The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Sunday, October 13, 2019

Headline CPI at 40-month Low Diverges with the CORE; Plummeting M2’s Savings Deposits Should Spur the BSP to Relaunch QE Soon

Thursday, June 16, 2011

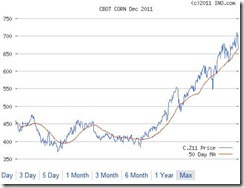

Corn Prices Drifts near Record Highs Amidst Stock Market Turmoil, Signs of Stagflation?

Recently, prices of corn raced to record highs, although downside volatility has dominated the past few days. Nevertheless corn still drifts at near record levels.

Chart from Ino.com

Bloomberg’s chart of the day posits that demand has been outpacing supply as the alleged main reason.

From Bloomberg,

Corn demand is accelerating beyond farmers’ ability to boost yields, depleting stocks and adding to price gains as consumption in China and ethanol factories grows.

The CHART OF THE DAY shows gains in farm productivity have trailed demand that expanded more than fourfold since 1961, according to U.S. Department of Agriculture data. Consumption accelerated in the past decade on Chinese demand for feed and corn starch and increased use in the U.S. for ethanol output.

Corn futures climbed 86 percent in the past 12 months, more than any other grain traded in Chicago, after dry weather limited the 2010 U.S. crop and as flooding in the past two months delayed planting, threatening prospects for this year. July delivery corn rose to a record $7.9975 last week.

“It’s a huge problem,” Abdolreza Abbassian, a senior economist at the United Nations’ Food and Agriculture Organization, said from Rome. “This is primarily U.S. ethanol and starch in China, and then you have the feed where you have stronger growth, again in China, but across the world.”

Consumption demand represents an oversimplistic tale.

There are many questions to ask

To what degree of consumption has been artificially boosted easy money globally?

How much of the imbalances or diversion of resources have been due to subsidies to ethanol?

To what degree has restrictive trade policies (locally or internationally) has contributed to hampering of the supply side?

To what degree of local based regulations has contributed to boosting the demand side?

Why has there been a generalized increase in food prices if consumption has only been the major factor involved?

There are many more.

It’s easy and popular to attribute consumption growth to China, but China has been in the process of inflating her ballooning bubble economy, which means whatever growth we see, a large segment of which must be artificial.

Only when China’s bubble implodes shall we see the true extent of the consumption ‘growth’ story.

Lastly high corn prices as stock markets undergo selling pressures seem much like symptoms of stagflation.

From Tradingeconomics.com

Even in the US, statistical inflation figures has been going higher.

Yet the mainstream keeps denying them. Data from recent news, as producers and consumer prices indices, reveals that prices have risen beyond the expectations of the ‘experts’. This even comes in the face of the questionable method of computing for inflation indices.

Incidentally, denial makes up the 2nd stage of the Kubler Ross grief cycle. This denial is especially strong for those blighted with ideological (political and economic) biases.

It will take more pain for these people to finally reach the state of acceptance or reality, especially for those who insist to live in a self-designed world.

Saturday, June 20, 2009

Chart: Global Food Price Inflation

According to the Economist,

``CHANGES in global food prices are affecting some countries much more than others. Despite a big fall from peaks in 2008, food-price inflation remains high in places such as Kenya and Russia. In China, however, falling international commodity prices have been passed on to consumers faster. The price of food, as measured by its component in China's consumer-price index, rose by more than 20% in 2007 but fell by 1.9% in 2008 and by a further 1.3% in the past three months alone."

Of course, there are also many factors that gives rise to these disparities, aside from monetary and fiscal policies (taxes, tariffs, subsidies, etc...), there are considerations of the conditions of infrastructure, capital structure, logistics/distribution, markets, arable lands, water, soil fertility, technology, productivity, economic structure and etc.

Our concern is given the present "benign state of inflation", some developing countries have already been experiencing high food prices, what more if inflation gets a deeper traction globally? Could this be an ominous sign of food crisis perhaps?

Sunday, June 07, 2009

Our Mises Moment Answers Mainstream’s Conundrum of Market-Fundamental Disconnect

``But on the other hand inflation cannot continue indefinitely. As soon as the public realizes that the government does not intend to stop inflation, that the quantity of money will continue to increase with no end in sight, and that consequently the money prices of all goods and services will continue to soar with no possibility of stopping them, everybody will tend to buy as much as possible and to keep his ready cash at a minimum. The keeping of cash under such conditions involves not only the costs usually called interest, but also considerable losses due to the decrease in the money’s purchasing power. The advantages of holding cash must be bought at sacrifices which appear so high that everybody restricts more and more his ready cash. During the great inflations of World War I, this development was termed “a flight to commodities” and the “crack-up boom.” The monetary system is then bound to collapse; a panic ensues; it ends in a complete devaluation of money Barter is substituted or a new kind of money is resorted to. Examples are the Continental Currency in 1781, the French Assignats in 1796, and the German Mark in 1923.”-Ludwig von Mises, Interventionism: An Economic Analysis, Inflation and Credit Expansion

The mainstream is obviously very perplexed.

They can’t seem to figure what’s going on with market prices that can’t seem to match “fundamentals”.

Take this as an example. ``With oil inventories high and demand down year on year, yet prices surging, "fundamentalists" are puzzled” observes Liam Denning of the Wall street Journal.

Skeptical of the fundamental –market disconnect, the unconvinced Mr. Denning concludes his article with, `` Ultimately, however, the danger for China, and commodities bulls, is that Beijing's efforts fail to fully offset the harsh realities afflicting the world economy as a whole.” (bold highlight mine)

Many have attributed the rise in oil or iron ore prices primarily to China see figure 6. But the unpleasant fact is that this isn’t just about oil or iron ore or China.

It’s about policy induced inflation whose growing influences are being ventilated on markets and which has been percolating and distorting the real economy.

And the primary mechanism for such release valve has been the US dollar.

As we wrote in last week’s Mainstream Denials And The Greenshoots of Inflation, a broadening category of the commodities have been experiencing price gains. So it’s not only oil or iron ore or gold but a whole range of commodities which includes food prices.

In addition, it isn’t just China or Sovereign Wealth Funds, but a broader spectrum of participants have joined the bandwagon as buyers of commodities. As we noted in Hedge Funds Pile Into Commodities, hedge funds have been growing exposure to commodities.

Even life insurance outfit as Northwestern Mutual Life Insurance Co. ``has bought gold for the first time the company’s 152-year history to hedge against further asset declines” (Bloomberg) could be signs of possible major reconfigurations of investments flows towards commodities.

My recent post which surprisingly turned out with a high number of hits, deals with Hedge Fund Ace John Paulson who made an amazing allotment of 46% of his portfolio into gold and gold related investments [see Hedge Fund Wizard John Paulson Loads Up On Gold]! He didn’t say why, but the message was loud and clear! What a statement.

Aside, Bond King and regulatory arbitrageur Bill Gross recently wrote to warn the public to diversify away from US dollar before ``central banks and sovereign wealth funds ultimately do the same amid concern about surging deficits” (Bloomberg)

He thinks that the US has reached a “point of no return”, again from the same Bloomberg article, ``“I think he’ll fail at pulling a balanced rabbit out of a hat,” Gross said from Pimco’s headquarters in Newport Beach, California. “They are talking about -- once the economy in the U.S. renormalizes -- the move back toward balance or much less of a deficit. I suspect that will be hard to do.”

Moreover, a public gold fever (not swine flu) appears to have infected ordinary Chinese sparked by the revelation of massive gold accumulations by the China’s government. According to the China Daily, ``Inspired by the increase in the government gold reserves, the more savvy investors are also buying shares of Chinese gold producers on the Shanghai Stock Exchange and the smaller Shenzhen Stock Exchange.”

Furthermore, drug trades have reportedly been reducing transactions based in the US dollar and could have possibly been replaced by trades in gold bullion (telegraph).

This Dollar based concerns won’t be complete without Russia’s continued outspoken campaign to replace the US dollar as the world’s international reserve currency, which apparently not only got support from major Emerging Markets as China and Brazil, but even the IMF has reportedly jumped on the bandwagon saying that replacing the US dollar is possible.

This from Bloomberg, ``The IMF’s so-called special drawing rights could be used as the basis for a new currency, First Deputy Managing Director John Lipsky told a panel discussing reserve currencies at the St. Petersburg International Economic Forum today.

``“There are many, many attractions in the long run to such an outcome,” Lipsky told a panel discussing reserve currencies at the St. Petersburg International Economic Forum today. “But this is not a quick, short or easy decision,” he said, adding that it would be “quite revolutionary.” (bold highlight mine)

And worst of all, US dollar as a safehaven status has been scoffed at by Chinese students! Incredible.

This from Reuters, ``"Chinese assets are very safe," Geithner said in response to a question after a speech at Peking University, where he studied Chinese as a student in the 1980s.

``His answer drew loud laughter from his student audience, reflecting skepticism in China about the wisdom of a developing country accumulating a vast stockpile of foreign reserves instead of spending the money to raise living standards at home.” (bold highlight mine)

It’s obviously a question of what degree of the Chinese population has been represented by the adverse reactions of Chinese students on Mr. Geithner’s statement. If these students account for a majority of China’s sentiment, then it is quite obvious that the public will likely be shunning the US dollar as mode of payment or as transactional currency or as medium of exchange (sooner than later) despite the Chinese policymakers’ avowed insistence to buy US dollar assets (but on a short term basis) which is no less than politically premised, as previously discussed here and here.

All these account for votes of displeasure over policies governing the US as reflected on its currency the US dollar, which mainstream can’t seem to comprehend.

As I wrote in my March outlook Expect A Different Inflationary Environment (emphasis added), ``This leads us to surmise that most of global stock markets (especially EM economies which we expect to rise faster in relative terms) could rise to absorb the collective inflationary actions led by the US Federal Reserve but on a much divergent scale. Currency destruction measures will also possibly support OECD prices but could underperform, as the onus from the tug-of-war will probably remain as a hefty drag in their financial markets.

``And this also suggests that commodity prices will also likely rise faster (although not equally in relative terms) than the previous experience which would eventually filter into consumer prices.

``In other words, the evolution of the opening up of about 3 billion people into the global markets, a more integrated global economy and the increased sophistication of the financial markets have successfully imbued the inflationary actions by central banks over the past few years. But this isn’t going to be the case this time around-unless economies which have low leverage level (mostly in the EM economies) will manage to sop up much of the slack.”

So far everything that we have said has turned out to be quite accurate.

But we seem to be transitioning to the next level.

This brings us to the question why the public seems to be gravitating towards commodities?

Ludwig von Mises has an explicit answer which I unearthed in Stabilization of the Monetary Unit? From the Viewpoint of Theory,

``If people are buying unnecessary commodities, or at least commodities not needed at the moment, because they do not want to hold on to their paper notes, then the process which forces the notes out of use as a generally acceptable medium of exchange has already begun. This is the beginning of the “demonetization” of the notes. The panicky quality inherent in the operation must speed up the process. It may be possible to calm the excited masses once, twice, perhaps even three or four times. However, matters must finally come to an end. Then there is no going back. Once the depreciation makes such rapid strides that sellers are fearful of suffering heavy losses, even if they buy again with the greatest possible speed, there is no longer any chance of rescuing the currency. In every country in which inflation has proceeded at a rapid pace, it has been discovered that the depreciation of the money has eventually proceeded faster than the increase in its quantity.”

So let us break these down into stages:

First, the loss of the currency’s purchasing power.

Second, is the loss of a currency’s function as medium of exchange or the “demonetization process”.

Third, is the accelerating feedback loop between the first two stages which brings upon the irreversibility of the process and

Finally, the total collapse of the currency.

So there you have it. The public’s increasing exposure to commodities is fundamentally a question of the viability of the present monetary standards.

So far the political path and market responses have been behaving exactly as described by Prof. von Mises.

Hence, I call this the Mises Moment.