immediate financing difficulty. Instead, the government’s heavy borrowing requirements crowds out private business.

However, exports are slowing as a result of weakness in India’s trading partners. Higher imports, mainly non-discretionary purchases of commodities and oil, have increased. India imports around 75% of its crude oil from overseas.

India’s weak external position has manifested itself in the volatility of the rupee, which was one of the worst performers among Asian currencies in 2011. Indian businesses, which have unhedged foreign currency borrowings, have incurred significant losses as the value of their debt rises as the rupee falls. Many Indian companies face large debt maturities in the coming year.

India has around US$250-300 billion in currency reserves. Foreign debts that must be repaid in the current year represent about 40-45% of this amount which highlights the increasing weakness in India’s external position.

Further, India is plagued by inadequate infrastructure especially in critical sectors like power, transport, and utilities. While its workforce is young and growing, there is a shortage of skills which has led to large increases in salaries for skilled workers.

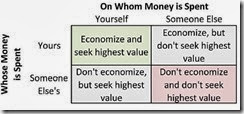

The above account shows how India has been TOO reliant on the government.

Since government spending is ALWAYS politically determined, where decisions are usually made according to the needs of the moment or on what is presently popular or on what will accrue to votes for politicians (public choice theory), then the obvious result has been wastage, inefficiency and corruption.

Such dynamic has been the same even in the US, the erstwhile bastion of the market economy where dependence on government spending can be equated to crony capitalism.

Also infrastructure problems represent symptoms of too much politicization, viz., regulations and bureaucracy.

Now for the fun part. Adds Mr. Das… (bold highlights mine)

Corruption and Political Atrophy

Another major problem is large-scale, deep-seated and endemic corruption, highlighted by scandals surrounding the issue of telecommunication licenses and the sale of coal assets.

Used to accessing power and influencing politicians, businesses have advanced their interest in securing rich natural resources, especially land and minerals, and ensured a favorable regulatory framework restricting competition, especially from foreign companies.

India’s economic challenges are compounded by internal and external security concerns. For 2012, Indian defense spending is forecast to be $41 billion, around 1.9% of GDP or the ninth highest in the world. Financing this spending diverts resources away from other parts of the economy.

Political paralysis is another impediment to economic development. Successive governments have failed to undertake meaningful reforms. Complex coalition governments are a barrier to decisive action. The current government failed to implement its own plans to allow limited entry of foreign retailers. The government also failed to get a key anti-corruption bill through parliament.

Changes in land and property laws have not been made. Problems in acquiring land, for instance, are a factor in 70% of delayed infrastructure projects. The land acquisition process falls under a 19th century law and amendments proposed three years ago remain unlegislated.

Tax law reforms, including introduction of a direct sales tax correcting cumbersome differences in individual states, have not been completed. Changes to mining and mineral development regulations to allow proper, environmentally controlled exploitation of India’s mineral wealth have not been made.

Other crucial areas that remain unaddressed include rationalizing unwieldy and economically distorted subsidies; implementing economic pricing of utilities; promoting foreign investment in key sectors; reforming agriculture, especially the wasteful and inefficient logistics system for transporting produce to market. Reform of labor markets and privatization of key sectors has not progressed.

To sum it up, the basic reason why India’s economic advances has stalled has been due to the lack of economic freedom: particularly, too much government spending (crowding out effect), too much regulations (evidenced by stringent labor regulations, corruption), political concessions (subsidies, price controls), protectionism (restriction of foreign investments, and restrictions on agricultural and mining investments) and problems concerning property rights (land and property laws)

Indians have been used to the “License Raj” mentality or a business or commercial environment strangulated by elaborate licenses, regulations, and stultifying red tape, where vested interest groups fervently compete to acquire political power to generate economic clout at the expense of society.

India’s structural problems has important parallels with the Philippine political economy.

Nonetheless people’s opinions signify as the most important force in determining political trends that ultimately affects the state of the economy.

Another quote of wisdom from the great Ludwig von Mises

Many who are aware of the undesirable consequences of capital consumption are prone to believe that popular government is incompatible with sound financial policies. They fail to realize that not democracy as such is to be indicted, but the doctrines which aim at substituting the Santa Claus conception of government for the night watchman conception derided by Lassalle. What determines the course of a nation's economic policies is always the economic ideas held by public opinion. No government, whether democratic or dictatorial, can free itself from the sway of the generally accepted ideology.

Bottom line: the direction of economic growth will run along the prevailing ideology held by the citizenry. The greater the dependence on governments, the lesser the dynamism of the economy and vice versa.

Economic freedom ultimately determines the society's prosperity.