Agricultural protectionism rears its ugly head again.

As prices of food continue to surge, a farmland boom in the US and elsewhere has been taking place. And some governments along with participating private sectors have been adding to the demand pressures for international farmlands.

Unfortunately, xenophobia and anti-market sentiments have prompted some nations to impose restrictions on agriculture land ownership.

The New York Times reports, (bold highlights mine)

Even as Brazil, Argentina and other nations move to impose limits on farmland purchases by foreigners, the Chinese are seeking to more directly control production themselves, taking their nation’s fervor for agricultural self-sufficiency overseas.

A World Bank study last year said that volatile food prices had brought a “rising tide” of large-scale farmland purchases in developing nations, and that China was among a small group of countries making most of the purchases.

Foreigners own an estimated 11 percent of productive land in Argentina, according to the Argentine Agriculture Federation. In Brazil, one government study estimated that foreigners owned land equivalent to about 20 percent of São Paulo State.

International investors have criticized the restrictions. At least $15 billion in farming and forestry projects in Brazil have been suspended since the government’s limits, according to Agroconsult, a Brazilian agricultural consultancy.

“The tightening of land purchases by foreigners is really a step backwards into a Jurassic mentality of counterproductive nationalism,” said Charles Tang, president of the Brazil-China Chamber of Commerce, saying that American farmers had bought sizable plots in Brazil in recent years, with little uproar.

Responding to the criticism, Brazil’s agriculture minister said this month that Brazil might start leasing farmland to foreigners, given the barriers to ownership.

China itself does not allow private ownership of farmland, and it cautioned local governments against granting large-scale or long-term leases to companies in a 2001 directive. China also bans foreign companies from buying mines and oil fields.

Agriculture has been the least globalized sector owing to regulatory and sundry political hurdles.

Proof of this is that global agricultural tariffs has substantially been higher than non-agricultural products.

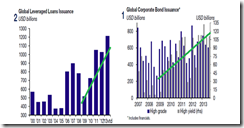

So trade restrictions has impelled other private and public entities (such as international governments) to try to circumvent national trade restrictions by acquiring land or by providing financing to domestic food producers in return for the assurance of access to future production. [charts from Amber Waves, US Department of Agriculture]

From my end, aside from imbalances erected by local regulations and political privileges (e.g. subsidies), rising prices are likewise consequences of inflationism. This means that the upward trend in food prices and subsequently the demand for farmlands have been either artificially inflated or possibly reflects on a monetary malaise as seen through a “flight to real values”.

Besides, as we have predicted, this boom will continue to deepen as government introduce more market distorting measures.

So far, the global campaign to secure food supplies have been coursed through cooperative channels via trade and investments, in spite of current emergent signs of protectionism.

Otherwise, we should keep in mind that the close door policies will only lead to mutually undesirable consequences.

As the great Frederic Bastiat (1801-1850) warned,

If goods don’t cross borders, armies will